What is more refreshing than drinking water in this hot weather in Shanghai? China is the world’s largest market for bottled water. The poor tap water quality, increasing health awareness, higher income levels, and international tourism is fueling the demand for good-quality water.

Bottled water sales in China grew tremendously from US$1 billion in 2000 to US$45.1 billion in 2020 and are further projected to reach US$76.2 billion by the year 2027, growing at a CAGR of 7.6% in the forecast period.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

However, China’s bottled water market is highly fragmented and localized. Few leading companies are holding more than half of the market share. This article will present you with the landscape of China’s water market and some of the leaders of the industry.

Overview of China’s water market

Poised to become a superpower, China confronts some of the most serious environmental threats in the world. Statistics show China is among the world’s 13 thirstiest countries. As a country with the largest population, about 400 of 699 cities are short of water, threatening the daily consumption of more than 30 million citizens and causing annual economic losses of more than US$ 14.5 billion.

The government is taking reasonable measures, one of them was to invest US$ 87 billion in environmental protection programs focusing on water, drinking water, and air pollution control. We could optimistically expect a great improvement in China’s water treatment industry in the near future.

There are a lot of active Chinese companies in the field of water and water treatment or drinking water, this number has been increasing and is expected to increase further. This is an emerging environmental industry where China is opening its environmental protection industries to overseas investors and expects the sector to grow at an annual rate of 14-17% in the following years.

The mistrust over water safety boosts the bottled water market

In early 2013, 7,500 rotten pig carcasses were found floating in the Huangpu River. As the river supplies 80% of tap water to Shanghai, you can imagine in what state people and mass media were at that time… Although the authorities have guaranteed the quality of the city’s drinking water, residents have remained concerned about water safety, and many of them have stopped drinking tap water and are buying bottled water instead.

The fast growth in this market is because of the mistrust over water safety. The country only has about 6.5% of the planet’s renewable water resources to sustain one-fifth of the world’s population. Chinese chose to drink boiled tap water or bottled water instead of using a home water filtration system.

In 2013, China surpassed America, becoming the world’s biggest bottled water market by volume. According to China Daily, the market has steadily grown in the years from 2010 to 2015, from 19 billion to 37 billion liters of bottled water. It is expected to reach US$76.2 billion by the year 2027. China is the world’s biggest bottled water market in terms of increasing.

The three leaders of the water market in China

Kang Shi Fu (康师傅)

Kangshifu Water respects the national drinking water hygiene standard (GB5749). It was part of the Chinese beverage industry’s top 20 in the 30th year after the reform and opening-up policy. In 2008, the company was named China’s Beverage Industry Water Saving Outstanding Enterprise.

Kangshifu is also well-known for its food products in China.

Nong Fu Spring (农夫山泉)

Nongfu Spring Co. Ltd., formerly known as “Zhejiang Thousand Island Lake Yangshengtang Drinking Water Co., Ltd.”, is headquartered in Hangzhou, Zhejiang Province, holding a company of Yangshengtang. It was founded on September 26, 1996. The company is a drinking water production company in mainland China with eight high-quality water source bases.

Nongfu Shanquan has recently made a great marketing campaign, sponsoring some popular web shows such as “the rap of China”.

Wahaha (哇哈哈)

Wahaha Purified Water, since its listing in 1996, has built its excellent quality image with its world-leading production equipment, advanced secondary reverse osmosis technology, and ozone sterilization process. It is highly favored by chines consumers and has been recognized by the country as the “national inspection-free products” and won the “China Top Brand” award.

Wahaha’s brand representative is Wang Leehom, a popular singer in China.

How to market your products in China’s water market?

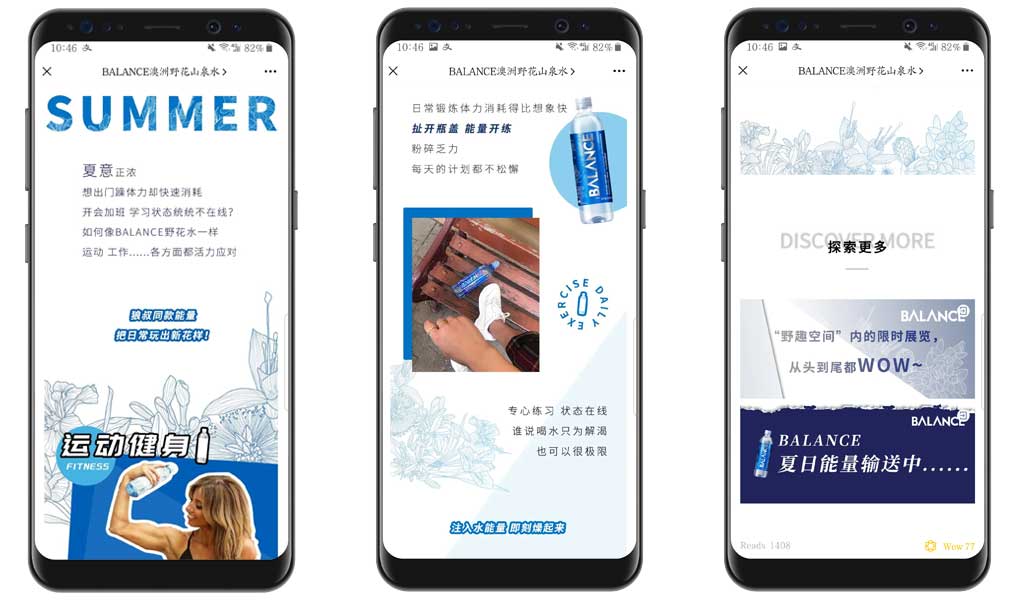

Bet on digital channels to develop your reputation in China. Even the biggest companies and brands are using social media to reach their consumers. Chinese people are very connected online and the impact of social networks on individuals is immense in China.

Social media marketing

Chinese social media platforms, particularly WeChat, have a significant presence in China, with over more than 1.26 billion users as of 2023. WeChat offers various features that can be beneficial for businesses, such as creating an Official Account to enhance brand awareness and act as a newsletter.

Additionally, WeChat allows users to establish their own store, share video content, and run advertisements, among other functionalities.

While WeChat is essential for building brand loyalty among existing followers, it operates within a closed ecosystem.

To expand your customer base and reach new audiences, other social media platforms like Weibo, Little Red Book, Douyin, or Kuaishou can provide a boost to your brand. Utilizing these platforms alongside WeChat can help you effectively engage with a broader range of potential customers.

To promote yourself effectively on Chinese social media it is necessary to:

- create an official account, which is essential to build trust in users

- post new comments and frequent updates

- manage the community and interact with users and Kols

- cross-marketing with other platforms

Build a Chinese website that will be optimized for Baidu

Chinese people are known to make a lot of research online. Baidu is the first search engine in China, you can find all kinds of questions (it is almost like if you have any question, you will find that someone else has already asked it on Baidu before).

Then Chinese consumers and distributors must be able to find you on Baidu, the most popular search engine in China. As we use Google to check brands that we are interested in, Chinese customers and distributors will try to look you up in Baidu, to learn more about your brand.

Anyway, being well-positioned in the Chinese internet sphere is very needed if you want to develop your visibility among consumers. It is also about a question of trust, the more easily your target consumers can find your brand and information on it, the more they will be reassured.

To build a great website follow some easy tips:

- The website must be in Chinese Mandarin, as Baidu doesn’t rank high as foreign websites

- Leave the contact information on the homepage (and here the most important contact will be your WeChat Official Account and phone number)

- You can have an option of a live chat, which will increase your conversion rate, it’s a very popular tool in China

- Your website must be hosted in Mainland China or Hong Kong/Singapour (To put it simply your website will load faster and get a ranking boost on Baidu).

- The content must be adapted to Chinese tastes, be original, and frequent (It will give your Website authority on Baidu)

Invest in Storytelling and Packaging to sell your soda brand in China

Investing in storytelling and packaging is crucial when it comes to selling your water brand in China. Chinese consumers value not only the quality of the product but also the story behind it.

By crafting a compelling narrative that resonates with their values and aspirations, you can create a strong emotional connection with your target audience.

Additionally, paying attention to packaging design is essential, as it plays a significant role in capturing consumers’ attention and influencing their purchasing decisions.

A well-designed, visually appealing packaging can make your water brand stand out on the shelves and attract potential customers. So, by investing in storytelling and packaging, you can effectively sell your water brand in the competitive Chinese market.

Go Digital, Try E-Commerce

Chinese consumers are more willing to purchase online because of the convenience and the greater range of available items on e-commerce platforms.

Nowadays, Chinese consumers have a huge appetite for foreign products, and e-commerce platforms have become the channels of choice for Chinese shoppers looking to purchase such items. Take a look at the most popular e-commerce platforms JD and Tmall here.

Our agency offers a complete range of services for e-commerce marketers from e-commerce consulting to digital marketing operations. We have developed many successful e-commerce projects because we know how to effectively promote your e-commerce business in China by using the latest digital tools.

We are your local partner in China! Contact us!

The bottled water market in China has experienced significant growth in recent years. With increasing concerns about water quality and safety, bottled water has become a popular choice among Chinese consumers. The market is highly competitive, with both domestic and international brands vying for market share.

One of the key drivers of growth in the Chinese bottled water market is the rising middle class and their increasing disposable income. As people become more health conscious, they are willing to spend more on safer and higher-quality drinking water. Additionally, the growing urban population and rapid urbanization have also contributed to the demand for bottled water.

We are a China-based marketing agency offering cost-effective solutions to foreign brands interested in tapping into the Chinese market. Our team of Chinese and foreign experts has the experience and know-how needed to succeed in this lucrative, yet complicated market.

Gentlemen Marketing Agency offers many digital marketing and e-commerce solutions, such as web design, e-commerce and social media marketing strategies, localization, market research, KOL marketing, and more.

Don’t hesitate to leave us a comment or contact us, so that we can schedule a free consultation with one of our experts, that will learn about your brand and present you the best solutions for your China market strategy.

Very good article aboutbottled water in china

Do you know if ecommerce can be the way for exporting bottled water to china

What is the bottled water sales in china, the Size amount ?

Where can I know the bottled water prices in china

Do you know if coca cola have bottled water in china ? or just Soda ?

I work for a premium water in china

testing

Hello

Iam pastor Godson Osondu from nigeria I want to establish a pure industry I wanted to get acquainted through you tnx

What if your bottled water helped with corona virus check that out smart guys