In recent years, the Chinese contraceptive market has fast developed with an increasing demand for contraception among the Chinese population. According to a report released by Research and Markets in March 2018, the value of China’s contraceptive market grew from $2.9 billion in 2017 to $5.5 billion in 2022, at a compound annual market growth rate (CAGR) of 11.3%. This growth is being driven by factors such as the country’s large population base, growing awareness of contraception methods, and the rising prevalence of sexually transmitted diseases (STDs).

The contraceptive market is attracting attention from both domestic and international players, so there is sure to be plenty of competition in the coming years. In this blog post, we would like to understand the opportunities of China’s contraceptive market with its key trends and recent developments, to get to know how to sell condoms, oral contraceptives, and contraceptive devices in this competitive landscape.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

China Contraceptive Devices Market Dynamics

China’s contraceptive market was valued at around USD 3,175.9 million in the year 2018. The market is expected to grow at an annual rate of 7.98% between 2018 and 2026. Condom sales in China will increase from $1.9 billion in 2015 to $5.2 billion in 2024. According to a detailed analysis from Statista, the number of people in China who are interested in or need contraceptive pills and other contraceptive devices has increased dramatically over the last few years, which means there’s an even greater demand for hormonal preparations.

In February 2022, China imported a record amount of female contraceptive pills. The country received 42 tons during that month alone and their value totaled 218 million yuan! In comparison, at the same time last year, the imported amount accounted for only 5.28 metric tons.

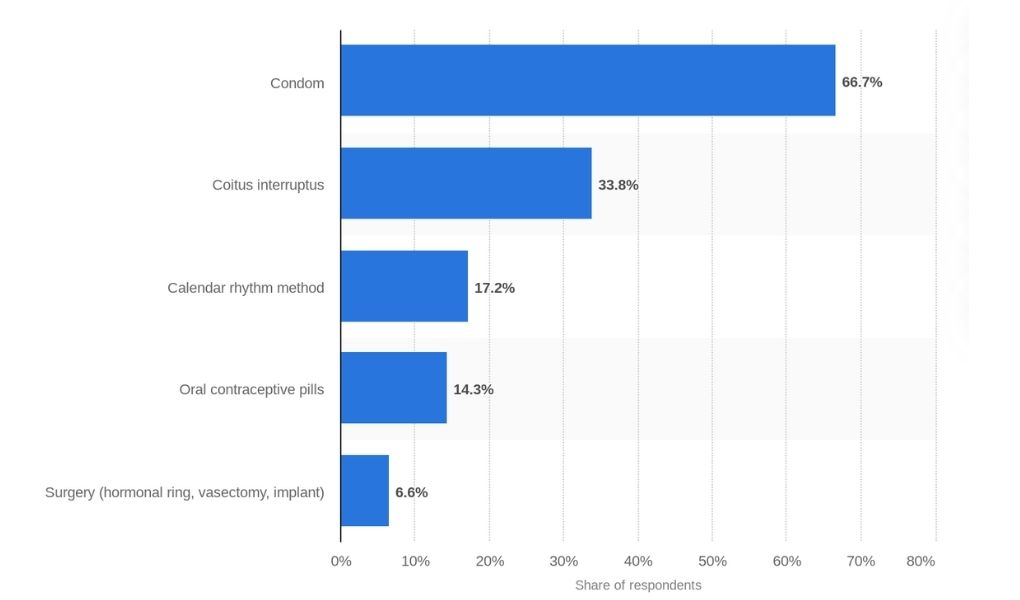

Times have changed and young Chinese adults are already familiar with and fond of contraceptive devices and oral contraceptives, like all their counterparts in the developed countries of the West. Despite the taboo that sex-related topics still face in China, Chinese people report taking different types of contraceptive devices when having sex.

The research done by Statista in 2019 presents that around two-thirds of the respondents said they had used condoms as contraception. From this data, we can see condoms are dominating the market.

Traditional cultural beliefs vs. natural needs of a modern society

It is believed that Chinese netizens have very conservative views toward sex. It’s true that sex-related issues were always taboo topics in China and the Chinese government was trying to omit this topic in the country as much as possible. It’s also true that older Chinese netizens still hold very traditional beliefs when it comes to sex, just like older people in other countries, due to cultural backgrounds and the education they received on the topic. Additionally, because of the one-child policy in the country, people were treating abortion as a contraceptive method.

China didn’t have it easy when it comes to the contraceptives market, as the People’s Republic of China was never fond of contraceptive devices, and emergency contraceptive pills. In fact, in 1989 Chinese government issued a ban on the advertisement of all sex-related products.

But the situation changed with the continued growth of AIDS-infected patients. As a result, in October 2006 China’s started some government initiatives to prevent the spread of this virus and this time marks the beginning of the government’s acceptance of the use of male condoms and contraceptive devices as well as female contraceptive devices.

Nowadays Chinese people admit they use contraceptives to prevent unplanned pregnancies. China is becoming more liberal when it comes to sex, and the research done by the Chinese Journal of Sociology proves, that most young Chinese adults have premarital sex and engage in casual ‘hookups’. The emergence of discussions about LGBTQ+ community in China also works in favor of the market growth of the contraceptive market in China.

China’s demographic problems

China recorded 7.5 births per 1,000 people in 2021, the lowest rate in more than 70 years, according to official data released in November. With one of the world’s lowest fertility rates — at 3 children per woman, it is below Japan’s — China’s population could begin to fall within a few years, demographers predict.

The loosening up of China’s birth control policies brought a bit of help, as the number of vasectomies performed fell from 149,432 in 2015 to 4,742 in 2019, according to official data. China implemented a two-child policy in 2016. But the number of births is still falling every year. What is troubling news for the government, is great news for the contraceptive market in China.

The Chinese birth control market has seen an important increase during the COVID-19

At the beginning of 2020, the sudden epidemic ravaged the entire planet crazily. While changing people’s travel methods and consumption habits, it also changed the market structure of various industries, causing many industries to face a new round of reshuffling.

It is especially true for the adult products and condom industries. Unlike the “Great Depression” in some industries, the demand for condoms skyrocketed during the epidemic. Condoms in many supermarkets and convenience stores were all sold-out, and shelves were empty. As the pandemic had a positive impact on the contraceptive market, there is a bigger demand for contraceptive devices, especially condoms in Chinese society.

Foreign condom brands dominate the Chinese market

The condom market is the biggest when it comes to contraceptive devices in China. In 1995 China produced merely 1 billion condoms, while in 2022 it already exceeded 10 billion, and we are talking only about domestic brands.

Due to family planning policies and the aim to prevent sexually transmitted diseases in China, one of the government initiatives is to purchase over 1 billion condoms annually for free distribution to encourage population control after whole generations of the only first child.

It’s hard to believe there is a place for everyone in this competitive landscape, but there are indeed opportunities available for everyone when you take into account the market size and the annual market growth of the contraceptive market in China.

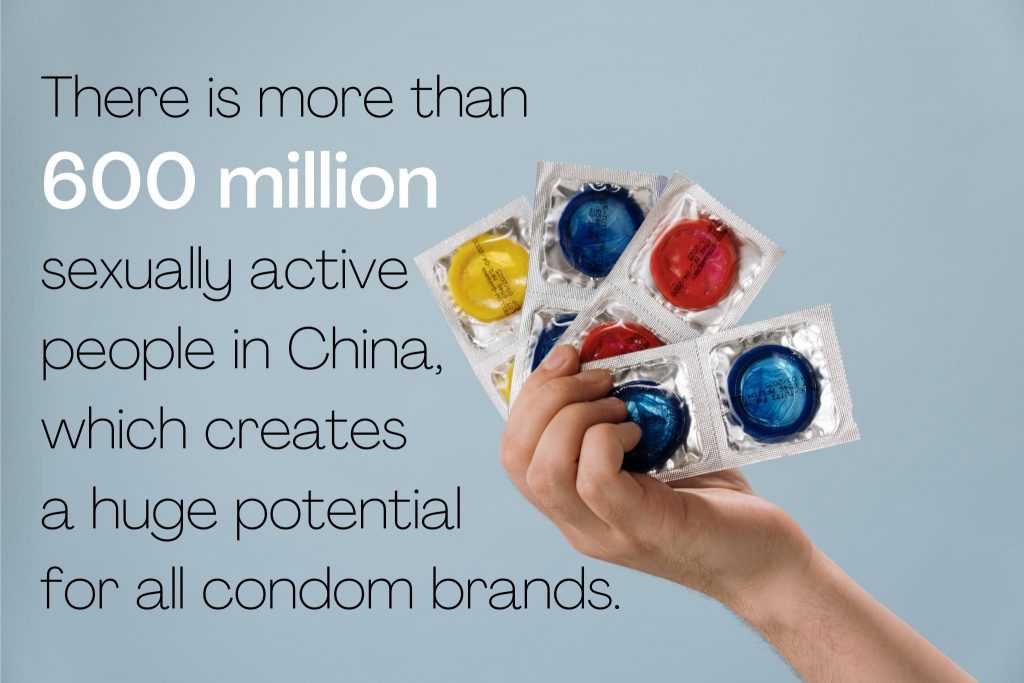

The domestic condom market is still monopolized by foreign brands. Chinese people prefer to buy condoms and other contraceptives from foreign brands, considering domestic ones less safe and comfortable. There are over 600 million sexually active people in China and because of changes in behavior and a shift towards casual sex, the potential for condom companies is huge.

Even though the Chinese government doesn’t approve of such behavior, it’s a cultural change that is inevitable. Therefore, authorities requested nightclubs, bars, hotels, and other entertainment places to provide condoms, to prevent the spread of AIDS and other sexually transmitted diseases.

How to Sell Condoms in China?

Although the male contraceptive devices market, especially condoms, and its huge market share in China offer an opportunity to foreign condom brands, selling condoms in China is not a piece of cake. One of the best examples to check before considering China’s expansion is Durex, the most-known condom brand in the world.

The brand had the ambition to expand its sales nationwide but realized that the strategy that works in other parts of the world won’t succeed in China.

Counterfeit: one of the obstacles to Durex’s China dream

Counterfeits are one reason for the lack of trust in domestic condoms and contraceptive devices among Chinese people. Fake products were also a nightmare for Durex company, as fake and substitute products from other domestic brands flooded the market.

Durex, the first brand of condoms to enter the contraceptive market in China, has been popular among Chinese consumers due to its high quality and reasonable price. Such a big cake has attracted many lawbreakers, which has led to the appearance of many counterfeits on the market.

As you can see in the photo above, fake condoms were no different than the original ones in the eyes of the end user. Therefore, Durex was facing a lot of problems with the business, since those counterfeit condoms were sold for a much lower price.

Today Chinese people prefer to pay more and be sure of the high-quality Durex condoms (in the end condoms quality is something hard to neglect, especially if you’re trying to prevent yourself from getting pregnant), but low-quality cheap condoms are still a nightmare of the condoms market.

How is Durex approaching the contraceptive market in China?

Durex is the industry leader in the condom market in China, with a great reputation that exceeds the one that domestic brands have. Despite the continuous problem with fake condoms and counterfeit products, Durex managed to get to the point of having its production and manufacturing bases in Mainland China. But how do they approach marketing in a rather conservative society?

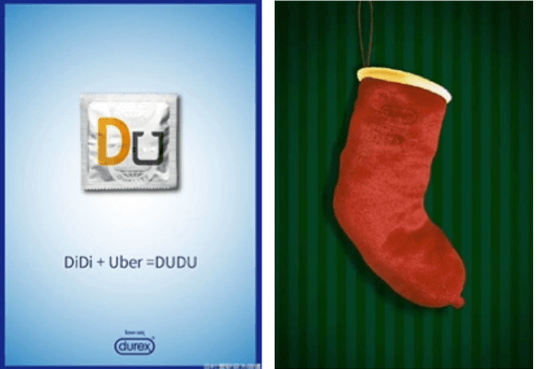

Durex is known for its humorous and subtle approach to marketing. As people feel a bit awkward and shy while talking or watching sex-related commercials and ads, it is important to make them feel okay with the presented topic, either through humor, or subtle and educational content.

Durex’s humorous marketing campaign

Durex decided to go for humor, releasing its April Fools campaign on the 1st of April 2022 localized for the Chinese market. Instead of promoting the typical fruit scents that condoms have, Durex offered the Chinese audience traditional Cantonese dishes flavored condoms. The four flavors depicted are braised eggplant in garlic sauce (鱼香茄子), braised pork belly with preserved vegetables (梅菜扣肉), creamed corn with pork (玉米肉粒), and the street-food favorite curry fish balls (咖喱魚蛋).

But it turned out, that after clicking the link provided by Durex, it was taking customers to Durexs’ product landing page, showing the latest 001 condom, which is unflavored.

Ambition, patience, and strategy needed to enter the market

To succeed in a market such as China you need two things: ambition and patience. We have seen through Durex’s example how difficult it could be to win the market, even for big brands.

The Chinese environment is competitive and complicated. You need good strategies and partnerships with professional Chinese marketing specialists. Think of new strategies that will make you a leader in the market. We’ve put together some key factors that will help your business access the Chinese condom market. Rather than adjusting your plan little by little, choose a strategy based on five pillars:

Social Networks

You need to be aware of the fact that traditional advertising in China, as anywhere else in the world is not as effective as it used to be. But it’s good news since there are more cost-effective ways to spread the word about your brand.

More than 90% of the total population of China uses social media platforms such as WeChat, Weibo, Douyin or Little Red Book, which makes it a great opportunity for you to gain trust and brand awareness among your target audience. You can promote your products via WeChat Official Accounts, WeChat Channels, Douyin short videos, and long articles on Weibo or collaborate with Chinese influencers on RED or Douyin to gain an audience of engaged young people, interested in your message.

Story Telling

A condom is a rather special product. We could say that it is intimate and personal; therefore, the sale is quite delicate or difficult, even if you target young people, so you have to opt for a softer approach. Remember to adjust your story to the audience and the social media platform of use.

Female contraceptive devices, such as female condoms need a softer approach than male condoms, which can go well with funny ads and word plays. You can tell exciting stories, stories that convey your message without being direct. Try to engage potential customers, so they will find your content interesting and funny.

You can also publish videos or images about the importance of sexual health and subtle messages about love and emotions. Chinese internet lacks good sexual education, so it’s also a niche topic that you can leverage while advertising your products.

KOLs and KOCs Campaigns

Key Opinion Leaders and Key Opinion Consumers are Chinese influencers that have a big audience of engaged followers. KOLs and KOCs are useful for marketing campaigns, as they can promote products to their audience, that trusts them and will be willing to buy something that their idol is using.

Little Red Book is the platform especially profitable when it comes to influencers and as the majority of users there are women, it’s a very fertile ground to promote female contraceptive devices.

Viral marketing

You will need a viral to reach people who never followed you, especially on Little Red Book or Douyin (Chinese Tik-Tok). A viral is a video or photo that got popular and therefore gained thousands or even millions of viewers, making your whole brand popular. There are some techniques to go viral, but it’s also always a bit unknown if you will be able to generate growth this way.

When it comes to videos, it’s good to publish with music and effects that are popular at the moment, to gain more viewers. Therefore it’s good to check the current trends and work with influencers, that are professionals in reaching big audiences.

Online sales

The distribution is very expensive in China because the trade is generally done in the family stores. Moreover, Chinese distributors prefer well-known brands to new brands.

It is, therefore, necessary to review your distribution strategy. The creation of an e-commerce site is the first step to achieving more sales: Alibaba Taobao, JD.com, Little Red Book, or WeChat Stores are all platforms that you can partner with to keep pace with online sales, so you will allow Chinese consumers to buy condoms in the Internet. And when it comes to the contraceptive market, online sales have fertile ground, because a lot of people are shy to buy them in a shop or pharmacy, especially women.

Customers in China will be able to shop for male or female condoms from your company via WeChat and Weibo and have the product delivered to their homes or office.

What About Contraceptive Pills and Other Contraceptive Devices?

Although there are many different birth control methods available in China and a lot of domestic and foreign companies that provide contraceptive devices on the market, condoms still hold the biggest market share. When it comes to other methods on the market, there are mostly;

Oral contraceptives

Oral contraceptives are far less popular and accepted in China, as they are believed to be less effective and bad for health. The education about oral contraceptives is still rather low, resulting in Chinese women believing they will gain weight and become ugly while taking pills.

But the market share of oral contraceptives is slowly growing, with more women turning to this method because they are allergic to condoms or simply because they don’t trust men, as a consequence of a lot of cases when men simply take out the condom during sex without telling them. Researchers forecast that the oral contraceptives market will see constant growth in the next years.

Intrauterine Devices

Another trend in the Chinese market is intrauterine devices, which will see significant growth in the upcoming years. An intrauterine device (IUD) is a small contraceptive device that is placed inside the uterus by a doctor. There are two types of intrauterine devices on the Chinese market so far; one is covered with copper and the other releases the hormone progestin.

Intrauterine devices are one of the best birth control methods, as they are 99% effective. We’ve only been able to reach statistics from 2018 done by Reproductive Health. The report shows, that 35.2% of women in China use intrauterine devices. Today the numbers are even higher, with intrauterine devices being one of the most used birth control methods on the market.

Need Help Entering the Competitive Landscape of the Contraceptive Market in China?

China is not an easy market for contraceptives, as there are still a lot of misconceptions, especially when it comes to oral contraceptives. But on the other hand, it is a very fertile market with a lot of opportunities, that will only grow with young Chinese adults entering the market.

If your business needs support and advice on entering the contraceptive market in China, contact us and we will provide you with solutions for your project.

We are a marketing agency specializing in SEO and marketing on Chinese social media platforms. We advise foreign companies wishing to develop their communication in the Chinese market thanks to our expertise in each sector. For more information visit our website.

Hello

I am a local distributor in the province of Sichuan, and we are looking to import exclusively a condom brand from oversea.

Good brand, quite famous from European countries, Australia or North America are our requirements.

super article… What can I say. huge market and huge opportunities.

Huge Opportunities indeed 😉

The question is who will be brave enough to challenge Durex?