The Chinese luggage market is projected to grow at a CAGR of 7.3% until 2025. Generally, the luggage and bag business is associated with tourism. As Chinese people are coming back after their absence, it’s predicted that the domestic demand in the Chinese luggage industry will only grow.

China opened its borders on the 8 of January and many travelers are getting ready for the holidays. It’s expected that most of the tourists will travel in Q2 2023, so it’s right about time to promote your luggage brand on the luxury goods market in China.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

The Chinese luggage industry overview & market trends

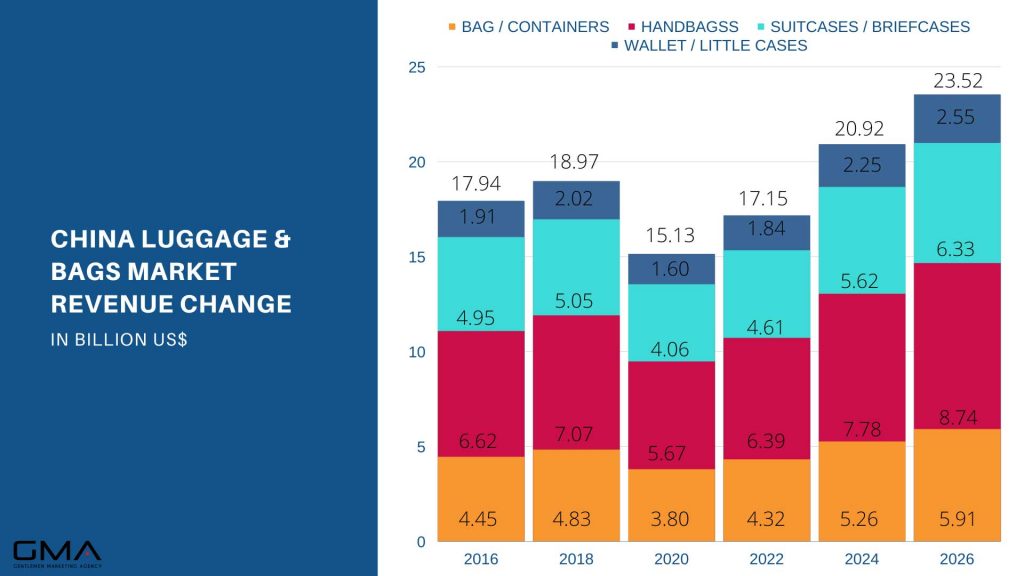

The Chinese luggage market is enjoying steady growth since 2020 when most of the sectors went down due to the Covid-19 outbreak. From 15.13 billion dollars in 2020, the luggage and bags market went up to 19.51 billion in 2023 and is expected to grow up to 23.52 billion in 2026, with an annual 7.3% market growth.

More than half of the sales in the Chinese luggage and bag market can be attributed to the luxury market, which is not a surprise, as many Chinese people want to have a luxury and premium bag to distinguish themselves.

Chinese Millennial consumers made a tendency to characteristic premium luggage brands. Younger consumers purchasing bags and luggage products favor trendy designs and affordable prices, and they want to show their unique style through leading brands they bought on any tour. Therefore this growing consumer group prefers renowned affordable premium brands such as Rimowa, Tory Burch, Coach, Michael Kors, and Kate Spade.

Impact of Covid-19 on the market

Since the Covid-19 pandemic hit China, it has forced a major part of the Chinese population to sit at home, unable to travel due to restrictions and consecutive lockdowns, as a consequence the luggage industry has been hit very hard by the pandemic. Most potential consumers restricted their spending on travel luggage which of course impacted the sales revenues of big brands in the luggage market.

However, as the Covid-19 pandemic situation is gradually improving, Chinese consumer spending has increased and the luggage market is expected to regain its potential. Chinese travelers have been visiting destinations in their own country which led to growth in luggage sales, from both international and Chinese brands. Now, as the borders are open, the industry is expected to bounce back.

Unisex bags are enjoying increasing popularity among Chinese consumers

Before the arrival of the Covid-19 pandemic, China was experiencing unisex luggage/travel bag shopping increase, mainly driven by more accepting gender norms. Chinese women were increasingly choosing more power suits and oversized bags and luggage and opting for a more masculine vibe. Unisex accessories and clothes are one of the key trends in the market, so it’s definitely something to consider while developing a product line for the Chinese market.

Chinese consumers want premium and customized products with innovative technology

Thanks to the abundance of production options in the luggage and bags segment, Chinese consumers have more and more options to choose from and they don’t need to stick with the low-quality products from local brands, which were almost the only option a few years ago.

Nowadays consumers want to have premium products (followed by premium customer service) and unique, customized items that can make them feel special. More and more companies offer customization of their products, like the option of selecting colors, additional inscriptions etc. A brand that will offer customization options will definitely gain their attention.

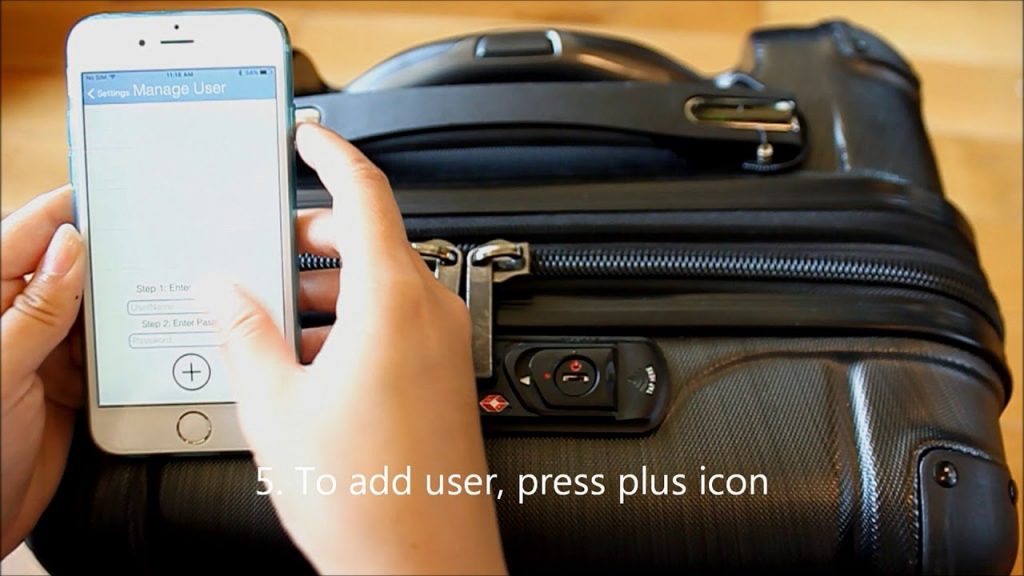

Apart from customization, Chinese consumers are also looking for more innovative products. It’s true for almost all markets. They are very tech-oriented and they are used to smart appliances surrounding them in daily life. Therefore, they expect the same from their luggage, ex. fingerprint lockers, phone apps locking and unlocking the luggage, and more.

How to promote your luggage brand in China?

The key to the Chinese market is through digital marketing, as this is where all your customers look for information. Although they still go to brick-and-mortar stores to purchase products, they like to check the brand image, products, and available discounts online and go to the store with selected products in mind. They might even go to the store to check the product and then order it online, for a better discount.

Build your own website to gain trust among Chinese consumers

To be visible to your target audience, you need to have a website in Mandarin, hosted in China, for SEO reasons. Baidu, the leading search engine in China, will not rank websites hosted in other countries or websites in other languages than Chinese.

In addition, your website must follow Chinese standards and Chinese trends. In most cases, a homepage consists of a lot of information, written in small characters. If western consumers preferred a clean aesthetic, it’s not the standard of Chinese consumers.

SEO on Baidu to gain visibility

75% of the research in China is on Baidu. You need to have a good ranking on Baidu to be visible. To develop your visibility on Baidu, you can use different solutions: Pay Per Click (PPC) or Search Engine Marketing (SEM): these solutions are very efficient but can be quite expensive in the long term.

SEO is better for long-term strategies, and is extremely efficient but asks you more work. SEO is a long-term process, requiring writing articles and content using keywords, in order to increase presence on the web for search engines. Baidu has its own websites and redirects 27% of its traffic to these sites: Baidu Zhidao (Q&A), Baidu Baike (Wikipedia), Baidu Tieba (Forum). This means that, in order to promote your website on the Chinese internet, you also have to be active on these affiliating websites of Baidu.

Use popular social media in China

If you want to raise the reputation of your luggage brand, it is costly and pays back little by using traditional media. However, social media platforms like WeChat, Weibo, RED, or Douyin can ease your promotion problem, especially for small businesses. They are also becoming one of the main sales channels in China in recent years.

WeChat is the most popular social media with more than 1.26 billion monthly users. It’s the perfect place to communicate with your consumers and publish content. You also have to know that WeChat provides brands with an e-commerce part. You can build your own WeChat store and sell directly on the platform. In China, Chinese consumers are used to sharing their purchases on their WeChat profiles. It’s a good way to improve your awareness and gain recommendations.

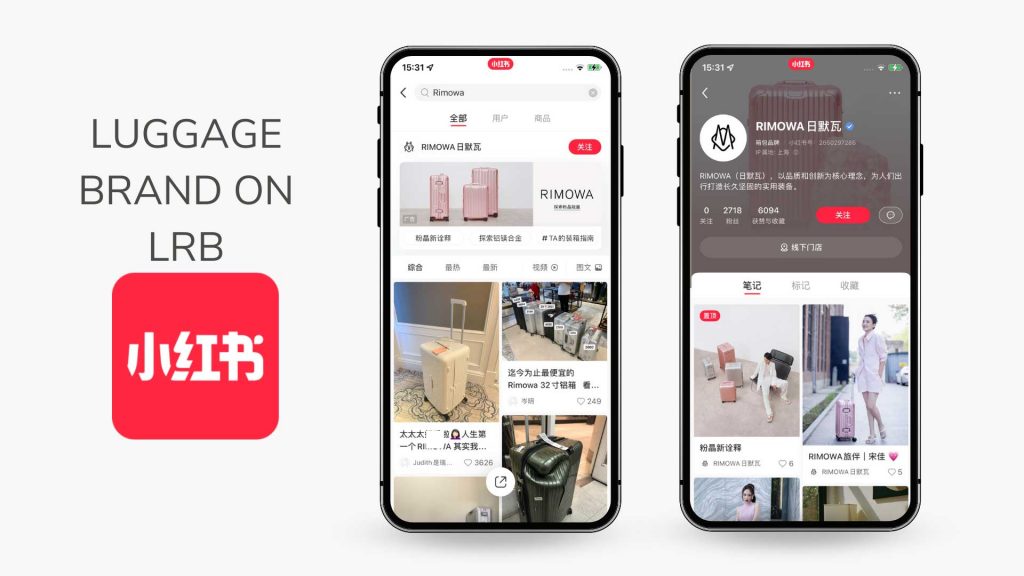

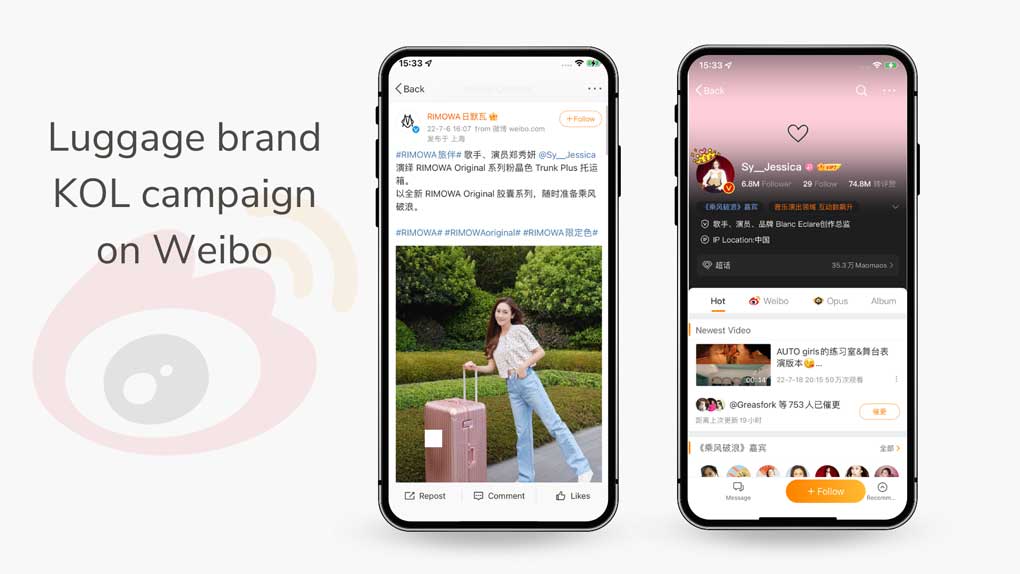

Weibo is another efficient way to promote your brand. It’s a microblogging platform where consumers are used to expressing themselves. It’s really convenient to communicate with your consumers and potential consumers. RED, also called Little Red Book or Xiaohongshu is also worth mentioning. This user-generated content-focused platform is a great place for e-reputation building, as you can post your content with some travel tips or collaborate with travel influencers.

KOLs to promote your luggage brands

To gain visibility and e-reputation, it is crucial to encourage positive word-of-mouth. KOLs can help you. The Key Opinion Leaders (KOLs) are social media users who succeeded to make a lot of traffic on their accounts and became famous. Chinese consumers idolize KOLs, and trust them more than brands.

Through Chinese influencers, you are able to reach your target audience. In other words, intermediaries can be a great asset in selling your imported spirits to Chinese consumers. However, KOLs are not an easy tool to control, it’s definitely one of the most useful ones out there but they are humans with their own thinking power. They can improve the reputation of a brand but also destroy it.

You can collaborate with another luxury brand

There are many successful stories of luxury brands collaborations, that can really help you gain visibility and trust among Chinese consumers. The luggage industry has also seen some great collaborations, like;

Fendi x Rimowa

The first collaboration between Fendi and luggage brand Rimowa took place in November 2017 to celebrate Rimowa’s 80th anniversary. The second Fendi x Rimowa collaboration was announced on June 14 this year and targeted Chinese consumers via the brand’s official WeChat account.

Louis Vuitton x Supreme

In June 2017, Supreme’s streetwear brand released a collaboration with French luxury fashion house Louis Vuitton.

Tumi x Kith

The business luggage brand Tumi has gained popularity in China in the past three years. Chinese consumers are used to being exposed to the New York streetwear brand through Kith’s collaborations with other designers. Kith posts about their collaborations with Adidas, Mitchell & Ness, and even Coca-Cola through Weibo posts which are viewed by many platform users.

Sell your products on Chinese e-commerce platforms

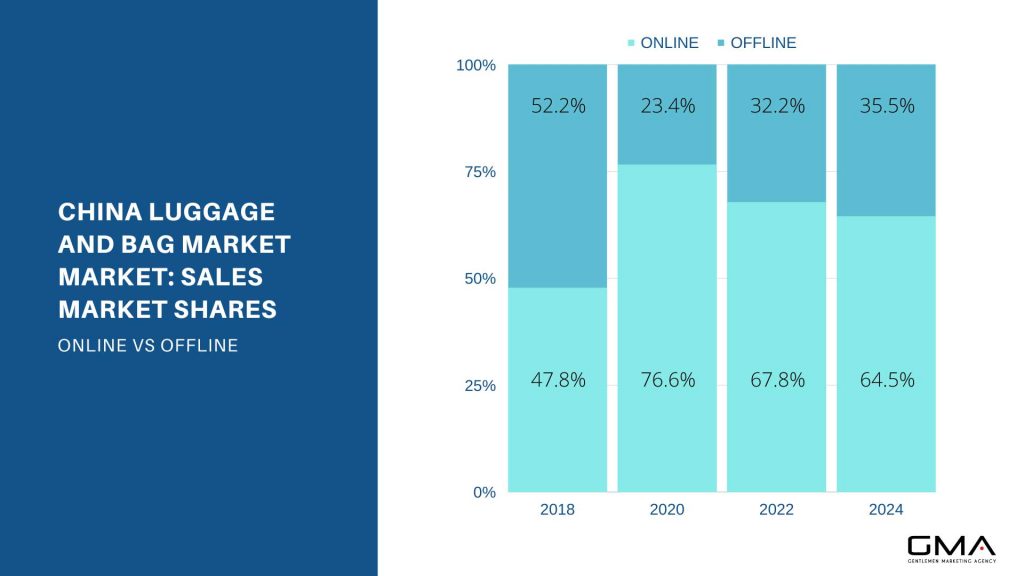

As we mentioned earlier, Chinese people are very used to looking for products and purchasing them online. In fact, between 2018 and 2024, the online share of luggage sales is predicted to grow from 47% to 64%. This is why it’s advisable to promote and sell your premium luggage, because this is where all your consumers are.

Use Tmall B2D for distribution

If you do not have a huge budget for opening your own stores, you have to try the Tmall B2D for your product. If you want to sell in China, finding a Chinese distributor is not a good solution. This is because the infrastructure for sales is very different.

Distributors do not respond well to new brands. They are all searching for a popular brand and usually, they don’t do branding, which is easy to sell and easy to promote to other smaller resellers. If you meet them, usually they will refuse any collaboration. Tmall B2D is really the key factor for success in terms of distribution because brands need to sell at the beginning to start their development in this vast country.

Sell on E-commerce platforms

Foreign brands are already loved by consumers, it’s your competitive advantage. Use it! If you want to start an e-commerce adventure in China, there are several smart solutions available for you.

Tmall, Taobao, and JD are the giants of e-commerce. They are the biggest platforms and also the bests in terms of quality and safety. Because these e-commerce platforms are very popular in China, it’s not easy to sell there. Most of them only accept brands that have already a significant presence and realized high sales in China. That’s why most of the spirits brands failed to sell on the giants’ platforms, Tmall, Taobao or JD.

If you are a luxury luggage brand or a premium brand, you can try to sell on Tmall and JD because the 2 platforms want to keep a high ranking and only offer their consumers’ famous brands and quality products. That’s why they are so selective. If you are not very famous yet, the Wechat store also provides good e-shops. It’s a bit more accessible for beginners in this market.

Contact us to start selling your luggage in China!

Gentlemen Marketing Agency is a China-based agency offering digital marketing and e-commerce solutions to all foreign brands wanting to enter the Chinese market. We have a team of experts that have the experience and know-how of the market and consumers’ shopping behaviors. Over 10 years, we helped more than 600 brands offering tailor-made solutions depending on their needs and budget.

Each project is different, this is why we offer a free consultation with one of our experts to discuss your brand and the options for your China strategy. Leave us a comment or contact us to get started!

How do I advertise my site in China

Thanks

Hello Dan. That is a good question and we can help you to advertise your site in China. if you want to know about our solutions sent us an email to marketingtochina@gmail.com and we will be happy to help you;)

Chinese market is major market for luggage over the past 10 years, with local demand increasing from $12.1 billion USD in 2006 to an estimated $62.5 billion USD in 2017, according to IBIS World.