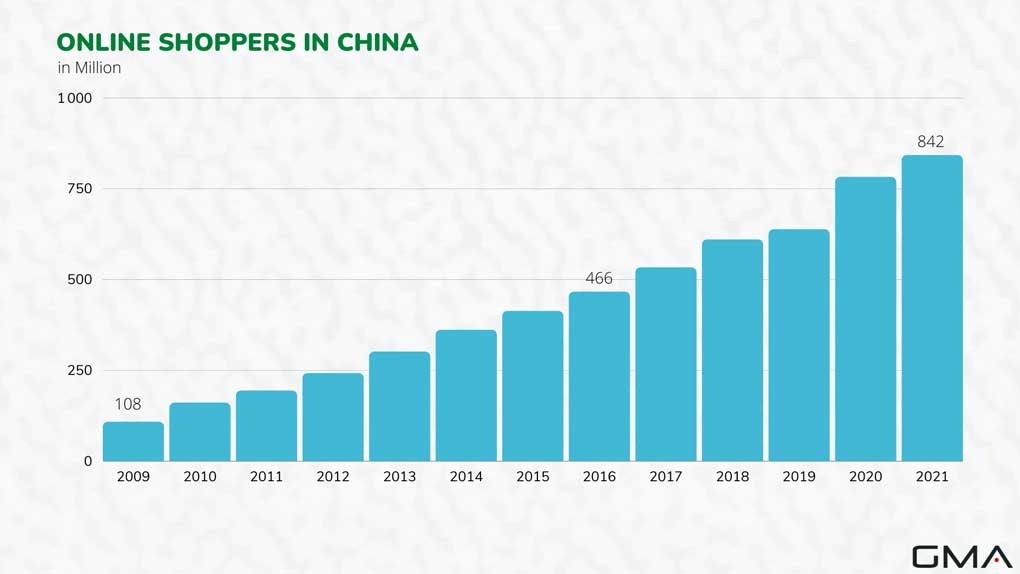

Over the years, the Chinese e-commerce market has changed a lot, revolutionizing the traditional system for both consumers and sellers. Chinese internet giants have made a real run to become the best e-commerce platforms in China by developing cutting-edge technologies. Thanks to their efforts, the opportunities to increase sales for companies and entertainment for consumers have developed significantly.

In this post, we will explore the reasons for the Chinese eCommerce market’s rapid growth as well as look a bit deeper into China’s most popular eCommerce platforms.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

The engine of growth in consumption is the new generation of Chinese consumers which is characterized by a motivation to:

- Free spending

- Sophistication

- Use the internet daily to do any type of business from chatting to online shopping

Over the past 10 years, many eCommerce platforms have developed, and improved to adapt to the demanding and ever-changing needs of Chinese consumers. In 2022 we can group the most popular Chinese eCommerce platforms as below:

- Tmall

- Pinduoduo

- JD.com

- Kaola

- Little Red Book (Xiaohongshu)

- VIP

- Taobao

- Suning

Those are China’s major e-commerce players. Some are specific to some industries, others are better for smaller or larger companies. Therefore, how can a company choose the most suitable Chinese e-commerce platforms for its sector?

Let’s take a look at some of the most popular Chinese e-Commerce platforms and understand their specificities.

The Chinese E-commerce Landscape

The Chinese e-commerce market is on its way to surpassing expectations as it is expected to reach 3 trillion dollars by 2024. It’s expected to represent more than 60% of total retail sales in the country.

Back in 2017, eCommerce sales outpaced estimates by $44.41 billion, driven largely by sales from leader Alibaba’s Taobao and Tmall. Alibaba’s share is shrinking as the market diversifies with the emergence of retailers and newcomer Pinduoduo’s recent success.

From 2015 to 2018, Alibaba’s market share of e-commerce sales in China fell from 77.6% to 53.5%. Alibaba’s e-commerce sales are now growing slower than the overall e-commerce growth rate of 34.3% with Alibaba’s sales forecast to increase by just 22.8%.

E-commerce in China: a Rapid Evolution

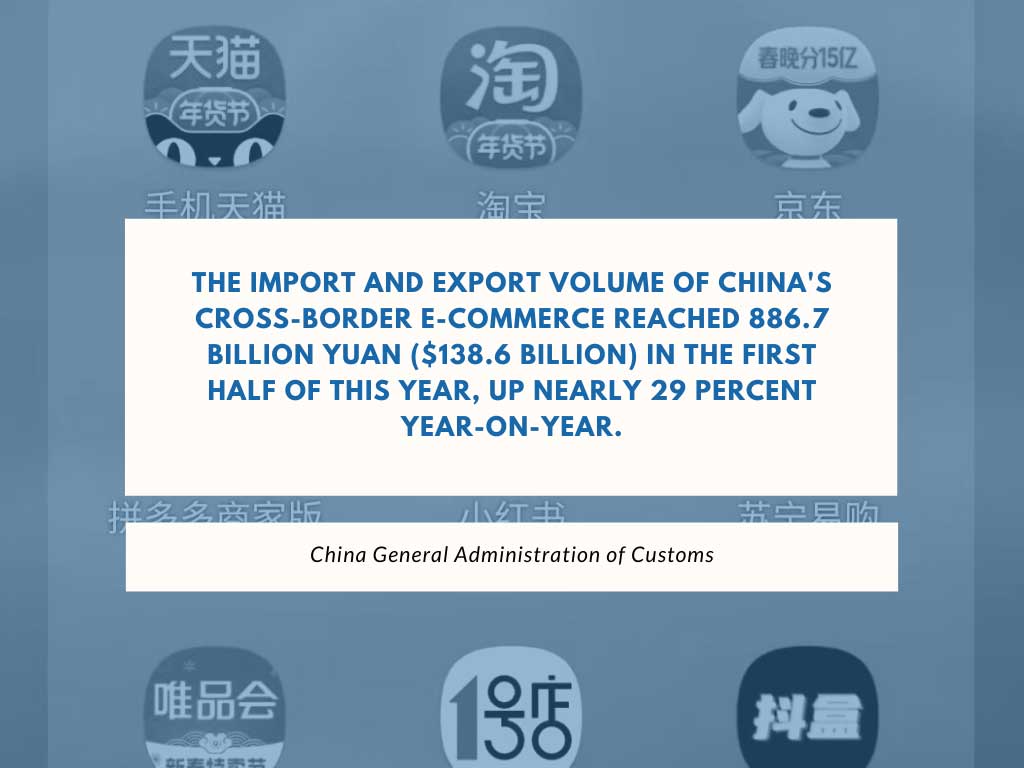

In addition, the rapid expansion of cross-border e-commerce in the Chinese market is creating opportunities for small and medium-sized enterprises to participate in world trade.

Consumption among the upper middle class is still growing fast, at over 17% per year. That compares with a 5% growth rate among emerging-middle-class and middle-class consumers.

However, the emerging middle class and middle class will remain the largest consumer group in many categories, particularly in rapidly evolving consumer goods such as personal care products and detergents.

Five key trends driving Mainland China’s E-Commerce market

- China e-commerce shopping festivals

- Consumption upgrade in the Chinese e-commerce sector

- A new form of retail: online and offline integration

- Digital payments

- The boom of social media and e-commerce integration in China: social e-commerce

1. China eCommerce shopping festivals

E-retailers are creating more shopping festivals and themes to increase consumer engagement. For example, over 79% of consumers said they participate in Double 11.

Double 11 and some other online shopping festivals are a key opportunity for local and international brands to leverage the enthusiasm for shopping among Chinese consumers.

Chinese consumers are looking to experience, try new things, and buy products that may be new to them. These shopping festivals are a perfect opportunity for new brands to enter the Chinese market.

2. Consumption upgrade in the Chinese E-commerce sector

With the rise of disposable income, consumers are more confident in spending their money on a number of categories such as food, cosmetics, and clothing. The demand for fashion is growing much faster than other consumer demands.

Middle- to upper-class consumers are now increasing their demand for goods that are not available domestically. For this reason, the number of Chinese online platforms and cross-border shopping sites where high-end and niche international brands are growing in popularity and are also driving the consumption updating movement.

Thanks to various online platforms, such as Kaola.com, Tmall Global, and JD Global, Chinese consumers now have broad access to products from overseas.

3. A new form of retail: online and offline integration

Since the term “new retail” was used by Jack Ma in 2016, it has been an important topic for manufacturers and retailers alike. This concept involved the integration of online and offline retail elements, including physical stores, products, services, logistics, big data, marketing, management, and so on.

Currently, in China, online players are taking the initiative to drive this integration. For example, the largest e-commerce platform in China, Alibaba recently invested $2.9 billion in China’s biggest offline retail group, Sun Art. The online-to-offline (O2O) business model is transforming the retail industry.

Both Alibaba and JD.com are focusing on the millions of other physical stores in Mainland China, as they believe a physical store is a place where consumers can be targeted to drive further penetration of payment platforms and e-commerce.

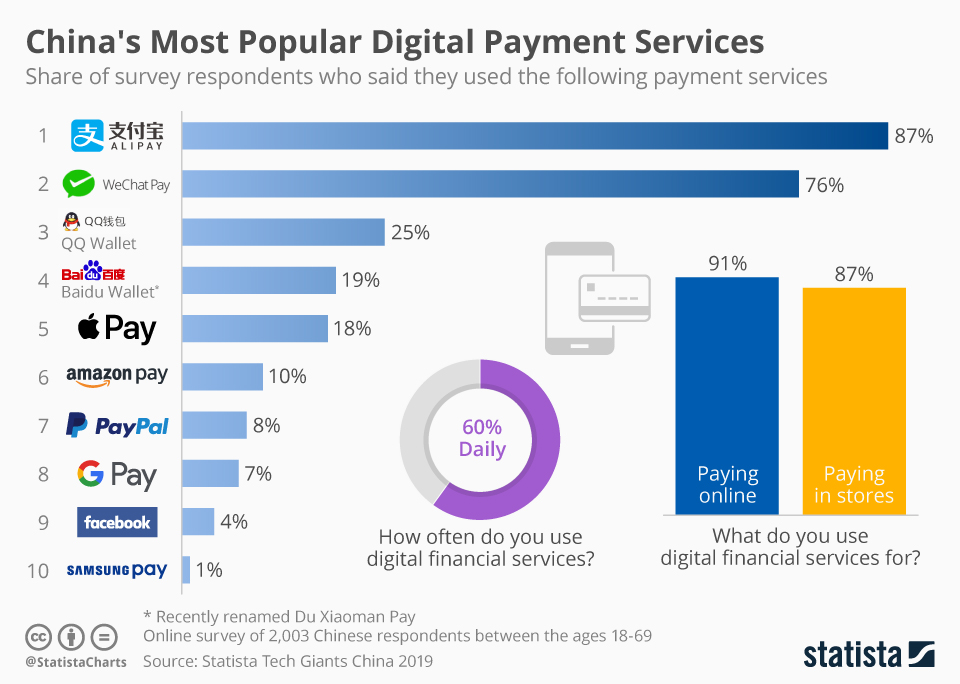

4. Digital payments are the main payment method for most Chinese consumers

Alipay and WeChat Pay are the most popular online payments in China, and they are already an integral part of leading Chinese e-commerce platforms such as Alibaba and JD.com.

Online financial companies like Alibaba’s Ant Financial and JD.com’s Baitiao are becoming very famous among Chinese consumers, especially millennials, due to their low fees and convenient user experience.

Online wallets are the top payment method, nearly 33% of Chinese shoppers use them to complete transactions. Roughly half of all China’s eCommerce sales are made on mobile devices. There are dozens of mobile Chinese eCommerce apps and they are frequently used by Chinese Internet users. Alibaba Group recorded a number of 903 million monthly active users on its e-commerce platforms in China in the first quarter of 2022.

5. The boom of social media and e-commerce platforms integration in China

Social media are the main platforms where people come to interact with one another, what’s making it an ideal place to share and comment on products. As the number of mobile users rises, the importance of social media constantly increases.

The high concentration of mobile e-commerce has accelerated the transition of the advertising ecosystem. Thus social media has become a crucial tool for marketing, especially when they are communicating and engaging with potential consumers.

WeChat & its vision of e-Commerce in Mainland China

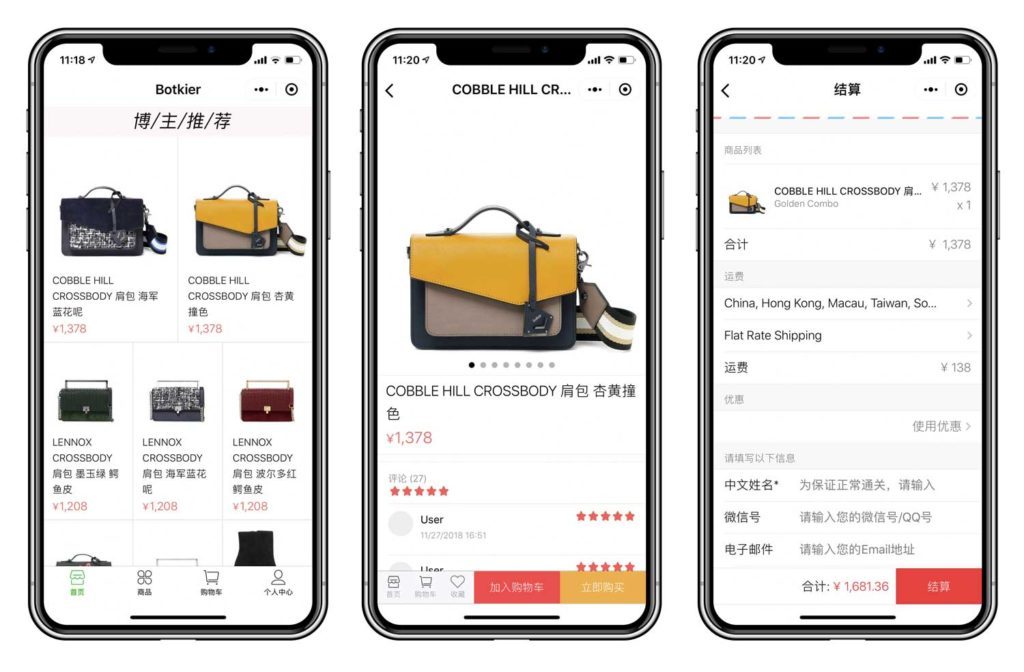

WeChat allows retailers to feature online stores and has a convenient third-party payment function (WeChat Pay).

It also features push messages to introduce new product lines or deliver promotions. U.S. companies interested in exploring social media avenues and working with these sorts of social media players should seek to work with a local marketing partner to develop a strategy and support execution.

China e-commerce market: what opportunities does it offer to brands?

With the development of new technologies, building a beautiful and dynamic website is not a big deal. The important thing that really matters is building a website that is relevant to your target customers.

China is a challenging market for foreign brands and Chinese netizens are difficult to please. They have a unique language, different symbolic colors, and philosophies, and they face a different ecosystem and online regulations.

It’s important to adopt the best practices to set up your e-commerce design for China which will mean taking a big step toward your brand’s success.

GMA helps brands join China’s most popular e-commerce platform. We provide comprehensive and diversified professionally managed e-commerce services like:

- the registration and opening of online shops

- store decoration design

- uploading product

- daily customer communication operation, and maintenance

- optimization of promotional activities inside and outside of the platform

What are the most popular Chinese e-commerce platforms?

Although there are many platforms in China with e-commerce purpose, there is a number of those, that are well-known by most Chinese people.

The most popular e-commerce websites in China are:

- Taobao

- Tmall

- JD.com

- Little Red Book (Xiaohongshu)

- Suning

- Kaola

- Pinduoduo

But let’s get to know them in detail. What is the most suitable e-commerce platform for your brand?

Taobao: idea incubator for Chinese e-commerce

Alibaba-owned Taobao is not unknown to the e-commerce industry with estimated monthly traffic of over 500 million. The C2C (customer-to-customer) giant sells almost everything, from pets to vehicles. Taobao owes its success as the market leader in this industry to offer free registration for its users.

Taobao.com, the most popular online shopping site in China, is a platform for small businesses and individual entrepreneurs to open online retail stores. It features a variety of items and cheap prices. In fact:

- the products are usually offered by small business owners,

- buyers are very careful buying things, they check several aspects including the shop credit, customer satisfaction rate, and comments before making their final decision.

The app has recently launched its affiliate program: Taoxiaopu. Taobao has rebranded itself as a platform that encouraged entrepreneurship and young designer to find their fame online instead of being the online version of a fake goods market.

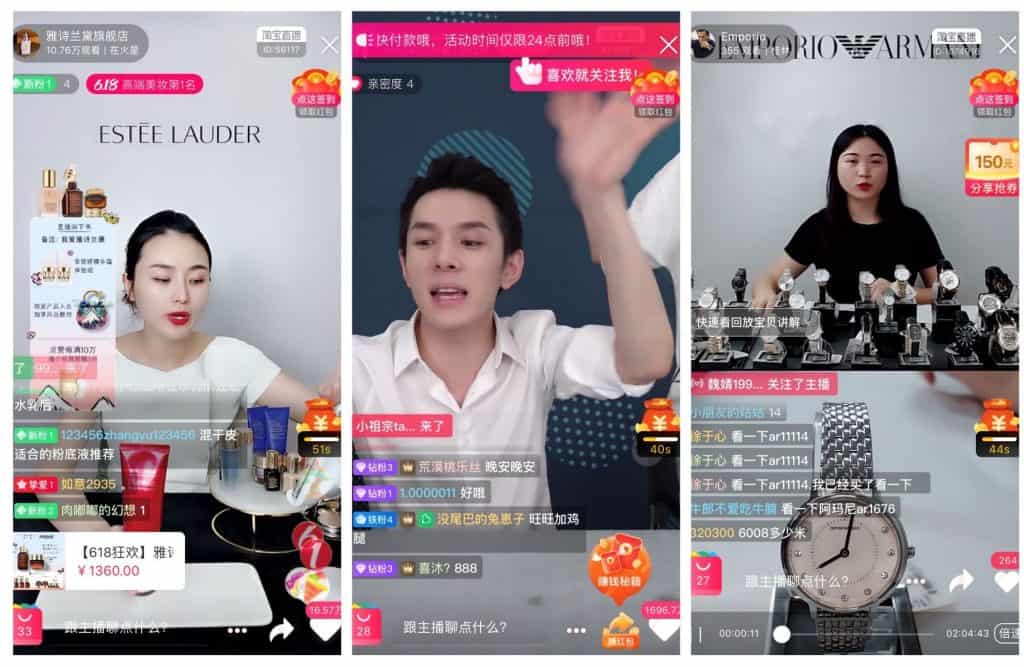

Taobao live-streaming feature

Taobao has also launched a live-streaming program in collaboration with Weibo. The program is called Taobao Live and allows businesses to promote themselves via live video to consumers searching for information and content regarding various categories.

Live streaming is becoming incredibly popular and hard to avoid these days. Especially during a global pandemic, Taobao Live has gained immense popularity. Live streaming has proved itself to increase ROI and conversion rates.

Weitao: Taobao’s social e-commerce platform

Another major feature within the Taobao ecosystem is Weitao. Weitao is one of the biggest social eCommerce platforms and can be accessed within Taobao and Tmall. This social function is incredibly engaging for consumers and since it is built within Taobao and Tmall, customers can quickly access and purchase products from Weitao.

Although the function was introduced in 2013, it has gained popularity over the last few years as KOLs and social eCommerce have grown in tandem.

Our Taobao services include:

- contact and confirm with the platform for product entry

- e-commerce consultancy

- page design on Taobao

- Marketing and advertising

- live streaming/video footage

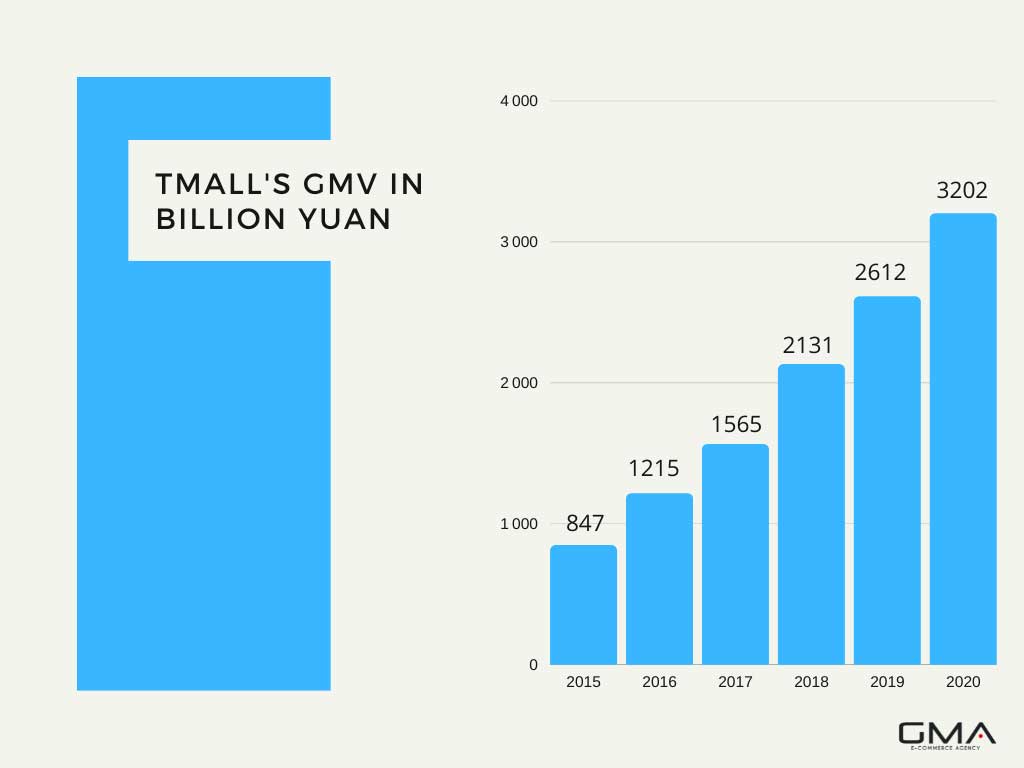

Tmall: the Chinese e-Commerce platforms king

Another e-commerce platform owned by Alibaba is Tmall: B2C (Business to Consumer) services, it’s recording estimated monthly traffic of over 57 million (keep in mind that Taobao and Tmall are linked). It is a virtual shopping center that hosts many international brands, such as Gucci, Calvin Klein, Burberry, and many others.

It is more high-end than Taobao and the requirements to enter as a seller are high. The idea is simple; only quality sellers are allowed. When one is ordering on Tmall, one does not have to worry about what he/she will receive.

To operate on Tmall, a company is required by regulation to use what is called a “Tmall Partner” which is a third-party company that helps to provide assistance in onboarding and operation for businesses that are working on Alibaba’s platforms such as Tmall.

A few specific functions of Tmall partners are as follows:

- Create an operation plan

- Execute store opening

- Decorate the store and enter the product information

- Webstore maintenance: Product management, campaign planning, and execution

- Execute day-to-day marketing and promotions: Network promotions, daily consumer marketing, brand marketing

- Customer Service

- Logistic services: Cross-border logistics, warehouse services, courier services

- Webstore analytics

Tmall partners can be found through official lists provided through Tmall where businesses can assess the quality and reputation of various Tmall partners and choose one that fits the needs and scope of the business.

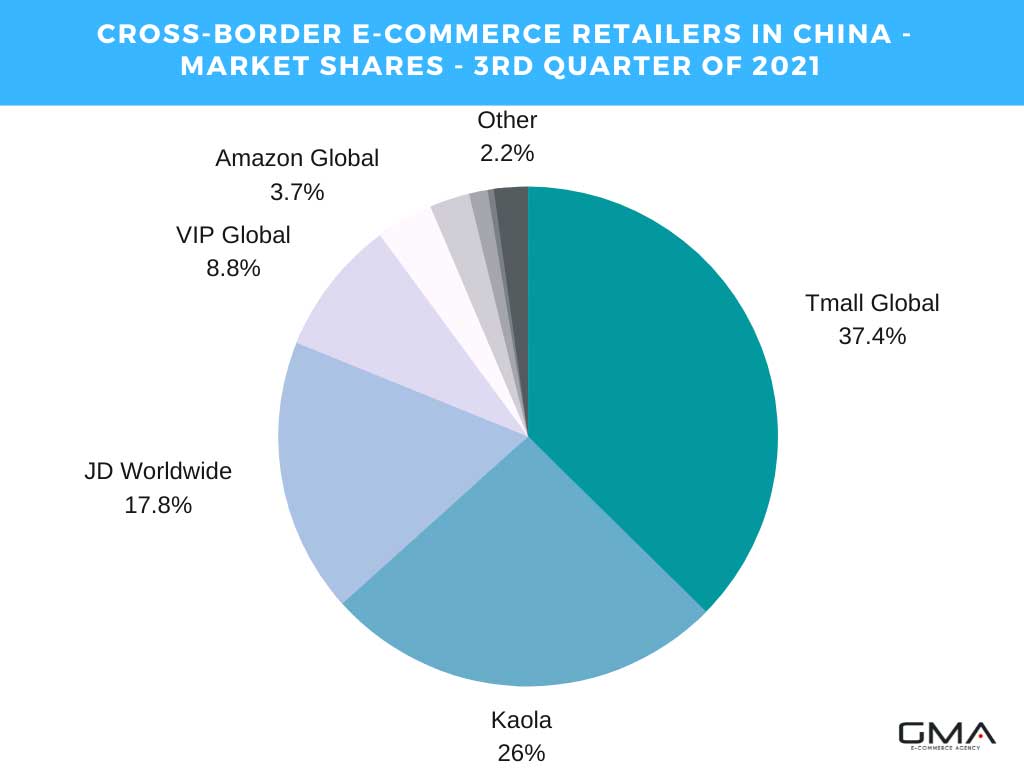

Tmall Global: Cross-border e-commerce in China

Tmall also offers a cross-border service for foreign entities (with Chinese business licenses) that do not have a presence in China and wish to try out the market and reach out to Chinese customers. The entry requirements are still quite high.

In the summer of 2019 however, the platform released TOF (Tmall Oversea Fulfillment) to encourage smaller brands and give them a chance in the Chinese market.

Tmall Global is perhaps the most interesting sub-platform within the Tmall ecosystem for foreign companies. Tmall Global allows international brands to sell their products directly to Chinese consumers within the Tmall/Taobao mobile apps.

Although there are stringent requirements for registering a Tmall Global account (i.e. registration, partnership with Chinese entities, etc.), this is an incredibly effective and well-worth acquiring tool for companies that want to reach more Chinese consumers directly.

Tmall B2D: For brands to find online distributors in China

Tmall B2D has implemented a new B2D strategy (Business to developers) to resolve the problem of distribution in China. This solution is considered the new revolution of distribution in China because major companies like Alibaba have started to find ways to arrange this market.

Tmall B2D manages to connect distributors with the brand directly to avoid any intermediate connections, by gathering all distributors and helping them to connect with the brand.

This platform allows significant gains for all participants (the final customer, as well as the intermediary distributors) and therefore the success of the product and its brand in China.

We are a Chinese E-Commerce Agency and a Tmall Partner. We help brands to sell their products on Tmall through:

- Consulting & Strategy

- Tmall store design

- Marketing and Promotion for Tmall

- Tmall Management

JD.com: eCommerce platform trusted by Chinese Consumers

Founded in 1998, JD.com is the largest business-to-consumer online retailer in China and one of the biggest competitors to Alibaba. It provides about 400,000 new products including cell phones, home appliances, apparel, wedding events, electronics, books, and more. It also has an English version website en.jd.com. It has an estimated monthly traffic of 227 million.

JD features a fast delivery service and guaranteed product quality. The main problem is it does not support instant online customer service and its customer-service phone is hard to get through.

JD Mall offers direct sales of electronics, general merchandise, books, home appliances, digital communications, apparel, food, and other goods.

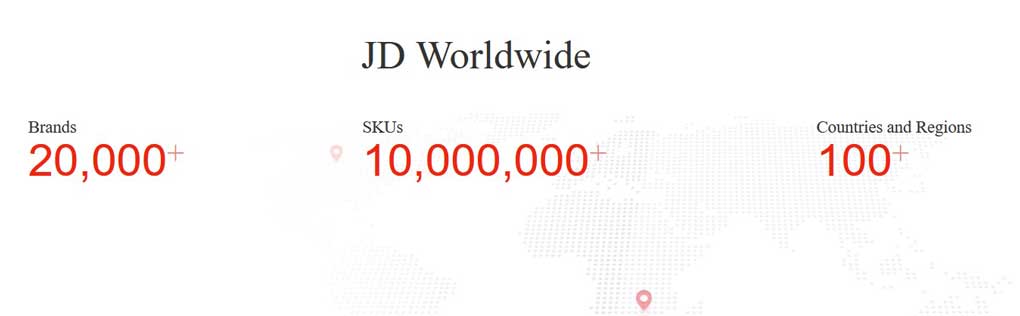

JD Worldwide: how much does it weigh on the Chinese eCommerce cross-border market?

JD Mall’s cross-border service, JD Worldwide, allows international merchants to sell directly to Chinese consumers without a physical presence in China. The company has the largest fulfillment: JD Logistics which provides business partners with supply chain solutions, including warehousing, delivery, and after-sales service.

Similar to WeChat, JD is now implementing mini-programs of its own which act as an app within the app. This allows businesses to create programs with specific features that highlight their brand – opportunities for direct sales, promotions, functions for delivery, and many more. Furthermore, this allows consumers to use payment systems within the app which removes yet another step and barrier for conversion.

JD is growing out of the electronic appliances segment

Although JD was once known as a primarily tech-focused platform, in recent years, the company has innovated quite rapidly in other industries. For example, it has taken similar action to other large eCommerce platforms by venturing into the grocery industry.

JD’s grocery chain, 7Fresh, has opened up several stores where customers can experience a high-tech grocery shopping experience. Customers can pay directly via JD’s payment system or through the more widely used WeChat Pay. The chain also offers 30-minute delivery for customers within a three-kilometer radius.

In addition to the grocery service, JD has also developed a strong presence in other industries such as the beauty segment.

Our JD eCommerce Solutions:

- JD.COM store Setup

- JD.COM Design

- JD products Update

- JD store Management

- Commission

- JD Promotion

Little Red Book (Xiaohongshu): Birth Place of Social eCommerce in China

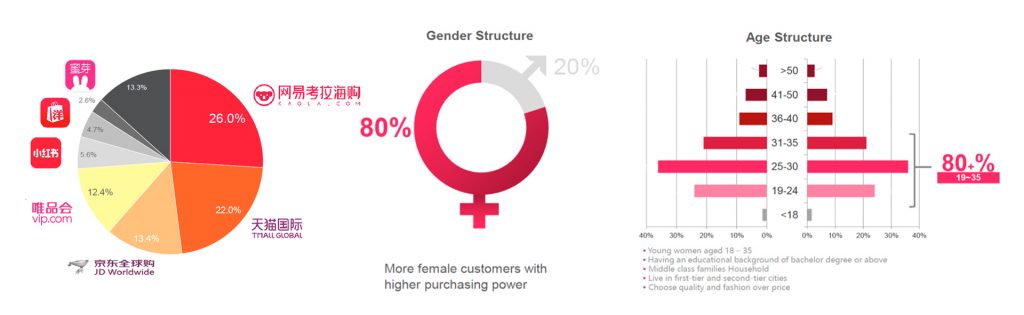

Little Red Book, founded in 2013, has over 100 million monthly young users. Its shopping program has estimated monthly traffic of 12+ million as of 2021; It is the most popular social media and lifestyle-sharing platform for high-end and luxury brands and shoppers in China.

Little Red Book grew very fast into one of the social media platforms where users/ Chinese customers post-shopping tips, including must-have products and stores frequented by local residents.

Following its initial success, the app entered the Chinese eCommerce platforms game with its RED Store, mainly targeted at high-end foreign brands.

The Little Red Book app displays product photos and videos posted by users as soon as it starts up. Cosmetics, clothes, and bags come with reviews, ratings, and user backstories on purchases. People can research products and buy them through the platform.

When thinking about marketing strategies in China, the Little Red Book is a key tool for beauty & fashion brands in China. It appeals to key opinion leaders to whom consumers are looking up and all in all will help your brand set itself apart in this competitive market.

Little Red Book is currently the most trusted social e-commerce platform with the main market and target audience on the app being consumers looking for fashion and luxury goods.

That means that primarily women, mothers, and those interested in beauty industry content are highly concentrated demographics on the app. These users also tend to be both young and wealthy which makes them highly valuable in terms of conversion rates.

The power of social influence, KOLs, and word-of-mouth marketing is the key to Little Red Book’s astonishing success and rapid growth. Users on the platform are highly interactive and engaged.

GMA can help you by offering you services including:

- RED Store Setup

- Influencers Campaign

- E-commerce Management

VIP.com: a Chinese eCommerce app focused on the beauty market

VIPShop focuses on discounts and flash sales. The online retailer partners with over 1,000 brands to bring certain amounts of items at a lower price for consumers. The site mainly covers clothing and electronics. It was one of very few Chinese tech stocks to list in the US in 2020.

When looking at Chinese eCommerce platforms as a whole, VIP certainly looks like a niche app. However, the e-commerce flash sale and the discount app have their place in this post as it is an excellent complementary sales channels for brands already set up in China. What is more, only a few of these e-commerce platforms in China offer cross-border options, and VIP Shop is one of them!

Suning: an online place to sell electronics on the Chinese market

Suning.com is one of the largest non-government Chinese companies, headquartered in Nanjing, Jiangsu Province. Suning’s e-commerce platform categories include physical merchandise, such as home appliances, 3C products, books, general merchandise, household commodities, cosmetics, and baby care products, content products, and service merchandise. Its estimated monthly traffic is over 40 million.

Suning Commerce Group Co., Ltd. principally operates franchised retail shops of electronics appliances in China. The Chinese company mainly offers color televisions (TVs), audio and video (AV) players, disc players, refrigerators, washing machines, digital and information technology (IT) products, small household electronics, air conditioners, telecommunications products, and other products. Suning also provides installation and repair services for electronic appliances.

Kaola: One of the biggest Chinese Cross-border eCommerce platforms

Kaola.com has grown by establishing a reputation for featuring reliable, genuine products on its site. It maintains quality by setting up purchasing teams in foreign cities such as Tokyo and tries to keep prices down by negotiating directly with manufacturers.

In a reliability survey of cross-border e-commerce companies in the first half of 2017 conducted by China’s iiMedia Research, Kaola.com topped the ranking, followed by Amazon.com (global leader) and Xiaohongshu. Kaola was bought by e-commerce giant Alibaba in 2019 for $2 billion.

Alibaba intends to allow Kaola to continue operating under its current branding but will inject some additional resources to improve the consumer experience on the platform.

This acquisition also has plans to grow Kaola as a cross-border-e-commerce giant to rival other e-commerce platforms in China such as Tmall Global and JD Worldwide.

Pinduoduo, the most innovative Chinese Social e-Commerce apps

Pinduoduo is a platform that has been growing in the shadow of third and fourth-tier cities and slowly eating some of Taobao’s and JD’s market share. The estimated monthly traffic as of December 2022 was over 250 million, putting Pinduoduo close to the biggest competitors in the Chinese market.

Pinduoduo’s business model relies on group buying and C2M (customer-to-manufacturer). With group buying, Pinduoduo connects consumers and producers directly for bulk buying, thus being able to offer the lowest prices on the Chinese eCommerce market.

The platform below is Pinduoduo. An app that works with rival giant Tencent and that is promoting a social eCommerce platform. We will talk about it later in the post, don’t miss out.

In the summer of 2019, many things happened in the Chinese eCommerce world, including Pinduoduo beating JD.com as the second-largest e-commerce platform behind Tmall. For years, Pinduoduo has been focusing on smaller Chinese cities by offering the best deal and the possibility for users to work in hand to get items at a bulk price.

Pinduoduo Business Model and affiliation marketing

2019 was the time for Pinduoduo to walk in Taobao’s footsteps and show what it was capable of. Not only does the app work directly with suppliers reducing the cost of sold items but it has focused on affiliation working hand in hand with Wechat.

Pinduoduo buyers can get discounts, gifts, and even free items by promoting, sharing links, and pushing people to register on Pinduoduo. This affiliation program worked so well that Taobao’s later launched its own affiliation program known as Taoxiaopu.

Pinduoduo has been heavily playing on the concept of limited-time and emergency buying with flash sales for instance.

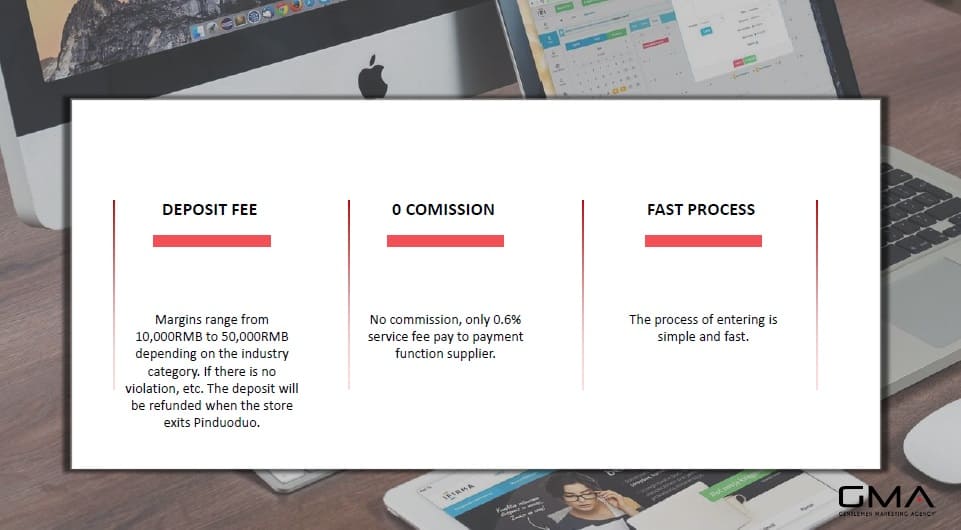

What are Pinduoduo’s benefits for foreign brands:

- No registration requirements

- No sales fees

- Cheap advertising

- The possibility of showing the total sales outside the platforms (great to increase conversion).

To sum up the topic of Chinese E-commerce platforms

We love the current dynamic in the Chinese e-commerce landscape. Because the platforms are racing to be the most attractive to customers and foreign businesses, we see the development of new marketing tools that are full of opportunities. This race not only means more tools for sellers and buyers but also relaxed requirements to register on these platforms. Believe us, it used to be challenging.

With the development of new technologies, one seems to overshadow the rest: Video. Live streaming by KOLs has a huge impact on sales conversion but short video ads are also part of the game with unicorn apps such as Douyin, which are not shy about their intention to become part of the leading Chinese e-commerce platforms with millions of annual active consumers.

Gentlemen Marketing Agency: help you start on Small & Big Chinese eCommerce platforms

We Build your Store, We Promote your Business and You make it thrive! There are many ways to sell online in China. Contact us now to discover which solution fits your business best! We set up e-commerce websites and stores and run smart digital marketing campaigns in China, market research, reputation, search engine optimization, and so on.

Gentlemen Marketing Agency is innovative marketing & e-Commerce in China Agency. Our China eCommerce and marketing solutions are designed to help you achieve your business goals in China.

We have 10+ years of experience in providing an invaluable online strategy to companies looking to develop their activity in the Chinese market. We seek to form long-term partnerships with serious projects.

Here you can see one of our case studies:

Leave us a comment or contact us if you’re interested in taking a step into the thriving world of China’s e-commerce landscape!

We are interested to find out more about your services as we are investigating going directly ourselves in the Ecommerce world in China.

Please let me know when we can have a brief discussion and if you have any experiences with Sports wear brands entering to China

What are the Chinese marketplaces ranking list?

top online marketplaces 2018 in China?

Any source 2019?

Among emerging economies, China’s e-commerce presence continues to expand every year. With 668 million Internet users, China’s online shopping sales reached $253 billion in the first half of 2015, accounting for 10% of total Chinese consumer retail sales in that period.

Cool thanks for the update. Looking forward to seeing more content about Pinduoduo.

Excellent Extravaganza Extravagant Announcement

A great article, the best article i have read about ecommerce and China in 2020.

What do you recommand for a luxury brand for ecommerce in China?

Hey,

A great question to which the answer differs greatly depending on how famous the brand is.

I’m gonna over-simplify the answer, but it should give you a good idea of where to get started:

Is the brand is new to China, then the priority is Brand Awareness

If the brand is already in China, has quite a reputation, then it’s time to try new things. Live streaming and Videos for instance.

Feel free to contact-us, we’de be happy to schedule a call with you and talk more in-depth about the best strategies for luxury

Super good article. I love it.

I share it as well. congrats ecommercechinaagency

Hey Peter,

Thanks so much for the feedback

I’m very happy to hear you appreciate our work 🙂

I have to admit I never paid attention to localization, I always thought that translating the website content was enough, very good content! Do you know which shopping festival is the more profitable regarding e-commerce in 2020? There are so many platforms nowadays, thanks!

Shopping festivals are great to run unique campaigns, sell limited editions

festivals campaigns usually generate more engagement/conversion.

When you think about localization it also about culture and consumption habits.

It is rather common for Chinese netizens to buy more during these festivals and to hunt for the best deals.

For instance: During 11.11 consumers tends to buy necessity products in bulk.

But if you take a festival like mid-autumn, consumers look for gifts for family reunions

Congrats for this full article about e-Commerce China, it be really helpful for my research.

Glad you like it 😉

Amazing website sir. A great information given by you in this blog. It really informative and very helpful. Thank you.

Is it possible for brands to sell on severals chinese ecommerce marketplace at the same time? and would you recommened it?

Hi jay,

Thanks for your question.

The short answer is yes and yes we would recommend it if your company has the resources.

It is possible for foreign brands to sell their products on different Chinese eCommerce marketplaces, though it takes a bit more work due to complicated registration and high fees.

It is very common for well-known brands to be on JD and Tmall and even to have a store on the global version of these eCommerce apps. It shows consumers you are a legitimate brand with enough found to be on many market place. It also helps with conversion, as the more your target audience sees you, the more likely they are to convert at some point when they need something you sell.

However, it takes a lot of effort to set up and maintain, and it’s probably not worth it if your brand is not well established in the market yet. If you are new in China, we would suggest you focus on 1 app, get familiar with the market, and promote your name. Once your brand awareness in the country is good, you could think about launching several flagship stores.

in 2021, there a fierce competition between tech giants in e-Commerce.

This drop in profits comes as a tightening of regulations in China has shaken the tech giants for several months.Long regarded as a model of success for Chinese companies, Alibaba was the first to suffer retribution from the authorities, and new regulation that are facing these big giants.

want business

Such a Golden mine of information about EComemrce websites in China

If you need to sell via vietnam Ecommerce you can have a look on my websit, i have a list

Some are Entry Free (no charge)