Vitabiotics, a UK-based company, is expanding its reach in China’s lucrative health supplement market through Alibaba Group’s Tmall online platform. HBW Insight exclusively speaks to Benji Lamb, Vitabiotics’ China & South Asia director about how the company has successfully navigated the country’s new retail phenomenon.

Vitabiotics is the UK’s “no. 1 vitamin company.” Vitabiotics has had success selling brands such as Osteocare and Pregnacare on China’s Tmall Global platform. The company also has a new agreement with Alibaba Group to expand its presence in China.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Vitabiotics said that it will bring to China popular UK products such as Wellman and Wellwoman, Cardioace and Menopace, along with Tea+.

It stated that the partnership would accelerate Vitabiotics’ already impressive growth in China (where Vitabiotics’ sales grew 30% in 2020) and further grow the brand in South East Asia.

Benji Lamb, Vitabiotics’ China director, said that China and Southeast Asia offer huge opportunities; “Indeed China is one of our top markets and we plan to achieve over 70% growth this year.” He said, “We can’t get enough of what the future holds in this market that we consider being one the most important recovery markets worldwide.”

Vitabiotics’ success story in China’s health supplement market

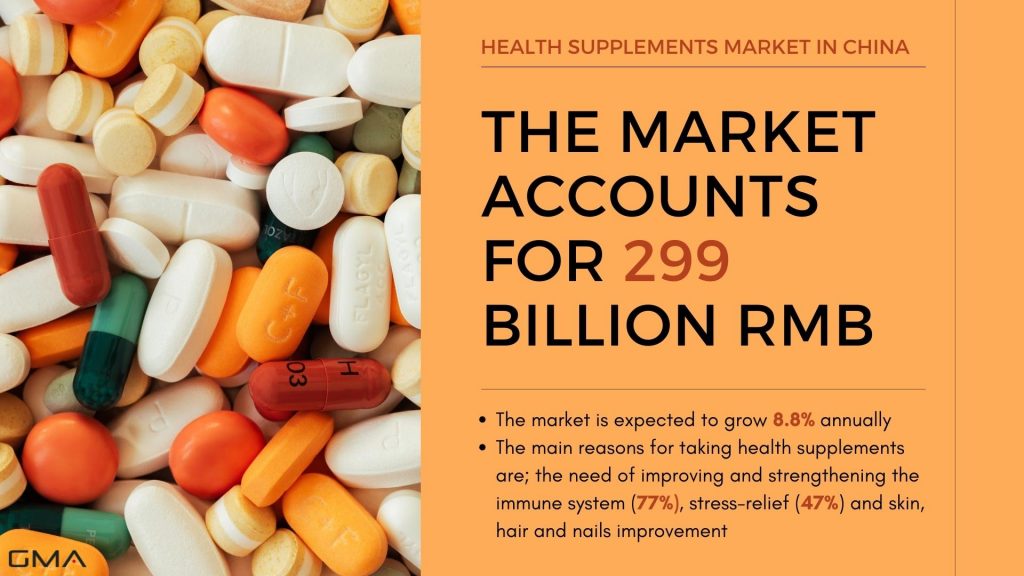

There are many factors that contributed to the success of the brand. As Chinese people start taking more care of their health and pursuing a healthy lifestyle, they turn to vitamin and health supplements to strengthen their immune system. Thanks to that, health supplements sales are growing at a very fast pace, with more and more Chinese customers gaining interest in foreign brands of health products, as opposed to traditional Chinese medicine.

So what did Vitabiotics do right in the Chinese market of health supplements?

Glocalization

Vitabiotics’ success has been due to the willingness of the company to adapt to local conditions. Lamb spoke exclusively to HBW Insight. Visionace’s success, for instance, is dependent on understanding the needs of younger Chinese consumers who spend hours every day staring at their phones and computers.

Lamb stated that Visionace is a great choice for Chinese Millennials. “In the UK we sell the brand primarily for consumers over sixty, while in China, we sell to people under thirty.”

He said that China has the most immersive digital environment anywhere in the world. The number of hours spent on the screen has made it a great incentive to take care of your eyes, especially for those who are younger. It’s a great example of “localization.”

Specific Chinese demographic

The consumer demographics of a particular vitamin product are heavily dependent on its category, formula, and specific formulation. The overall focus of the Chinese supplements and vitamins industry is on prevention, not cure. Chinese consumers are more likely to start taking supplements earlier than those from overseas. This makes Gen-Z and Millennial consumers an important demographic.

Visionace is an example of this sub-brand, which focuses on eye care and lutein-based product. Visionace is sold primarily to people over 50 in the UK. In China, however, most of our customers are millennials and younger.

Partnerships

Vitabiotics is echoing other companies’ experiences exporting to China’s $40bn health supplement market. Vitabiotics uses partnerships to gain insights on the ground to adapt brands and products to local trends and needs.

Lamb explained, “Launching the second store in Tmall’s health category has allowed us to reach new demographics and we’re leveraging support from category managers and senior-level experts as well as high-profile key opinion leaders’ for growth.”

Distribution is the key

Vitabiotics is using its knowledge of Alibaba’s new retail e-commerce ecosystem, which it developed since the platform’s launch in 2015.

Jack Ma, Alibaba co-founder, said that “new retail” refers to the complete integration of eCommerce and brick-and-mortar retail. Ma envisions a future where the “boundary” between online and offline commerce is eliminated by focusing on each customer’s individual needs.

Lamb said, “It’s an amazing market. New retail is digitization at every level of the retail chain, and every part of the consumer journey and retail ecosystem.”

Although new retail can be described as omnichannel retail with new clothes, or more precisely, in-store conveyor belts with personalized shopping apps, and ultra-fast delivery, and in-store conveyor belts – the digital component of this integrated ecosystem opens up completely new ways to engage with consumers.

Digital presence

The company’s success wouldn’t be possible without a good digital presence, that positions the brand as a trustworthy British company of health-related products. Vitabiotics started with a Chinese website hosted in Mainland China, where Chinese customers can see brands’ health supplements products and educate themselves, which helps the brand to raise health awareness and generate better online sales.

The website is linked with Tmall, allowing for something very similar to direct sales. When a customer enters a product page, he/she gets redirected to Tmall purchasing page of the specific health supplement.

Lamb stated that “new retail also applies to how consumers engage, and with whom,” Digital immersion is an excellent way to put it. This is what Chinese consumers have grown to expect. It’s their environment.

Apart from taking care of the website itself, the company also focused on good Baidu SEO, making sure the brand is easy to find in Baidu search results. Baidu also offers a wide range of forums and internet communities, where people discuss different Vitabiotics dietary supplements, spreading the brands’ name even further.

Social media

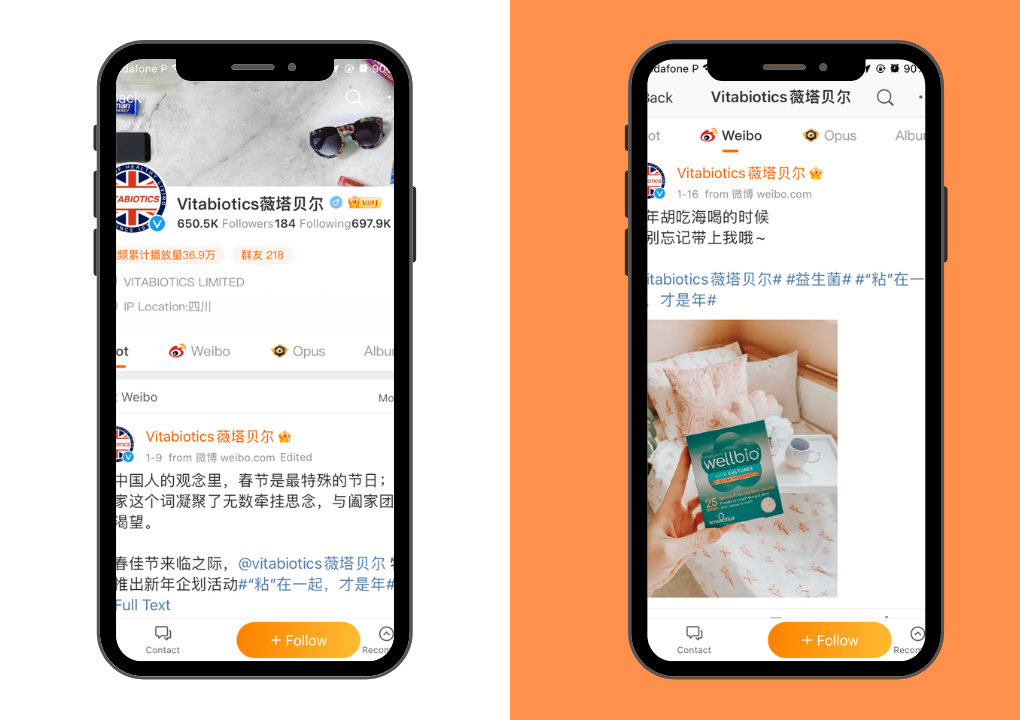

Lamb provided two examples of Vitabiotics’ use of the new digital ecosystem to drive customers to its products on Tmall. Vitabiotics creates interactive video content that is focused on shopping and uses Weibo and WeChat as China’s answer for WhatsApp and Twitter, respectively.

Vitabiotics has verified accounts on the main social media platforms in China and successfully carries out campaigns to raise health awareness and educate people about different types of health supplements and which dietary supplements will be best suitable for each individual.

It’s important to bare in mind that the health supplement market is not developed in China yet and most people are not familiar with health supplements. Therefore it’s very important to put educational content on social media platforms so that people will read/watch and reshare it, growing your followers base.

Of course, the most important social media to be on in China is WeChat and Vitabiotics understands it, offering its customers an official WeChat account as well as a dedicated mini-program, that works as a mini website, with all the important information, product descriptions, in-app store and gamification events that offer discounts and bonuses.

Made in the UK: Vitabiotics branding

Online games were also developed by the company, where users could jump through hoops to locate Vitabiotics brands that have a British Tawny Owl symbol. This is another example of “glocalization”. Lamb stated, “really resonates with Chinese consumers”. He noted that “Brand Britain is very strong in China.” “British products have a reputation for innovation and superior quality.”

Vitabiotics uses the owl symbol as a brand symbol. Vitabiotics also uses hand-drawn Chinese paintings of British scenes for its online marketing.

Lamb said, “It’s all about finding that fusion between Brand Britain and what appeals locally to consumers,” and that this is only possible by listening to talented voices on the ground. Lamb suggested that Vitabiotics’ new retail ecosystem is viewed as a simple way for consumers to engage with the Tmall stores.

Tmall

Vitabiotics is the UK’s top vitamin and supplement brand. China is Vitabiotics’ third largest market globally. They sell approximately 50 of their 450 subbrands in Asia. Most of the brands’ sales are generated on Tmall.

Vitabiotics Chinese market entry strategy

Small and medium-sized businesses can find it difficult to crack China’s retail market, Lamb admitted. However, he stated that Vitabiotics have a blueprint for growth that others can follow. He said, “Our entry strategy consisted of more bread and butter.” “Pregnacare has the strongest international reputation so we started with it first. You learn, test, and adapt over time. Leave your ego at home and listen to the trade partners and teams on the ground.”

Lamb was cautious about whether Alibaba’s new retail model is the future of other markets. “Look, there are definitely fascinating retail models emerging from China, with Alibaba’s new retail phenomenon being an example.” Everyone is interested to see how this unique ecosystem translates beyond China.

“Post COVID, who knows?” He concluded that he wouldn’t be surprised to see the digitization of the entire retail chain being explored by more countries.

What are the key differences in the Vitamins and Health Supplements industry in China and other countries like the UK?

China is an extremely digitally-driven market. This means that for vitamins and supplements, you can use online pharmacies as well as e-commerce platforms. The UK, however, still puts a greater emphasis on offline retail and doctor’s advice. Although physical retail presence in China is important, many brands find it difficult to enter the Chinese market due to the complexity of registration and the required investments.

Vitabiotics launched in China through cross-border commerce, a different strategy than our initial offline strategy in the UK. We hope to launch offline in the future.

Covid-19 impact on the health supplement market

Covid-19 helped to accelerate the market’s growth and brought more consumers into the picture. There is also a growing demand for domestic brands. There is still the argument for supplements being strongly supported as a cross-border industry. This is because Chinese consumers trust overseas formulas and products, particularly from established brands. Vitabiotics, which has been selling supplements for over 50 years, has a strong history and is therefore more protected from domestic brands on the rise.

This sector is becoming increasingly competitive and overseas brands must be more innovative. Chinese consumers will not buy products from brands that aren’t native to China. They need to think about how to appeal to Chinese consumers and develop localization strategies for brand and product formats.

Covid-19 has also accelerated social media plans. Brands should be present on social media channels like Douyin and Weibo, WeChat, and Kuaishou. As China is a huge market, brands must also have the appropriate video assets. Tmall’s offsite display ads are overwhelmingly in the video.

Covid-19 has caused a shortage for us and other brands in this sector. However, it is important to maintain supply in China because it is an investment market that lasts ten years. It’s all about cumulative effects when it comes to repeated retention products like vitamins and supplements. Therefore, if the product is not available to Chinese consumers, it would impact long-term strategy. This could also cause consumers to switch brands, especially since domestic brands are growing in popularity.

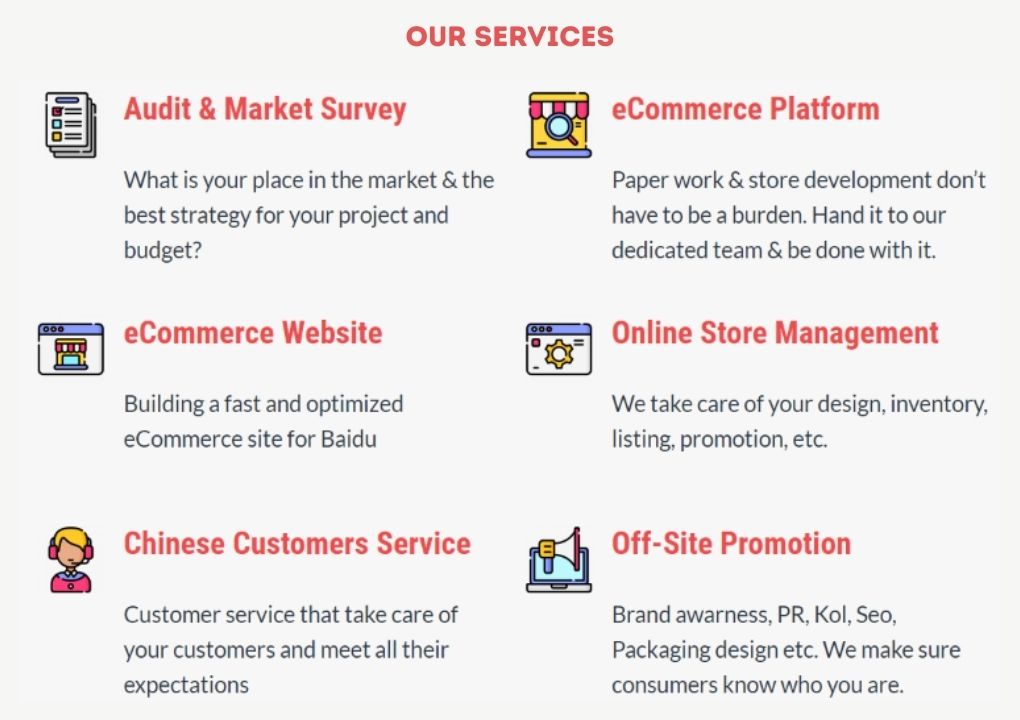

We can help you enter the Chinese health supplements market

Gentleman Marketing Agency is a Shanghai-based company focused on digital marketing and e-commerce strategies. Over 10 years we helped more than 600 brands succeed in the Chinese market. Many of those brands come from the health supplements sector.

We have the experience and know-how in the industry and we understand the demands of customers in China. Our team of Chinese and foreign experts offers tailor-made solutions, depending on your company’s profile, goals and budget.

Our services include:

Don’t hesitate to leave us a comment or contact us to discuss your options in the Chinese health supplements market. We offer a free consultation, where our expert will learn about your brand and present you with the best opportunities in China. Let’s keep in touch!

Hello

I am a reseller of health product in China and want to resell Health supplement products from oversea (America, Europe, Australia) . I have connexion to Tmall Global and Douyin , i am searching for famous brand oversea , ready to sell big.

Let s connect, send me your Brochure and information on wechat please , and we can work together I am sure