It’s very clear that domestic luxury in China has become heating up, and e-commerce means an essential opportunity for brands to offer to digitally savvy Chinese individuals. According to KPMG, approximately fifty p.c of luxury goods sales in China might be built online by 2020.

The major e-commerce players in China

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

With all the significant number and buying the electric power of Chinese luxurious customers, the problem quite a few luxurious makes confront is ought to they open up their own individual e-commerce web sites or launch channels on important third-party marketplaces?

Usually, luxurious manufacturers are actually hesitant to join e-commerce web pages in China. Some brands are worried about the lack of command of brand name impression and availability of counterfeits. A lot more importantly, the marketplaces’ mass-market photos depict a different deterrent for luxurious manufacturers to get on board. However, a variety of luxury brand names that were slow to embrace e-commerce have radically altered their path and so are now signing special promotions with major e-commerce market gamers such as Tmall, JD.com, and Vipshop.

An additional crucial part of this dialogue will be the key e-commerce organizations by themselves. The competitors concerning them are now fierce. Earlier this calendar year, news broke that makes have been asked by a single major e-commerce player to “choose a single or another” platform to affix, and supplied exceptional organization advantages in exchange. It is uncertain irrespective of whether this really is true, but it is now progressively apparent what styles of long-term rewards brand names can take pleasure in by picking out certain platforms. This calls for a very careful assessment of key e-commerce players in China.

Understanding the future of Chinese E-commerce

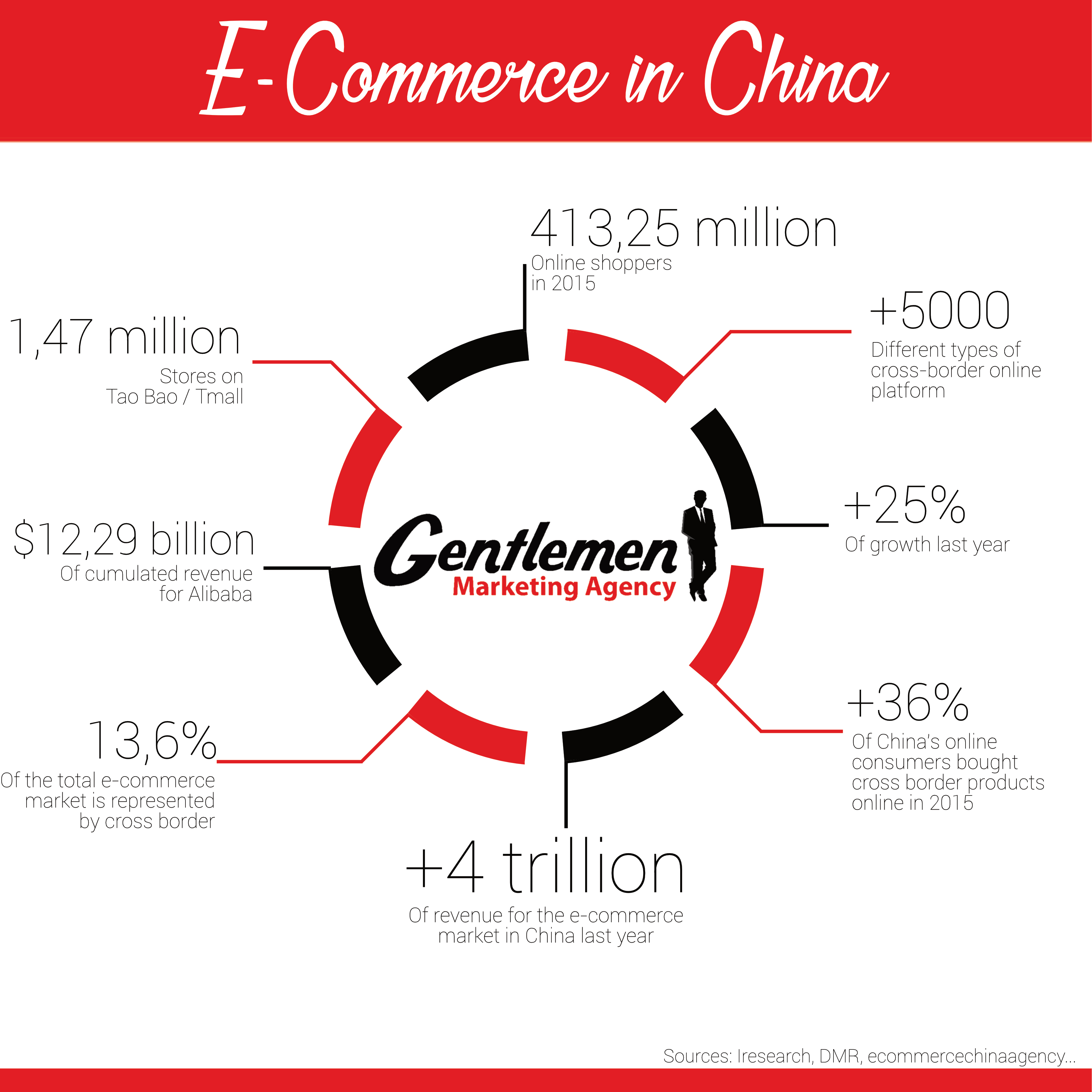

In 2015, China already overtook the USA to become the largest e-commerce market in the world based on value and is on track to be worth US$840 billion in 2021, almost double the estimated size of the US e-commerce sales in the same period (US$485 billion), demonstrating that the e-commerce growth rate in China exceeds the USA’s rate by about 4 times. This type of velocity makes China the market to watch and understand when it comes to e-commerce trends.

The incredible e-commerce growth we are seeing in China is being driven by third and fourth-tier cities, and for the first time, these cities have surpassed first and second-tier cities. The emerging trend to watch here is how rural markets in other parts of emerging Asia will also experience significant e-commerce growth. We already see this trend in India so expect to see this in other parts of the region as emerging middle-class consumers with little or diminished access to physical retail outlets turn to e-commerce and their mobile phones to find the goods they want.

Tmall: the largest B2C platform in China

Tmall is definitely the largest B2C platform in China, it offers a wide selection of affordable products and decent logistics and attracts value-conscious shoppers. People born in the 1980s with high incomes will be the essential demographic of the site. Its recently launched, exclusive Luxury Pavilion offers a VIP portal for these customers and delivers a premium shopping experience. Additionally, Tmall will lead the implementation of Alibaba’s New Retail Initiative by integrating the internet and physical retail spaces through data technology, which could serve as an option for brand names to explore combining their online and offline channels.

JD.Com: Tmall ‘s biggest rival

Known as the “Amazon of China,” JD.com is Tmall’s biggest rival, but in the apparel market, it is trailing behind Tall. It’s got a smaller apparel product selection and less competitive pricing compared to Tmall.

However, JD has launched its own luxurious site Toplife, which is separate from its main e-commerce platform. Unlike the invitation-only Luxurious Pavilion, this site is open up to the public and targets high-end individuals through the use of big data. This stand-alone site signifies JD’s ambitions for the luxurious industry. Having said that, it is still too early to determine irrespective of whether this will shift consumers’ perceptions of JD as a mass current market site.

JD’s best-in-class fulfillment infrastructure is a vital differentiator among its competitors, especially considering Chinese people often expect same-day delivery. The efficiency of JD’s delivery service is better suited to meet consumer expectations, but regardless of whether this effectively encourages impulse buys of luxurious products on the internet is still unknown.

In addition, the company formed a strategic partnership with Tencent in 2014. The deal enabled both parties to leverage their respective strengths in e-commerce and social messaging in order to strengthen their competitive position against their shared competitor Alibaba.

Vipshop: China’s top online discount retailer

Applying a similar model as Gilt Groupe, Vipshop is China’s top online discount retailer. Customers gave Vipshop the highest score on branding and quality. Even though the company has limited product offerings compared to Tmall and JD, its goal is to maintain a core of loyal customers. In accordance with the company’s financial report, over 93% of orders are placed by repeat customers and over 79% of customers are repeat customers. It launched a super VIP program before this 12 months and seeks to improve its customers’ shopping experience. Moreover, American label Marc Jacobs launched its initial China e-commerce channel on this platform.

Our VIP Shop Merchant Guide here

Through the years, I’ve considerably admired how promptly, as well as in numerous instances how in a different way, the Chinese electronic ecosystem has grown. So differently that we frequently experience we simply cannot understand considerably from China for the reason that the most important worldwide (social & messenger) platforms do not exist in China (yet). It is easy to default to viewing China as the unique digital ecosystem unto its self as well as in most ways it is. However, e-commerce is one area we should pay strong attention to as a potential crystal ball of trends that could extend to the rest of APACE.

![Immunity Boosting Market in China [Full Report]](https://ecommercechinaagency.com/wp-content/uploads/2023/05/boosting-china-768x545.png)

Hello,

I would like to know how beneficial is to join an E-commerce platform for my brand. We have luxury accessories from native Latin American hand made products. Which app is the best and how to join?

Hey there,

I would consider joining Little Red Book to try out the market as it is focused on foreign luxury brands and less expensive than Tmall.

However, I would not suggest entering the Chinese market without working on your brand awareness and e-reputation.

But please, drop us an email at ecommerce@marketingtochina.com and we will let you know more about the best strategy for luxury brands new on the chinese market.