As the population ages and wealth increases in China, knowledge, and understanding of nutrition expand; consequently resulting in a large surge for health supplement products. Additionally, the pandemic has sparked an unprecedented interest in personal fitness and wellness, leading to a remarkable expansion of the health supplement sector.

The Chinese health supplements market is growing fast, becoming one of the most promising market sectors in 2022-2027. During this period, the dietary supplements market is expected to grow 8% annually. Particularly, given its association with bone health, it is projected that the demand for calcium supplements will remain strong in the foreseeable future. In this blog post, we will see the market trends and opportunities for foreign calcium manufacturers in China.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Overview of the health supplements market in China

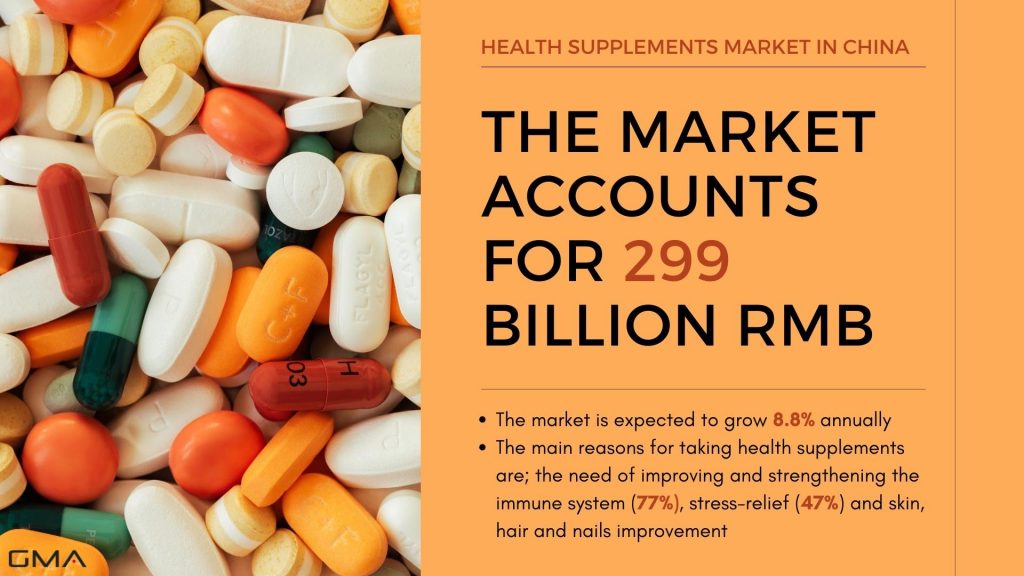

The health supplements market in China is reaching record sales, thanks to the COVID-19 pandemic and increasing health awareness among Chinese netizens. In 2022, almost 300 billion yuan worth of health supplements were sold. Given the fact, that China is ending its zero-covid policy and people are afraid of getting sick, we can expect big growth in the next year.

The Chinese health supplements market is the biggest in the world. Chinese people take dietary supplements to strengthen their immune systems, relieve stress, or improve their skin and hair. As the majority prefers foreign brands over local ones, there are many opportunities for international companies in the Chinese market.

What are the reasons for the higher demand for calcium supplements in China?

Calcium deficiency is a widespread health concern among the Chinese population. During growth, adolescents require adequate calcium intake while adults up to 35 years of age should take it as a preventive measure against osteoporosis in later life. For seniors, calcium supplementation helps reduce bone deterioration and sustain general well-being. Therefore, taking regular doses of this nutrient has become an integral part of family healthcare routines.

According to WHO, calcium is essential for maintaining a healthy bone structure, as well as for muscle and nerve functioning. Calcium citrate-based supplements can help reduce the risk of rickets, osteoporosis, and tooth decay.

Calcium Supplements Market in China

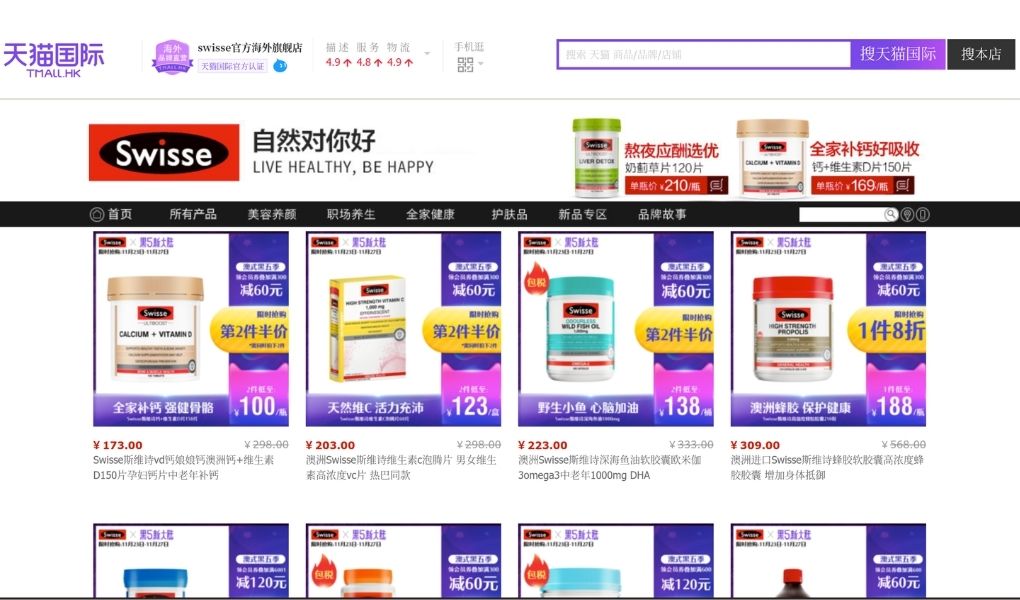

Calcium supplements in China: #1 on T-Mall

Of all the products sold on T-mall, calcium is in a class of its own when it comes to sales volume. The Swiss-manufactured product Swisse has proven very popular – with over 50K units moving off the shelves for 170 RMB each and total revenues surpassing 8.7M RMB!

Calcium Supplements in China: Australia is the market leader

In 2019, China imported a whopping 100 Million US Dollars worth of calcium-based products from Australia. The leading brands included BioIsland’s and Swisse’s children’s calcium tablets as well as Blackmore’s calcium and magnesium tablets. Staggering figures like these demonstrate the demand for such minerals in the Chinese market!

Top countries with the highest revenue from calcium supplement sales

It’s no surprise that the top 5 countries with skyrocketing sales of calcium supplements are:

- 1. China, generating 4.8B USD;

- 2. The United States at a close second, bringing in 4 B USD;

- 3. India comes in third place for its contribution of 2.3B USD;

- 4 and 5 – Australia and Japan respectively creating 1.10 B US and 1.10 B US each!

Calcium Supplements Key Market Trends

Demographics for Calcium Supplements

Millennials are becoming increasingly aware of their calcium intake, with women in particular during the mid-30s actively seeking out calcium-based supplements to promote better bone health. This surge in demand has propelled the development of the calcium citrate market.

The demand for calcium supplements is not only from Millennial women but also pregnant women, the elderly, and men & children alike. This surge in demand demonstrates a widespread need across multiple demographics.

Citrate-based supplements are preferred

Calcium citrate-based supplements are the optimal choice for enhancing absorption efficiency, as they do not require additional bile acids during digestion. Moreover, they can be taken with or without food – making it even more convenient and reliable.

Popular forms of calcium supplements

Recently, the market has seen an influx of calcium citrate supplements in numerous forms. Yet, tablets remain the go-to choice due to their affordability and accessibility.

Calcium Supplements forms include:

- Tablets

- Liquid forms

- Capsules

- Chewing Tablets

- Powdered Forms

Vegan consumers and people with lactose intolerance

Chinese adults are the most lactose intolerant group in Asia and therefore, struggle to get enough calcium from dairy products. In such cases, Calcium supplements are the best option.

Additionally, in China, the vegan population has experienced a surge in recent years. Instead of consuming dairy milk, these vegans opt for calcium supplements to ensure they receive their daily dosage of this essential mineral.

Top-selling product for the Calcium supplements market in China

Brand case study: Swisse

Swisse skyrocketed to the top of Chinese calcium supplement sales in August 2022 with their Calcium and Vitamin D product on Tmall. From its original price of 399 RMB, they sold it for a discounted rate of 171 RMB — resulting in 8,621,461 RMB revenue from 50,359 volume sales

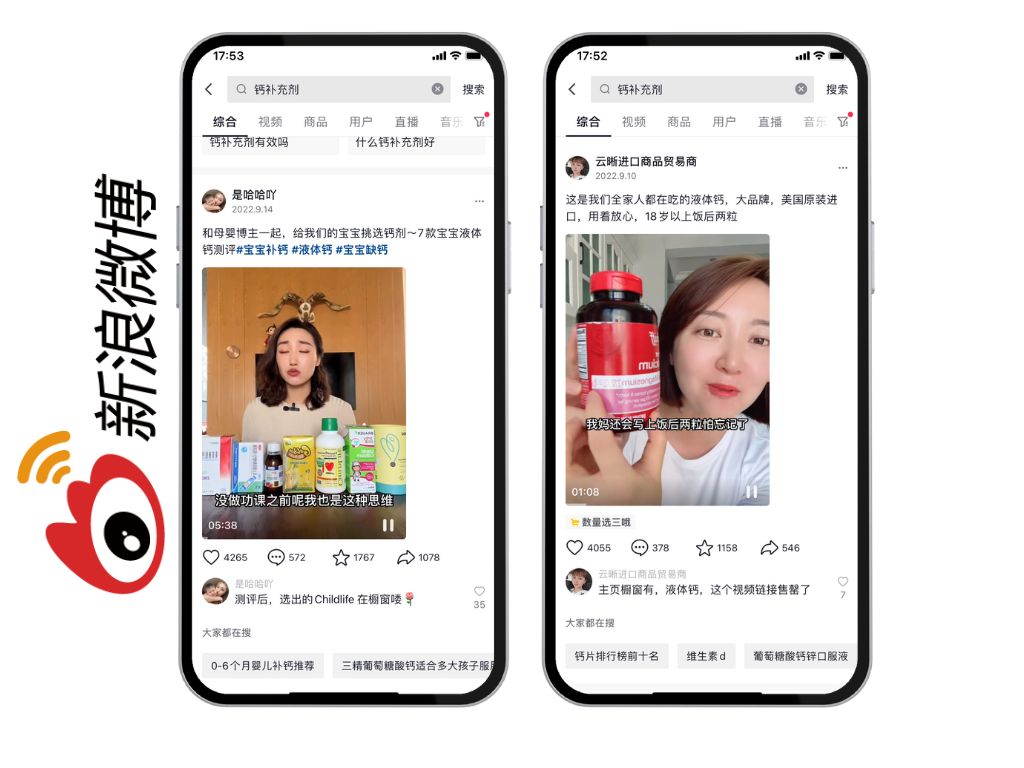

To make this happen so quickly Swisse employed an impressive strategy: utilizing social media outlets like Weibo, WeChat, RED, and Douyin as well as influencers; selling both locally through CBEC platforms and offline via distributors across China.

After 3 years of penetrating the market by first entering through CBECs followed by registering products within local platforms -Swisse’s overall strategy was successful beyond expectation.

To sum up the calcium market in China

As people become more informed about the importance of adequate calcium levels in their bodies to promote strong bones, as well as healthy heart and muscle functioning, demand for calcium supplements is rapidly increasing. It’s expected that this trend will continue into the coming years due to rising awareness around its potential benefits.

Are you interested in the Chinese Market?

When considering a new entrant challenge, our expert team will guide you in detail through the CBEC process including both your logistics operations and eCommerce optimization.

China is a marathon, not a sprint. Qualified brands are here for long terms and target high performances. Therefore, GMA will assign you a personal manager dedicated to analyzing your development capabilities but also monitoring your investment while maximizing your ROI.

As a licensed TP operating in China for +10 years, contact us to determine which platform may be more suitable for your brand: JD or Tmall. Our expert Alexis will tell you all you need.

We invite you for a 15 min discovery call, where Alexis will learn about your brand and see if the company qualifies for customers’ expectations in China.

Tell us your brand story and our expert will tell you your future China story. If it matches our qualification process, we offer an additional 1 hour of free strategy consulting + creative brainstorming.

Do not hesitate to contact us and apply for our 6-month brand incubator program.

How it works:

1. Brand interview: Tell us who you are and what’s your brand story. Let us get to know each other and see if you’re made for China.

2. Strategy Demo: Get to know more details on the Chinese market, and how similar brands like yours are doing, and get a tailor-made strategy matching your needs, FOR FREE.

3. Onboarding: if we determine that we can be a good fit and that we can help you to successfully grow your business in China, we’ll make you an offer to put your brand on a launchpad and get all you need for measurable success.

Here are some of our success stories in the health supplement market