The energy drink in China takes a positive direction. for 2024 with a +8% growth

The Chinese Energy Drink Market is set to soar, reaching an estimated US$ 16.19 Billion by 2030, up from $8.19 billion in 2023, with a robust CAGR of 8.89%.

Trends in the energy drinks market in China

- Health and Supply Awareness: Increasing consumer awareness around health and energy drink supply is fueling a surge in demand within China.

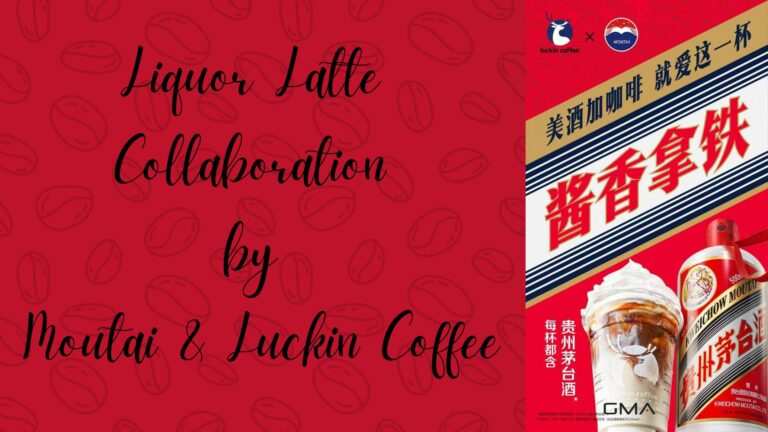

- World’s Largest Market with Diverse Flavors: As the largest energy drink market globally, China offers an array of flavors catering to varied consumer tastes.

- Rapid Market Expansion: The market’s growth is propelled by changing lifestyles, heightened fitness demand, and a predominantly young demographic.

- Shift from Carbonated Drinks to Energy Drinks: With a decline in carbonated beverage consumption, energy drinks are becoming a favored alternative in China.

- Beyond Sports – Work and Leisure Consumption: Unlike traditional usage, energy drinks are now consumed during work hours for enhanced focus and performance, reflecting China’s intense work culture.

- Variety of Occasions for Consumption: Energy drinks are popular during both work and leisure, breaking the stereotype of being sports-only beverages.

- Flavor Diversity and Herbal Ingredients: From classic citrus to unique herbal blends, Chinese energy drinks offer a wide flavor range, including ingredients like ginseng and green tea for added health benefits.

- Engagement with the ‘Fan Economy’: The millennial-driven “fan economy,” especially on social media, offers immense marketing potential for energy drink brands.

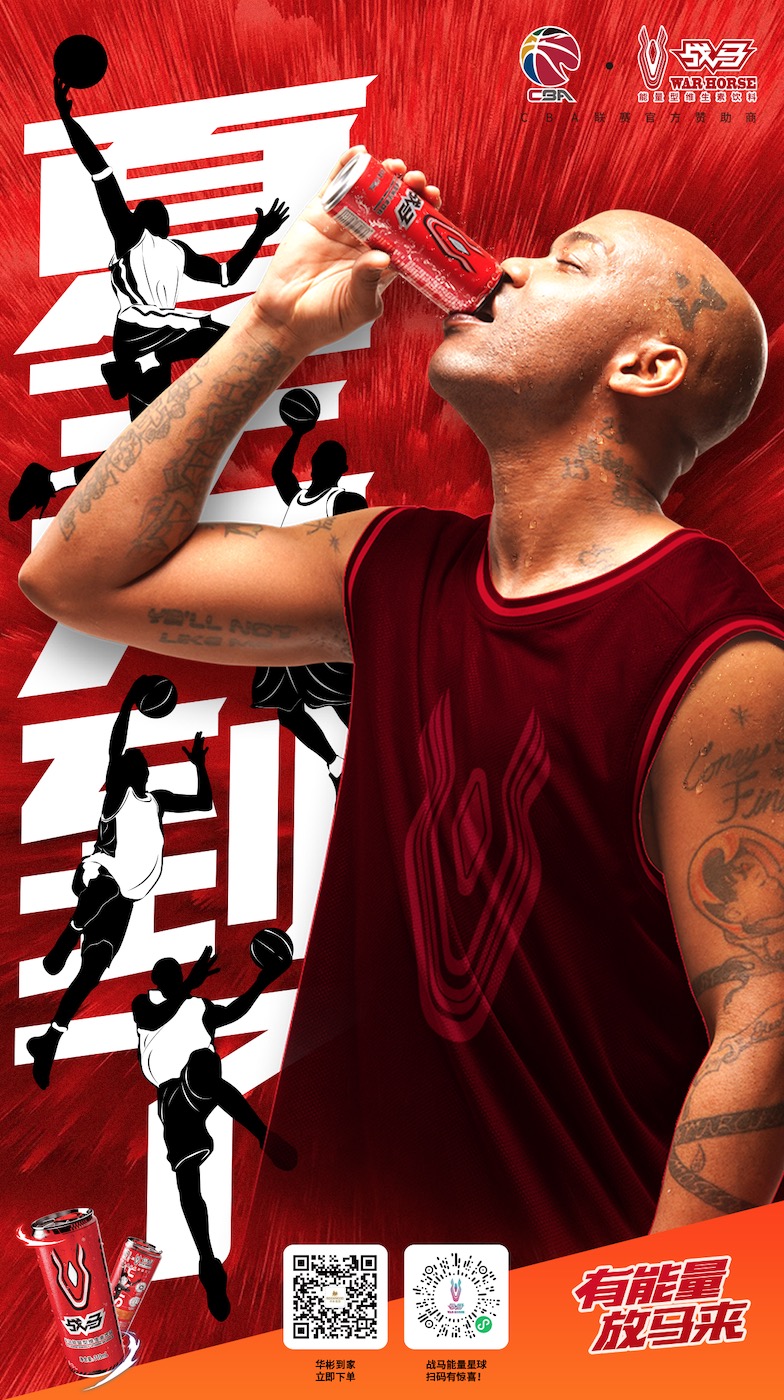

- Digital and Visual Branding for Millennials: Leveraging digital trends and creative marketing strategies is key to capturing the millennial market.

- Opportunities for International Brands: The Chinese market presents lucrative opportunities for international brands to introduce products using local flavors and ingredients.

- Communication Strategy for Health-Conscious Consumers: Emphasizing the health benefits and natural ingredients in marketing efforts resonates with the health-aware Chinese consumer base.

The development of the country pushes the expansion of the market. Indeed, the industrialization and urbanization participated in the migration of people, from the countryside to cities. The Chinese government turned its policy toward a market-based economy.

As a consequence, the Chinese people have higher incomes and see their living standard improving. They get closer to western lifestyles and tend to copy their consumption habit. In addition, the commerce is facilitated by the distribution and the infrastructure.

Energy Drinks Market in China and regulations

There are several categories but the sector can be divided into two main branches: sport and nutrient- enhanced drinks. The first one contains sodium, potassium, and magnesium. The second one contains extra supplements of vitamins. Depending on the country the classification can change. In China, energy drinks are considered as drinks with other functions because they include caffeine, taurine, and sugar coupled with other ingredients such as guarana and B vitamins.

China expect to reach $12.6 Bn Energy Drink Markets to 2027

Good News 2024

Exciting news for wellness enthusiasts and beverage innovators! The National Health Commission of China is ushering in a new era of health and vitality by greenlighting the integration of essential vitamins B1 and B2 in your favorite beverages. Imagine sipping on your go-to sports or nutrition drink, now supercharged with the added benefits of these crucial vitamins, with an approved boost ranging from 2mg/kg to 5mg/kg.

This groundbreaking move marks a significant shift from the previous regulations, where vitamins B1 and B2 were confined to the realms of dairy powder for children and expectant mothers, and select food items. Now, they’re set to invigorate a broader spectrum of beverages, delivering wellness in every gulp!

But wait, there’s more! 🙂

In a bold stride, the NHC has also ramped up the permissible levels of taurine, the powerhouse amino acid celebrated for its energizing properties, from 0.5g/kg to a robust 0.6g/kg. This enhancement aligns perfectly with the rising popularity of taurine-infused drinks, a market where Red Bull, with its taurine-rich formula, has already captured a whopping 52% share of energy drink sales in China, as per Statista’s 2020 report.

This regulatory rejuvenation isn’t just about numbers. A recent study by Chinese researchers throws the spotlight on taurine’s potential in combating visual fatigue, a revelation that’s set to revolutionize the functional food landscape. With taurine’s proven safety and burgeoning popularity, we’re on the cusp of a new wave of functional beverages designed to refresh not just your body, but also your eyes!

Get ready to experience your beverages like never before – fortified, functional, and tailored to the demands of your active lifestyle. Cheers to health, cheers to innovation

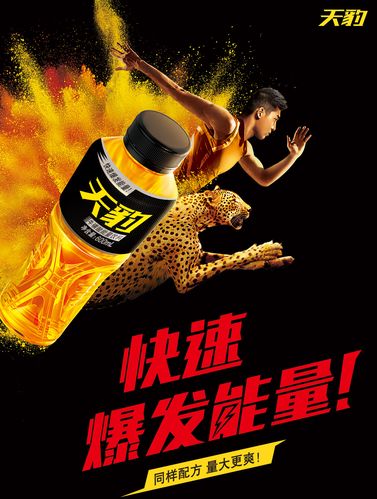

Populars Packaging in China

Energy drinks in different formats (cans, bottles) are sold everywhere: super & hypermarkets, convenience stores, grocery stores, bars but also online.

Several categories of people are targeted by energy drinks. We have for instance: gym goers, sports people, the working class, school student who drink them in order to be more active and to keep them awake because they have long days and have to work a lot.

Consumers Preferences

Chinese people pay attention to their health. Health has a significant place in Chinese culture. This fact coupled with some scandal in the food industry, they are willing to pay more to have a product of better quality. In the field of Energy drinks, it means less sugar

Localized packaging is extremly popular, creating buzz and lot of social interaction

Even though in the Chinese market, most drinks contain more sugar than western countries’ ones. Consequently, they are used to it but because of the health issue that can be caused by the consumption of certain products that can change their habits.

Healthy trend helps the evolution of the demand. Indeed, eating better goes with doing sport.

Business Opportunities for International Brands

Because China, e-commerce ecosystem is very developed, launching your online store is facilitated. All the digital infrastructure such as mobile apps already exist. Chinese people are very familiar with this kind of purchasing. Order things on the internet are enshrined in their daily life. Cross border trade is encouraged by the Chinese government since the country opened itself to the world.

Red Bull in China

Red Bull entered China in the late 1990s, bringing its global energy drink phenomenon to a vast new audience.

- Joint Venture Establishment: The brand established a joint venture with local partners, adapting its strategy to fit the unique Chinese market.

- Rapid Popularity: Red Bull quickly gained popularity in China, becoming a leading energy drink in a rapidly growing sector.

- Local Production and Adaptation: The company set up local production facilities, tailoring its formula and marketing to cater to Chinese tastes and preferences.

- Dominant Position: Over the years, Red Bull has maintained a dominant position in China’s energy drink market, consistently outperforming competitors.

- Diverse Product Range: It has diversified its product range in China, offering various flavors and formulations to suit different consumer preferences.

- Innovative Marketing Strategies: Red Bull in China is known for its innovative marketing strategies, including local sponsorships, events, and digital campaigns.

- Focus on Youth and Lifestyle: The brand has successfully positioned itself as not just a beverage, but a lifestyle choice, particularly appealing to the younger demographic.

- Adaptation to Regulatory Changes: Red Bull has adeptly navigated China’s regulatory environment, ensuring compliance while continuing to expand its market presence.

Foreign brands are welcome because they symbolized quality and modernity for Chinese consumers

It is an occasion to try a new kind of product and marketing campaign. Indeed, the risk taken online is lower than in physical shops.

Branding, the key to hack distribution

Your brand needs to reflect the essence of the product. It should be something fresh, dynamic. What is important nowadays when you’re making your marketing and communication campaign is to think about the experience you are going to give to your customer. Buy your brand for the consumer is a way to express the social category he or she belongs to. It is also a way to express their lifestyle.

Your brand needs to reflect the essence of the product. It should be something fresh, dynamic. What is important nowadays when you’re making your marketing and communication campaign is to think about the experience you are going to give to your customer. Buy your brand for the consumer is a way to express the social category he or she belongs to. It is also a way to express their lifestyle.

Social media are unavoidable especially in you are doing e-commerce business. Competition in energy drinks is fierce mainly because of the strong presence of big brands such as Red Bull. Energy drinks sector is composed of different segments as we mentioned at the beginning of this article. Thus, you should, therefore, choose a specific branch and adapt your strategy to reach by the list effective way your target.

Red Bull marketing operation rocks

Red Bull’s marketing strategy in China is a masterclass in adaptation and localization. Recognizing the unique cultural and consumer landscape, Red Bull tailors its approach to resonate with the Chinese audience.

It leverages a mix of traditional and digital marketing, ensuring visibility across diverse platforms. Red Bull capitalizes on the growing trend of health consciousness in China, positioning its energy drink not just as a beverage, but as a lifestyle choice for the dynamic and ambitious. Its campaigns often feature local celebrities and influencers, creating a strong connection with the youth.

Moreover, Red Bull invests in local sports and cultural events, embedding itself into the fabric of China’s vibrant social scene. This multifaceted strategy has helped Red Bull establish a commanding presence in the Chinese market, making it a go-to choice for energy and vitality.

Distribution : all your options for 2024

Different options are available. Either you can choose to create your own platform or working with well-known channels.

The first option offline, shops, supermarket.

In other words, you can adopt specific aproach for the Chinese market especially if you are an international brand, deal with importer and enter to shops, restaurant, supermarkets. It takes time, take a lot of ressources.

We have contacts for importers and distributors of big supermarket in China (contact us)

The second option may be convenient : e-Commerce

Actually, established cross border online platforms presents true advantages. They allow you to sell the product directly to the consumers and have easy payment structures.

- Tmall to sell, like Tmall supermarket.

- JD like JD supermarket

- Have your Store in Douyin(Tiktok) super popular in 2024

- Other online stores may be a good options

Promotion Through KOL

Chinese people are influenced by KOL …. same for 2024

Well known as influencers in western countries as KOL( key opinion leader). They are very common in China and have true power to influence people in their consumption and their habit.

They have the power to make products “trendy”. They can bring you leads because they have numerous followers which whom they interact throughout the digital app. They can be integrated into your communication strategies but you need to make sure that their image fits with yours.

Good News 2024

Exciting news for wellness enthusiasts and beverage innovators! The National Health Commission of China is ushering in a new era of health and vitality by greenlighting the integration of essential vitamins B1 and B2 in your favorite beverages. Imagine sipping on your go-to sports or nutrition drink, now supercharged with the added benefits of these crucial vitamins, with an approved boost ranging from 2mg/kg to 5mg/kg.

This groundbreaking move marks a significant shift from the previous regulations, where vitamins B1 and B2 were confined to the realms of dairy powder for children and expectant mothers, and select food items. Now, they’re set to invigorate a broader spectrum of beverages, delivering wellness in every gulp!

But wait, there’s more! In a bold stride, the NHC has also ramped up the permissible levels of taurine, the powerhouse amino acid celebrated for its energizing properties, from 0.5g/kg to a robust 0.6g/kg. This enhancement aligns perfectly with the rising popularity of taurine-infused drinks, a market where Red Bull, with its taurine-rich formula, has already captured a whopping 52% share of energy drink sales in China, as per Statista’s 2020 report.

This regulatory rejuvenation isn’t just about numbers. A recent study by Chinese researchers throws the spotlight on taurine’s potential in combating visual fatigue, a revelation that’s set to revolutionize the functional food landscape. With taurine’s proven safety and burgeoning popularity, we’re on the cusp of a new wave of functional beverages designed to refresh not just your body, but also your eyes!

Get ready to experience your beverages like never before – fortified, functional, and tailored to the demands of your active lifestyle. Cheers to health, cheers to innovation

Need a partner in China, on the ground?

Starting a business in China in Energy drinks field requires precise knowledge about features, trends, and consumer behaviors. Thanks to its expertise GMA can help you to achieve your goal.

Read also: Mobile apps are more and more important for food and beverage

For more information please go to the contact page .

Great article, i am a fan of your content ecommercechinaagency 🙂

Glad you like it! ^-^