The company’s business online Alibaba has long dominated the Chinese market with 2.8 trillion yuan ($ 451 billion) of sales. However, there are signs that prove his JD.com competitor is now closing the gap that separates them.

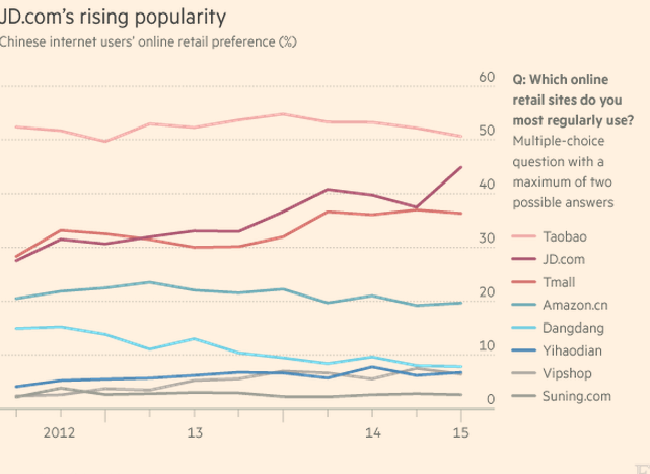

JD.com increases its popularity

According to data from FT Confidential Research, a financial research service, JD.com popularity has soared in recent months, reaching a record level. Nearly 45% of respondents in the first quarter of 2015, said they regularly bought on JD.com. They were only 30% of buyers in the first quarter of 2013.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

source: FT Confidential Research

Although Alibaba remains the undisputed leader in the e-commerce market, both through its Taobao platform and Tmall, which the latter declined slightly, JD.com is still rising sharply. The rise in popularity of JD is mainly due to the rapid expansion of its logistics in small towns and strategic alliance with Tencent group since last year.

While consumers living in first-tier cities and the coastal towns of the East were the first to adopt the online business, their fellow citizens living in smaller cities represent a greater demand because they have a standard of living lower and they seek to improve it.

The question is how far and how e-commerce companies can quickly deliver goods to consumers living in remote areas.

JD.com targeted small Chinese cities

JD.com has invested heavily in expanding its service to smaller cities in recent years. This has enabled to increase its popularity and gain more market share. At the end of the first quarter of 2015, 3539 orders were delivered by JD in over 1961 different cities and counties, which is an increase from the previous year when it had made orders in 3210 1,862 cities and counties.

The partnership between JD and Tencent

Meanwhile, the partnership with Tencent gave access to retailers at the database of the latter, WeChat and QQ both represents 1 billion users. JD.com promotion campaigns on WeChat and QQ, as the distribution of red envelope during the Chinese New Year, increased its popularity especially with its pricing policy and has recovered some users who were buying them in bulk on the Taobao platform owned by Alibaba.

Fast delivery and quality: the secret of success

The quality of the delivery service is also important. JD.com has invested heavily in its own logistics network, which, though expensive, has maintained a strict control and ensure prompt and accurate service. The quality of service has played in favor of the company and was able to convince the most demanding consumers. However, traders rely on Alibaba to expand and reach new markets.

In the survey by FT Confidential Research, we see that 36.3% of participants reported that the Tmall e-commerce platform is one of the sites they use most regularly. However, although Taobao remained the most popular site, it still fell in the second quarter. Its declining popularity was reflected in the percentage of participants who regularly use Alibaba commerce sites, 87% this year against 90% in 2014.

A decline in popularity for other e-commerce sites in China

Most other online shopping sites, including Dangdang and Amazon China, experienced declines in the popularity of last year, as the two leaders. While Alibaba dominates the market and continues to invest heavily, FT Confidential Research expects that JD.com still gaining ground. However, the high costs of these investments appear to predict that the company can’t hold in the long term period.

Nevertheless its strategy and investments allow it to be closer to its main competitor Alibaba. However, one question still lies: how long investors will waiting that JD.com records profits?

The ecommerce in China is a very huge market in China. The two leaders are Alibaba and JD.com but it exists a lot of plateforms in China. Chinese consumers are more and more numerous to use this methods to buy anything they want. It’s easier and its permits to change the life for many habitants, namely in the small cities.

Do you want further information about ecommerce in China, read this article.

2 Comments