Dive into China’s health supplements market, where ancient wisdom meets modern hustle, and wellness is not just a trend—it’s a revolution! In 2024, this vibrant market is where tradition sips tea with innovation, creating a powerhouse of opportunities for brands ready to blend in and stand out.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

China is the BEST market for health Supplements

Entering into new growing markets like China holds great excitement for international businesses, and among the potential options, China’s health supplement market stands out. With substantial recent growth and promising future prospects, this market presents lucrative opportunities.

Booming of Silver Economy in China

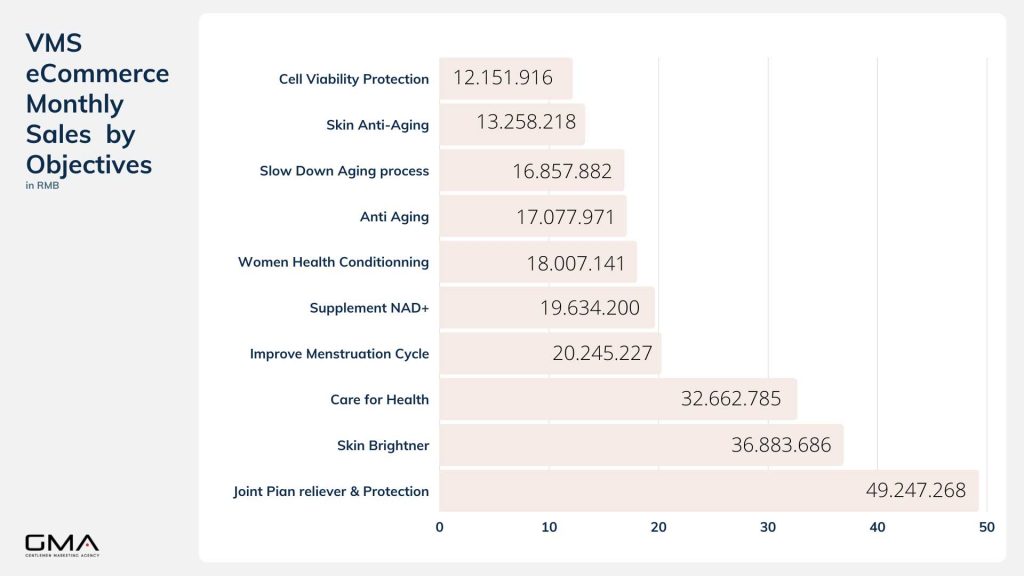

GMA overview: China’s health supplements market is a dynamic blend of rising “health consciousness”, technological advancements, and evolving consumer behaviors.

As disposable incomes grow and awareness about health and wellness , Chinese consumers are of course increasingly investing in their health, turning the supplements market into a thriving sector.

After Covid: This market is not just about filling nutritional gaps; it’s about enhancing life quality, boosting immunity, and embracing a holistic approach to wellness.

Digital : In this Booming ecosystem, digital play a crucial role, serving as the primary channels for discovery, education, and purchase of health supplements.

Chinese Heritage: The market’s expansion is also fueled by a unique blend of traditional Chinese medicine (TCM) principles and cutting-edge science, catering to a wide range of consumer preferences and needs.

2024 Trends:

- Social Reviews Amplify Trust: In 2024, social reviews on platforms like Xiaohongshu (Little Red Book) become the linchpin of consumer trust. Word-of-mouth and peer recommendations are gold, as shoppers seek authentic feedback before making health supplement purchases.

- Douyin’s E-commerce Ascendancy: Douyin transcends its role as a mere content platform, becoming a pivotal e-commerce hub for health supplements. Its short, engaging videos serve not only as entertainment but as powerful sales tools, making it easier for brands to showcase the benefits of their products directly to consumers.

- Zhihu as the Go-To Health Encyclopedia: Zhihu cements its status as the intellectual’s platform for health-related inquiries. Brands leverage Zhihu’s Q&A format to educate consumers, establish authority, and indirectly market their supplements through expert insights and discussions.

- Native Ads Video Domination: Native advertising, particularly video content, becomes increasingly sophisticated. Brands invest in storytelling that resonates with the Chinese audience, weaving their products into lifestyle narratives that engage, inform, and convert.

- Detox Products Surge: Riding the wave of health and wellness, detox supplements see a significant uptick in demand. Consumers, more aware of the impacts of pollution and modern lifestyles on their health, turn to detox products as a way to cleanse, rejuvenate, and boost their overall well-being.

In 2024, the health supplements market in China is a testament to the power of blending traditional health principles with modern marketing savvy. Brands that navigate this landscape with authenticity, innovation, and a keen understanding of digital trends are set to thrive in the heart of China’s wellness revolution.

DATAS

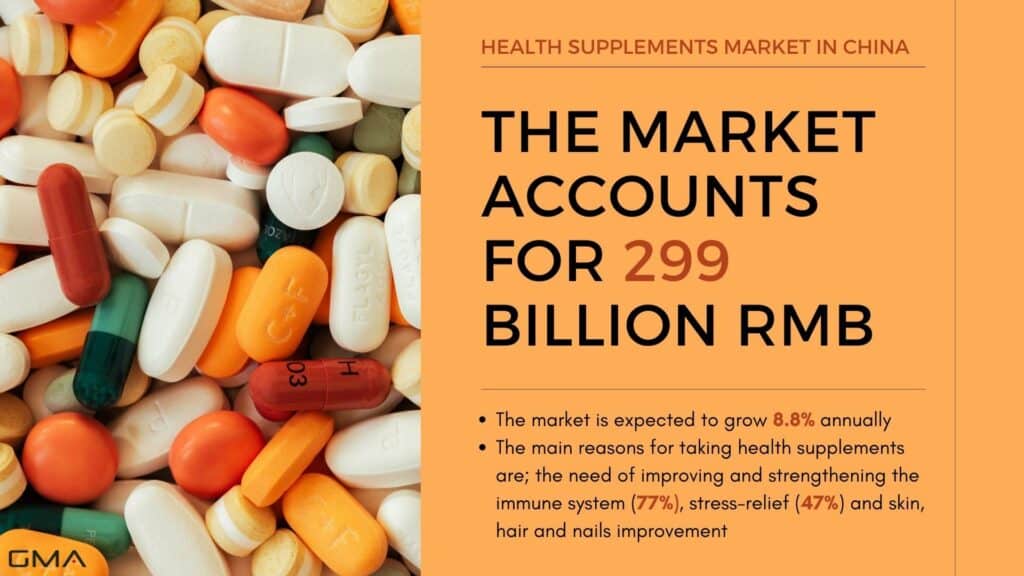

In 2023, the health supplement market segment in China achieved an impressive scale, reaching 299 billion RMB. Experts and analysts anticipate continued expansion, projecting a market size of US$ 27.03 billion by the close of 2028, reflecting a robust compound annual growth rate (CAGR) of 7.72% from 2022 to 2028.

To ensure a successful entry into the Chinese market and effectively promote vitamins and dietary supplements, thorough preparation is essential. Here are some vital tips to guide you through this unique market and enable you to efficiently sell your health supplements products.

Purchasing Factors for Chinese Consumers in the Vitamin Market

China’s Economic Growth

China’s remarkable economic growth has contributed to an increase in disposable income and purchasing power among its population. As a result, a significant number of people have joined the Chinese middle class, especially in major cities like Beijing, Shanghai, Guangzhou, and Shenzhen, as well as emerging cities like Hangzhou, Chongqing, and Chengdu.

This rise in the middle-class segment has created a strong consumer base with an inclination towards health and well-being products, including vitamins and dietary supplements. Brands have a unique opportunity to cater to this growing demographic and leverage the trend of health consciousness among consumers.

Emphasis on Healthy Lifestyle

An increasing number of consumers are dedicated to leading healthier and longer lives, while also seeking to enhance their appearances to align with Chinese beauty standards, especially among Chinese women. Alongside the desire for physical well-being, the pursuit of a more aesthetically pleasing appearance has become a prominent trend among these individuals.

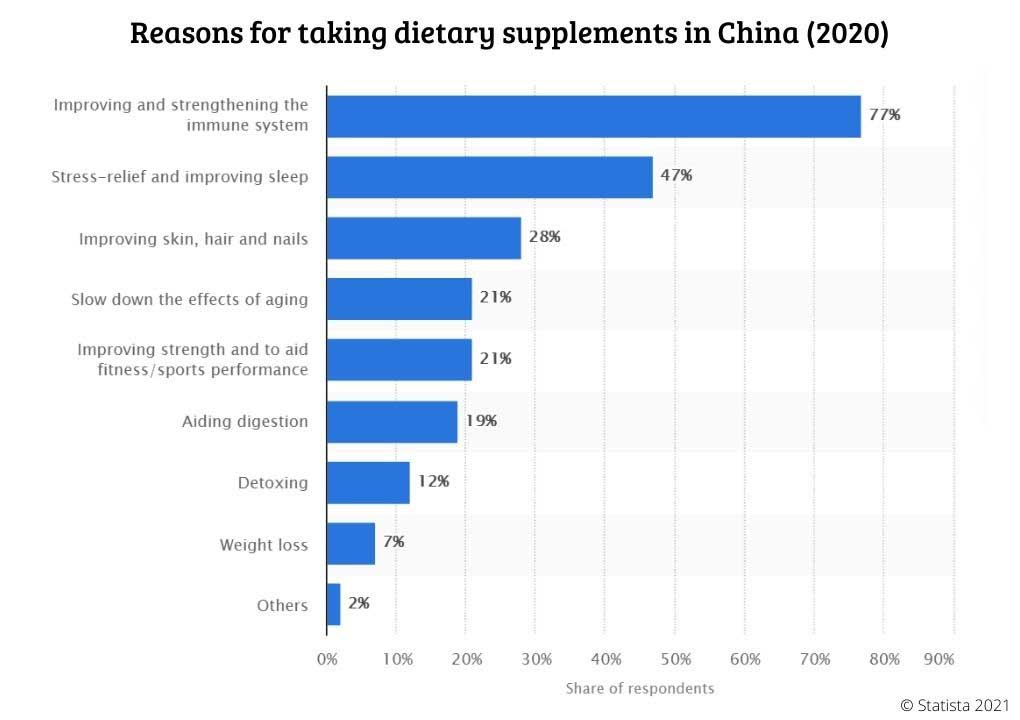

In a survey conducted by Rakuten Insight in March 2022, it was found that approximately 77% of respondents residing in Mainland China reported taking vitamin and dietary supplements with the primary goal of enhancing and fortifying their immune systems.

Conversely, only 11% of respondents used supplements for weight loss purposes. The survey indicated that for weight management, individuals were more inclined to focus on reducing food consumption, viewing it as a more practical approach compared to relying on vitamin supplements.

Children’s Market Expansion

Chinese parents are increasingly focused on providing the best possible nutrition for their children. Concerns about the quality of nutrition through a diverse diet have led to a rise in the consumption of vitamins and dietary supplements among children.

Brands that offer safe and effective products targeting the specific nutritional requirements of children have the opportunity to tap into this expanding market and gain the trust of parents seeking to enhance their children’s well-being.

Aging Society

China is experiencing a demographic shift, with a rapidly aging population. Traditionally, the elderly have embraced specific foods and adhered to traditional Chinese medicine practices for maintaining good health and preventing diseases.

However, there is now a growing trend among the elderly population to seek additional support from vitamins and dietary supplements to boost their immune systems and overall vitality. This presents an untapped niche for brands to develop products tailored to the unique health needs of seniors.

Impact of Covid-19

The outbreak of the COVID-19 pandemic had a profound impact on consumer behavior, particularly in terms of health and wellness. As a preventive measure, approximately 44% of the same Rakuten survey participants from mainland China reported an increase in their consumption of dietary supplements to bolster their immune systems.

This heightened awareness of health and immunity has created a surge in demand for vitamins and health supplements, making it a crucial factor for brands to consider when entering the Chinese market.

Skepticism Towards Local Brands

Instances of scandals involving domestic brands have led to a loss of trust among Chinese consumers. Consequently, they are more inclined to seek out and rely on foreign brands known for their quality and safety standards, especially in the health supplements, cosmetics, food, and skincare product categories.

Foreign brands with a reputation for authenticity and transparency have a competitive advantage in gaining consumer trust and loyalty in the Chinese market.

Presence of E-Commerce Platforms

China’s rapid digitalization has led to the widespread use of e-commerce platforms, making it easier for brands to reach a vast consumer base. The key players in the Chinese e-commerce industry, such as Tmall, JD.com, and Taobao, have amassed a user base of over 900 million individuals.

Moreover, other emerging platforms like Xiaohongshu, Pinduoduo, and Kaola are also gaining popularity. These platforms not only offer a wide range of products but also provide quick and convenient delivery options, making them attractive channels for foreign brands to sell their health supplements across the country.

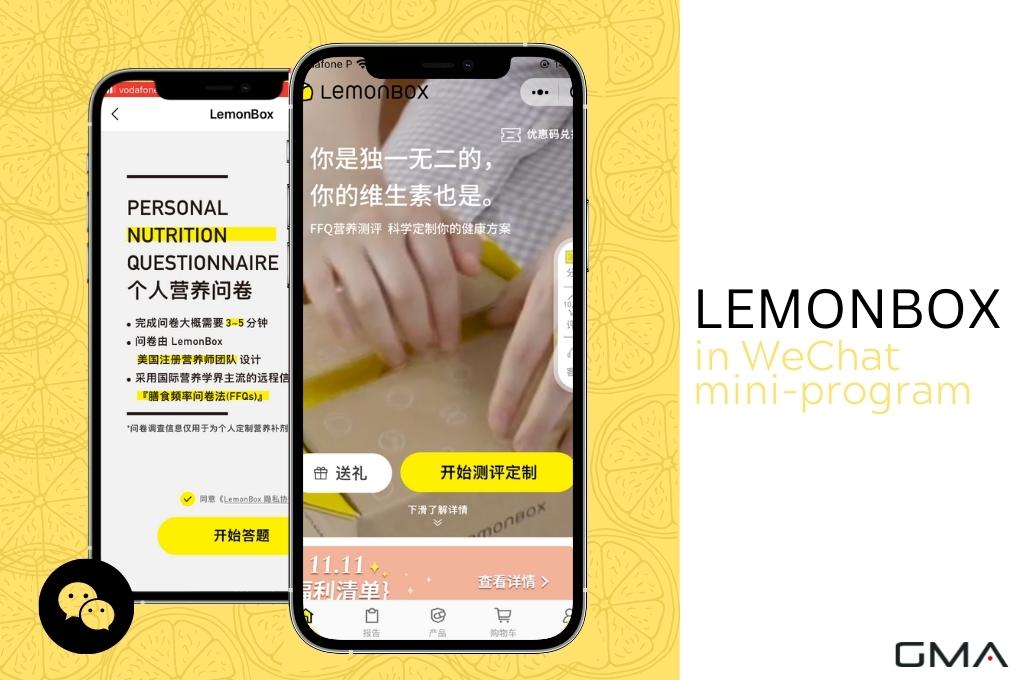

For instance, LemonBox, which emphasizes “ingredient customization” as its key feature, is presently the market leader in the personalized vitamin business model. Customers are requested to answer questions about their eating habits and health issues in online questionnaires that the firm creates using the WeChat mini-program and the Tmall program before obtaining a list of health supplements that are highly recommended. Customers may then purchase “recommended” supplements and have them transported from a bonded facility.

Health Reforms and Food Safety Standards for Vitamin and Health Supplements in China

According to the National Food Safety Standard, health foods correspond to food products that claim to have special health benefits while being suitable for specific groups to consume and control body function. Important to notice that healthy foods are not made to treat disorders or to be considered medicines in any case.

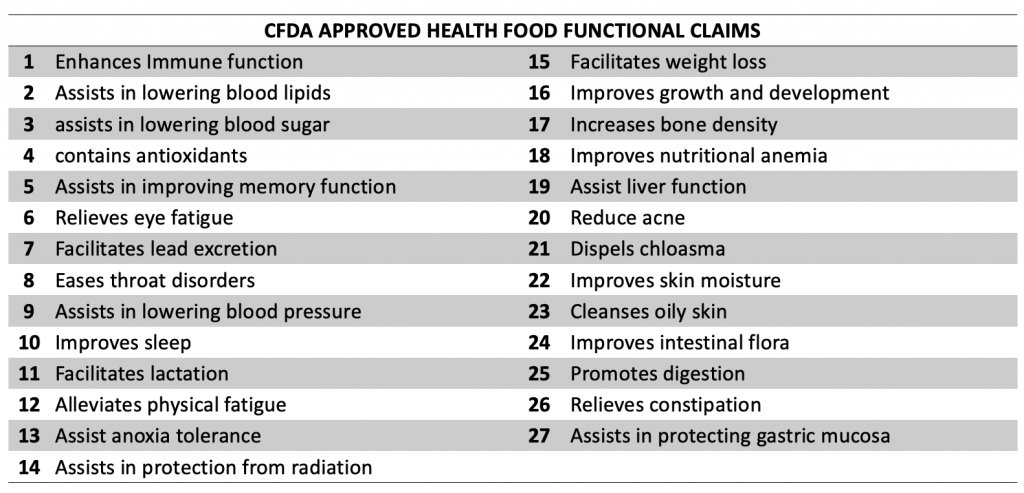

Categorization of Health Food Products

- Health foods with functional claims (about 60% of China’s health food market)

- Nutritional supplements (about 40% of China’s health food market).

While the first one corresponds to general food items that regulate human body functions but are not used to treat diseases; nutritional supplements are mostly used to replenish nutrients such as vitamins or minerals.

Four Sub-Categories of Health Food Products

- Dietary supplements: Supplementary nutrients and bioactive substances for the human body. The main raw materials are vitamins, minerals, and plant extracts.

- Traditional nourishing health food: Products prepared using traditional Chinese methods based on the concept of regulation and balance in traditional Chinese medicine.

- Sports nutrition: Products that will improve physical fitness and enhance the effect of exercises, according to the nutrition needs of different sports.

- Weight management: These products will help towards gaining or losing weight so that the desired weight is achieved.

China’s President, Mr. Xi Jinping, has positioned health at the center of the nation’s whole policy-making machinery and has made it an official government policy to include health in all initiatives. The National Health Conference in China was the most significant national health conference in the previous 20 years. At this meeting, the administration made clear its political commitment to funding health-related initiatives.

According to President Xi, having good health is essential for both people’s personal development and economic and socially sustainable development. Therefore, he issued a warning that if healthcare concerns were not properly addressed, people’s health may be jeopardized, which may endanger China’s social stability and economic prosperity.

Strategies for Successfully Selling Your Vitamins and Health Supplements in China

E-Commerce in China

The Chinese eCommerce market is the biggest in the world, with a size that is three times that of the US market. With over 1.4 billion people, the Middle Kingdom’s traditional and innovative goods, going along with the government’s protectionism, have all combined led to a thriving online and offline economy. Chinese selling festivals are starting to be adopted even in the West.

To get a better outlook on the Chinese eCommerce market, let’s start with an overview of the biggest online shopping platforms:

Douyin best ONE in 2024

Tiktok in China, is called Douyin … all these short video have completly transformed into the premier e-commerce app for selling health supplements in China. It is a unique complete ecosystem combines entertainment, education, and shopping in a way that no other platform can match.

7 reasons why Douyin stands out as the ultimate marketplace for health supplements:

- Video-Driven Engagement: Douyin’s backbone is its short, compelling video content. These videos offer a dynamic way to showcase health supplements, demonstrating their benefits in real-time, sharing user testimonials, and visually conveying the science behind the products. This format is inherently more engaging than static images or text, making it an ideal medium for capturing consumer interest.

- Influence of KOLs: Key Opinion Leaders (KOLs) on Douyin wield significant power in shaping consumer preferences and driving purchase decisions. Their endorsements of health supplements lend credibility and desirability to the products. KOLs can simplify complex health information, making it accessible and persuasive to a broad audience.

- Targeted Native Ads: Douyin’s native advertising seamlessly integrates promotional content into the user experience, focusing on solving specific health problems. This approach ensures that ads for health supplements appear natural and relevant, directly addressing the viewers’ health concerns and encouraging them to consider the advertised solutions.

- E-commerce Integration: The app’s built-in e-commerce capabilities allow for an effortless transition from discovery to purchase. Consumers can buy health supplements without ever leaving the platform, streamlining the shopping process and capitalizing on impulse purchases driven by compelling content and recommendations.

- Access to Exclusive Deals: Douyin often features exclusive deals and flash sales for health supplements, enticing users with discounts and limited-time offers. These promotions not only boost sales but also increase brand visibility and consumer engagement within the app.

- Average User Engagement: With users spending an average of 2 hours per day on Douyin, the platform offers unparalleled access to potential customers. This high level of engagement increases the likelihood of health supplement brands capturing consumer attention and converting views into sales.

- Customized User Experience: Douyin’s algorithm customizes the user experience, ensuring that health supplement ads and content reach those most likely to be interested. This targeted approach maximizes marketing effectiveness, ensuring that promotional efforts resonate with the right audience.

Tmall – Alibaba Group

Launched in 2014, is the world’s largest cross-border e-commerce marketplace for international companies. It is run by Alibaba, the Chinese eCommerce giant that also owns Taobao, Lazada, and the domestic version of Tmall.

Tmall Global, unlike Tmall, is not available to domestic enterprises; instead, the platform exclusively works with international companies having an actual presence in foreign countries. To open a store on that platform, companies must have registered an international trademark, or at least get trademark authorization from the official brand owner.

Tmall Global has been recognized as a leading platform aiming to cooperate with the world’s top brands, offering high-quality items to customers. The platform intends to cater to China’s high-end consumers while answering their growing desire for high-end products and leveraging their increasing purchasing power.

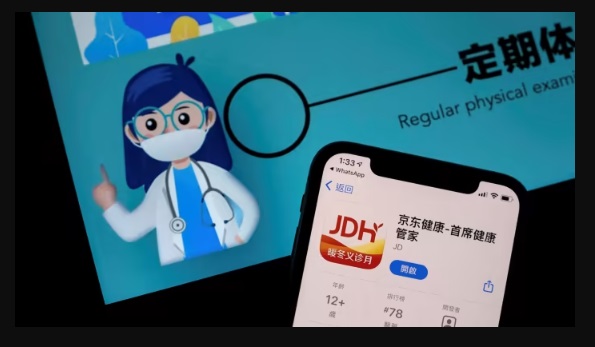

Selling Vitamins in China with JD.com

Launch by Tencent in 2015, JD Worldwide has been created as an answer to Alibaba’s CBEC platform and therefore competes in the cross-border e-commerce market. JD Worldwide or also called, JD Global, has been succeeding by exploiting the vast user base of JD.com, which is China’s second-largest marketplace.

JD Worldwide offers almost 10 million SKUs from nearly 20,000 different brands. As an example, we’ll find their electronic products, but also nutrition and healthcare, household appliances, and automobile-related things, just to quote a few.

JD Worldwide is organized into several national and regional “pavilions.” The present focus of the worldwide cross-border e-Commerce platform is on exports.

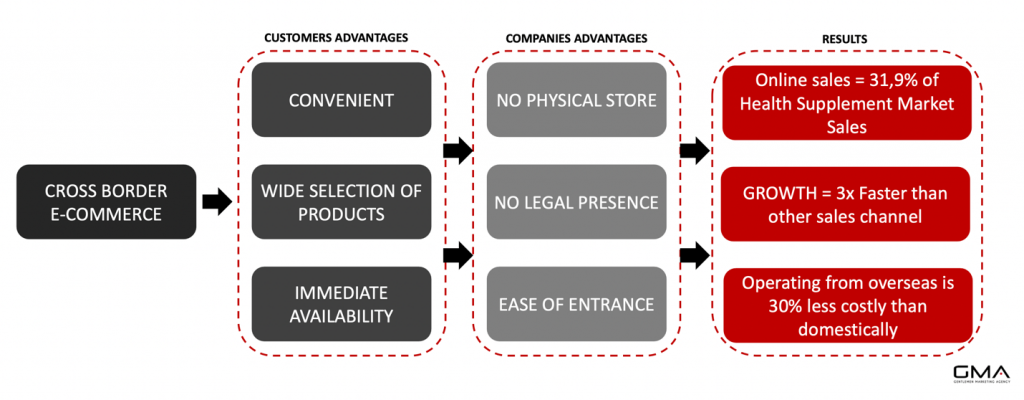

Enter China Vitamin and Health Supplement Market with Cross Border Ecommerce

However, if operating within the healthcare industry (or you sell health-related products), considering the current restriction in terms of products licenses, products registration, and the importance of the brand reputation, the very large majority of foreign healthcare companies will consider their operation on the following platforms instead of local eCommerce platforms:

- Tmall Global

- JD Worldwide

These are basically the corresponding cross-border platforms for Tmall and JD.com. The main benefit for foreign companies is the ease of entrance through this CBEC model:

- A Chinese business license is not required

- Products registrations are not required

- Chinese trademarks are not required

In short, it’s the simplest way for foreign companies to enter the market.

Effective Promotion of Dietary Supplements on Chinese Social Networks

To get started in China, give the Chinese people the opportunity to know more about you. And this will go through the following platforms:

WeChat (Very Competitve and not ROI friendly)

WeChat is like the Chinese Facebook. Everybody uses it in China. A great messenger APP that also gets a “moment” system allowing people to share content (messages, pictures, videos) and personal feedback.

Through this app, people use “Wechat groups” to communicate solutions to their problems and therefore recommend brands or products. Not very efficient for direct advertisement but is a super tool for community management and building engagement. You can also create your own groups through the APP.

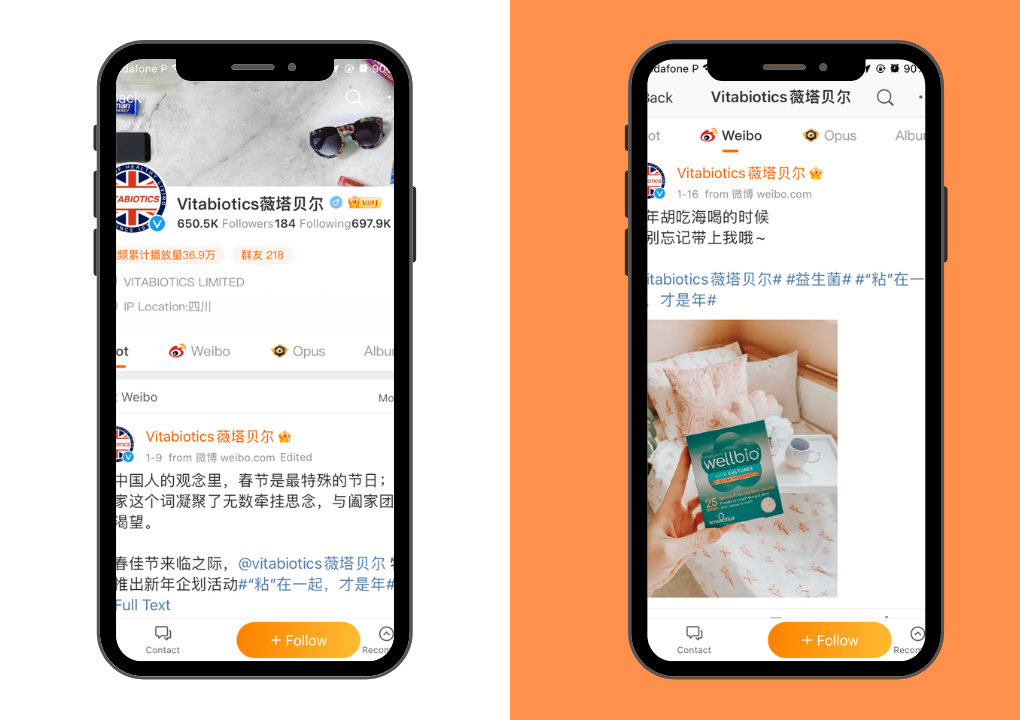

Weibo (Old strategy )

Weibo is known as Chinese Twitter. Not only being one of the most popular social media in China, it’s also an excellent platform to develop KOL strategy and ads campaign. If you plan to target a large audience and engage with your customers, Weibo will be a perfect tool.

Reach Out to the Chinese Middle Class on Xiaohongshu

XiaoHongShu, also called Little Red Book, is similar to Instagram or Pinterest. 80% of its users are female from 20 to 40 years old, with a nice purchasing power. Perfect for visuals and interactive content, this platform is a must-do if promoting cosmetics, beauty, and healthcare products.

However, we’ll note here that as a brand you won’t need to post dozens of monthly publications. 1 or 2 per week is enough… To get the most benefits from this platform, we’d recommend you cooperate with KOL and KOC to deliver online testimonials and product recommendations. A perfect platform to work out your brand reputation.

Search Engine Optimization: Baidu is the #1 Search Engine in China

A fundamental if you want to succeed in the Chinese health supplements market. And if people tend now to spend more time on social media than on Baidu, it will still be important for you to get minimum visibility on this platform as it can not only help to drive traffic to your online store but also enable the development of a network of potential distributors.

In terms of content, and regardless of the platform, you can’t do a simple copy past from western social media and expect to get results in China. Everything needs to be adapted. As your marketing strategy will be a key success factor in your business development, it’s crucial to manage this part with caution.

To sum up – How to Effectively Attract Chinese Customers

- Chinese website

- Presence on Chinese social media

- Positive word of mouth and references on the Chinese Q&A platform

- Cooperation with influencers

- Online-store: Tmall Global / JD Worldwide

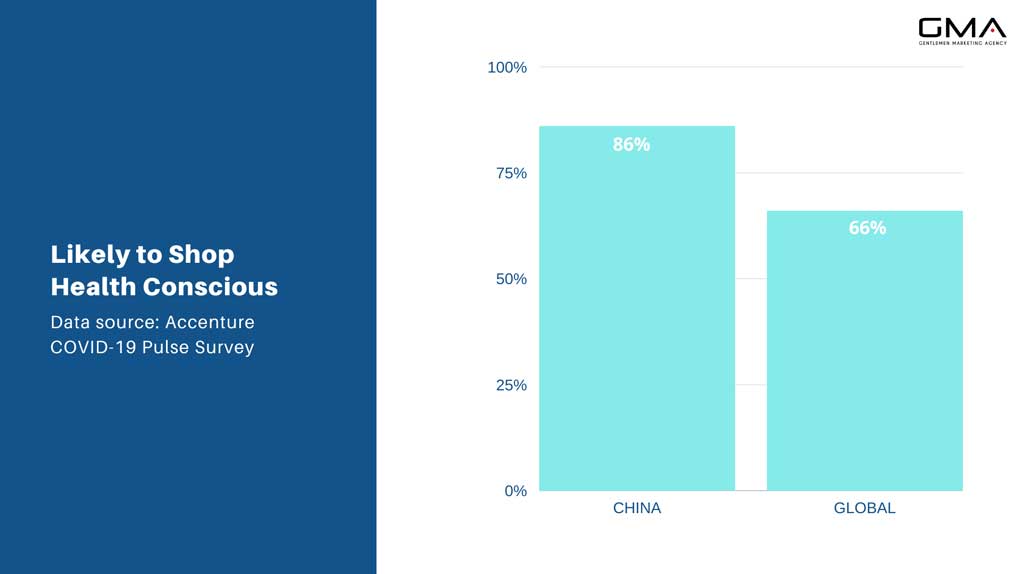

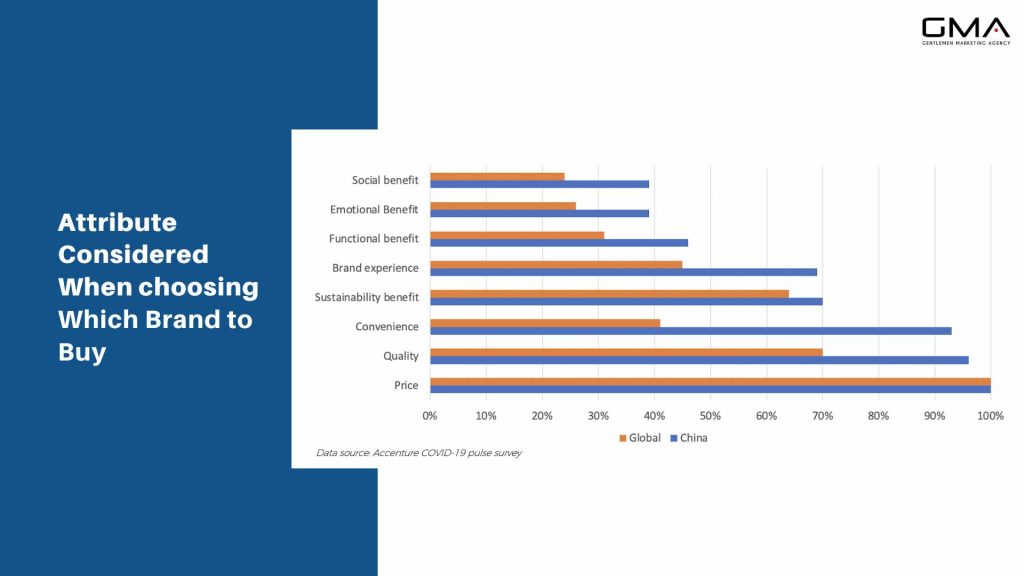

According to Accenture 2021 China consumer study, we’ll note 4 main trends in terms of both consumer behavior and mindset changes that have been amplified and accelerated by the recent Coronavirus outbreak:

- Everything’s about health now: People express a strong desire to pursue a healthy lifestyle by preferring healthier food consumption and increasing their practice of indoor/outdoor exercising.

- Strong digital focus: There’s now a greater reliance on digital media for interactions and activities in daily life. Customers across the world are turning to digital alternatives to satisfy essential daily requirements, from shopping to medical consultations, as they grow more at ease being “homebodies.”

- Sustainability as the new hype: We’ve noticed a stronger emphasis on sustainability while making purchases. However, because price, quality, and convenience are still the top three purchasing factors for Chinese consumers, companies must strike a balance between sustainability and these other factors to effectively attract them to buy products.

- Open to new change: Chinese customers are getting more and more open to new ways of buying and commercial interactions. A rising curiosity and willingness to experiment may lead businesses to new opportunities.

Case Study

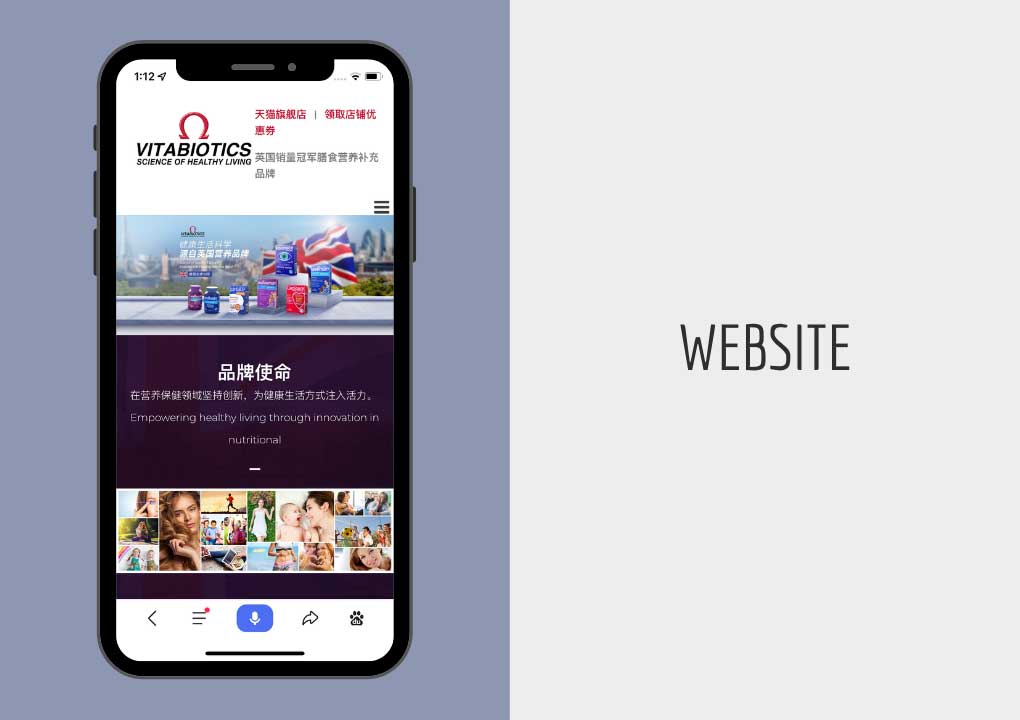

Vitabiotics, like Blackmore, has entered China health supplement market with a step-by-step approach, while focusing on building its dietary supplements brand & e-reputation and then optimizing its e-commerce performances to maximize sales. Now, it is one of the most popular brands for pregnant Chinese women.

Exploring the Winning Strategy for Success in the Chinese Health Supplement Market

Play on its origin: a quality Vitamins brand from the UK

Although international brands need to adapt to the market and its consumers, many foreign brands are still encouraged to play around with their foreign origin. For many Chinese people, despite local brands increasing their reputation and product quality, a renowned foreign brand is still perceived as more trustworthy than a Chinese pharmaceutical manufacturer.

Thus, we can see that in the Vitabiotics Tmall store, whereas all products displayed and information will be translated into Chinese, the packaging and official certificate & accreditation will still be introduced in English.

Company History: Be a storyteller

While introducing the brand’s highlights from its first step to its international development and awards, Vitabiotics had an interest in sharing its story. This built a notion of trust with customers, as when purchasing healthcare products consumers will tend to favor companies with experience, awards, and legitimacy rather than the newbie that come out from nowhere.

Therefore, listing rewards and certificates in health care can help brands to win the consumer’s trust. It indicates the product has passed all the required testing stages and reviews. That it’s safe and efficient. Sharing your brand story will be a key element of your development in China.

Powerful content to increase the brand health supplements sales

Vitabiotics also provided professional information associated with pregnancy and baby care in order to help first-time parents to take care of their children. It’s all a matter of delivering the right content to the right audience and engaging with your potential customers.

In China, young adults can’t really count on their parent’s advice to take care of their newborns. They’d rather discuss it with their friends or look for online advice and recommendation. Therefore, such context can be an opportunity for brands to build their authority in the market while delivering content to their audience.

Transparency: share details on your products and process.

This point matter, even more, when it comes to the health industry. Each product introduction page clearly describes every detail of the products and the volume of each ingredient. It makes customers feel more comfortable when knowing what they are taking in.

Targeting different audience

Vitabiotics has an extensive and multiple range of products for their different customers. It can be divided into several categories such as baby, mother, adult man, and elders. And all those categories can be found on the front page of the store.

This enables the customers to directly find what they’re looking for based on basic criteria. A customer experience improvement considering their time value and avoiding them to waste too much time browsing on products.

Adapting to the Chinese language and norms

The product’s description and display are in Chinese, with a specific design following the Chinese codes. Some simple actions may seem extremely basic but are unfortunately not considered by all western brands. Customers need to get a good understanding of what you’re offering before considering any purchase, and being a foreign brand is not a USP.

Logistics on track

China is well known for its extremely efficient logistic system, and from all the platforms present in the country people are now custom to delivery being executed within a couple of days. 2-3 days on average, up to 7 maximums.

Once an order is placed in the store, customers will access information to track the delivery in real time. And be aware that if they can’t access tracking information of their purchase or if it takes more than 7 days, you may face a very high refund rate.

As Vitabiotics did, it will therefore be strongly recommended to operate directly through bonded warehouse solutions that can be provided by the logistic suppliers or the platforms themselves. A direct mailing will be here a risky solution…

Looking to Launch Your Brand in the Chinese Dietary Supplement Market?

Strong from our experience in the nutritional supplement industry, our expertise has been built through the management of over 1000 projects. If looking for a partner that understands both your challenge and the healthcare market development, that can help you grow your brand and generate sales through Chinese platforms, then we may help you.

When considering a new entrant challenge, our expert team will guide you in detail through the CBEC process including both your logistic operations and ecommerce optimization. We will help you select the more suitable e-commerce platform for your brand.

China is a marathon, not a sprint. Qualified brands are here for long terms and target high performances. Therefore, GMA will assign you a personal manager dedicated to analyze your development capabilities but also to monitor your investment while maximizing your ROI.

We invite you to a 15min discovery call, where we will get to know if your product and qualification match the customer’s expectations. Tell us your brand story and our expert will tell you your future China story. If you’ll match our qualification process, we offer 1h of free strategy consulting and creative brainstorming.

For more details on the Chinese healthcare market and if interested to see if we could be a good match for your development in China, please feel free to contact us and talk with our consultant or apply for our 6 monthly brand incubator program.

How it works:

- Tell us who you are and what’s your brand story. Let us get to know each other and see if you’re made for China.

- Get to know more details on the Chinese market, and how similar brands like yours are doing and get a tailor-made strategy matching your needs, FOR FREE.

- If we determined that we can be a good fit and that we can actually help you to successfully grow your business in China, we’ll make you an offer to put your brand on a launchpad and get all you need for measurable success.

My company is looking to sell health products and services in China. Please advise how you can help.

Please contact me as I would like to find out how I can sell my products in China.

Hello Shirin, can you send us an email to marketingtochina@gmail.com we will be happy to help you

Loan and mt103 cash offers

We are the providers and senders of the following bank instruments.

1) Mt103 cash transfer to an unlimited account.

2) Genuine LOAN & SBLC

For procedures, please contact me on my Email: expow72@gmail.com

Thank you