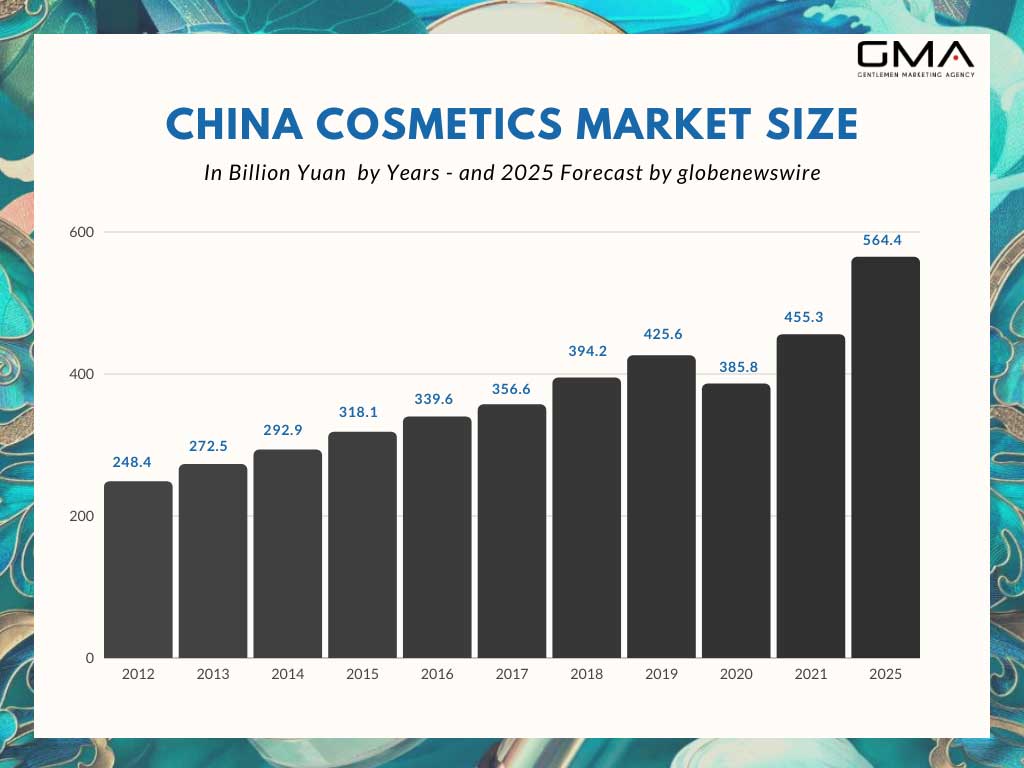

China is the world’s second-largest cosmetics consumer market and is growing steadily. For those brands looking to sell in China, they need to be aware of the Chinese regulations on imported cosmetics that are now stricter than ever before. This blog post will tell you everything you need to know about the China cosmetics market and how to sell your brand in China while also providing tips for promoting it.

Introduction to China Beauty & Cosmetics Market

China’s beauty market has been developing at a rapid pace and this trend does not seem to be slowing down any time soon. Even though the whole world experiences the results of the Covid-19 pandemic, in 2023 the cosmetics industry feels stronger than ever.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

There are still some challenges that foreign brands need to overcome when entering the most promising market in the cosmetics world, such as language barrier, lack of product availability, and high cost of operating.

In order to overcome these challenges and reach out to Chinese beauty consumers, international cosmetics brands need to run interactive marketing campaigns tailored to the needs of their consumers

The beauty industry never falls it just comes up with new ideas, concepts, or transitions in product choices as long as people seek aesthetic changes. It is observed that consumers shift their tastes and brands accompany those changes, making them look always new and on-trend.

What makes China attractive for Cosmetics brands?

Besides the advantages of a massive population, there are other forces that contribute to the beauty market growth on the Mainland.

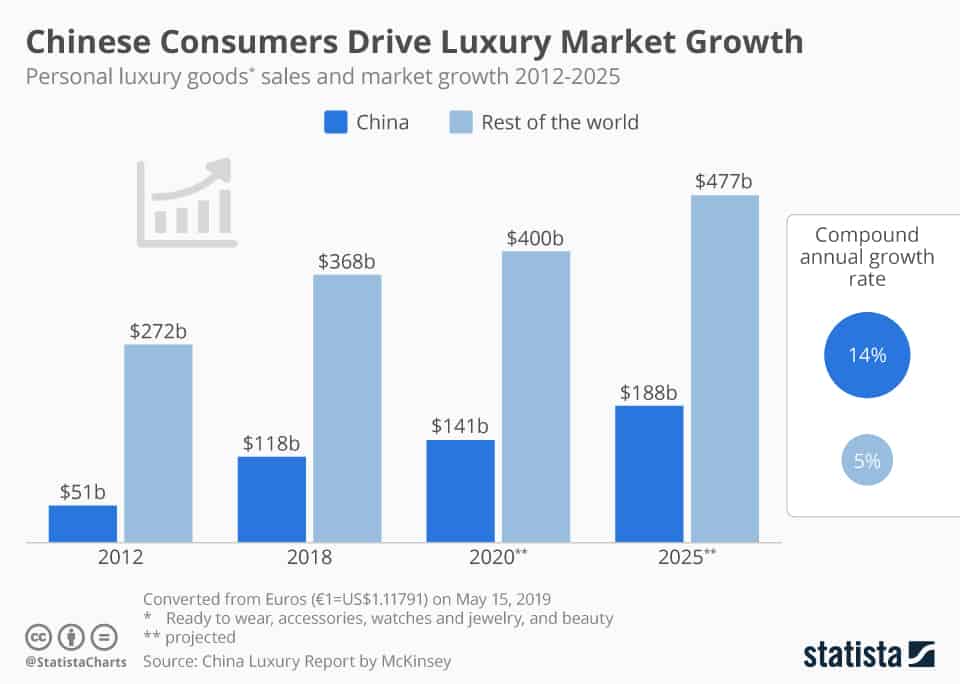

Higher-income and consumption per capita

One of the reasons why there has been a growth in consumption has to do with an increase in income. The data show that for the past decade, the middle class has been growing at a very high rate and it is believed this rhythm will only increase. With more people in the ranks, there’s an increasing demand for luxury beauty products to go along with their newfound wealth.

According to a recent survey by OG&C Consultants, 58% of Chinese people are willing to buy more expensive products in the future. This gives some indication that China may be ready for high-end cosmetics which could give beauty brands a chance at increasing their market share as well now that they have an opportunity with higher prices and increased demand.

Wider consumer range

In the last decade or so, make-up has gained traction in China with many people under 30 less shy of their purchases than previous generations.

Studies also show that Chinese female consumers aged from 19 to 25 (Gen Z consumers) have started to use international premium cosmetic brands when buying make-up products, and this presents an excellent opportunity for foreign and domestic brands. When it comes to cosmetics in China in 2023, one of the biggest trends is also a boom for skincare and cosmetics products among men.

Consumers born in the ’90s have an eye for quality products no matter what they cost and will buy international beauty brand names such as Giorgio Armani. Indeed, if the product is valuable enough, then the price is a second thought.

China’s cosmetics market trends

The Skincare Segment is ahead of the curve

Chinese women have long attached high value to their skin and are usually fashion-conscious. They are known for meticulously applying skincare products before starting the day or going out, “explaining” in part, how skincare has become the fastest-growing segment of the Chinese cosmetic industry.

Skincare is a hot topic in China, and it’s for good reason. Chinese celebrities are ditching the heavy makeup look that was so popular just a few years ago – instead opting to go with “glass skin” inspired by Korean pop culture beauty trends. These stars even share their own skincare routines on live streams which attract tons of followers.

Chinese skincare product consumers are shifting from price-focused purchases to quality and brand-oriented. Although, you should note that the Chinese cosmetics market is huge and segmented so there absolutely is also a market for more affordable cosmetic products.

The make-up segment in China is far from saturated

Even though the skincare segment is gaining a lot of traction it doesn’t mean make-up products are lagging behind, it’s actually the opposite. It’s growing every year, particularly for enhancement items, such as color correcting (CC) and blemish balm (BB) cream.

There is however an interesting trend among Chinese consumers. They are looking for skincare functions in make-up products, such as lipsticks with vitamin C. This trend illustrates well the gain of awareness from Chinese cosmetics consumers regarding the quality of what they put on their skin.

It is especially true for cosmetic products that claim health benefits – beware, products like this still require animal testing to be sold in the Chinese market, as well as a specific license and be approved by the National Medical Products Administration.

Male Grooming Products on the rise in China

There is a global growing trend in men being more conscious about how they look and want to enhance their features through beauty products, as well as to improve their skin health. Men’s beauty market in China reached over one billion yuan in 2022. Male beauty is a thing in Asia and China becomes one of the best markets for male cosmetics and beauty products, especially in the skincare section.

China’s growing demand for cosmeceuticals

Cosmeceuticals are a subset of the cosmetics industry but with more active and natural ingredients intended to act on the skin. In China, the definition of cosmeceuticals is broadened and may include remedies for hair loss or dandruff. Cosmeceuticals, especially Chinese herbal cosmetics, are opening up a new territory in the Chinese cosmetics market.

Young Chinese consumers are the main purchasing force in the market, they are more aware of the concerns of poor quality products. Consumption of cosmeceuticals tends to start at increasingly early ages.

China baby skin care products craze

Baby skincare products are experiencing significant growth. I know what you are all thinking: How is this segment growing when the population of babies and infants is declining in China?

Well, as simple as it may sounds, new mothers in China tends to spend more on their offspring’s skincare and personal care. More info on China’s baby skincare market here.

What are the main challenges for foreign brands entering the Chinese market?

The cosmetics market in China is seeing a regain of attention from Chinese Brands

Chinese brands on average cost less than international brands, and Chinese consumers believe they get better value for money. According to Euromonitor, China’s domestic brands occupy nearly 61% of the overall cosmetics market.

This is well above foreign companies’ penetration rate of 39%. Local companies recorded an average growth rate of 12% over the last five years – compared with 6.5% for international players.

Chinese cosmetics consumers perceive domestic brands and skincare products as more affordable since they cost roughly half the price of imported products.

Local companies have also ramped up their marketing effort in recent years, which means they are better known by consumers than ever before. However, the public might have some reservations about whether these domestically produced cosmetics meet their standards of quality.

A fierce battlefield for new-comers in the China beauty market

Though the Chinese cosmetics market is far from saturated, and there is still an obvious huge potential to grow still, the beauty industry in China is highly competitive with many brand segments in different sections.

There’s a rise in local brands that own a reputable image in China, emphasize natural and herbal cosmetics (the Herborist), and have also high coverage of lower to middle-tier cities, which end up with more market penetration than international brands.

Consumers in first-tier cities tend to buy international premium brands & luxury cosmetics brands like L’Oreal, Estee Lauder, and Yves Saint Laurent, which are also very well-established brands internationally. Most of the foreign market shares are occupied by these brands that can be found in department stores all over China.

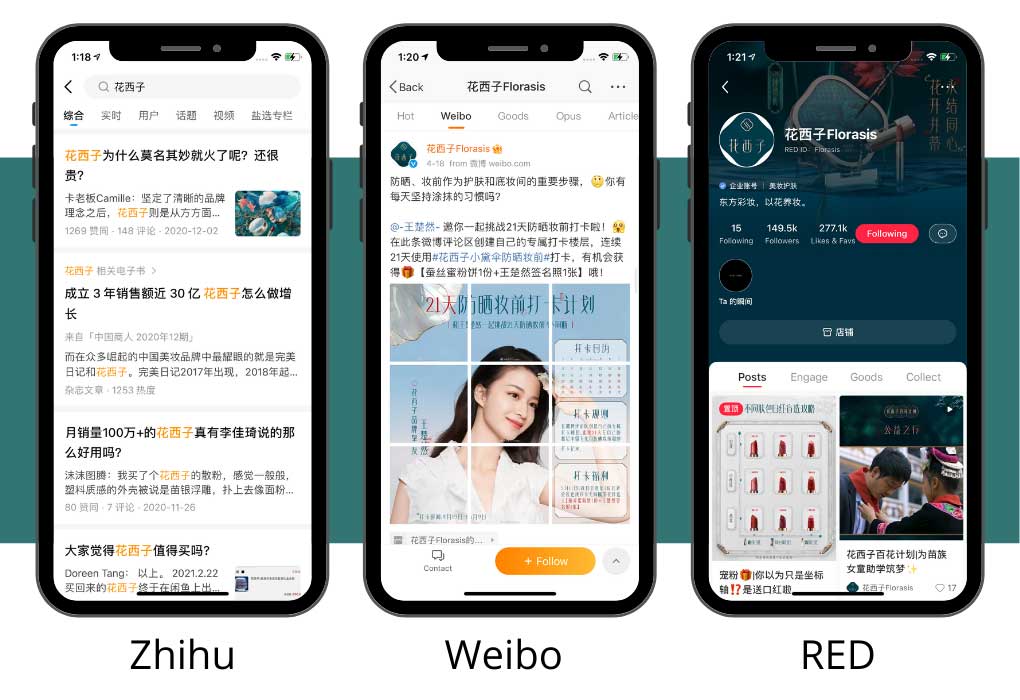

The rise of local competitors: the case of the Perfect Diary and Florasis

The Chinese cosmetics market leader, Florasis and Perfect Diary are making a name for themselves. They both started exclusively on e-commerce platforms and following their success, later expanded their distribution channels to physical stores.

The newest competitor is Florasis (also makeup products). 2021 #1 brand of cosmetics in China, which was launched by Zhejiang Yige Enterprise Management Group.

Both brands were released at around the same time, and Perfect Diary went on to become a big talking point due to its innovative design and features that innovated throughout 2019 (with new offerings such as an app for children’s sleep cycles or personalized milk powder made from Hong Kong cow’s milk), Florasis with a more “Chinese classical” design is absolutely killing it on Chinese eCommerce platforms.

Loyalty and novelty craze in the Chinese beauty market

Cosmetics consumers, that are changing from Generation X to the after 90’s, have a totally different psychological purchasing behavior. Studies show that the younger generation tends not to be as loyal to brands as the previous generation.

They base their choice on different standards, especially on how appealing the KOLs promotion is, depending much more heavily on their opinions.

High-end niche brands sometimes take advantage of that, making people feel differentiated from others, and also making them feel like they need to have that new product. Therefore unique product design, as well as a personalized connection, are crucial components for success.

How can foreign brands promote their products in the Chinese market?

The first step is to build an online presence and brand awareness. It may sound obvious but this is a really important step, It’s very hard for a company to sell its products with no brand awareness. So, in order to increase your brand awareness, you have to be at the top of the list, making an effort in advertising not just your products but what your brand stands for, and what differentiates it from the other ones.

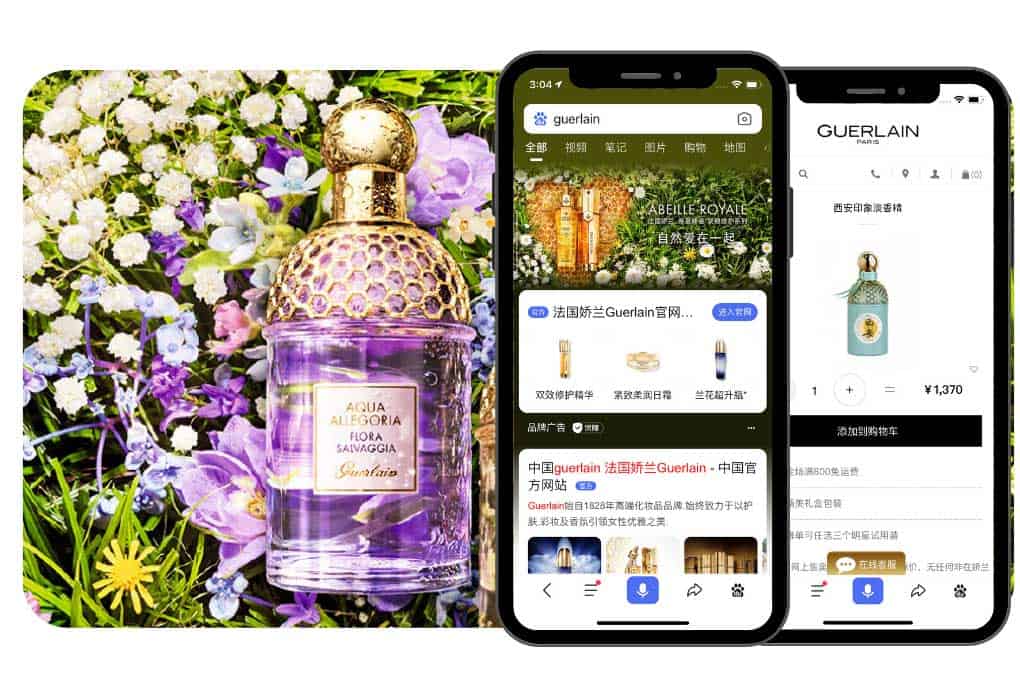

Get your cosmetics brand a Chinese website and work on Baidu SEO

Baidu is an example of a tool that is extremely important to understand. With an 70% market share in the Chinese search engine market, it’s the dominant search engine on Mainland. It handles about 6 billion searches/queries per day on average and has over 60 million viewers per day as well.

As Baidu has covered 95% of netizens in China to increase brand visibility and attract more traffic, it is the way to go whether to run paid ads or optimize organic search results. However, operating on Baidu is not the same as Google, below are some suggestions on how to set it up.

Since Baidu is a Chinese search engine that is meant for Chinese customers, it requires having a Chinese website, or else people who search in Chinese keywords won’t find you online.

Brand Recognition: Work on press releases and e-reputation

Branding is king in China, so there is an absolute need to build a good brand image and a reputation. Doing so will draw a great number of customers. This means knowing how to express your brand in an online environment, since cosmetics lovers always search for the latest trendy information online, especially posts or publications on websites. Focusing on upgrading the content will be a useful method to employ.

For many, they may feel like the super apps and platforms are everything when doing business in China but press releases also play a vital role. They help back up your credibility; which is an important thing to have before even entering into any deals with Chinese companies.

Here are a few points to make it easier when writing one:

- Press releases are a great way to promote your business.

- A press release can be used in conjunction with social media marketing.

- It’s important to include keywords and phrases that will make it easier for people to find you through search engines.

- Include links back to your website, blog, or social media pages so interested readers can learn more about you and contact you if they’re interested in your product or service.

- Be sure the information is accurate and current – this includes the date of publication on the press release as well as any other pertinent details such as company name, phone number, email address.

- Make sure any quotes from customers or clients are real and accurate.

Influencer marketing campaigns – build brand loyalty with Chinese KOLs

Nowadays, no marketing strategy in China is complete without KOLs’ collaboration. Unlike those A-list celebrities, KOL or micro-influencer engage consumers in a deeper way and help to build brand reputation and awareness, more than trying to sell products right away. It is suggested to start working with Kols later in the branding process as your brand awareness grows.

The advantage of Kols compared to celebrities is that they are more relatable and create a feeling of proximity with their followers who tends to trust them a lot more than official sources. What they do is create word-of-mouth scenarios on social media and thus generate a buzz, making people want to try that product.

Promote your brand on Chinese social media platforms

The internet in China is a vast and multifaceted place, where Western social media platforms are non-existent. From messaging app WeChat to microblogging site Weibo, or video sharing platform Douyin (aka Tiktok) – there are plenty of ways for brands to participate online.

In the same vein, China also has its own set of forums and Q&A platforms which are rather popular among the internet population when it comes to debating a topic, educating oneself, or making a purchase decision.

WeChat: the base of Chinese social media

WeChat is the biggest messaging app in China, similar to WhatsApp, and it has 1.2 billion Chinese users as of 2023. But Wechat is more than just a messaging app though, its features include social networking, mobile payment, microblogging, shopping, live-streaming, and so on. The WeChat team keeps adding more features to keep users (and brands) engaged.

WeChat relies on its user-friendly interface as a way to make chatting with family and friends a smooth experience. This has led many people who use it in their everyday lives not only for socializing but also for other purposes such as banking and shopping.

As a matter of fact, WeChat is not the ultimate social media for marketing due to its closed nature, however, the app is so mainstream, that not having an official account would hurt your brand legitimacy in China. If Wechat is not the perfect marketing tool, it still has many great features that can be used to nurture and communicate with your target audiences such as Wechat posts, mini-program, WeChat shops, or even live-stream.

Weibo: A “Buzz” marketing app perfect to get visibility in the cosmetics market in China

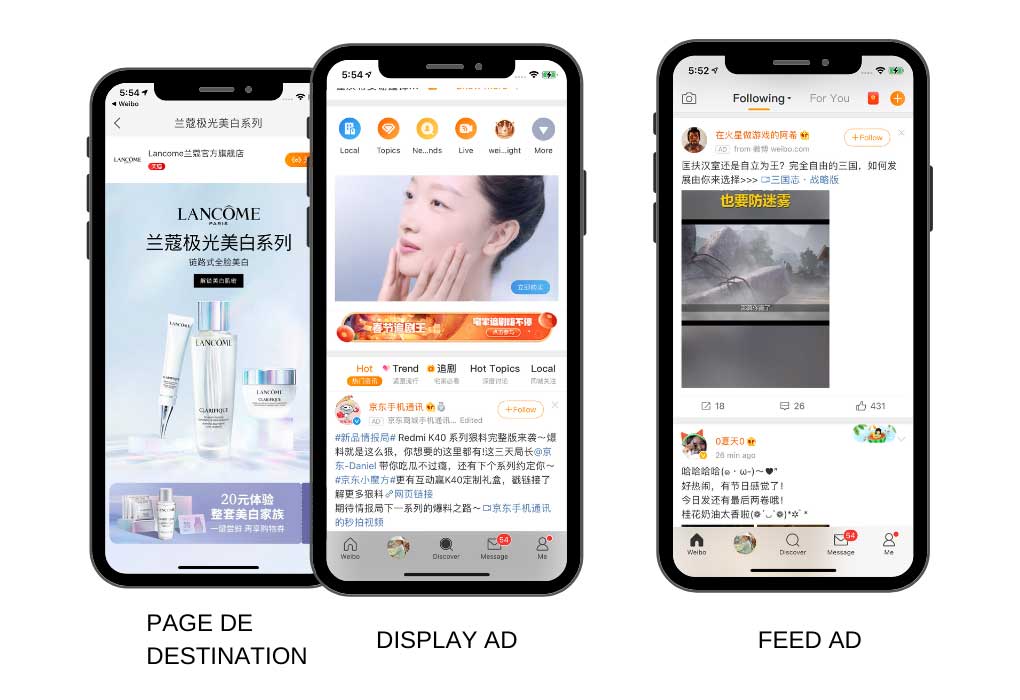

With over 580 Million MAU users as of 2023, Weibo (launched in 2009) is one of the biggest social media in China but is also considered one of the most influential as many debates take place on the app. Because of its open nature and its hashtag system (similar to Twitter), post on Weibo can spread like wildfire on the Chinese Internet.

Weibo users are engaged and varied making it a very interesting app for most companies wanting to get visibility in China but especially for lifestyle brands as shown by the prevalence of beauty and fashion influencers on the app.

Even for Weibo, advertising is much more efficient, compared to other platforms, since its database of users is extremely well-organized and fine-segmented, driving traffic efficiently to your official account or website.

In addition, the priority of Weibo is that its users are actually people who share similar consumption patterns. You can easily find out their interests and personal preferences, which helps you to enrich your marketing strategy on this platform, leading to a higher success rate for any campaign.

Little Red Book (Xiaohongshu): China lifestyle social e-commerce app

You may not have heard about it before, but it’s also one of the most important social media platforms for beauty companies and the cosmetics industry in China. It can be compared to Instagram, but with a mix of Pinterest and with the benefit of having an online store incorporated and one of the most powerful ways to sell cosmetics in the online market.

With 200 million MAU as of 2023, Xiaohongshu is a content platform dedicated to Chinese consumers. The core function of the app is product and service reviews known as shopping notes making it a perfect platform for KOL marketing.

Users’ shopping notes are mostly about fashion, cosmetics, high-end lifestyles, and travel. They are mostly authentic opinions of users and KOLs regarding their experiences with certain products, hotels, and restaurants, among others so that they can generate real word-of-mouth among young people in China.

With Xiaohongshu you can also open a RED store and have a brand official account, and a poster can add hyperlinks to their post directly sending other users to your online store (on the app or elsewhere), and the app has a live streaming feature as well as short video sharing. As an official account, you’ll also have access to an in-depth analytics dashboard.

Marketers can access promo tools such as wow cards, lucky draws, and paid advertising. All in all, a pretty well-rounded app for brand communication.

Douyin: the perfect online channel to promote your brand with video content

Douyin (Known as TikTok in the West), is a social media that grew a lot in the last few years both globally and in China. This app has the same functionality as her sister app and its focus is for people to create short clip videos and share them with other users.

Right now Douyin has more than 700 million monthly active users (2023). The ratio of male to female users is quite even with 52% of users being women against 48% men.

Douyin has two different main features; one is the “Live” function where you can stream live videos to your followers and other users as well. The second feature is the main part of it, which is posting short clips on what you are currently doing or thinking about.

Brands should invest in being active in this platform because it will have a great impact on the publicity of their products and get the attention they are looking for, creating a lot of awareness.

Another reason why brands should invest in this platform is that it has two different ways to communicate with your followers: reposting clips that people put up and commenting on them, creating engagement.

Furthermore, Douyin has a flagship store and official accounts function, offering brands many different marketing tools to engage with consumers.

Sell your Cosmetics Products on Chinese E-commerce Platforms

With online shopping becoming more and more appreciated by Chinese consumers and the varied options out there, it would be a shame not to invest in e-commerce. In fact, e-commerce platforms are the fastest-growing sales channel for cosmetics sales.

Direct Selling on Jingdong

After years of development, JD has not only become one of China’s largest e-commerce platforms but is also increasingly well-received by foreign brands. Through its unique characteristics, JD is becoming a global commerce trendsetter and brand influencer.

JD, which initially focused on electronics has become one of the leading selling platforms in the Chinese personal care market, with its beauty category growing consistently.

Online Retail Trough Tmall

Tmall is the representative e-commerce platform of China. All the brands tend to use Tmall as their official online stores: Apple, Armani, Kate Spade, etc. If you wish to access more Chinese consumers, setting up an account on Tmall would be a wise choice. It’s the leading marketplace when it comes to the cosmetics and skincare market in China.

Setting up an inland official store may be complicated, there are many documents that need to be submitted and a lot of testing before a store opens. So the majority of international brands may choose cross-border e-commerce which is still selling to people in China, but will also have an international presence, this is a solution to shorten the process as well as lowering the costs.

Besides these classical e-commerce websites, social e-commerce has made its way in China, and more social media launching their own integrated eCommerce app and investing heavily in live-streaming.

Contact us if you want to sell your cosmetic products in China

It can be very difficult to enter the Chinese cosmetics market as regulations and habits are not the same in Mainland China. However, even if it might seem unreachable, you can expand your activities in China with the help of experts.

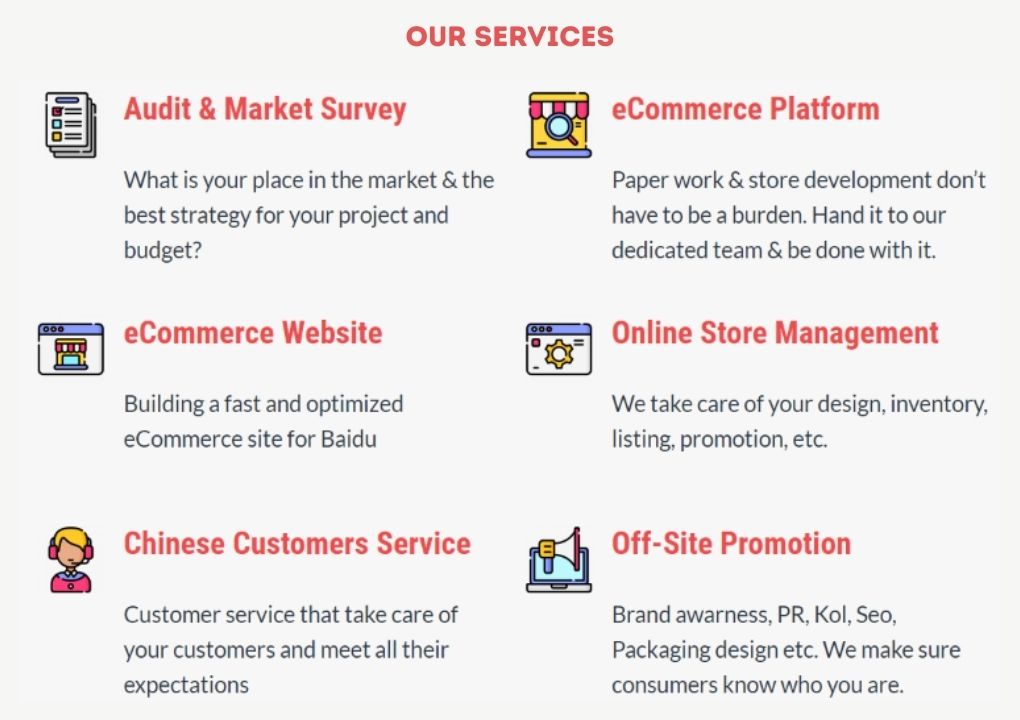

We help you with:

- Market research & Market segments understanding

- Marketing strategies developpement

- Entering Chinese e-commerce platforms

- Chinese social media

- Search Engine Optimization with Baidu SEO & Pr

If you’re interested in learning more and you’d like to enter the cosmetics market in China, don’t hesitate to leave us a comment or contact us so that we can schedule a free consultation with one of our experts that will learn about your brand and assist you with the best options for your China entry. Let’s keep in touch!

Really really good article. You explain everything. Every Marketer in Cosmetics & Beauty industry should read this.

China is a great market for cosmetics product was RMB 350 billion (USD56 billion)

…

China’s top 5 cosmetics brands in China

L’oreal.

Inoherb.

Maybelline.

Kans.