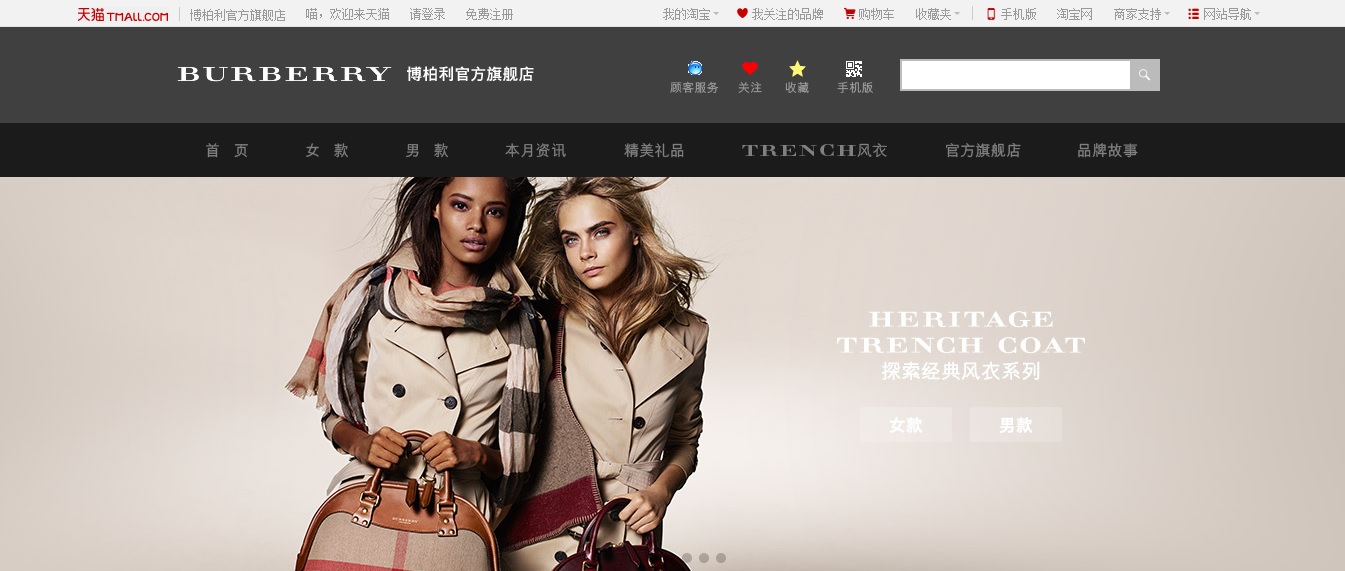

Tmall has become the place to be for those companies which want to increase their online sales in China.

There is almost no free traffic on tmall, for 95% of brands…. and prices of ads double, making ROI almost impossible to reach .

To increase traffic in the highly competitive Chinese digital marketplace, businesses need to understand and leverage unique strategies tailored to local platforms and consumer behavior.

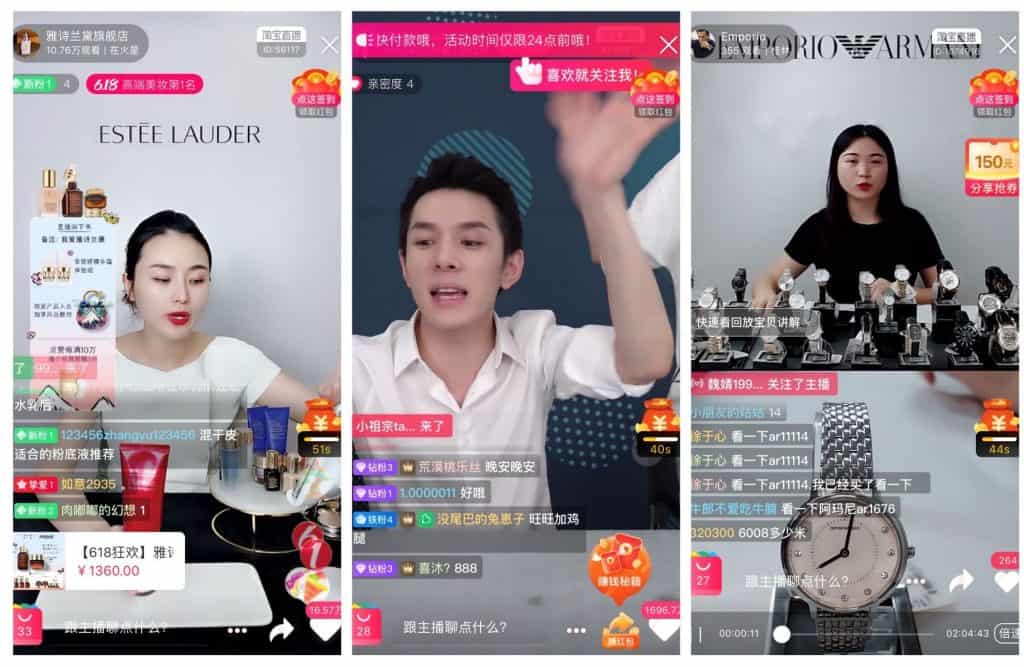

- Leverage Little Red Book (Xiaohongshu) KOLs: Partner with popular KOLs on Xiaohongshu to tap into their large and engaged follower base, ensuring your brand gets noticed.

- Utilize Douyin Influencers: Collaborate with influencers on Douyin, China’s version of TikTok, for creative and viral content that resonates with the younger demographic.

- Invest in Douyin Ads: Take advantage of Douyin’s advertising options to reach a wider audience with tailored video content.

- Optimize for Tmall’s Organic Search: Implement SEO strategies specific to Tmall to improve visibility in search results within this massive e-commerce platform.

- Engage with Taobao KOLs: Partner with influential KOLs on Taobao, leveraging their credibility to promote your products and drive traffic.

These strategies, centered around influencer partnerships and platform-specific optimizations, can significantly enhance online visibility and engagement in China.

In 2023, brands face several challenges on Tmall, including:

- Increasing Competition: The platform is crowded, making it harder for new entrants to stand out.

- Complex Operating Environment: Navigating Tmall’s policies and algorithms requires expertise.

- Higher Costs: Rising costs for marketing and promotions on Tmall can impact profitability.

- Changing Consumer Preferences: Keeping up with the fast-evolving preferences of Chinese consumers is challenging.

- No Free Traffic , Taobao is decreasing

Companies must design a digital strategy to increase their sales in China.

Beginning are almost the complicated part.

China is the fastest growing e-Commerce market in the world. During 2013, the global e-commerce sales were $889 billion and China became the largest e-commerce market in the world with $314 billion.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Chinese consumers are increasingly choosing e-commerce over physical retail shops. online spending per Chinese consumer accounted $1,040 per Chinese in 2019 and it’s expected to increase to $2,880 in 2024.

As reported by eMarketer, China account for more than $1 trillion in e-commerce sales which means over 40% of global internet commerce. Due to this great expectation, companies are looking for enhancing their e-commerce presence in China.

Tmall Global was launched by Alibaba, the largest online sales company in China. The sales of Tmall international have decreated over 10 times since its creation.

There is no Free Traffic on Tmall Global.

By the end of November, more than 5.000 foreign brands had launched official stores on Tmall Global and the transactions of only 30 of those stores accounted for 1.6 million U.S. dollar.

Tmall Global will become the largest e-commerce platform in the world very soon.

Thanks to international brands have the opportunity to sell their products in China without the need to have a physical presence in the Asian giant. Over the last months, many foreign companies have opened a store on Tmall to commercialize their goods across China.

What do Tmall Global for International brands?

Easy penetration in the Chinese market:

Tmall is an effective method for companies that want to expand their business to China. Through this online marketplace, brands are able to reach a vast number of consumers with a minimum investment.

A large number of online shoppers prefer Tmall as their e-commerce channel because they trust in the veracity and quality of the products unlike other e-commerce platforms.

In addition, shoppers can purchase both international and local brands and have access to a huge number of products that are not available in physical stores.

Nowadays, many foreign brands have already opened an online store on Tmall.

Brand awareness in China

Through Tmall, brands have the chance to increase their brand awareness among Chinese consumers.

Foreign brands with limited to no visibility at all in China should open a store in e-commerce platforms instead of developing their own separate

Brands that have a minimum visibility or even no visibility in China should open a store on an e-commerce platform but instead develop their own e-commerce site.

With 50% share in the B2C e-commerce market, Tmall is the best choice for foreign companies.

With its massive popularity, Tmall is an efficient way for companies in order to showcase themselves to Chinese shoppers and to establish brand’s reputation across China, which is especially important for companies that don’t have a strong presence in the country.

How can brands promote their Tmall stores?

The first step is to open an online store on Tmall. Next step? Promote, promote, promote to attract consumers!

For this, social media platforms are critical.

Social networks are an important part of the Chinese daily life. Chinese netizens spend no less than 25h per week online, with 30% of that time only dedicated to social networks.

Social networks allows brands to stay close to their customer, thus promote more efficiently elements of their business like a Tmall store.

Spreading content about your Tmall store on the two most important social networks, Weibo and Wechat is a must do when you are on the Chinese market

- On their social accounts, brands must drive directly the consumers to their Tmall shop.

- In addition brands must set events within the platform to make sure that their shop stand out from the competitors.

We know what has to be done in order to increase traffic to your Tmall shop, from design to promotion, do you want to establish and promote a Tmall shop? Contact us!