Beijing has released new Chinese Food and Beverage Regulations. Many are worried that their products will not be allowed to enter the huge market, as there is a Jan. 1 deadline.

China’s customs authorities published new safety rules in April. These regulations stipulate that all foreign food processing, storage and manufacturing facilities must be registered by the end of the year to allow their products to enter China.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

However, detailed instructions on how to obtain the registration codes were not available until October. Last month however, a website was launched for companies that are allowed to self-register.

“We are heading for major disruptions following Jan. 1,” said a Beijing-based diplomat representing a European country, who is helping food producers to implement the new measures.

China food imports

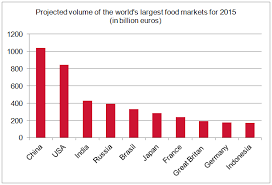

China’s food imports have risen in recent years due to growing demand from a large middle class. According to the United States Department of Agriculture report, they were worth $89 Billion in 2019. This makes China the sixth-largest food importer.

New rules for F&B exporters

China has been trying to introduce new rules for food imports for many years. This has triggered opposition from exporters. The General Administration of Customs of China, which oversees the most recent iteration of these rules, has not provided any explanation as to why all foods, including those that are considered low-risk like wine, flour, and olive oil, are included in the regulations.

Experts believe it’s an attempt to improve oversight of large quantities of food arriving in Chinese ports. It also places responsibility for food safety on the manufacturers and not the government.

GACC stated in a statement to Reuters it had sought public comments on the rules before April.

It stated that it has “fully considered” and “actively accepted reasonable suggestions” and adhered to WTO agreements regarding the implementation of food safety measures.

Four letters were sent by the European Union to Customs this past year, asking for more clarity and more time to implement, according Damien Plan, an agriculture counsellor at Beijing’s European Union Delegation.

GACC agreed last week that implementation should apply only to goods manufactured on or after January 1, 2022 thus granting delay for products already shipped. However, it has yet to publish an official notification.

However, many diplomats and exporters still believe that the rules are a trade barrier to products from overseas.

- Due to disinfection and coronavirus testing, food, particularly chilled and frozen, has been delayed in clearing Customs in China for the past year.

- Unroasted coffee beans, cooking oils, milled grains, and nuts are just 14 of the new high-risk categories that must be registered by exporting countries’ food authorities by October 31st.

- A website which was launched in November and has not always been functional can be used to register facilities that make low-risk food.

- Li Xiang (business development manager, Chemical Inspection and Regulation Services Ltd. Europe), which assists companies in the registration process, said that the Chinese system is now working but the English version is still in a trial phase.

- These rules apply only to factories that produce finished products for export to China. However, they do not allow for any flexibility in changing sourcing or labelling.

- Robert Maron, Vice President International Trade at the Distilled Spirits Council of the United States, stated that some U.S. spirits companies have been registered, but they are not clear on labelling requirements.

Li stated that no Irish whiskey producers assisted by CIRS Ireland were able to register their products so far.

It is unclear what will happen if the registration codes are not on packaging.

He said, “For the moment the information we received from (Chinese), authorities is that there won’t be a grace period.”

The F&B experts in China

Euromonitor International’s in-country analysts are experts in their respective industries and can help you understand the market trends and future growth prospects for China’s Food and Drink Internet Retailing sector.

The most recent research data is combined with key trends are concisely and clearly summarized. Our qualitative analysis, insight, and confident growth projections will help you understand and assess the competitive threats to your company.

Our research can help you make informed and intelligent decisions if you are in the Food and Drink Internet Shopping industry in China.

E-Commerce a new opportunities for Food & Beverage exporter in China

Chinese consumers prefer shopping online for convenience over price. Chinese customers are highly tech-savvy and make use of mobile technology to improve their functionality. China’s consumers are open to new technologies and will often adopt new products.

E-commerce in China experienced a tremendous increase in sales during 2020, due to the lockdown of COVID-19. Technode.com interviewed Alibaba CEO in February 2020. According to Tmall’s sales data, there was a 154% increase in food-related purchases despite difficulties with logistics during coronavirus quinte. Alibaba is also seeing a shift in shoppers’ shopping habits. Online shopping is preferred over brick-and-mortar vegetable markets and supermarkets for fresh food and other daily necessities. Although this phenomenon may be temporary due to a shortage in supply and logistics, it offered businesses opportunities to plan for the long-term changes that could affect market players.

Cross-border purchases are a way for Chinese consumers to ensure product quality. Cross-border ecommerce offers international brands the opportunity to enter China without a physical presence or trademark licence.

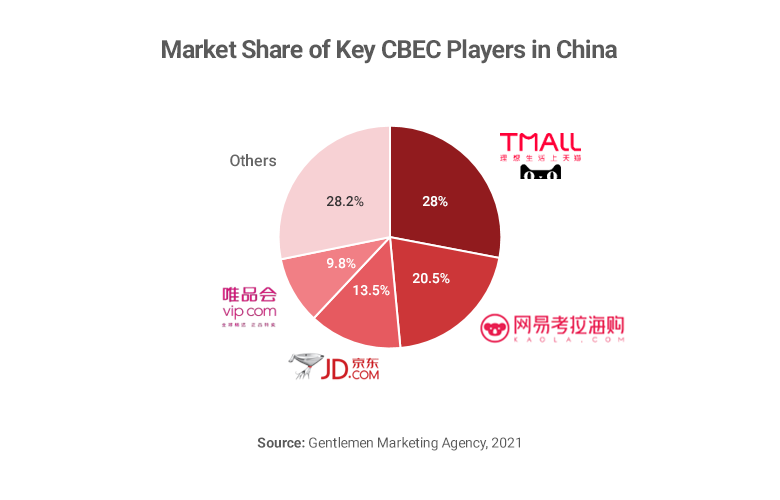

As the number of payment options, channels and offers has increased, cross-border ecommerce has seen a strong growth in recent years. New entrants to the sector have been encouraged by targeted government support. Tmall Global, JD Worldwide, and smaller, more specialized players offer cross-border options for foreign brands. There are two main operating models: the direct shipping model from overseas and the bonded warehouses model.

E-commerce law will be renewed, which will impact the sale of goods online.

The regulation of cross-border E-commerce is particularly important. “Daigou” refers to the term used for selling goods from overseas into China via travel or private post. Private sales into China from overseas will be regulated. It also allows for more product categories to legally be sold through cross-border ecommerce platforms. This is to help China achieve its goal of opening up the market to other countries, and encouraging export and import to and from China.

China cross-border e-commerce (CBEC)

China’s government supports cross-border e-commerce (CBEC) businesses. It also promotes foreign trade through a variety of new initiatives. CBEC is gaining momentum in China, opening up more opportunities for foreign F&B exporters and enterprises to access China’s huge consumer market.

- TRENDY CATEGORY OF FOODS AND BEVERAGE ON ECOMMERCE PLATFORM

- Fresh Food

- Healthy Food

- Dairy Products

- Novelty Snacks/Candy/Chocolate/Nuts

- Fashion/Functional drinks

- Coffee (Drip Coffee), tea/Premium instant foods

- Oat Milk/Soy milk

- Cold chain related / Low temperature Dairy/ Yogurt

- Butter cheese/ Ice cream/ Vegetable Meat/ Cake/semifinished food

- Natural healthy Snacks

Live streaming ecommerce and KOLs are the new way to sell in China

Live streaming is gaining popularity and is closely linked to e-commerce. This can be seen in its influence on Chinese consumers. China’s live streaming market for e-commerce reached RMB 434 trillion (US$61.24 Billion) in 2019, with a 226 percent increase in year-on-year sales. Live streaming has been a major investment by e-commerce giants Taobao, JD.com, and live streaming companies Kuaishou & Douyin. Kuaishou, a live streaming company, now allows its customers to purchase products from JD.com via the Kuaishou App.

read also