The sports industry in China is booming, and there’s big money to be made selling sportswear there. But it’s not as simple as just setting up shop and selling your fashion brand. China sportswear market offers great opportunities to international brands as long as they play the game smartly. In this blog post, we’ll give you some tips on how to sell sportswear in China. Follow these tips and you’ll be on your way to success!

China Sportswear Market Overview

After the successful feast of the Beijing Olympics in 2008, there is a sports trend around China, whether in big cities or rural areas. Therefore the competition among sports goods marketers has been fiercer and fiercer. According to Statista, the revenue in the Sports Equipment segment in China is up to US$31,458m in 2020. The market is expected to grow annually by 5.9% (CAGR 2020-2023). In global comparison, most sporting revenue is generated in China (US$31,458m in 2020).

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Over the five-year period, the main factors driving industry performance have been higher consumption in China, large sporting events hosted by China, people’s increasing pursuit for healthier lifestyles, and the country’s active involvement in international trade within the World Trade Organization (WTO) framework.

The Obstacle for Foreign Marketers to Sell Sporting Goods in China

Cost is always the prior concern for any business. For sports goods marketers to China, inventory expenses are a major cost for sporting goods wholesalers, accounting for about 15.7% of industry revenue.

And there is a substantial barrier for prospective entrants probably caused by the ability to effectively manage and control inventories. Significantly, now foreign enterprises must still be certified by the Ministry of Commerce.

China’s Market is Huge and the Potential is Even Bigger Online

China’s online retail sales are huge and potentially bigger. In 2015, online retail sales in China totaled $581 billion, a 33% rise from 2014. Except for popular sporting goods, there are more products sold online in a large amount, such as smartphones, groceries, beer, antiques, and even art.

In 2020, 35.3% of China’s retail sales occur online and China represents 50% of the world’s e-commerce. The income of the sporting goods industry online was 130 billion yuan in 2018, and it is expected to further exceed 200 billion yuan in 2023.

A growing portion of China’s 1.4 billion people are making discretionary purchases every day, and it’s showing no signs of stopping. In 2020, there are more than 280 million affluent consumers in China with a disposable income of $20K to $1m. In general, whatever you’re selling, it’s hard not to take notice of China.

The Affection for Foreign Sportwear Brands in China

The truth is almost all Chinese people are more willing to buy things from e-commerce platforms. For them, they love buying western products because Western brands are generally perceived as higher quality and safer, with more “cool factor”.

According to BCG, 61% of Chinese would pay more for US-made products. In certain categories, the preference is even higher. The World Luxury Association found that 86% of Chinese consumers refuse to buy luxury goods labeled “Made in China”. 61% of Chinese have less confidence in local food than in 2011, and 28% expect to replace their domestic purchases with imports says Ipsos.

5 Most Popular Global and Chinese Sportswear Brands in China

As mentioned above, Chinese people prefer Western brands to any else brands, such as Nike or Adidas.

1.Nike

Founded in 1964, Nike is indisputably one of the most widely recognized athletic brands in the world, which includes, of course, China.

Nike, which expanded internationally in 1978 to markets in Canada, Australia, Europe, and South America didn’t arrive in China till 1980 aftermarket reforms but is currently one of the most popular athletic brands among Chinese youth.

2. Adidas

Founded in Germany by Adolf Dassler in 1948, Adidas entered China in 1997, almost 20 years behind competitor Nike, which helps explain the market gap, but as the second most popular athletic brand in China, and a vast retail network, Adidas isn’t particularly worried

3. Li Ning

Founded in 1990, China Li Ning Company Limited is China’s largest sporting goods retailer, selling its own brand ” Li Ning ” sports shoes, apparel, and accessories.

In 1990 the company was founded by former Chinese gymnast Li Ning, Li Ning Chairman of the Board and Executive Director. By the end of 2007 as the world’s fourth brand Li Ning sporting goods industry, the company founder Li Ning in 2008 Beijing Olympic torchbearers lit the Olympic flame.

Anta

Founded in 1994 in China, Anta Sports Products Limited is a joint venture between Sports Goods Co Ltd. and Footwear Co., Ltd. Beijing Oriental Anta Sports Products Limited and Anta (Hong Kong ) International Investment Company.

After years of effort, Anta has moved from simply being a regional sports shoe manufacturing enterprise to the development of a national integrated marketing-oriented sporting goods conglomerate.

5. Converse

Founded in the United States in 1908, specializing in manufacturing men’s shoes and children’s insoles, Converse was once one of the most popular sports shoes in the world and held a near-monopoly on sports shoes in the 1950s and 1960s in the United States.

Purchased by Nike in 2003, converse continues to grow in popularity in the Chinese market with outlets in nearly every major city throughout China. Converse continues to be hip shoes worn by young trendsetters throughout the country.

How to Market Your Sportwear brand in China?

Branding is Everything for Your Business

Branding in China is one of the most important things. Chinese consumers buy the name of a brand. They want to buy premium, reputable brands.

You need to build a strong image of your brand. Branding is a way to be popular in China. Make people dream, and make beautiful stories around your brand name. It’s the key to success in China.

Establish Your Own Store on Chinese E-commerce Platforms

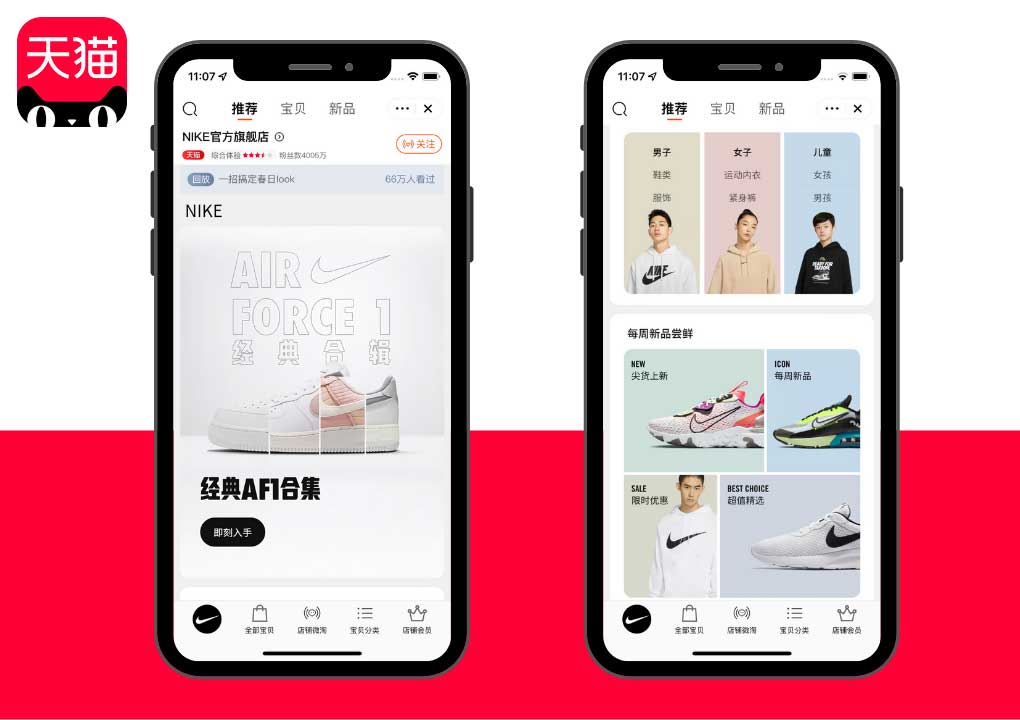

One of the best ways to sell your products is to sell on some popular e-commerce platforms in China, because Chinese people love to check their demands on e-commerce platforms than real stores, such as Tmall.

Tmall is the most reputable cross-border e-commerce platform in China. Chinese people trust Tmall because this platform guarantees to sell consumers only quality and authentic goods.

A Tmall.com storefront is essential to the China retail strategy of leading global businesses. It’s the most effective way for China’s market penetration. But Tmall only accepted brands that have already a significant presence and realized high sales in China. That’s why a lot of companies are rejected by the platform which wants to keep a high standard.

Should you sell Sportwear on Tmall or Tmall Global?

There are two ways to join Tmall’s platform: Tmall & Tmall Global. If you are a company with China in-country business operations, you can apply to Tmall. com; If you are a company with overseas licenses, you are eligible for Tmall Global.

In addition, selling on other cross-border e-commerce platforms is also favorable and lucrative, such as Haitao or Xiaohongshu.

Work on Your Ranking on SEO with a Chinese Website

75% of online research in China is done on Baidu. You need to have a good ranking on Baidu to be visible. Chinese consumers will only buy brands that have a good ranking on Baidu. To develop your visibility on Baidu, you can use different marketing solutions such as Pay Per Click (PPC) or Search Engine Marketing (SEM).

You can also do SEO. It’s extremely efficient but asking for more work. It requires you to create good content, sharable, using keywords in order to increase your presence on the web for search engines.

Social Media will Increase the Visibility of Your Sportwear Business

Chinese users are very active on social media platforms. They are used to commenting, sharing their purchase, and giving purchasing advice. The two most used social media platforms in China are WeChat and Weibo.

Wechat – No. one of the Chinese social networks

WeChat has more than 1.2 billion users every day. The social media platform is amazing with a lot of convenient features useful for brands and users.

For brands, it’s really easy to communicate with your target and develop a strong community of followers. Having an account on WeChat enables you to promote your brand via mobile or tablet. And you also can sell your products on the WeChat store.

Weibo: the largest open social platform in China

Weibo can be associated with online shopping and 85% of consumers frequently use social media to share their online shopping experiences and 55% have participated in a discussion about a foreign brand.

The social media platform attracted more than 130 000 companies because it’s a really effective way to develop your e-reputation. Brands have to create a Weibo Official Account to improve their presence in China and attract more followers. More than 56% of Weibo users follow at least one brand on Weibo.

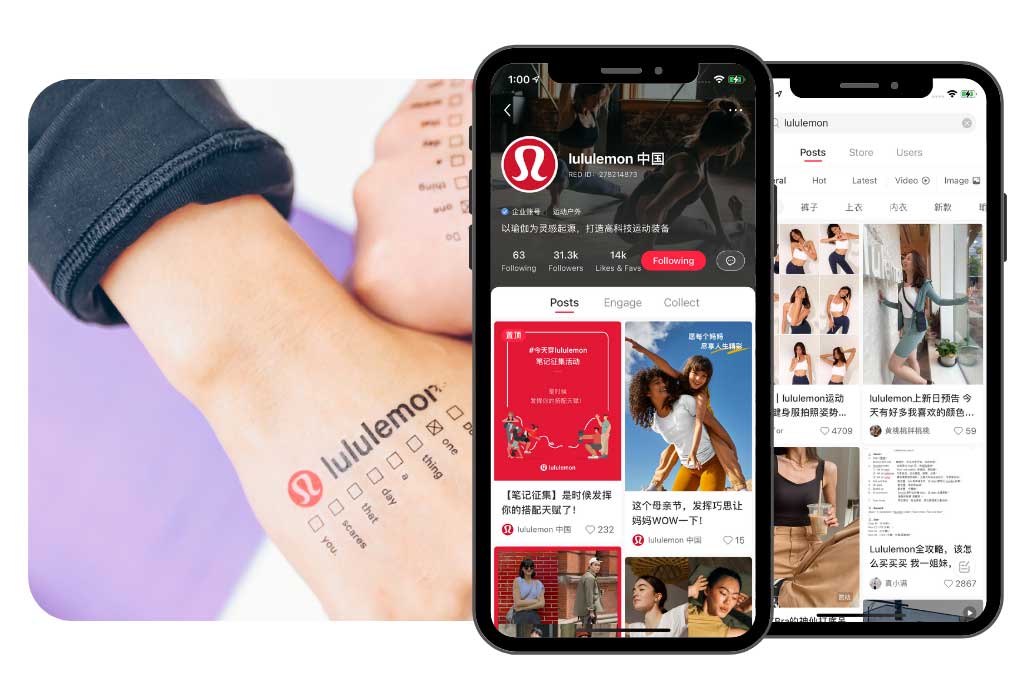

Chinese Kols Influencers are Key to Promote Your activewear brand in China

Influencers or KOLs are really powerful in China. They are simply users who drive traffic to their pages with good and interesting content. Chinese consumers love following KOLs on social media and they listen to their advice.

You can employ a KOL in your communication strategy. He or she will be the image of your brand and can help you to develop your image toward Chinese consumers. It’s an effective way to develop your awareness and brand image in China because Chinese consumers trust more KOLs than brands.

There are a lot of sports celebrities or famous players in China at every event. Due to a large sports fan base, choosing the right sports influencers will boost your business to a new level.

Want to start selling your Sportswear Brand in China?

Gentlemen Marketing Agency is specialized in digital marketing in the Chinese market. Do not hesitate to contact us if you want to discuss any projects in China

Really good article, do you know how big is the football market for accesorries in China?

We would like to associate Sport, Music, Fashion and Film/TV stars in China. We represent some of the biggest names in Sports and Entertainment and would like to discuss potential opportunities.

Let me know your thoughts and maybe we can expand further on a call.

Customers in China Are Further Ahead Than Europeans for Sport

Reall nice article, do you have any data about sport nutrition in China?

I would like to make deep research.

Hello

We are a Chinese investment fund and we would like to purchase Foreign Sporting Brand that want to sell in China.

The brand need to have history and popular oversea.

The Brand need to have a minimum of awareness in China

Contact me

Hello

I am a importer in Guangshou, and want to distribute Sport Brands from oversea. I have connexion to some shopping mall, want to sell onine via douyin, tmall, jd

, i am searching for famous brand oversea to corperate.

Could you send me your Brochure and information on wechat please so we can have partnership