Looking to break into the Chinese perfume market? You’re not alone. This booming segment of China’s cosmetics market with untapped potential is attracting investors and entrepreneurs from all over the world. But what are the specific opportunities in this market, and what do you need to know before entering it? In this blog post, we’ll give you an overview of the perfume industry in China, and highlight some of the key opportunities you can capitalize on. Keep reading to find out more!

Perfume in China, a love/hate history for a growing market

Perfume has a long and varied history in China. The first perfumes were likely made from natural ingredients like flowers, herbs, and spices. They were used for religious ceremonies, to enhance the scent of clothing, and as personal fragrances.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

However, the Chinese perfume culture suffered in recent history as it was being perceived negatively. You can read more about this topic here.

In more recent times, the use of perfume in China has evolved to include both traditional and modern scents. There is now a wide range of popular classic Chinese scents and perfumes available, including floral scents blends, woody scents, and spicy fragrances. Many Chinese women also enjoy wearing Western-inspired perfumes to express their unique style.

Attitudes towards perfume are shifting in China

Because of historic reasons, the Chinese perfume industry although not so young is still in its infancy, but it’s quickly growing. In the past few years, there have been changes that allow more people access to this luxury product- not just those with money or status symbols like elaborate cars!

Before now wearing fragrant scents was only reserved for special occasions such as weddings and birthdays; however these days anyone can buy their favorite scents at any time because they’re much cheaper than other items typically found within one’s personal hygiene kit;

It is no secret that the behavior and cultural trends of the Chinese market are changing due to increased disposable income and westernization. Now, in first-tier cities, where people have more awareness of luxury brands prefer to buy a Chanel perfume than a Chanel bag, which is still a luxury product but a little less expensive and more low-key.

Local Brand on top of increasing Chinese Perfume Consumption

The Chinese market is a gold mine for any company that can pull off an effective marketing strategy. A recent report has shown there are many cheap Chinese perfume retailer mushrooming (With 20% of market shares altogether), but so far no brand in the country has managed to take control of this lucrative industry and establish itself as a top dog

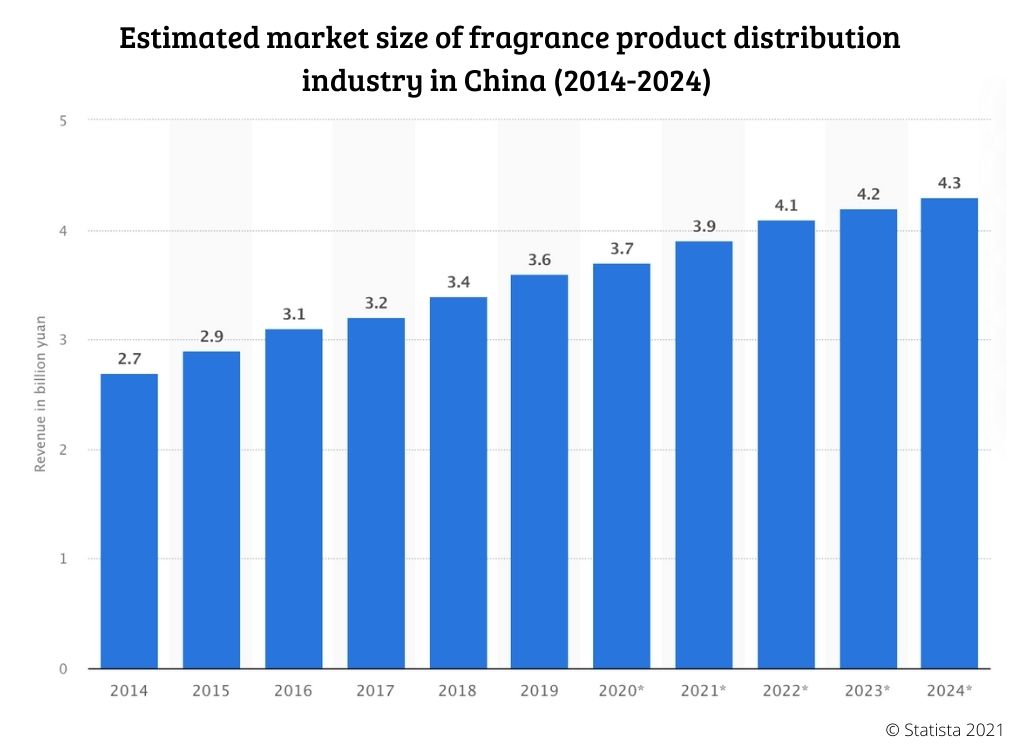

The market surged 48.2 percent between 2014 and 2018, and the total annual retail market for fragrance is expected to expand from $1.18 billion in 2018 to $1.81 billion in 2023.

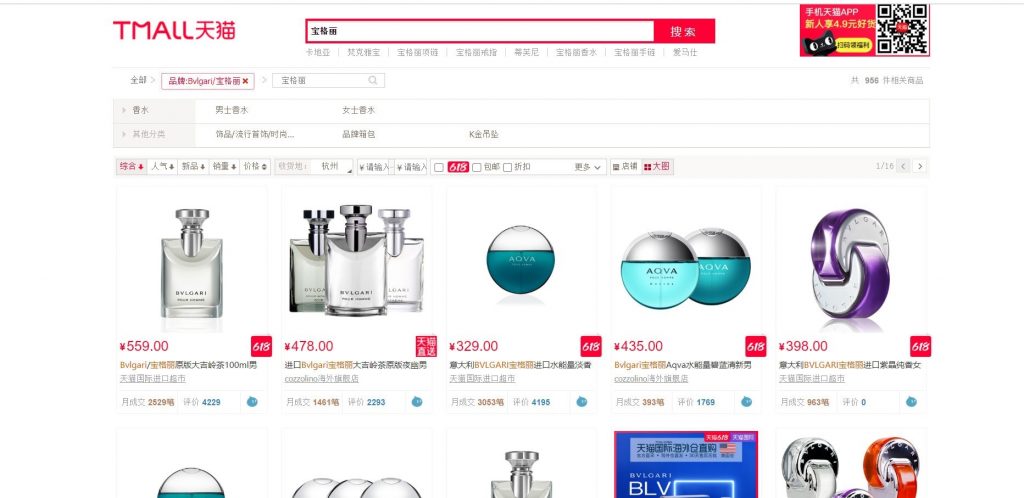

China’s population accounts for 18% of the world’s population, but only owns 1% of the global perfume market. This huge gap has prompted perfume brands to explore the Chinese market. Hermes, Hugo Boss, Dior, Bulgari, Versace, etc. have all opened counters in China. The world-famous perfume brand Coco Chanel has launched a full range of perfumes in the official flagship store of Tmall. The Chinese market has a giant potential.

Chinese Gen-Z is driving the market

The Chinese perfume market is growing at a fast pace, with about 20% per year, and is driven by Gen-Z consumers that particularly enjoy customed fragrances as well as gender-neutral ones

Entering the Chinese Fragrance market is not straightforward

Several marketers have suggested that the Chinese Fragrance Market is complicated. As stated by Olivier Verot, CEO of the renowned Digital Marketing Agency of China:

“China’s Fragrance market is certainly different and cannot be compared to fragrance markets of South Korea and Japan or any western countries”.

For the Fragrance market, one needs to take a completely different approach to target the market. Gentlemen Marketing Agency created successful marketing campaigns for Guerlain and Perums du Château de Versailles in China.

To attract distributors, there was a trade fair conducted and hundreds of female Chinese consumers and Caucasian models were photographed in baroque-style Versailles costumes. According to Olivier, “Chinese distributors are very sensitive to such show-style inventions and this was a good way of launching a new fragrance to target multi-brand shops, where these distributors hold a key place”.

What type of fragrances are preferred by Chinese customers?

- Fruity scent

- Floral scents

- Woody scents

- Fresh scents

- Gender-neutral scents

In recent years, there has been a huge growth in China for unisex fragrances. It’s the perfume segment that has recorded the fastest growth since 2016, especially among Gen-Z consumers. International brands have been capitalizing on the promotion of their premium unisex fragrances in China. Fragrances like Un Jardin Sur le Nil by Hermes, Light Blue by Dolce & Gabbana, L’Eau Froide by Serge Lutens, Silver Mountain, Water by Creed, and CK One by Calvin Klein were the popular go-to brand

Reports from the ‘Baidu Index’ also indicate that male fragrances were inquired about quite a number of times by Chinese netizens

Niche, brands like Estee Lauder-owned label Jo Malone and Labo have also gained popularity in recent years. Many young Chinese who seek to express their individuality wear these perfumes. This pattern was noticed by an increased number of store openings during 2014-2016 in China in first-tier cities.

Challenges for International Fragrance Brands to Enter the Chinese Perfume Segment

Observing the current trend and increase in fragrance demand for international brands among Chinese, Chinese don’t seem to skip the usage of fragrances. Although, the Chinese market is challenging to enter for International brands due to the price gaps and fake product issues.

Presently, Chinese consumers purchase International fragrances from overseas duty-free shops. In this way, Chinese consumers try to avoid fake fragrances available on Chinese E-commerce sites and get a good price for the international brand fragrance.

Digital channel – a smart solution for foreign perfume brands

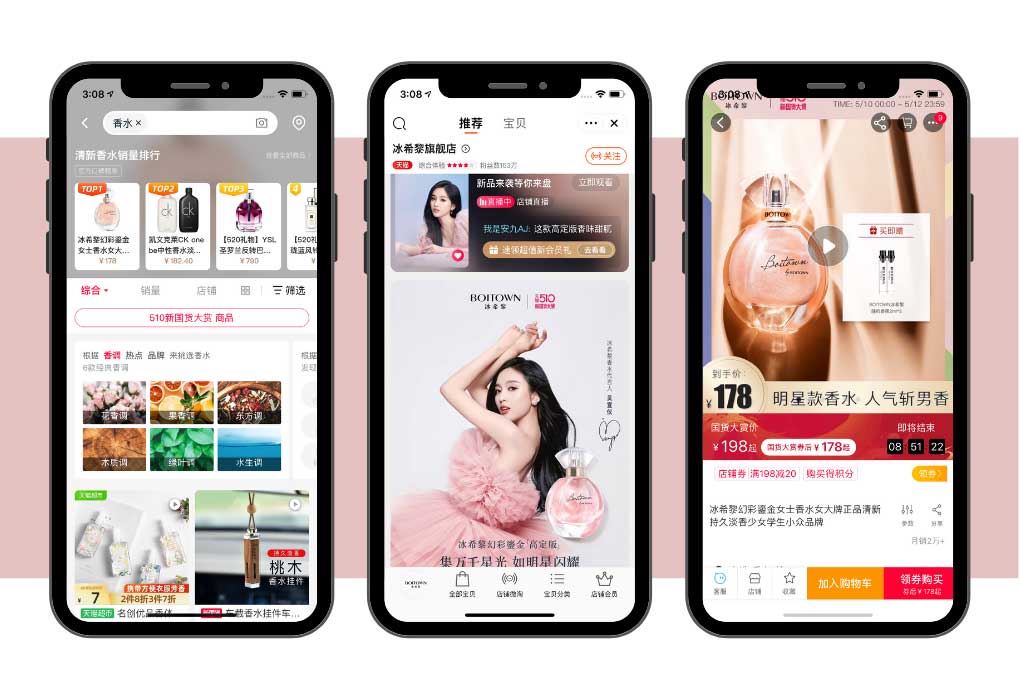

As the Internet develops very well in China, e-commerce and social media are playing an extremely important role in Chinese modern daily lives. They use their telephone to keep in step with new fashion and beauty trends in the world. The Internet is also an essential way for Chinese consumers to get promotions and product information.

Since Chinese customers deeply rely on the Internet channels to find out brand information, reviews from former buyers, and their KOLs’ opinions. Digital channel for foreign perfume brands who are planning to enter the market is the key and cost-efficient way.

International Fragrance Brands can partner with a reputable digital marketing agency with considerable experience in promoting International Fragrance brands in China. This local digital agency must have a wide range of knowledge of Chinese culture and behavior patterns. Such a digital marketing agency is equipped with the right set of skills to find a “sweet spot” between the International brand value and the preference of Chinese consumers.

How can your Perfum Brand enter the Chinese E-commerce Market ?

Two solutions are optimal for entering the Perfume Market in China via the Digital Eco space in China. One, Branding, and Two, presence on the E-commerce website.

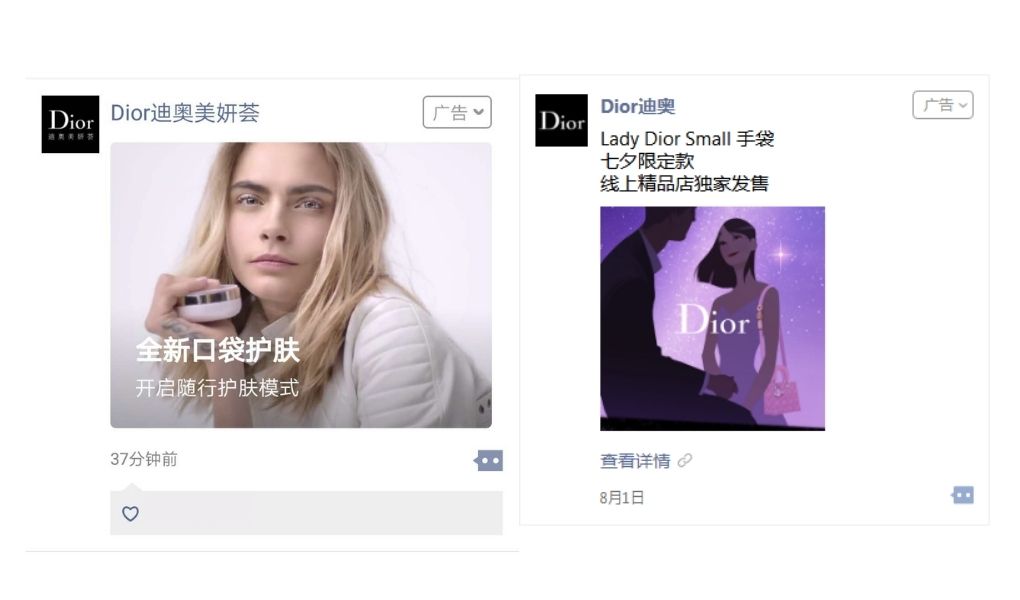

Branding to Increase your Perfume brand awareness and e-reputation

As stated earlier, Chinese consumers consider International fragrance brands as luxury products hence fragrance needs to resonate with the Chinese audience. Secondly, International Fragrance brands need to gain the trust of Chinese customers by building e-reputation in order to gain popularity among customers.

The marketing campaign must contain the “awe” factor. It is highly important for International companies to understand the local culture and demands before it translates their offerings.

As it may be well-known that Chinese consumers are quite suspicious about counterfeits and bad quality due to scandals that happened in the market, it is thus very important for Foreign brands to create brand awareness and a good reputation in the Chinese market.

Perfume brands should be on E-commerce websites

By holding a presence on a reputable Chinese E-commerce website, international brands appear genuine and trustworthy in the eye of Chinese customers. Previously, Chinese customers avoided purchasing international fragrance brands from untrusted and bad reputed E-commerce websites which are known for lenient policies and allow any type of product to be sold.

Following is a list of reputable, trusted E-commerce websites having a high market share and are popular among other international brands for entering the Chinese E-commerce market. However, due to cultural barriers, language differences, and strict e-commerce platforms policies it is not easy to gain access to the authentic E-commerce website of China but Gentlemen digital marketing agency can assist International Brands to enter and capture the Chinese E-commerce market seamlessly.

Tmall – the Chinese largest e-commerce platform

Tmall has an invitation-only policy where only qualified international brands can either be invited to join or can apply through a local digital marketing agency.

Tmall holds the biggest market share in the e-commerce market of China at 57%. It mainly focuses on premium brands. This characteristic makes Tmall the most expensive e-commerce marketplace in China.

It provides an opportunity for international brands to open exclusive online stores and directly sell products to Chinese consumers without being physically present in China.

JD.com – one-package e-commerce service

JD.com is China’s largest online direct sales company. It relatively has less market share than TMALL.com. International companies can open individual online stores on JD.com.

JD’s cross-border service enables suppliers to sell directly to Chinese consumers without a local presence. JD.com is less expensive than TMALL.com. JD.com has a zero-tolerance policy for counterfeit products.

Moreover, unlike Tmall where brands should take care of marketing, customer relationship management, and logistics, JD offers brands full services, that is to say, brands only need to supply genuine products.

WeChat store – Chinese leading social media

WeChat is engrained in the lifestyles of Chinese consumers. It is an all-in-one app that integrates social e-commerce seamlessly. WeChat store gives numerous possibilities to International brands to reach Chinese consumers effectively. Possibilities range from Branding to campaigning and easy payment methods.

With more than 1.2 billion users, WeChat can be served as a powerful and essential digital marketing tool in China.

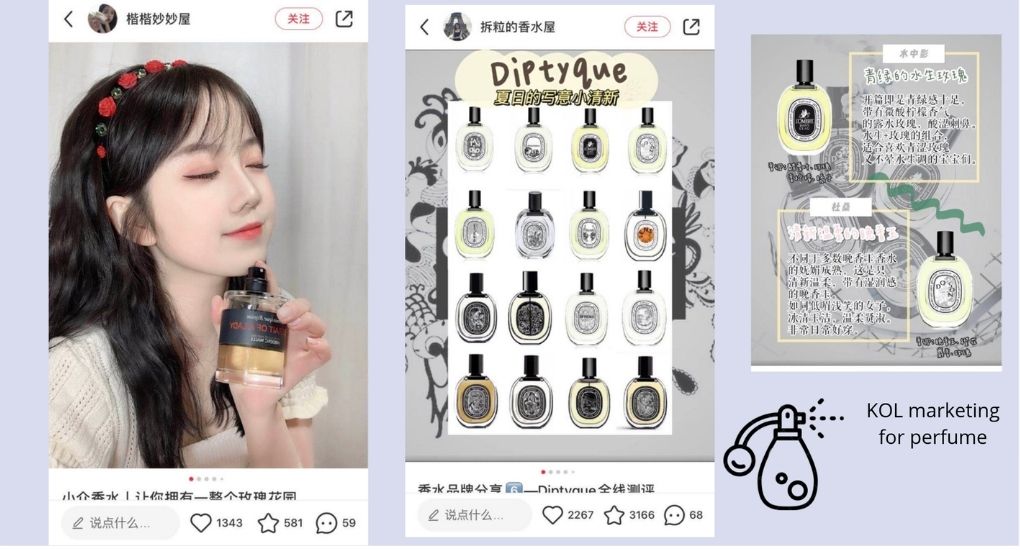

Xiaohongshu: bring in a high retention rate by building connections with the audience

With the fierce competition for Internet traffic, the cost of acquiring traffic for brands continues to rise. If you want to obtain more efficient, low-cost, and more sticky traffic sources, besides long-term ROI marketing, try to establish connections and interactions with users via KOLs in order to increase the retention rate.

Xiaohongshu, literally “Little Red Book (RED)” in English is a very good choice for you. RED was created as a UGC (user-generated content) in 2013 and it has more than 300 million registered users, as of July 2019.

It is an ideal place for marketing cosmetics, skincare, and perfume kind products. Chinese users who are planning to buy for example perfume, but he has no idea which one to choose, then will go to RED to be “Zhong Cao” ( to be planted grass). On the platform, those KOLs give followers suggestion on fashion, and cosmetic, this is so-called “Zhong Cao”; if the audience takes the suggestion and purchase the product recommended, this is called “Ba Cao” (pull up weeds). RED is a popular and powerful platform for KOL marketing.

It is an ideal place for marketing cosmetics, skincare, and perfume kind products. Chinese users who are planning to buy for example perfume, but he has no idea which one to choose, then will go to RED to be “Zhong Cao” ( to be planted grass). On the platform, those KOLs give followers suggestion on fashion, and cosmetic, this is so-called “Zhong Cao”; if the audience takes the suggestion and purchase the product recommended, this is called “Ba Cao” (pull up weeds). RED is a popular and powerful platform for KOL marketing.

Marketing to China is your partner to enter the Chinese Perfume Market

The above listed are a few options that are mainly used to enter the Chinese E-commerce market. To learn more solutions, on how International Brands can enter the Chinese E-commerce market, contact us for a friendly discussion and learn about your brand’s prospects.

How can one order for some goods,i need some perfumes for business.

hi

i need 100 kinda of perfume . each perfumes 24 peaces

how i can get the prices

i am in somalia

Plz send your contact and Whatsapp number

Plz contact me this is my Contact and whatsapp number

+919919919255

I need some good perfumes for business. Am fro Nigeria

sir i am from india pls contact

Where are you from

How do I buy international brand perfumes from China. For example: PURE Poison by DIOR 100ml.

Hello I need STRONGER WITH YOU by Emporio Armani

I have raw material to priduct of perfumes

Please contact me I’m from the UK want to buy perfume in bulk orders

Hello,

We are a Chinese online resellers with 1000 influencers and we want to collaborate with perfum brands from oversea. Commission based live streaming operation.

Send us your brand

Hey very nice web site!! Man .. Beautiful .. Amazing .. full of infrmation about Perfum in China.

I’ll bookmark your website and take the feeds also…

Thank you