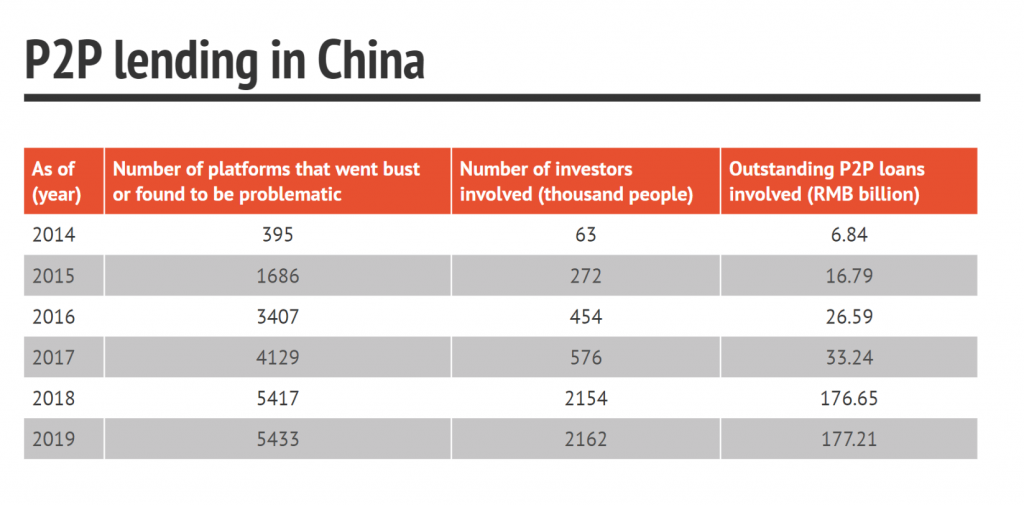

Peer-to-peer lending is booming in China. Traditional financial services face stiff challenges. In China, online loans are growing in popularity because they are simple and convenient.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

- Diverse Lending Landscape: China’s loan market encompasses a range of financial institutions, including state-owned banks, commercial banks, rural credit cooperatives, and online lending platforms.

- Growing Consumer Lending: There has been a significant increase in consumer lending, driven by rising personal incomes and a growing middle class, with loans for home purchases and personal consumption being particularly prominent.

- Expansion of Digital Lending: Fintech and online lending platforms have grown rapidly, offering convenient, quick, and often less stringent loan processes compared to traditional banks.

- Regulatory Environment: The Chinese government has been actively regulating the lending market to control risks, especially focusing on shadow banking, peer-to-peer (P2P) lending platforms, and micro-lending.

- Interest Rate Liberalization: The People’s Bank of China (PBOC) has been moving towards interest rate liberalization, which affects how banks price loans, potentially leading to more competitive rates.

- SME Financing Challenges: Small and Medium Enterprises (SMEs) often face challenges in securing loans due to stringent requirements and risk aversion from traditional banks, though this is being gradually addressed through government policies and fintech solutions.

- Real Estate Lending: A significant portion of lending is tied to the real estate market, with mortgages and loans for property development being major components.

- Debt Levels: The overall debt level, including government, corporate, and household debt, is a point of concern, with authorities taking steps to mitigate systemic risks.

- Innovation in Lending Products: Financial institutions are increasingly innovating with new lending products, such as green loans and supply chain financing, to meet diverse market needs.

- Impact of Economic Policies: Economic policies, including stimulus measures and financial support during economic downturns, significantly influence the loan market dynamics in China.

More borrowers are taking out such loans, particularly young people.

The balance of online consumer loans in china has grown about fivefold between 2015 and 2024, reaching 350 billion yuan ($54.6 billion) according to a Chinese research company Analyst.

The rise and fall of online loans

China’s government push to encourage lending to smaller companies has created business opportunities for large financial technology companies. President XI JINPING has both publicly announced support for privately run companies, the central bank has also freed up cash for lending, and eased rules to help small businesses obtain funds more easily.

Roughly 80 percent of the 90 million small and micro-sized enterprises in C

China issues comprehensive regulations on internet finance

Thanks to their close ties to Chinese technology giants, Alibaba-backed online lender MYbank and Tencent-backed Webank can use hordes of payment information or social network data to ascertain the ability of a business to pay back its loans. That’s the kind of basic credit information many companies in the private sector have been unable to provide, and partially why traditional banks prefer to lend to large, state-owned enterprises instead.

Finance Services in China

ecommercechinaagency.com

The process of taking out a loan from the bank is slow and complicated, giving companies more incentives to turn to other lenders, even if the interest rate is higher, Yang said. Smaller loans, quicker application, in contrast, taking out a loan through an online service in china can take just a few minutes.

The traditional banks rarely issue loans of less than 1 million yuan ($148.385) while the average size of a loan on a financial technology platform is often far smaller.

The average size of a loan to small and medium-sized enterprises and individual businesses on MYbank is about 9.900 yuan ($1.469) according to minority stakeholder Ant financial. As of the end of September 2018, the latest figures available, nearly 9.78 million of such businesses had received a cumulative total of more than 1.19 trillion yuan in loans through the online platform. The non-performing loan ratio was about 1 percent. With internet banking, every customer is a VIP.

10 +1 winning strategies to market Financial services in China in 2024

- Leverage WeChat Platforms: Embrace China’s digital ecosystem to reach a wider audience. Utilize popular social media platforms like WeChat channel for targeted marketing campaigns.

- Douyin: Best way to target users with video in feed advertsinng. Just magic 🙂

- Partner with Fintech KOL : Collaborate with fintech KOL to offer cutting-edge financial solutions, enhancing service appeal to tech-savvy consumers.

- Focus on Mobile-First Strategies: Prioritize mobile-friendly services and marketing, as the majority of Chinese consumers use smartphones for financial transactions.

- Utilize Data : Employ big data to gain insights into customer behavior and preferences, tailoring your services to meet their specific needs. (available on Douyin & uaishou)

- Embrace AI and Machine Learning: Integrate AI for personalized customer experiences, from chatbots for customer service to tailored investment advice , best way to create video.

- Offer Diverse and Flexible financial services: Cater to varied financial needs with a range of products, from wealth management to micro-loans, appealing to different market segments.

- Educate : Provide valuable financial education and advice, establishing your brand as a trusted source of information in the finance sector.

- Content Marketing: Develop engaging, informative content that resonates with your target audience, from finance tips on RED to investment webinars.

- Build a Trustworthy Branding: Branding is everything in China. Foster trust with transparency and compliance to regulations, crucial in the financial services sector.

- Innovate : Offer exceptional customer service with innovative features like instant online support and financial advisory services, enhancing customer satisfaction and loyalty.