Why Immunity Boosting are top sellers in Ecommerce Sites in China in 2024 ?

The health industry in China in 2024 is experiencing a significant surge in growth and development, with a growing emphasis on products that enhance immunity. As the world continues to grapple with the ongoing pandemic, people are becoming increasingly aware of the importance of maintaining good health. This has led to a significant increase in demand for natural remedies, raw materials, and supplements that can help boost the immune system.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Sumup & Trends 2024

The immunity-boosting market in China is poised for significant growth in 2024, driven by evolving consumer behaviors and digital trends. Here are five key trends that will shape this market in the coming year:

- Douyin E-commerce Integration: Douyin has transformed from a platform for entertainment to a powerful e-commerce giant, especially for health and wellness products. In 2024, Douyin’s e-commerce capabilities are expected to become even more sophisticated, offering seamless purchasing experiences right from the app. Immunity-boosting products will leverage Douyin’s short, engaging video content to demonstrate product efficacy, share user testimonials, and provide educational content about immune health, directly influencing purchase decisions within the app’s ecosystem.

- Influential KOL Partnerships: Key Opinion Leaders (KOLs) continue to wield significant influence in the immunity-boosting market. These partnerships will evolve beyond simple product endorsements to include more in-depth collaborations, such as co-branded products, KOL-curated immune health kits, and interactive live-streaming sessions focusing on immune health education and Q&A. KOLs’ ability to connect with their followers on a personal level will be instrumental in building trust and credibility for immunity-boosting products.

- Post-COVID Trauma and Health Consciousness: The lingering effects of the COVID-19 pandemic will continue to influence consumer behavior, with an increased focus on health and well-being. The trauma and heightened health consciousness post-COVID have led consumers to prioritize their immune health more than ever. you have to know that thedemand for products that offer evidence-based immune support, including traditional Chinese medicine (TCM) formulations, modern supplements, and functional foods and beverages enriched with immunity-boosting ingredients.

- Little Red Book Conversations: Xiaohongshu will remain a key platform for health and wellness conversations, particularly around immunity boosting. Users turn to Xiaohongshu for authentic product reviews, wellness tips, and to share their health journeys. In 2024, expect to see more detailed discussions and user-generated content on Xiaohongshu about immunity-boosting strategies, product experiences, and lifestyle adjustments to enhance immune health, making it a valuable platform for brand visibility and consumer engagement.

- Educational Content: As Chinese become more health-savvy, there will be a growing demand for educational content that not only promotes immunity-boosting products but also provides a deeper understanding of immune health. International Brands that invest in creating transparent, informative content—explaining how their products work, the science behind key ingredients, and offering guidance on overall immune health—will gain a competitive edge. This trend will be evident across all digital platforms, from brand websites to social media channels, as consumers seek reliable information to make informed health decisions.

This full report done by GMA will provide an overview of the immunity-boosting market in China, including growth trends, key product categories, consumer behavior, regulatory environment, competitive landscape, challenges, and risks faced by companies entering this market.

Enjoy 🙂

The Health And Wellness Market In China

The health and wellness market in China has grown rapidly due to the urban middle class’s increasing purchasing power and changing lifestyles. Consumers are placing more importance on personal well-being, leading to a demand for products that promote good health.

The industry caters to both young professionals and the aging population, with a focus on immunity-boosting products to mitigate chronic conditions like diabetes and cardiovascular diseases.

For instance, goji berries are a popular superfood in the Chinese health and wellness market due to their nutritional content, which promotes longevity and strengthens the immune system. They are widely used in various segments and products.

Importance And Relevance Of The Immunity Boosting Sector

The importance and relevance of the immunity-boosting sector are crucial in today’s fast-paced world. Marketing managers in China should understand that a strong immune system is the foundation for maintaining overall health and wellness.

Consumers of different age groups are seeking alternative means to boost their immune systems during uncertain times. Products like vitamins (vitamin C) with antioxidant properties have seen increased demand due to their potential ability to support immune cell function and provide protection from pathogens.

This presents an opportunity for companies to enter or expand in China’s health market by offering immune-boosting products.

Immunity-Boosting Market Overview

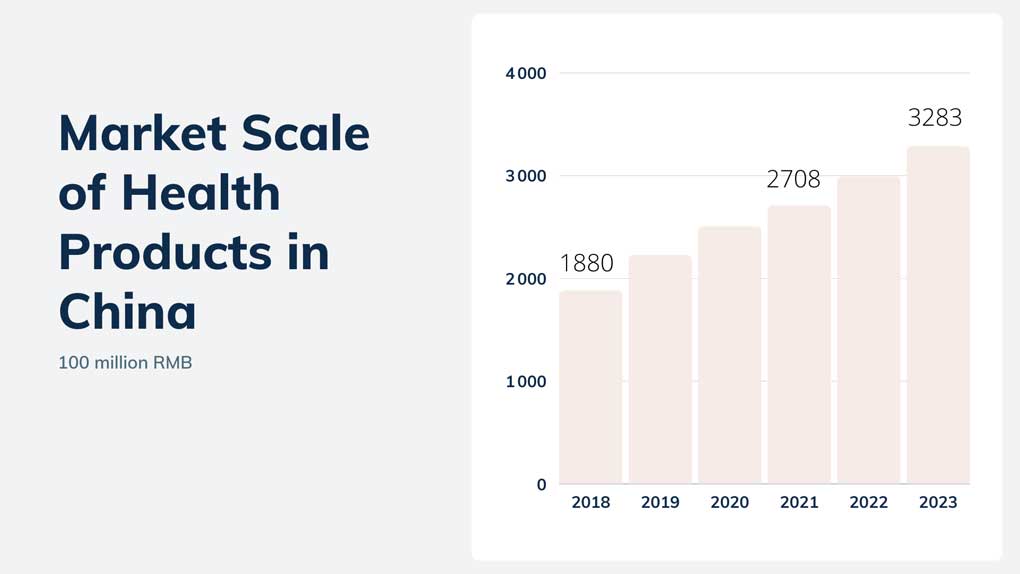

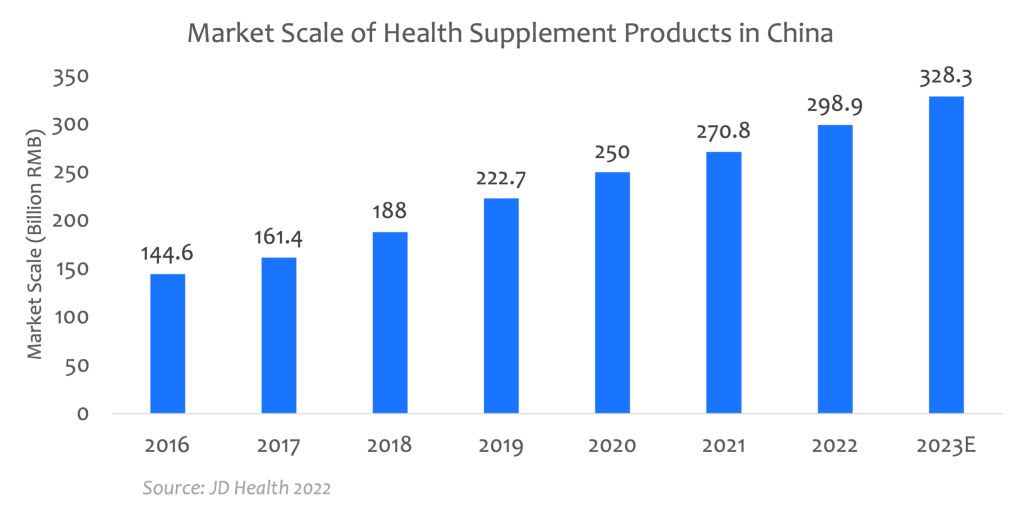

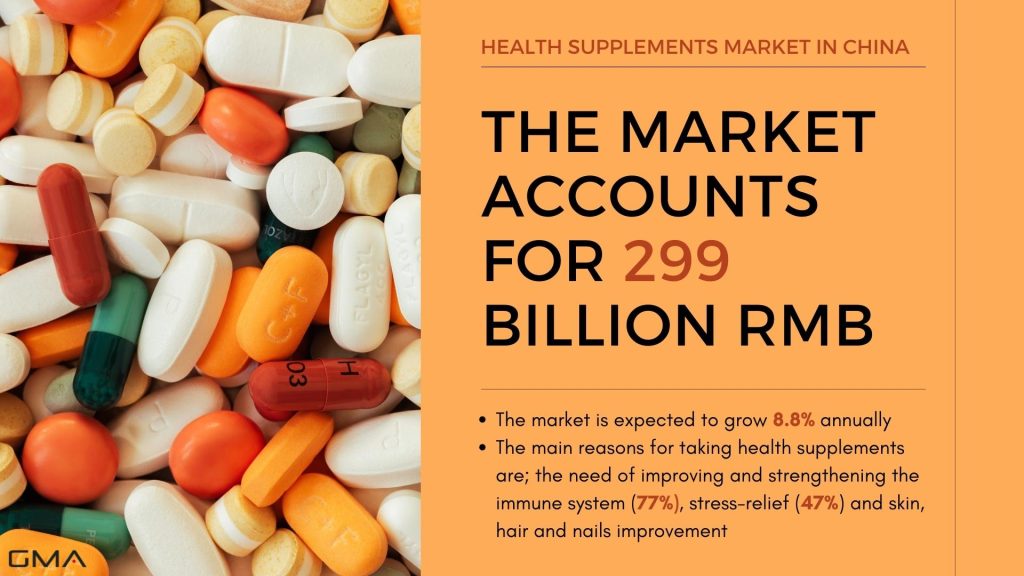

The immunity-boosting market in China is growing rapidly, with an estimated market size of $39,747.3 million. This growth is due to increased health awareness amongst Chinese consumers and a drive towards wellness in the population.

It is important to understand the potential of China as the second-largest market for healthcare products and the global market for immune health supplements, which is projected to grow from $20.18 billion in 2021 to $31.50 billion by 2028.

Growth Trends And Future Projections

Companies in China can expect continued growth and opportunities within the immunity-boosting market, as consumers claim to have specific health needs and are becoming more conscious about their health concerns and fitness trends, which is the main driving factor of the market.

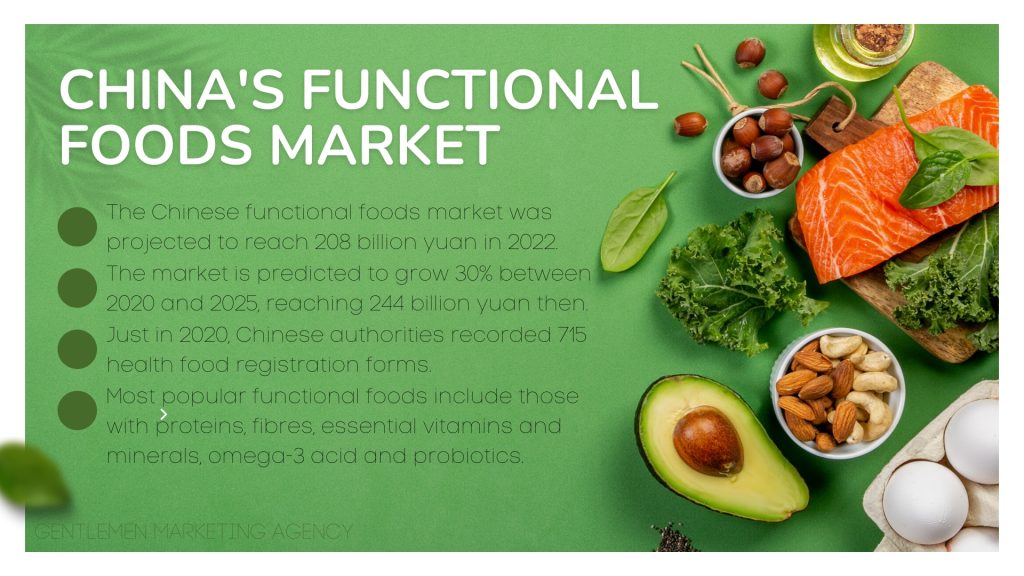

The global immunity-boosting food products market has experienced significant growth, with a CAGR of 8.2%, and China specifically has a growing demand for functional foods and supplements that promote health and wellness. As a marketing manager, understanding these growth trends and future projections is crucial.

Major Factors Driving The Demand

Increased health awareness due to the global pandemic, the aging population and their health concerns, as well as the rise of fitness and wellness trends among younger demographics, are some of the major factors driving demand in China’s immunity-boosting market.

Increased Health Awareness Due To The Global Pandemic

The global pandemic has led to a demand in the global immunity-boosting food market, as consumers in China and around the world are becoming more health-conscious and focused on improving their overall well-being and immunity. This shift in consumer behavior is expected to continue beyond the pandemic.

Aging Population And Their Health Concerns

However, many seniors also face healthcare needs that go beyond basic medical care, such as chronic conditions or limited mobility.

The aging population in China is driving demand for immunity-boosting products, as seniors face healthcare needs that go beyond basic medical care, such as chronic conditions or limited mobility

To tap into this market, companies should develop products tailored to the specific needs of senior citizens, such as dietary supplements or functional beverages designed to address common health concerns among older adults.

Rise Of Fitness And Wellness Trends Among Younger Demographics

As a marketing manager targeting China, focus on the rise of fitness and wellness trends among younger demographics.

Over 50,000 fitness clubs in China indicate that more people prioritize their health and staying active. Younger consumers adopt healthy lifestyles, including exercise and nutritious diets, and use immunity-boosting products like dietary supplements and functional beverages.

Key Product Categories

Dietary supplements, superfoods, functional beverages, and herbal products including traditional Chinese medicine are the four key product categories in the immunity-boosting market in China.

Dietary Supplements

Dietary supplements are a significant player in this sector, with an increasing demand for vitamins, minerals, and other nutritional supplements.

The traditional supplement market in China is also thriving, with ton-supporting supplement products being popular among consumers. Additionally, research is ongoing on dietary supplement use among primary school students in China.

One notable trend within the Chinese dietary supplement market is the rise of organic products and superfoods as immunity-boosting options. These healthier alternatives have become increasingly popular among health-conscious consumers who prioritize natural ingredients over artificial ones.

Probiotic products have also seen growth due to their benefits for gut health and overall immune system support.

Superfoods

In China’s health food market, the post-COVID-19 era is predicted to see a shift towards healthy foods, including superfoods that aid in improving overall health and immunity. Organic food, in particular, are gaining popularity among Chinese consumers who prioritize their health. Peanuts, an organic superfood, contain essential fatty acids that make them excellent for improving heart health.

Functional Beverages

Functional beverages, which are drinks with added ingredients to provide extra nutritional value and health benefits, are an important part of the immunity-boosting market in China. They include health drinks, energy drinks, sports drinks, anti-aging drinks, and mushroom-infused beverages.

Herbal tea infused with traditional Chinese medicine (TCM) is a popular functional beverage in China, as TCM has been an important part of Chinese culture for centuries and can help boost immunity while providing other benefits.

The use of herbs such as ginger, chamomile, goji berries, ginseng tea can help boost immunity while also providing other benefits such as reducing inflammation or aiding digestion.

Herbal Products And Traditional Chinese Medicine

The immunity-boosting market in China is comprised of key product categories such as herbal products and traditional Chinese medicine (TCM). TCM includes various health and healing practices, beliefs, and philosophies, including Confucianism.

During the COVID-19 pandemic, TCM was used to treat patients in China with five classic categories of herbs.

Herbal medicines made from plants use combinations of plant parts such as leaves, flowers or roots with each part having different benefits.

Consumer Behaviour

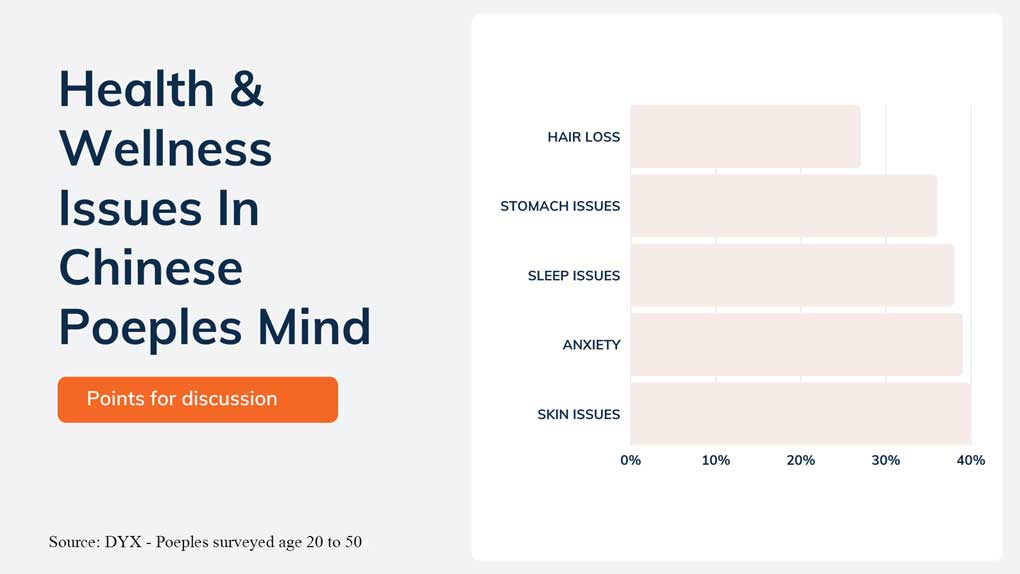

Chinese consumers are increasingly adopting a “health is wealth” mentality, leading to growth in the immunity-boosting sector.

Purchasing Habits Of Chinese Consumers In The Immunity Boosting Sector

Chinese consumers are increasingly buying natural immunity-boosting products like dietary supplements, functional beverages, and herbal medicine due to a greater focus on staying healthy during COVID-19.

With COVID-19 still looming large in people’s minds, there is a greater focus on staying healthy and building up one’s immune system. In addition to this trend toward preventative health measures, many Chinese consumers also prioritize convenience and affordability when making purchasing decisions.

They prioritize convenience and affordability, leading to a rise in online sales channels for health products like Tmall and JD.com offering a wide range of options at competitive prices.

read more

Preferences And Popular Product Types

Chinese consumers prioritize functional foods with health claims related to boosting immunity, including nutraceuticals and traditional Chinese herbal products.

Young consumers consider these products essential for preventing illness and premature aging. Lifestyle choices and culture also play a significant role in influencing consumer intentions, highlighting the importance of a healthy lifestyle.

For example, soups made from chicken bones or mushrooms are believed to be beneficial for the immune system due to their warming properties according to traditional Chinese medicine.

Influence Of Digital Platforms And Online Marketplaces

Digital platforms and online marketplaces have a significant influence on China’s immunity boosting market, with e-commerce platforms like Alibaba and JD.com leading the way.

Chinese consumers, especially younger demographics, regularly use their mobile devices to research products, compare prices, and make purchases. Immunity boosting products have specific categories on websites such as Tmall Global, Kaola, and VIP.

To tap into this trend effectively requires a deep understanding of local consumer preferences across digital channels including social media platforms like WeChat (China’s dominant messaging app).

Competitive Landscape

Major domestic and international players are vying for a share of the Chinese immunity boosting market, including companies such as BY-HEALTH, Swisse, Blackmores, and Amway.

Major Domestic And International Players In The Chinese Immunity Boosting Market

To succeed in the Chinese immunity boosting market, marketing managers need to understand the competitive landscape, which includes major domestic and international players such as By-health Co Ltd, GlaxoSmithKline, Swisse Wellness Pte Ltd, and H&H Int’l.

These companies are competing fiercely to capture a significant portion of China’s fast-growing health supplement market.

By-Health is one of China’s leading health product manufacturers, with sales revenue exceeding RMB 10 billion ($1.54 billion), and is known for its commitment to quality products that meet global standards.

Market Gaps And Opportunities For New Entrants

Marketing managers should identify market gaps and opportunities in the immunity boosting market in China. The demand for natural health solutions has created opportunities for new products. The probiotics sector is a potential gap in the market, with rising awareness indicating untapped potential.

Additionally, there are opportunities for companies to invest and expand into the biotech market as biopharma innovation continues to grow in China.

We can help you to succeed in immunity boosting market in China! Contact us!

In conclusion, after analyzing the immunity boosting market in China, it is evident that this sector is a significant player in the overall health and wellness industry. The current COVID-19 pandemic has further emphasized the importance of maintaining a healthy immune system to prevent diseases and infections.

Dietary supplements, superfoods, functional beverages, herbal products, and traditional Chinese medicine are popular product categories within this market.

However, companies looking to enter or succeed in the Chinese market must be aware of cultural differences and regulatory challenges. Collaboration with local firms and leveraging digital platforms for distribution is essential for success.

We can help you with:

If you’re interested in learning more and you’d like to enter the cosmetics market in China, don’t hesitate to leave us a comment or contact us so that we can schedule a free consultation with one of our experts that will learn about your brand and assist you with the best options for your China entry. Let’s keep in touch!