In the dynamic world of luxury goods, watches have stood the test of time (pun intended) as symbols of prestige, craftsmanship, and tradition. As China emerges as one of the largest consumer markets in the 21st century (and luxury watch sales exceeded $10.89 billion in 2023), tapping into its vast potential is the ambition of every watch brand, from vintage classics to modern tech-infused pieces.

But selling in China isn’t just about offering a beautiful timepiece; it’s about understanding the intricate play of culture, digital platforms, and evolving consumer preferences. In this article, we’ll explore the ins and outs of selling watches in the Middle Kingdom, guiding you through the best platforms to showcase your pieces and tips to resonate with the Chinese consumer.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

China is The Leader of The Luxury Watches Market

The taste of Chinese consumers is evolving with growing international tourism. Chinese consumers now prefer better-quality products in life and have developed an eye for finer luxury items. Among other luxury items, Chinese consumers have become very demanding about the types of watches they prefer. From old-style watches offering practical functionality, in China, watches have gradually evolved into special consumer goods that are trendy and ornamental and offer brand value.

The luxury watch market in China is the biggest in the world, with sales revenue reaching $10.89 billion in 2023. Although it’s true, that the market slowed down during and after the pandemic, generating only around 2% CAGR, it’s still a huge market full of opportunities and consumers hungry for luxury watch brands.

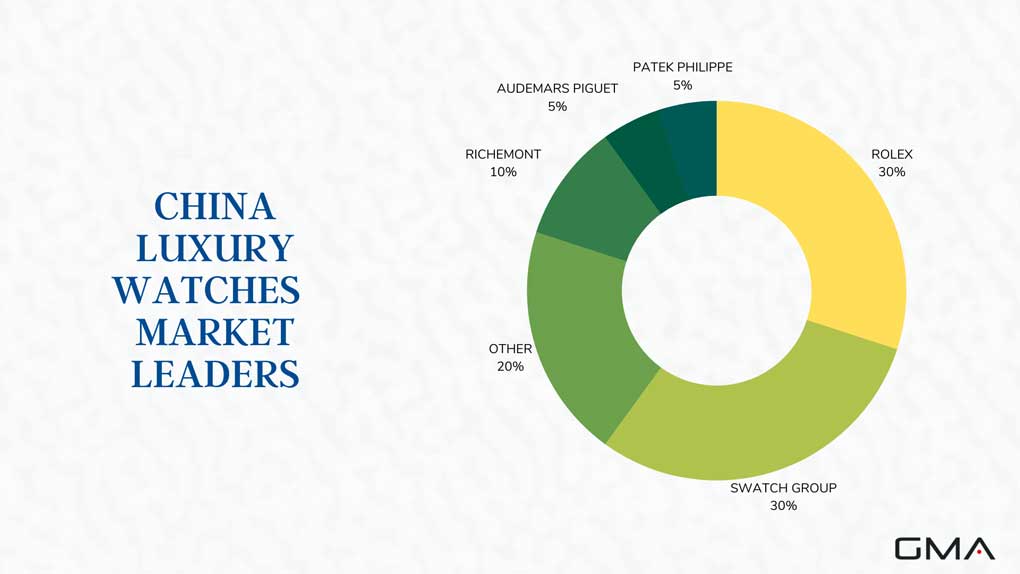

The leading luxury brands of watches include Rolex, and Swatch Group which have a 30% market share each, followed by Richemont, Audemars Piguet, and Patek Philippe, as you can see below. From this graph it’s evident, that luxury watches preferred by Chinese consumers are from foreign brands, with a preference for Swiss watches.

Growing market of non-luxury watches

Although the luxury watch market is growing rather slowly in China, the overall watch segment is not doing badly. In fact, it is predicted to grow annually by 6% (CAGR 2023-2026). In 2023, 33% of the sales in the watch segment will be attributable to non-luxury goods. The revenue in the watch segment reached $17.80 billion in 2023.

Although the luxury segment is still very strong and a typical Chinese consumer still prefers to spend money on a luxury watch brand, there is a growing demand for so-called ‘affordable luxury‘ and non-luxury, but fashionable items. Watches are also falling into that trend.

Which luxury watches are preferred by Chinese consumers?

Watches sold in the Chinese market mainly fall into three categories:

- Work/business watches: Chinese consumers prefer wearing expensive watches to work depicting their status symbol. They wear luxury watches to attend important functions, but may also wear them during leisure hours. Usually, high-income male consumers prefer business and work watches.

- Casual fashionable watches: Chinese young females prefer casual, fashionable watches. These are trendy watches and usually have a very chic and slick design. These watches mainly serve ornamental purposes like necklaces and bracelets. Chinese girls prefer wearing these watches during leisure hours. Sometimes they are also worn to match business outfits.

- Sports watches: Chinese consumers have been interested in sports events more than ever before. This group mainly consists of young Chinese, students and sports enthusiasts as main consumers.

Other types of popular watches include antique watches, multi-function watches, and cartoon watches.

Who are the main consumers of luxury watches in China?

In China, most luxury watch buyers are men, especially those aged between 25 and 40. About 60% of all luxury watch customers are male. This trend is partly because watches have traditionally been viewed as items for men in Chinese culture. Moreover, many Chinese men wear luxury watches as a way to show their success and wealth.

There’s also a group of watch enthusiasts who collect them, valuing the quality and craft behind each piece. However, it’s important to mention that interest from women and younger folks is growing, as they begin to see watches both as a stylish accessory and a nod to tradition.

Best Strategy to Promote and Sell Watches in China

There is an enormous opportunity for luxury watch brands in China, but due to cultural barriers, language differences, and strict e-commerce platform policies, it gets challenging for international brands to enter the Chinese market. However, there are two vital approaches to entering and being successful in the Chinese market: good branding and presence on well-known e-commerce platforms.

You need to focus on branding in China

Before targeting Chinese consumers, it is advisable to understand the culture of China’s closed ecosystem. Several International brands experienced a negative impact on their brand image when their marketing campaign went wrong. Therefore, the first step after market analysis is Branding!

You need Chinese people to start recognizing your brand and talking about you on social media platforms and forums. You need a few contact points with the Chinese audience, so that whenever they search for you online, you will easily pop up.

Create a Chinese website and optimize for Baidu SEO

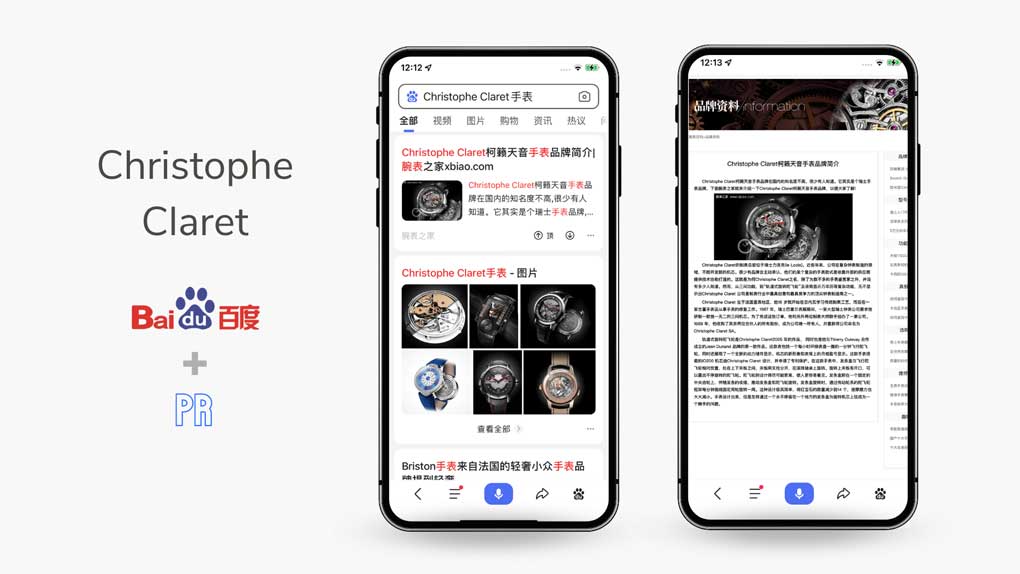

Breaking into the Chinese market goes beyond offering premium products; it requires a tailored approach to digital presence. Establishing a localized website optimized for Baidu, China’s leading search engine, is crucial. While Google reigns supreme in many parts of the world, in China, Baidu holds the scepter. To maximize visibility, brands should invest in a Chinese-language website that caters to local tastes, aesthetics, and browsing habits.

But having a website is just the beginning. Baidu SEO has its unique algorithms and ranking factors. Brands should focus on obtaining backlinks from Chinese websites, incorporating relevant keywords based on local search trends, and ensuring their site adheres to Baidu’s strict content guidelines.

Additionally, obtaining an ICP (Internet Content Provider) license is a must for hosting your website in China, which further ensures better loading speeds and accessibility for Chinese users. Through a finely tuned blend of localization and Baidu-specific optimization, brands can achieve a robust online foothold in the Chinese market.

Try to get press releases for good e-reputation

Press releases play a pivotal role for luxury watch brands looking to make their mark in China. For starters, they ignite conversations, capturing the media’s attention and spotlighting the brand. Additionally, they provide a direct avenue to potential customers, establishing a brand’s prestige and reliability. Press releases also foster crucial ties with influential Chinese journalists and thought leaders. Furthermore, they serve as conduits, channeling viewers to the brand’s online platforms, be it their website or social media.

Given the weight of media attention for luxury brands in China, collaborating with adept PR experts, well-versed in navigating the Chinese media landscape, becomes indispensable.

Create official accounts on Chinese key social media platforms

Promoting a luxury watch brand in China necessitates a deep understanding of the premier social media platforms, each holding its unique capabilities tailored for luxury outreach. Here’s a breakdown:

WeChat – The Super App

Often referred to as China’s “app for everything,” WeChat stands as a multifunctional giant in the digital realm. Beyond basic messaging, WeChat’s ‘Moments’ allows for content sharing, while official brand accounts facilitate direct sales, customer engagement, and bespoke storytelling.

The platform’s integrated ecosystem means brands can nurture potential buyers from awareness to post-purchase services seamlessly.

Xiaohongshu (Little Red Book) – Bridging Authenticity and Commerce

A blend of social media and e-commerce, Xiaohongshu thrives on genuine user experiences and reviews. This platform is ripe with unboxing videos, product reviews, and authentic user testimonials. It provides an environment of trust. Brands can engage with a community that values authenticity, offering a more transparent and genuine connection with potential customers.

Weibo – The Buzz Creator

Echoing similarities to Twitter, Weibo is the heartbeat of trending topics and viral narratives in China. The app features a layout conducive to images and short posts, allowing for influencer campaigns, celebrity tie-ins, and prompt brand responses. Given its massive user base, Weibo is perfect for grand launches, visually showcasing timepiece collections, and building rapid brand momentum.

Douyin – Engaging through Videos

As China’s answer to TikTok, Douyin thrives on short, captivating video content. With its emphasis on creativity and user-generated content, Douyin offers brands an arena to present innovative video showcases. By leveraging the platform’s dynamic nature, brands can highlight the intricacies and craftsmanship of watches, appealing especially to younger, tech-savvy audiences.

Collaborate with Chinese Influencers and Celebrities

In China, teaming up with local influencers and celebrities, often called Key Opinion Leaders (KOLs), is a powerful strategy. When a KOL recommends something, many people listen. If a KOL talks up a luxury watch brand, it can quickly lead to increased sales because their huge follower base trusts their word.

More than just pushing sales, KOLs can help mold how people see a brand. If a well-regarded KOL aligns with a brand, that brand can be seen as trendy, classic, or whatever the KOL is known for.

Sell Your Products in Chinese E-Commerce Platforms

There have been several recent examples of prestigious watch brands entering Social E-commerce platforms of China to provide Chinese customers with easier and seamless digital experiences. Brands such as Bulgari and Jaeger LeCoultre have appeared on China’s social media platforms and introduced Chinese online influencers (KOL) to attract and reach Chinese users by leveraging their marketing campaigns to attract young customers.

To enter the e-commerce market of China international brands must learn policies of following digital platforms.

Tmall and Tmall Global

Tmall holds the biggest market share in the e-commerce market of China at 57%. It mainly focuses on premium brands. This characteristic makes Tmall the most expensive e-commerce marketplace in China. It provides an opportunity for international brands to open exclusive online stores and directly sell products to Chinese consumers without being physically present in China.

Tmall has an invitation-only policy where only qualified international brands can either be invited to join or apply through a local marketing agency. For more information on how to sell international products through Tmall, please contact a local digital marketing agency.

In addition, when it comes to high-end watches, Tmall offers a sub-platform called Tmall Luxury Pavillion. Tmall Luxury Pavilion caters specifically to the high-end clientele of China. Offering a curated selection of global luxury brands, it provides an immersive and exclusive shopping experience tailored for the discerning consumer.

E-commerce via JD.com

JD is China’s largest online direct sales company. It relatively has less market share than Tmall. International companies can open individual online stores on JD.com and brands are permitted to import food, beverages, apparel, and shoes from overseas. JD’s cross-border service enables suppliers to sell directly to Chinese consumers without a local presence.

JD.com is less expensive than Tmall and has a zero-tolerance policy for counterfeit products.

Taobao

Taobao is owned by Alibaba Group. It offers the largest C2C e-commerce marketplace in China. Taobao allows registered or non-registered businesses to sell directly to consumers. Establishing a store on Taobao is virtually free but the online marketplace is ruled by small sole sellers who compete fiercely on price and honesty and authenticity is an unwritten rule of their trade ethics. Sellers with low-budget and low-quality products opt for this platform.

WeChat E-commerce

WeChat is engrained in the lifestyles of Chinese consumers. It is an all-in-one app that integrates social e-commerce seamlessly. Apart from being a great marketing tool (as we mentioned earlier), WeChat is also growing to become one of the key e-commerce platforms, thanks to its integration of WeChat mini-programs, where brands can create their flagship stores.

It’s a perfect opportunity for smaller and niche brands that don’t want to start from a big investment (that is required on platforms like Tmall or JD), and would like to test the market.

Don’t forget the physical presence

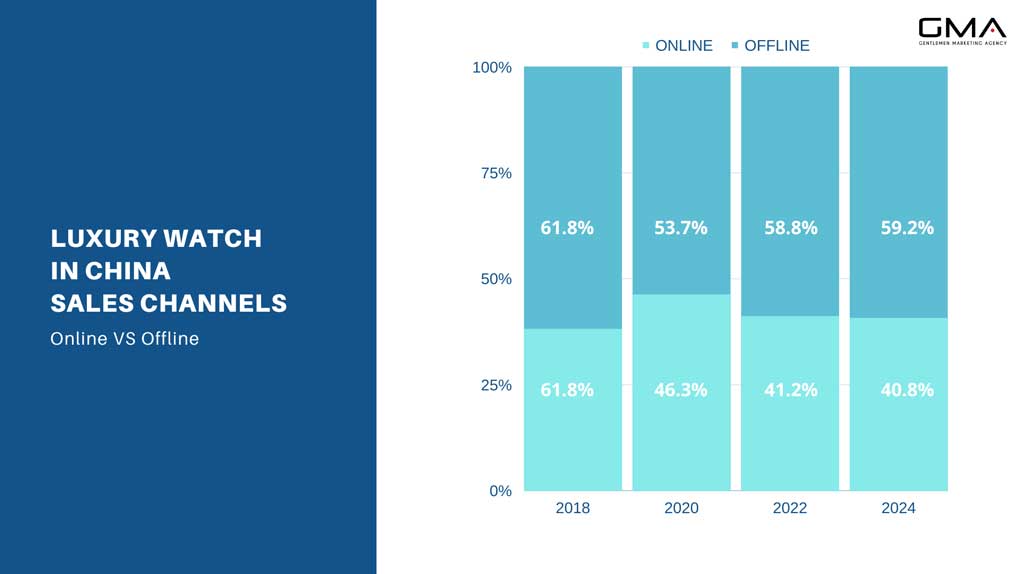

In China, while digital platforms continue to grow, offline sales remain dominant in the watch industry, emphasizing the importance of physical boutiques.

The right location—be it bustling shopping districts, upscale malls, or trendy areas—can significantly influence customer footfall. These boutiques do more than just display watches; they encapsulate the brand’s essence, providing an immersive experience that leaves a lasting impression on visitors.

Moreover, pop-up stores have become an innovative way to capture market interest. Strategically launched around festivals or notable events, they capitalize on heightened consumer activity. Furthermore, partnerships with other brands for these pop-ups can amplify their reach, bringing together synergies and introducing timepieces to diverse and potentially larger audiences.

Maximize Your Watch Brand’s Impact with Gentlemen Marketing Agency

Breaking into China’s luxury watch market can seem daunting, given its unique consumer behavior and rapidly evolving digital landscape. However, with the right partner, this journey can not only be simplified but can also yield exceptional results.

Why Choose Gentlemen Marketing Agency?

- Market Acumen: Profound insights into the Chinese luxury consumer psyche and prevailing trends.

- Broad Connections: Direct access to top influencers, media houses, and industry leaders.

- Result-Driven Strategies: Customized digital campaigns designed for brand amplification and robust sales.

- Mastery in E-commerce: Expert navigation of leading platforms, ensuring your brand gets prime visibility.

- Seamless Event Execution: From the conception of pop-up stores to grand product unveilings, we’ve got you covered.

- Collaborative Spirit: We pride ourselves on understanding our partners’ vision and translating it into market success.

With the Gentlemen Marketing Agency by your side, you’re not just entering the Chinese market; you’re making a statement. Let us guide your brand to its rightful place in the spotlight, where quality meets recognition, and potential transforms into tangible success. Contact us today!

Very good article, most of Switzerland Brand should start their eCommerce business but like usually they are too slow for the Chinese Market and will miss the opportunity to be seen as innovative and will target too late the young Rich Chinese

Hi,

I’m looking to cross boarder sell Swiss watches, can you tell me what is needed to do so please?