China’s jewelry market is booming, presenting huge opportunities for foreign brands. According to a Statista report, the Chinese jewelry market is expected to reach a value of $865 billion by 2026, up from $116 billion in 2016. The growth of China’s middle and upper class and digitalisation is one of the main forces contributing to the rise of the Chinese and the world’s jewelry market, as Chinese people are leading the global market in terms of fashion jewelry revenue. In this blog post, we’ll take a look at some of the key trends shaping China’s jewelry market and discuss how international brands can capitalize on them.

China jewelry market overview (2022)

According to Euromonitor International, global jewelry consumption reached around 348.5 billion dollars in 2021 and China ranked first among all jewelry markets in the world, with revenue exceeding 84 billion dollars. Globally, jewelry market takes about 17% of all apparel spending. China is also first in fashion jewelry, with a 3.5% average annual growth rate. In comparison, the growth rate of the US jewelry market was -4.3%.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

According to a report published by Polygon, jewelry is also the third-largest investment category in China, behind real estate and automobiles. With over 3/4 of China’s population being jewelry consumers, it is no surprise that the country has become a major player in global jewelry sales. The Chinese government estimates that monthly retail sales for gold, silver and jewelry typically range from 20-30 billion yuan with stable demand throughout recent years.

China is one of the world’s major jewelry import destinations and the second-largest jewelry exporter. According to Statista, in 2020 around 13.5 billion Hong Kong dollars worth of jewelry was shipped from Mainland China to Hong Kong for re-exporting further, making it China’s largest jewelry export destination.

What are the most favoured types of jewelry on the Chinese market?

When it comes to the most favoured types of jewelry, every different age group has different preferences. We will discuss some of the main trends in China’s jewelry market later on, but when it comes to types of jewelry products, they can be divided into three main categories;

- Metal jewelry; this category includes all jewelry products made from precious metals. The major group here is gold jewelry, which is the most favoured type in China. Apart from gold products, this category also includes platinum jewelry, silver, copper or aluminium. This is the most preferred category of jewelry in China.

- Precious stones; this is a category that includes polished diamonds, sapphires, rubies, pearls, amber or jade, a symbol of longevity, really often bought as gifts for little kids from family members. Although diamonds are decreasing in popularity (as fewer people are getting married, and diamonds are very gifted to the bride as a romantic commitment), China is still the second country in the world when it comes to diamond sales.

- Other types of jewelry, including ivory, leather, clay, wood and other experimental jewelry with innovative designs are gaining ground among younger audiences.

Who are the new Chinese consumers of jewelry that are driving the market growth?

Jewelry was an essential part of Chinese culture for more than 5000 years, since the early days of Chinese civilization, as it was used during cultural and religious rituals. Two of the most important jewels were always jade, the symbol of immortality and gold, which symbolises wealth and richness. Jade and gold were always considered symbols of Heaven.

Nowadays jewelry is still an essential part of Chinese people’s lives. Several factors are driving the demand for jewelry. Millennials and Gen Z are the main drivers of the market’s growth, treating jewelry as a way to show off their socioeconomic status. Additionally, third-tier cities are growing and their inhabitants are becoming more wealthy, which means they can now afford to buy jewelry as wedding gifts and for themselves.

The growing demand for jewelry is also driven by globalisation and digitalisation, as young consumers in China have more and more access to global trends seen on the internet and foreign brands selling jewelry products in China’s jewelry market.

Because of that, companies are developing global strategies to adjust to shifting consumer shopping habits by accepting a wide-ranging multi-channel approach and considering offering customers more than one channel for purchasing, this way they expect to drive more sales, especially among the savvy young Chinese Internet population.

Trends in jewelry market in China that foreign brands need to know

Although branded jewelry will always trend in China when it comes to these fashionable accessories, there are some new trends on the market that all Chinese brands and foreign companies should know about if they want to enter China’s jewelry market;

Gold, the king of jewelry in China, is losing popularity

It’s important to say that gold jewelry is still the most popular in China, accounting for 58.3% of total jewelry sales in 2021. The market was worth 420 billion yuan that year and the gold jewelry consumption was 45% larger that the year before.

In China, lower prices combined with favourable macroeconomic factors – including the swiftly emerging middle class, greater disposable income, growing urban populations, and lenient government restrictions on gold buying – set new records for gold jewelry.

But the market is seeing a shift in consumer behaviour in recent years. According to World Gold Council, only 18% of women in first-tier cities like Beijing, Guangzhou or Shanghai, would purchase gold jewelry if they were given 5000 yuan. Favoured by older generations, this precious metal is not a prefered option for Chinese Gen Z, which opts for diamonds and platinum jewels instead.

Silver is trending among younger consumers

China is the world’s largest producer of silver jewelry, and jewelry manufacturing accounts for more than 35% of silver consumption in China. Although gold is still the first choice for many Chinese that are willing to purchase jewelry, silver is becoming more and more popular among young consumers, that consider gold old-fashioned and pricey.

Silver jewelry provides an opportunity for low-cost choices. When it comes to the most preferred choices of silver jewelry, rhodium-plated silver is the most bought as it has the look of platinum and can imitate platinum jewelry for a lower cost.

Chinese customers are interested in expensive-looking jewelry without the high price tag, as they want to show off, but do not necessarily have the financial capacity for it.

Diamonds are still preferred by rich Chinese customers

Diamonds are the favourite ornament among rich Chinese. Now, there are more and more options to buy diamonds, as more people can afford them and the prices are not always very high.

The majority of consumers start their purchasing process online by shortlisting and comparing prices of diamonds on various websites and sales are completed in person. Therefore, having a sturdy online digital presence is necessary for diamond jewelry retailers.

In China, there is high-pitched demand for diamonds and thus, China is positioned as the biggest emerging diamond buying market. Gradually, demand is expected to grow, and it is estimated that it will soon outweigh supply, in large part due to the expanding Chinese and other emerging markets which is a great opportunity for international brands wanting to expand their sales to the Chinese market.

Chinese women are the main driving force of China’s jewelry market growth

As women in China start earning more and gaining a lot of success at work, they also reward themselves by buying luxury goods for themselves, and not only as gifts. The consumption of jewelry in China is dominated by women, with 63% of jewelry products bought by them.

When it comes to their purchasing preferences, diamonds are becoming increasingly popular, as they are no longer seen as something reserved only for the bridal market. Many single Chinese women don’t want to wait for men to spoil them with gifts and turn to buy luxury goods, such as diamond earrings or gold rings and bracelets for themselves.

Jewelry for children: longevity locks for a happy life

Gifting kids jewelry, such as gold necklaces, silver bracelets or diamond earrings is something that can be seen in many countries. When it comes to China, the Chinese jewelry market for kids is also a good niche to consider, as people often give longevity locks or other lucky items to children as lucky charms and as a way of wishing them a happy and healthy life.

Many companies seize this opportunity, for example, Chow Tai Fook, the biggest jewelry manufacturer in China and one of the biggest in the world collaborated with Disney and Marvel to create lucky charms for babies.

There are many more trends to consider, such as the growing demand for smart jewelry. Both women and men, especially younger consumers from first-tier cities are growing interested in smartwatches, lighting up bracelets and other devices. Men’s jewelry, although in an early stage, is seeing a growing interest, as men in China don’t consider makeup and jewelry as something reserved for women anymore.

Who are the main players in the Chinese jewelry market?

Chinese jewelry market, similar to many other luxury goods markets, is dominated by only a few brands that are taking the most of jewelry market share. The leading domestic jewelry brand in China, called Chow Tai Fook (although it’s one of the Hong Kong brands to be precise), saw revenue of almost 87 billion dollars in the recent year, only in Mainland China. Other domestic brands that are gaining ground in China are YIN, I Do and Qeelin, which are succeeding thanks to targeting new consumer groups.

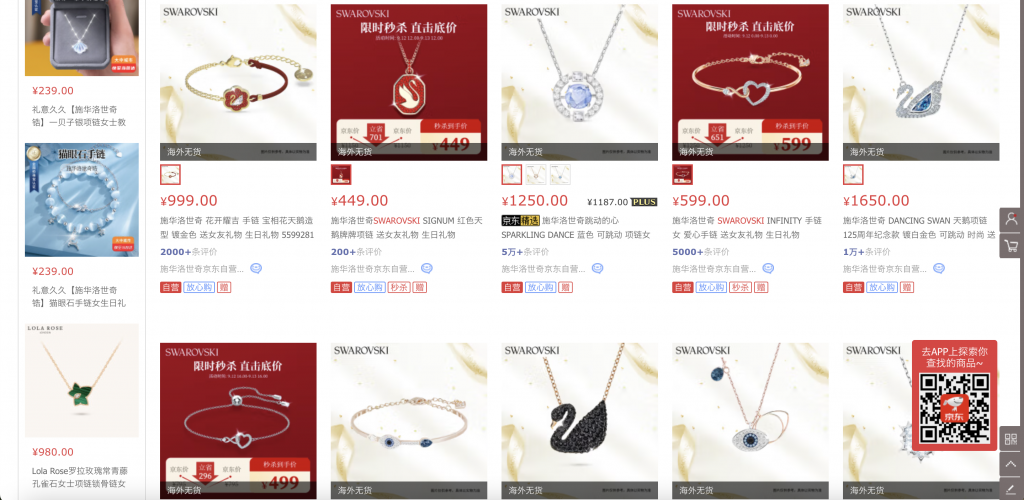

The most popular foreign brands in China are Tiffany, Cartier, Pandora, Swarovski and Van Cleef & Arpels. Those brands are positioned for the high-end markets in first and second-tier cities and their products are usually more expensive than the domestic ones. In general, Hong Kong and foreign jewelry brands target high-end consumers and offer higher prices, while domestic companies, which are usually far younger than their foreign competitors, are more affordable for middle-class Chinese.

E-commerce Solutions for International Jewellery in China

Entering the Chinese market might be challenging but it’s definitely worth the effort. By developing local market-centred strategies and partnering with local digital marketing agencies that offer all-inclusive digital marketing campaigns to reach, act, convert and engage Chinese consumers, you will be able to build brand awareness and increase sales in China.

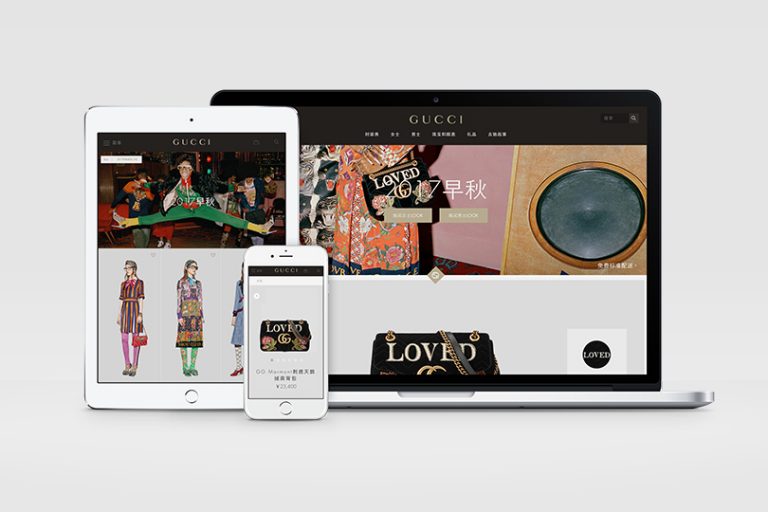

Entering the Chinese E-commerce platform is for those brands who are ready to seize this immense opportunity. To penetrate the Chinese jewelry market we recommend two vital solutions; branding and presence on well-known e-commerce platforms in China.

Branding is the most important step to success in China

A successful digital marketing campaign requires concrete branding. Nowadays people check everything online and because of the stiff competition on the market, it’s very important to take care of brands’ image and e-reputation. Chinese people won’t buy luxury products from companies that they never heard of. They rather ask a friend or family member or check their favourite social media platform for recommendations and opinions.

Your brand needs to stand out so that people will talk about it on social media platforms and online forums. Branding and good e-reputation are key to great success in China and it’s something that people from all industries need to remember.

Chinese people do not buy on a brand’s website, they prefer eCommerce platforms

Although having a website localised for the Chinese market is very important, just like it is in the West, its’ purpose is slightly different. We like to check brand’s websites and purchase products there directly. Chinese customer experience is different; they search for a brand’s website on Baidu and then check the website to learn about the brand, but after they do so, they turn to e-commerce platforms to purchase goods.

E-commerce revenue in Mainland China is on its way to surpassing expectations as it already reached US$1,543 billion in 202 and is expected to read 3 trillion U.S by 2024. There are many e-commerce marketplaces to select from. We will present you with the most popular and accurate ones for jewelry goods;

Tmall

Tmall, owned by Alibaba Group, is the biggest e-commerce platform in China, that focuses mainly on premium brands. Because of its popularity, it is also the most expensive e-commerce marketplace in China. For Chinese consumers, high price indicates high quality, therefore many customers prefer buying their products on Tmall. The platform provides an opportunity for international brands to open exclusive online stores and directly sell products to Chinese consumers without being physically present in China.

Tmall offers B2C services and is suitable for high-end brands, because it’s the platform for luxury goods with good quality so buyers won’t need to worry about counterfeits. Tmall also hosts a sub-platform, Tmall Global, that offers a cross-border service for international brands. It’s a good marketplace for jewelry brands that are already present and well-known on the Chinese market.

To protect the exclusivity of the online marketplace, Tmall has an invitation-only policy where only qualified international brands can either be invited to join or can apply through a certified so-called Tmall Partner, which is a third-party company that helps to provide assistance in onboarding and operation for businesses that are working on Alibaba’s platforms such as Tmall.

Requirements for an international brand to operate an online Tmall store

- To penetrate the Chinese e-commerce market, an international brand must be an authorized distributor and have a corporate identity outside China

- The company must be independent and hold retail and trade rights

- The company must be the brand owner or authorized agency having the authority to sell products under its name

- The company must hold relevant inventory certification for the stock

Taobao

Taobao is owned by Alibaba Group. It offers the largest C2C e-commerce marketplace in China, with estimated monthly traffic of over 480 million users by the end of 2021. Taobao allows registered or non-registered businesses to sell directly to consumers and its success as a market leader comes from the fact that Taobao offers free registration for its users.

Taobao is the perfect platform for small and medium-sized businesses that want to sell their products to consumers in China. As creating an online store is free, the only payments that need to be done are small transaction fees if the transaction is done via Alipay.

We can help you with registering your account on the platform, advise on product selection and marketing strategy, design the page for your store and many more. Taobao also offers a live-streaming option, which is a great idea for China’s jewelry market. Working with China digital agency is a must for foreign brands wanting to open stores on Taobao, as the platform doesn’t support non-Chinese companies and you would need to have a third-party company that is registered in China.

JD.com

JD.com was founded in 1998. It’s the biggest competitor of Alibaba Group, with estimated monthly traffic of 227 million users. International companies can open individual online stores on JD.com and brands are permitted to import food, beverages, apparel, and shoes from overseas. JD’s cross-border service, JD Worldwide, enables suppliers to sell directly to Chinese consumers without a local presence and a need for a physical presence in China.

JD.com is less expensive than Tmall. It provides active global promotion of JD Worldwide (mainly in the U.S. and Australia) and supports in-house logistics services. JD.com has a zero-tolerance policy for counterfeit products.

Requirements for an international company to operate an online JD store

- An international brand must be an authorized distributor and have a corporate identity outside China along with registration capital of over RMB500,000 (Around US$76,660.00)

- The company must be independent and hold retail and trade rights

- The company must be the brand owner or authorized agency having the authority to sell products under its name

- The company must hold relevant inventory certification for the stock

JD allows operating an online store in 3 different ways

- Franchising Business Partner –International brands can set up stores on JD.com and avail the facility of JD warehouse to stock their products. JD provides warehousing, delivery of goods, and customer service.

- Licensing Business Partner – International brands can set up their online store and can ship the order. JD will supervise customer service and process invoices.

- Self-Operation Partner – International brands can sell on the JD platform, however, warehousing and delivery of goods must be supervised by the international brands.

Apart from the aforementioned formalities, international brands are expected to have a Chinese consumer-oriented digital marketing strategy to attract targeted customers.

Although WeChat is mostly a social media app, it also has a whole ecosystem that provides eCommerce solutions for domestic and foreign brands. With over 1.26 billion active users in 2022, it’s an app that offers great opportunities for companies with a small budget, that didn’t establish their presence and brands name in China’s jewelry market yet.

Every company can start a Wechat Official Account, which is a public account that works like a website within the app. Brands can then send announcements and newsletters to their followers, informing Chinese consumers about new products, presenting new offers and so on. These accounts can be later on linked to Wechat Stores that are also built into the WeChat ecosystem, in so-called mini-programs.

The introduction of WeChat Stores was a game changer for brands since it’s very cheap and easy to create. Nowadays more than 95% of brands have an e-commerce store on Wechat, also the big ones, that have physical stores in China’s big cities.

WeChat Store is a great tool, making it easy to promote products to Wechat users. They are very shareable, allowing brands to link their stores to articles, Wechat Moments and many more, which is especially useful when it comes to targeting young consumers in China.

International Jewellery Brands in China: Case Studies

There are many international jewelry brands present in China’s jewelry market. Big players like Cartier, Swarovski, Tiffany, and Pandora are all present on main eCommerce platforms, and social media apps as well as in jewelry specialty stores or brands’ flagship stores all across China. Let’s take a look at Tiffanys’ and Pandoras’ successful moves on the jewelry market in China;

Tiffany is turning to KOLs for promotion

Tiffany is one of the most successful jewelry brands in China. Although it entered China in 2001, its first flagship store was opened in 2007. Today, China is the second largest market for Tiffany and even though China’s jewelry market has seen a big decrease during the pandemic, its recovery is creating big opportunities for foreign and mainland brands.

Tiffany was always reserved for the rich in China and associated with older generations. But today Tiffany is changing, trying to adapt to the Chinese changing society and young Chinese consumers, that can afford luxury goods.

One of the strategies targeting younger consumer groups is Tiffany’s attempt at influencer promotion on Chinese social media platforms like WeChat, Little Red Book or Douyin. Tiffany invited 小鲜肉 (lit. “Little Fresh Meat”), which are handsome men that have a big influential power in China.

One of the very well-known influencers, Yi Yanqianxi, became Tiffanys’ spokesperson and started promoting Tiffany’s products on Chinese social media. One such campaign (promoting a special offer of only 200 available necklaces for the 520 festival) generated a revenue of 18.750 yuan in just 6 days.

Tiffany is now visible on all e-commerce platforms and social media apps in China, targeting consumer groups of all ages and types. They are also investing in ads (for example; Wechat Moments ads), live streaming and many more.

Pandora Successful WeChat mini-program valentine campaign

Pandora is playing well in the Chinese E-commerce digital playground by marketing its trendy, silver charm bracelets on various digital platforms in China. Pandora entered China in 2011 and now has staggering 100 stores. The company targets middle-aged women in the U.S., but in China, it is extremely popular among 25-35-year-old customers.

When Pandora was creating a marketing strategy for the brand, they thought carefully about all the occasions when young people express their love. On one such occasion, the Qixi festival in 2020 which is the equivalent of our Valentine’s Day, Pandora launched a mini program, where users could send gifts to their Wechat friends.

This promotion was a huge success that helped the company to attract young consumers to follow new trends on their mobile devices, without the need of visiting physical stores, which is usually a domain of luxury jewelry brands. Apart from the launch of a mini-program, Pandora also launched a Qixi Capsule Collection, targeting consumers looking for a perfect Valentines’ gift.

We can help your brand enter the Chinese jewelry market! Contact us

As the Chinese economy continues to grow, there will be even more opportunities for international brands in the China jewelry market. If you are looking to expand your business into China, it is important to understand the unique dynamics of the Chinese jewelry market and how to reach Chinese consumers.

Our team at Gentlemen Marketing Agency can help you do just that. We have 10 years of experience helping businesses succeed in China. We are a leading social media marketing agency in Shanghai, with a lot of successful stories from many foreign luxury brands.

Here is one of our successful jewelry case studies. If you’d like to learn more about jewelry market in China or you’d like to discuss your project, leave us a comment or contact us!

Great article Ecommece China Agency. opportunites are here, you did not speak about Jewellery Regulation , Why ?

Hi I was wondering if you could walk me through the steps of getting an official WeChat account in more detail. How would I attain a Chinese business lisence? Can I do it if I live in the United States?

You just need a week to get a Chinese business liscense , you can have an agent running the daily operation for you.

HI, I AM A LOCAL MINER AND SELLER OF GOLD AND DIAMOND IN SIERRA LEONE WEST AFRICA. I NEED A BUSINESS PARTNER OR A POTENTIAL BUYER THAT WILL BE COMING FOR OUR GOLD AND DIAMOND. EVEN IF HE WANT TO DO TIMBER, I MAY BE HERE FOR HIM.I PROCEDURE IS BASE ON FOB OR CASH AND CARRY OR ON CREDIT BASES . AS LONG AS YOU MAY COME OVER HERE AND GO WITH THE GOODS AND MY REPRESENTATIVE TO YOU DESTINATION AND PAY OUR MONEY.

We are search for marketing full agency