China’s Sexual Wellness Market has experienced remarkable growth in recent years, reflecting a progressive shift in attitudes toward sexuality and increased awareness of sexual health. This market encompasses a wide range of products and services designed to enhance sexual pleasure, promote sexual health, and address various intimate concerns.

From adult toys and contraceptives to sexual education and wellness clinics, the industry is evolving to cater to the diverse needs and preferences of Chinese consumers.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Evolution of China’s Sex Mentality

Historically, Chinese society has been relatively conservative regarding discussions and expressions of sexuality. However, in recent times, there has been a notable change in attitudes and perceptions. Factors such as increased exposure to global influences, greater access to information through the internet, and growing urbanization have contributed to a more open-minded approach toward sexuality.

The younger generation prioritizes personal happiness and well-being over traditional marriage as their primary life goal. They strive to take control of their lives and embrace roles as active participants, seeking joy and fulfillment in all aspects of life.

Manifestations of the Revolution

- Openness towards Sexuality: Discussions on previously taboo topics such as sexual pleasure, consent, and sexual health have become more common in public discourse.

- Growth of Sexual Wellness Market: The market for sexual wellness products and services has expanded significantly, reflecting the increasing demand for products like adult toys, contraceptives, and sexual health supplements.

- Acceptance of Non-Traditional Relationships: Non-marital cohabitation, LGBTQ+ relationships, and open relationships are gaining acceptance, though challenges still exist due to societal norms and legal restrictions.

- Feminist Activism: Chinese feminists are advocating for gender equality and sexual autonomy, challenging patriarchal norms, and promoting body positivity.

Insights into China’s Sexual Wellness Market: Key Figures and Statistics

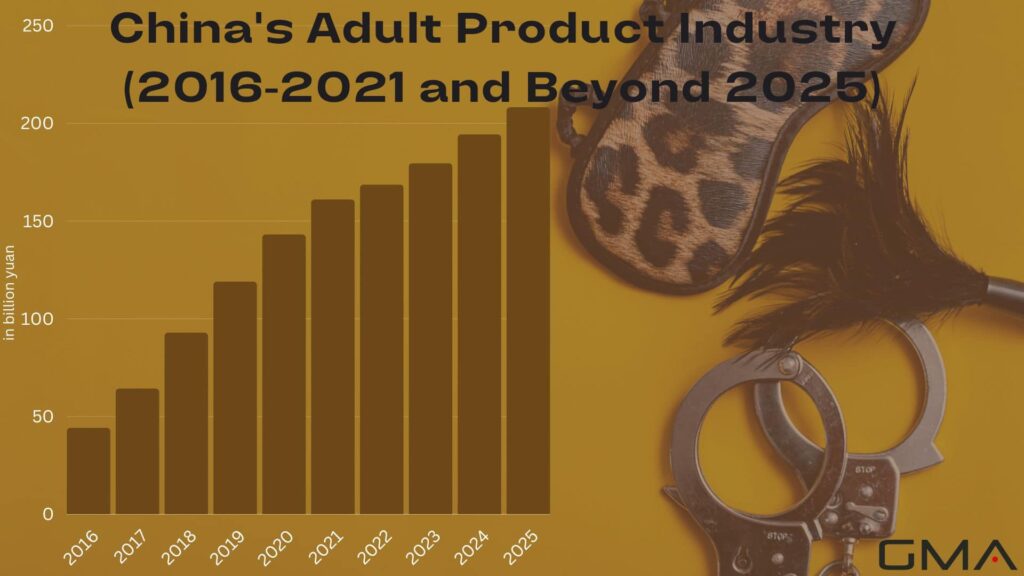

In 2023, the market size of the adult product sector in China is estimated to surpass 179.43 billion yuan, up from 160.96 billion yuan in 2021. The majority of adult products in China were sold online.

China’s sexual wellness market has experienced steady growth, particularly in the realm of adult products. Leveraging rapid digitalization, sellers have widened their market reach and enhanced branding efforts, contributing to increased revenue.

Collaboration with government agencies to raise STD awareness, rising contraceptive use, the popularity of sexual education, and growing acceptance of sexual wellness products, especially among women, are expected to drive sales in socially conservative regions like East Asia.

Understanding the Consumer Demographics and Buying Habits of Sexual Wellness Products in China

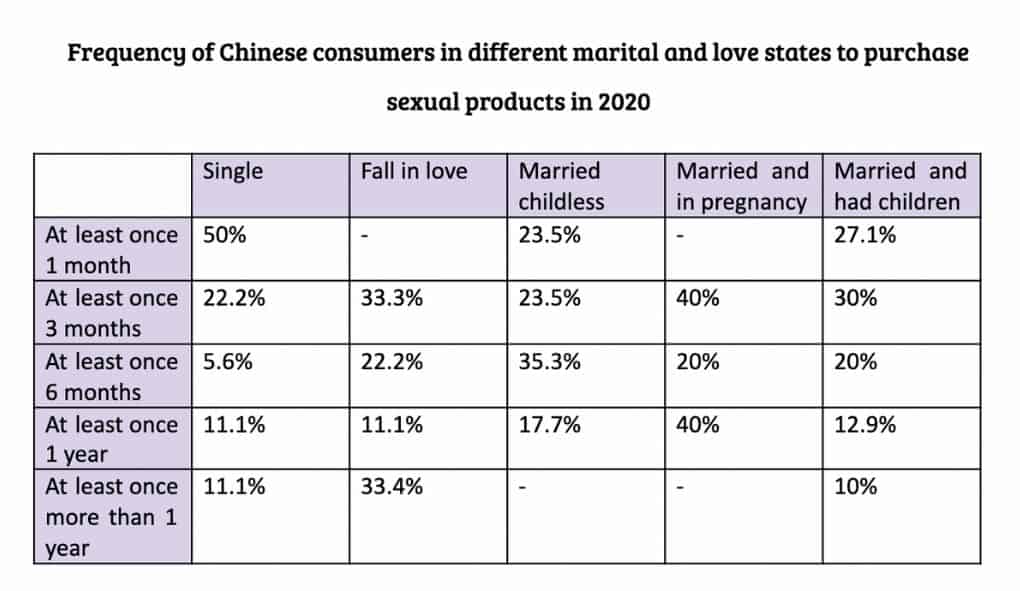

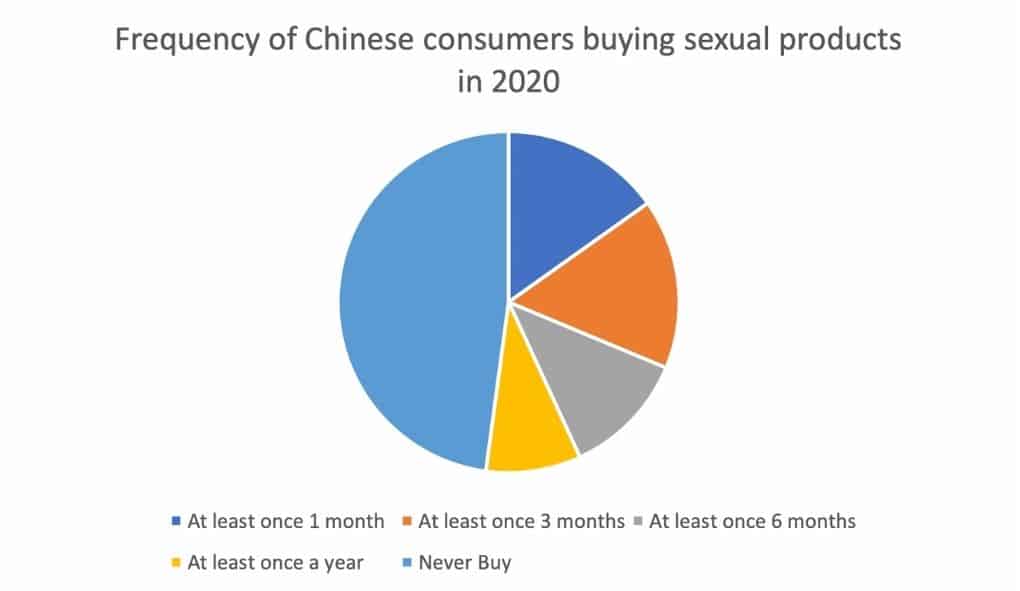

Based on the data, we observe the frequency of sexual product purchases among Chinese consumers in different relationship states.

Nearly half of the population has never bought such products, while approximately 20% purchase them at least once a month.

Regarding age groups, consumers aged 31-35 account for 32% of adult toy purchases, followed by those under 30, representing 31% of the market share.

From Taboo to Trend – How China’s Sex Toy Industry is Thriving

The sexual wellness market in China is experiencing remarkable growth, with sex toys emerging as a key driver. As societal attitudes towards sex and sexual products evolve rapidly, the enthusiasm for sex toys is gradually gaining momentum. This burgeoning demand has unlocked enormous potential for the Chinese adult toy market, leading to significant expansion in recent times.

Amidst the COVID-19 pandemic, the sex toy industry witnessed rapid growth, becoming one of the fastest-growing sectors in China. With an estimated 900 million sexually active individuals in the country, the market’s primary consumers are young adults under the age of 35, accounting for 93% of sex toy sales. As the industry continues to thrive, it presents lucrative opportunities for both domestic and international players to cater to the evolving preferences and needs of the Chinese market.

In recent times, China’s sex toy market has experienced significant growth, driven by a surge in startups and rising consumer demand for diverse pleasure products. While already the world’s largest exporter of sex toys, accounting for 70% of global supply, China is now shifting its focus towards importation. This strategic move aims to cater to the increasing demand from the domestic market, seeking high-quality products that can satisfy evolving consumer preferences.

Revitalizing Sexual Wellness: The Power of Chinese Herbs

Traditional Chinese medicine has long prioritized sexual wellness, offering solutions for issues like erectile dysfunction and diminished sexual energy. In contrast to prescription drugs such as Viagra, which target genital stimulation, Chinese herbal medicines emphasize overall health to naturally foster an active sexual life.

Chinese medicinal herbs address health concerns by targeting specific physiological imbalances in various body parts. For instance, kidney nourishment is central to resolving erection issues, adhering to the principles of Yin and Yang. Access to these herbal remedies is easy, and unlike some sexual products, they carry no stigma, allowing users to purchase them without shame or discomfort.

Growing Niche Segments in Sexual Wellness

- Male Performance Enhancers – Products like testosterone pills are gaining traction in the sexual wellness market, offering solutions for male performance enhancement.

- High-End Adult Toys – High-end toys are making their mark in the market, catering to consumers seeking premium experiences.

- Cosmetics and Creams – Cosmetics and creams, like cooling gel, are emerging as sought-after solutions to enrich intimate encounters.

- Addressing Erectile Dysfunction – This is a common issue among Chinese men and is being addressed in light of lifestyle factors such as excessive drinking, smoking, stress, and societal pressures.

- Innovation at Play – Innovative products infused with technology, such as AI-driven sex dolls, are revolutionizing the sexual wellness market with human-like qualities.

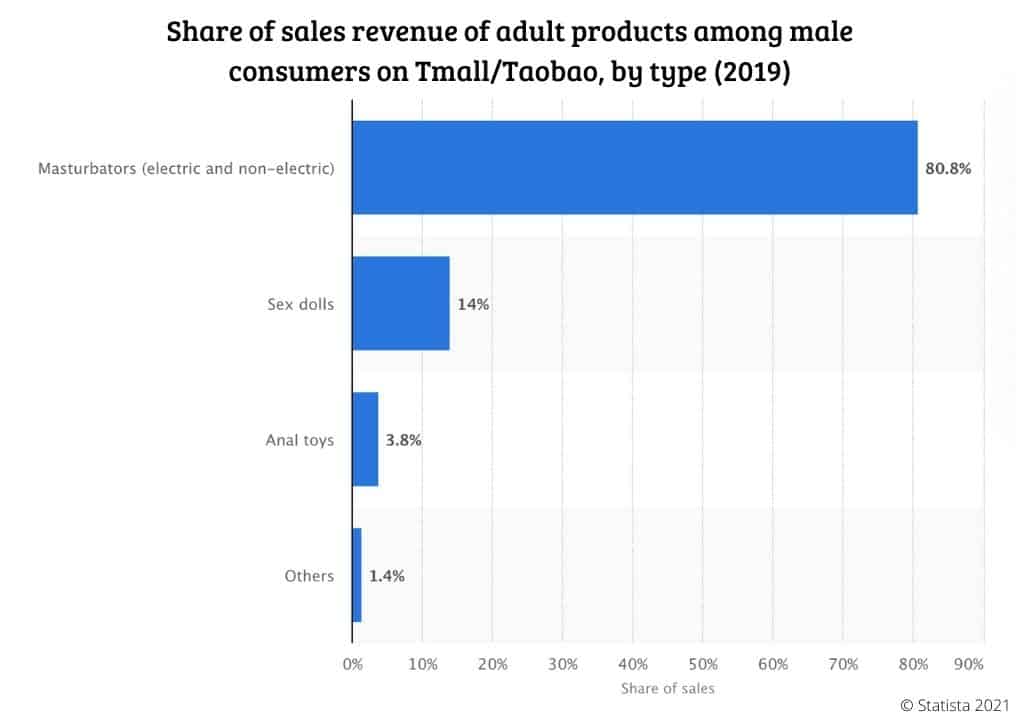

Adult Products Most Favored by Male Consumers

The surge in adult item consumption can be attributed to the growing mainstream presence of online shopping, which offers convenience and discretion. While basic products like lubricants and condoms are available in convenience stores, the selection is limited.

Consequently, Chinese male shoppers are turning to e-commerce platforms for a more extensive range of adult products. Among them, masturbators emerged as the top choice, accounting for 81% of male adult product sales on platforms like Tmall and Taobao, followed closely by sex dolls.

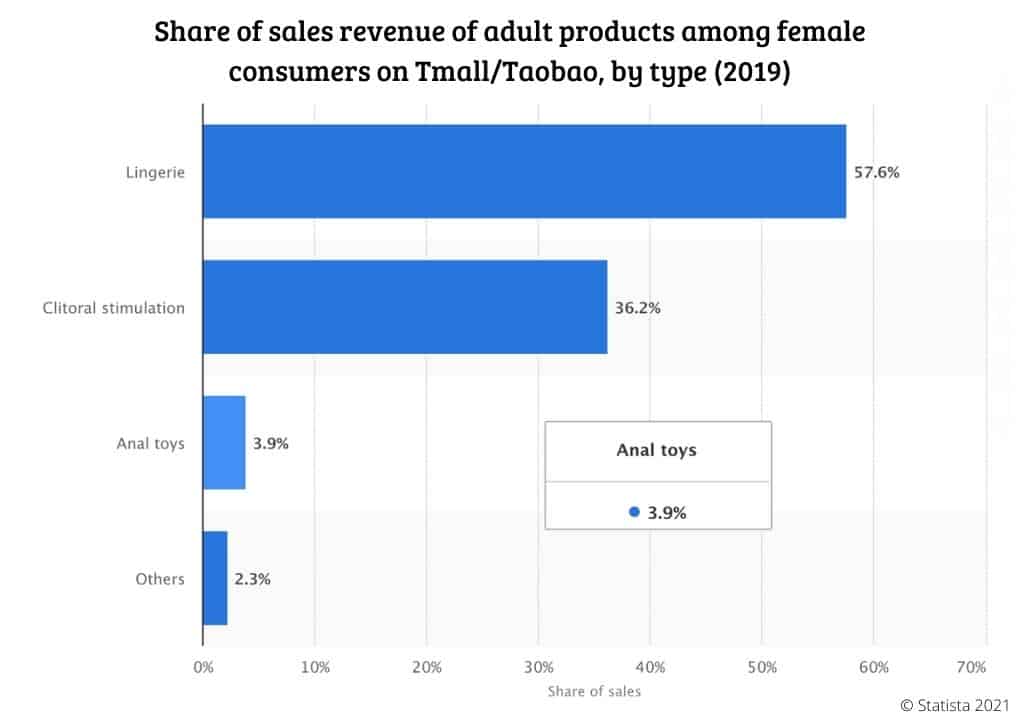

The Growing Industry of Female Pleasure Enhancers

In a historically male-centered industry, women have been relegated to a secondary market. However, recent years have witnessed a transformation as women embrace their sexual preferences with newfound confidence and freedom. This shift has paved the way for an array of female-focused products to emerge on online platforms.

Among female consumers, lingerie and clitoral stimulation products stand out as the most popular sex items on platforms like Tmall and Taobao. In 2019, lingerie sales accounted for 57.6% of female adult product sales on these platforms, closely followed by anal toys.

Furthermore, there is a rising trend in lubricants formulated to enhance women’s well-being, reflecting a growing emphasis on products catering to female pleasure and comfort.

Challenges Confronting Foreign Brands in China’s Sexual Wellness Market

Counterfeiting Concerns

The prevalence of counterfeiting in China poses a serious threat to foreign brands, especially those offering adult products. Registering trademarks with Chinese authorities can provide some protection, but combating counterfeits remains challenging.

Quality Demands and Competition

Ensuring high-quality products is crucial to gain consumer trust in a market where product safety is a significant concern. Foreign brands also face intense competition from a market flooded with low-end products.

Lack of Sex Education

The absence of comprehensive sex education in China creates a challenge for brands marketing sexual wellness products. The stigma surrounding sexual topics hinders the acceptance and understanding of such products among consumers.

Government Restrictions and Censorship

The Chinese government’s conservative approach to sexual goods and censorship regulations present obstacles for brands in terms of marketing and promotion. Brands may encounter limitations on advertising and content, leading to fines or restricted access to certain platforms.

Negative Perception of Sexual Goods

Despite the growing market, there remains a negative perception of sexual wellness products in Chinese society. Some consider these products to be against traditional Chinese values, linking them to Western culture and even prostitution.

Navigating the Chinese sexual wellness market requires careful consideration of these challenges. Brands must prioritize quality, conduct thorough market research, and work with experienced agencies familiar with local nuances and regulations. Despite the complexities, the allure of the Chinese market’s potential makes it a tempting opportunity for those willing to understand and adapt to its unique dynamics.

Strategies for Selling Sexual Wellness and Adult Products in China

China’s retail industry still leans heavily towards offline sales, with adult products following a close 6:4 ratio of online to offline sales. Despite a large number of enterprises operating under the franchise model, many face challenges, with stores often operating at a loss.

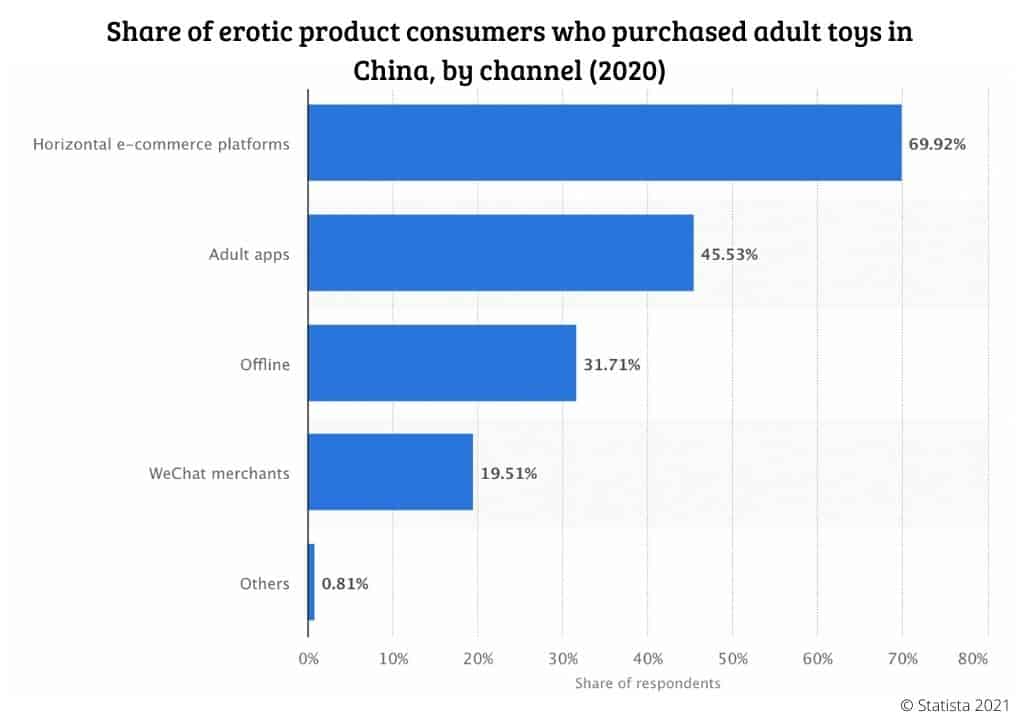

Selling sex toys in China can be done through two primary avenues: offline distribution and online e-commerce. Offline sales encompass sex toy shops, convenience stores, and supermarkets, providing a traditional approach that coexists alongside the growing online market.

With the internet’s rise, online sales have gained momentum, with e-commerce becoming a popular channel for adult products like vibrators and sex aids due to its convenience and discretion.

In the realm of online sales, B2C e-commerce stands as the most common and competitive model. Competitors can be classified into three major categories: large-scale comprehensive e-commerce platforms, vertical adult product e-commerce, and traditional medicine e-commerce. Understanding the market dynamics and adopting the right sales strategy can help foreign brands thrive in China’s vibrant and evolving adult product market.

Online Platforms Rule the Adult Product Market in China

According to a recent survey on adult product customers, nearly 70% of respondents stated that they prefer purchasing adult products on e-commerce platforms, with Taobao being a popular choice. On the other hand, approximately 32% of respondents still opt for offline purchases.

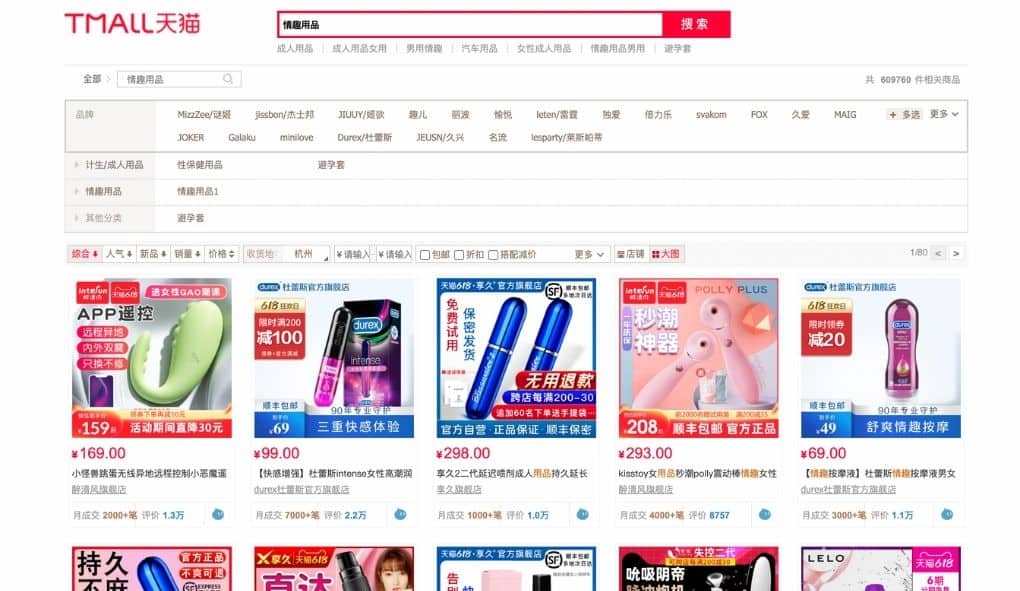

Taobao and its sister platform Tmall witnessed a significant surge in the sales of sex toys in China, with around 3.15 million units sold during the year’s peak, largely driven by the Singles’ Day shopping event on November 11 (11.11). This event offers discounts and deals, encouraging substantial purchases. Many sexual wellness brands capitalize on Taobao’s vast reach to promote and sell their products. However, it is essential to be cautious, as China faces issues with fakes and counterfeiting, leading Chinese consumers to exercise diligence when making their purchases.

Breaking Taboos: Adult Product Retail in China

Since the opening of the first sex shop in mainland China in 1993, the stigma surrounding brick-and-mortar stores for adult products has persisted. Decades later, Chinese consumers still feel uncomfortable purchasing in physical retail outlets, often leaving in a rush or shying away from face-to-face transactions. Consequently, the online space provides a more confident and judgment-free environment for adult product purchases.

Jusechengren (‘Orange Adult’), China’s largest adult product chain brand, recognized the need to address this secrecy and established an online platform to break through societal taboos in the adult product industry.

Building Trust Among Chinese Consumers

China’s highly digitalized market boasts over 989 million connected individuals, spending an average of six hours daily on their smartphones. To gain the trust of Chinese consumers, businesses must leverage online channels effectively. Search engines and social media play a crucial role in informing consumers about products before they make purchase decisions. Thus, creative and strategic online advertising becomes essential to gain a competitive edge over rivals.

Optimizing Baidu SEO: Creating a Chinese Mobile-Friendly Website

To establish a strong online presence in China, it is crucial to prioritize Baidu SEO and ensure your website is mobile-friendly. As Baidu is the leading search engine in the country, catering to over 70% of search queries, optimizing for its algorithms is essential for reaching the vast Chinese audience.

Creating a Chinese mobile-friendly website is the first step towards enhancing user experience and search engine visibility. Given the significant mobile usage in China, ensuring that your website is responsive and adapts seamlessly to various mobile devices is critical.

To enable Baidu SEO effectively, consider incorporating relevant Chinese keywords, meta tags, and alt text in your website’s content and images. Conduct thorough research to understand the most popular and relevant search terms for your target audience.

Leveraging Social Media

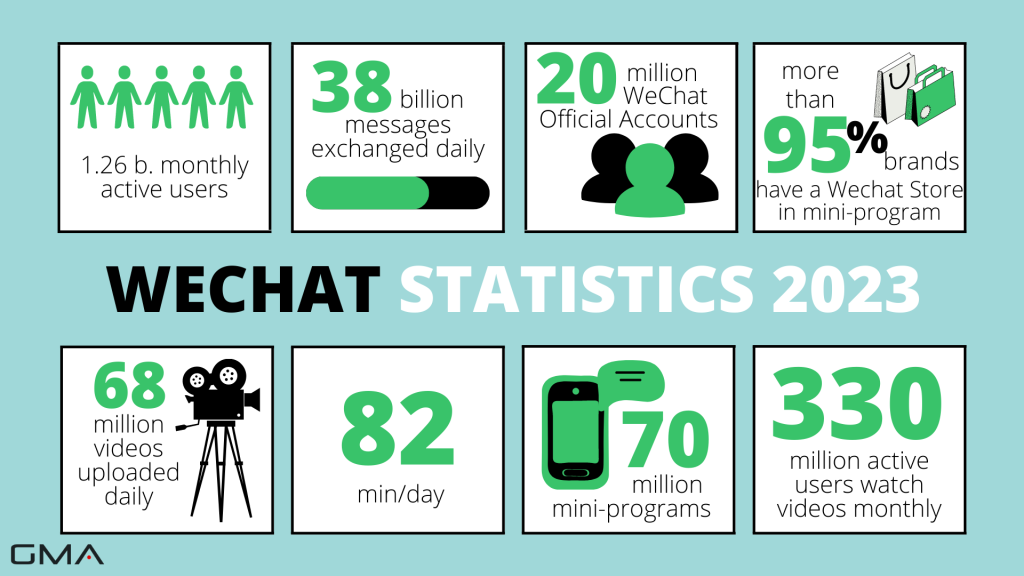

With over one billion monthly active users, WeChat stands as the leading messaging app in China, making it a powerful marketing platform. Its diverse ecosystem allows companies to promote products and services through live streaming, mini-programs, paid advertising, and engaging blog-like content. Brands can engage directly with their target audience, building rapport and trust.

As a prominent microblogging platform with over 570 million users, Weibo provides an avenue for brands to share updates, news, and valuable content. Engaging with consumers through interactive posts and user-generated content helps foster brand loyalty and awareness.

Xiaohongshu (RED)

Catering to female shoppers, Xiaohongshu has more than 200 million registered users. Focused on beauty and fashion products, this platform offers a unique opportunity for sexual wellness brands to connect with young female consumers seeking recommendations and reviews from Key Opinion Leaders (KOLs).

Your Gateway to Success: Contact Us to Sell Your Sexual Wellness Products in China

The sexual wellness market in China is on an upward trajectory, poised for significant growth in the coming decades. With its expansion, both local Chinese brands and international companies are swiftly seizing the opportunity by creating products tailored to local preferences.

Innovations such as aphrodisiacs made from exotic mushrooms and ginseng drinks catering to women’s health needs are gaining popularity. While the potential for success is evident, there is also a pressing need to raise awareness and promote sexual well-being among the populace.

As a seasoned Digital Marketing Agency with nearly a decade of experience in China, we have successfully navigated the complexities of the Chinese market and facilitated the entry of numerous foreign brands.

Our track record of fruitful collaborations speaks to our commitment to helping brands establish a strong foothold in China. We take pride in our ability to assist brands in expanding their operations and reach within this dynamic market.

Should you be interested in exploring the vast opportunities in China’s sexual wellness sector or have any inquiries about the market landscape, we encourage you to reach out to us. Our dedicated team is ready to provide prompt responses and valuable insights to propel your brand towards success in China.

Together, let’s embrace the potential of this flourishing industry and make a positive impact on sexual well-being awareness in the Chinese market. Contact us today, and we guarantee a response within 24 hours.