After two years of the pandemic, Chinese shoppers quickly shifted their attention toward beauty and self-care products that offer a higher level of physical wellness.

Recently, self-care products, particularly the ones with supplementary functions or additional benefits are gaining attention from Chinese consumers. As a result, brands are rapidly regaining their prominence and making their way back into the spotlight.

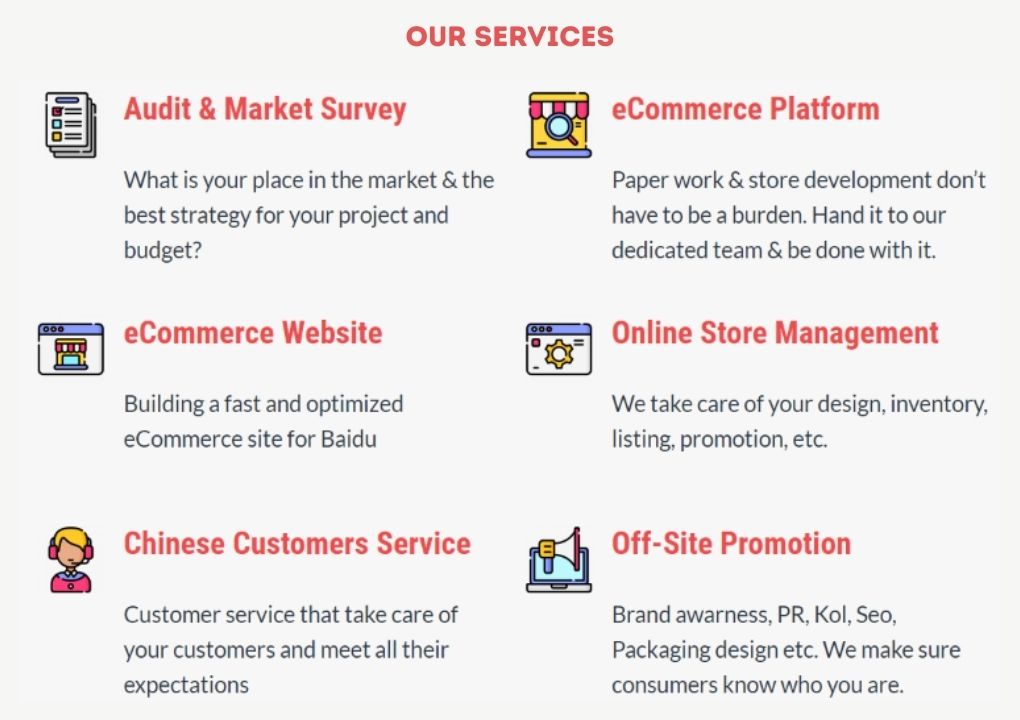

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

The pandemic has thrust people into the digital world like never before, providing retailers with a unique opportunity to capitalize on this influx of new web traffic. To ensure success moving forward, brands must make full use of the social media offerings in China

Overview of women’s self-care market in China

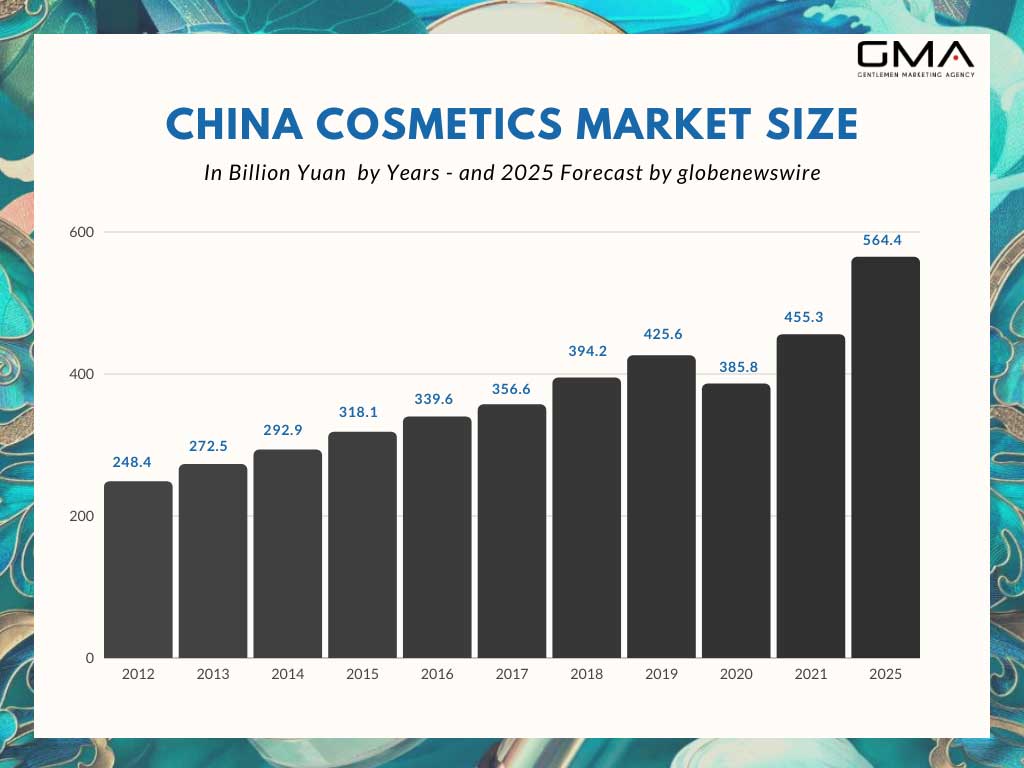

The female consumer market in China has surpassed 10 trillion RMB in 2022. By 2022, the beauty & self-care market is projected to have a total revenue of US$60 billion – and it’s only expanding from there! With an estimated compound annual growth rate of 9.50% between 2021-2026, this industry shows no signs of slowing down anytime soon.

By 2022, the women’s cosmetics and skincare products market is projected to generate a whopping 56% of total revenue from e-commerce sales. 85% of users are now engaging with e-commerce platforms – a significant leap from last year’s penetration rate of 78.2%.

With these impressive statistics, it is clear that women have become an integral part of today’s digital landscape and continue to drive innovation within this space in the Chinese market.

In the 1990s, women and men had an average life expectancy of 69 and 65 respectively; fast-forward to today, that number has risen dramatically to 77 years for women and 73 years for men! Thanks to the use of good skincare and organic products, Chinese consumers have healthy and nourished skin, they look and feel younger and they are healthier. And of course, they are driving the demand in the Chinese beauty market.

What are the latest trends in women’s self-care products?

1. Different women = different needs: cosmetics brands focus on tailored experiences

Surveys demonstrate that nearly four out of five Chinese consumers are more disposed to buy from a company that offers an individualized experience. These tailored experiences involve understanding customer preferences and using data-driven models to create personalized product solutions for different women.

2. Increasing demand for smart beauty technologies

The popularity of smart technology has spilled over into the Chinese skincare market, becoming one of the biggest market trends. Companies are now introducing more advanced products such as makeup brushes and facial cleansing devices that are connected to mobile applications. This helps women better manage their beauty routines and access the latest skincare tips.

3. At-Home treatments have become a routine

With never-ending COVID-19 lockdowns being enacted, Chinese consumers had no choice but to look for creative beauty treatments they could do in the comfort of their own homes. This exciting discovery showed them just how beneficial these products were, and the convenience they provided.

4. Brands blend dermatological products with traditional Chinese medicine

Foreign and domestic brands bring together the best of both worlds: by combining the knowledge of dermatology and traditional Chinese medicine, brands can create customized products that perfectly address each person’s particular needs. Therefore, Chinese consumers can confidently purchase a product that caters specifically to them—knowing their every requirement will be taken care of!

5. Digital platforms offer easy tutorials

Through social media platforms, especially China’s foremost shopping platform Tmall, women in China have access to a variety of information and tutorials on self-care. This includes skincare tips, makeup guides, diet plans, and more. These resources are easily accessible for women who need guidance or advice when it comes to taking care of themselves.

What are the Popular cosmetics and skincare products in 2022?

- Himalayan Salt Lamps

- Energy Cleansing Smudge Kits

- Silk Eye Mask for Sleeping and Cooling Gel Eye Masks

- Aromatherapy Diffuser & Essential Oil Sets

- Scalp Revival Dry Shampoo

- Deep Pore Minimizing Cleansing Clay Mask and Mud Detox Masks

- Jade Gua Sha Facial Lifting Tools

- Ultra-Clarifying Face Oils

- Bubble Foot Spa scrubs

- Silk Queen Pillowcase and Silk Headbands

How to reach Chinese consumers: Chinese social media

When it comes to the beauty and cosmetics industry, the best way to reach Chinese consumers is through Chinese social media platforms. Chinese consumers tend to check information about products online, especially from foreign companies. They are looking for product reviews, tips on how to use them, recommendations, and so on.

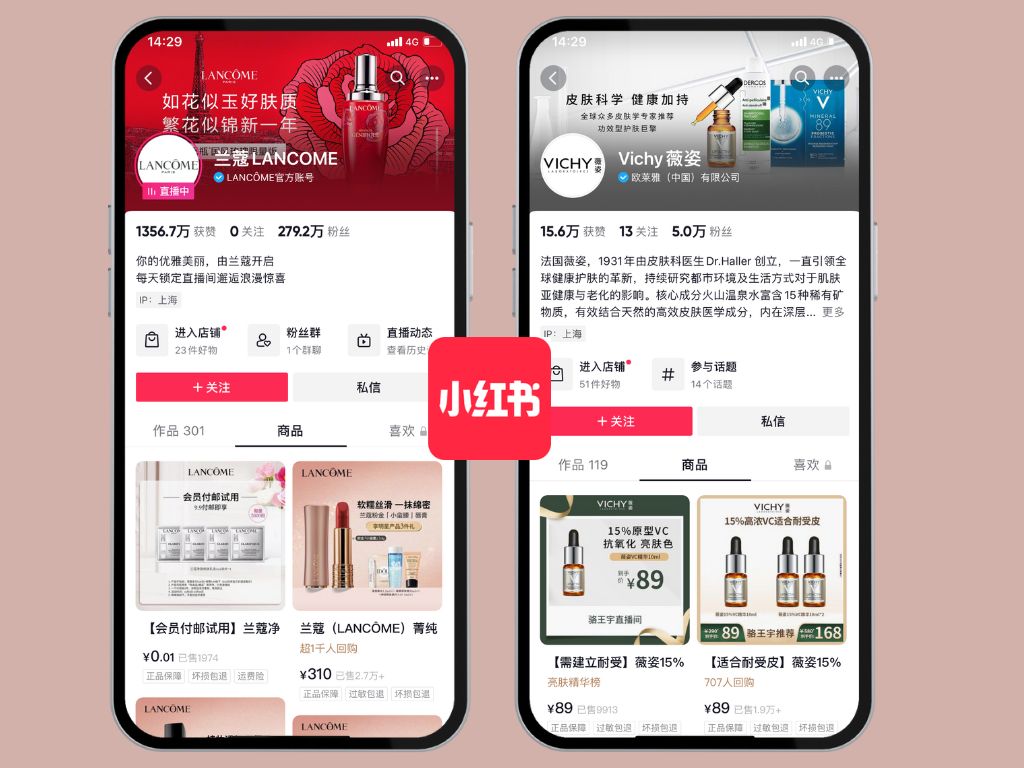

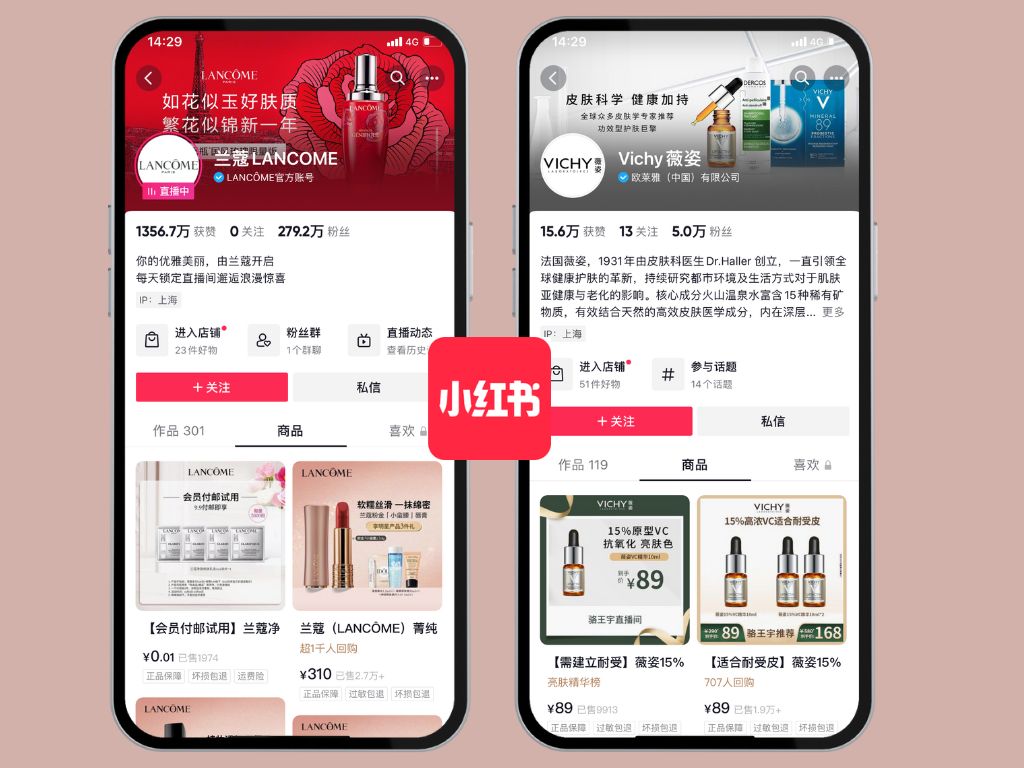

Xiaohongshou (RED)

With an astounding 300 million monthly active users, RED is a Chinese social platform that should not be overlooked by brands who are looking for e-commerce marketing, especially in the Chinese skincare market. This burgeoning app is often likened to China’s Instagram and its biggest demographic of users comes from the same group.

Xiaohongshou users regularly post videos, images, and stories of their self-care activities such as going to the gym, getting a manicure, or using a facial mask. The platform also offers women a range of beauty products, grooming, and lifestyle tips to follow.

What makes Xiaohongshou is its focus on women’s empowerment, as its content encourages women to take charge of their self-care routines and make healthy lifestyle choices.

RED has become a hit with urban women consumers who have significant buying power, making it their go-to platform to discover new products and numerous skincare practices. While the network is gaining traction among other demographic groups, its primary user base consists of young women: 85% are female, about 90% of which fall below the age of 35.

Douyin

Douyin, the Chinese version of TikTok, is a popular platform among women in Mainland China. Douyin offers an array of fun and interactive content that appeals to women who are interested in self-care. Douyins phenomenal influencers and foreign brands tend to provide tips, tutorials, and advice on how women in China can stay healthy, look their best and take care of themselves.

Even though the Douyin user base currently skews towards a younger audience, women of different ages are increasingly turning to Douyin for beauty and personal care-related advice and content.

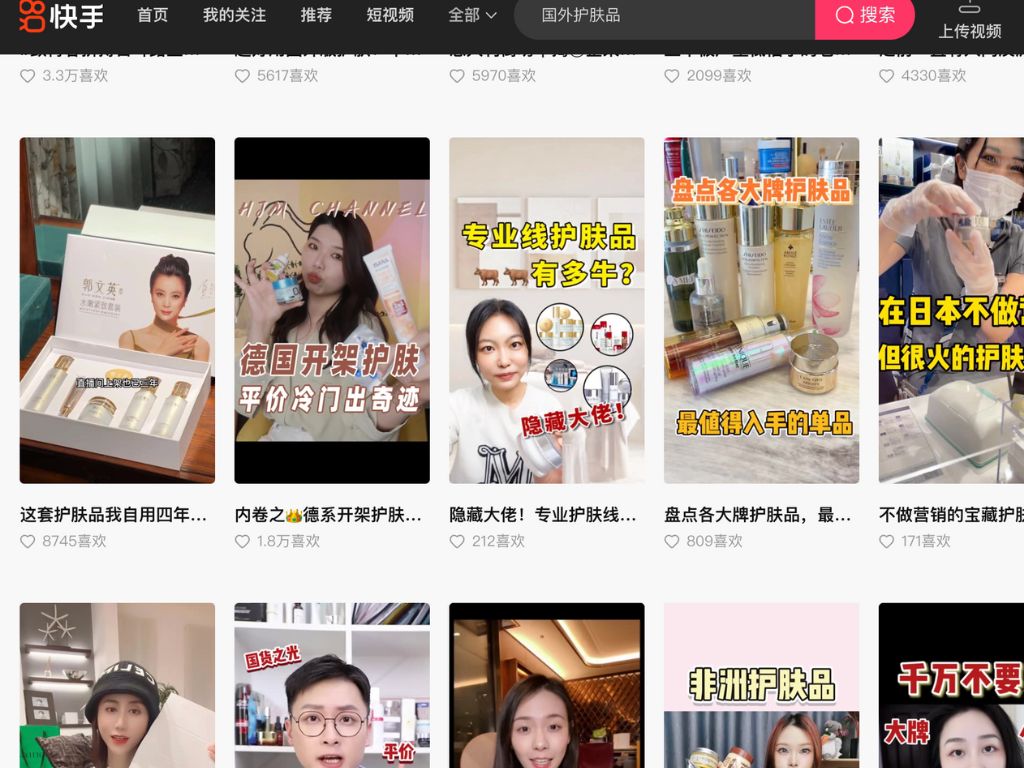

Kuaishou

The main difference between the other top platforms and Kuaishou is that it caters primarily to young people in lower-tier cities, who typically have more modest disposable incomes than those on Douyin. That said, Kuaishou has developed partnerships with JD.com and other major retailers; this strategy is paying dividends for them as evidenced by their impressive outcomes in online sales and user engagement.

Kuaishou also gives women access to a variety of products tailored specifically for women’s beauty and personal care needs. From makeup and skincare products to clothing and accessories, women can browse through an extensive selection of items with just a few clicks. Furthermore, the platform partners with numerous brands that offer discounts on their products, giving women great deals on their favorite items.

Local or Foreign products? For self-care, Chinese women prioritize foreign products

For Chinese women, foreign brands often have a greater aura of prestige than domestic ones. When it comes to the beauty and personal care market in China, Japanese skincare products are definitely the most popular, followed by Korean and French cosmetic brands. Despite the higher cost, these international companies consistently occupy a central role in the Chinese market over Chinese brands – even when the price is taken into account. Chinese people have a profound trust in foreign self-care product brands due to the quality and recognition they bring.

How can brands become competitive frontrunners in China’s booming women’s self-care market?

1-Sustainability and Inclusion

To become a leader in the Chinese cosmetics industry, brands must prioritize sustainability and inclusion while delivering personalized experiences across multiple channels. They should also tailor their products to meet customer needs and expectations for an unbeatable combination that is sure to win over Chinese consumers’ hearts!

2-Digital Experimentation and Customization

As a cosmetics brand, it is essential to set forth the values you want to represent and then consistently deliver on that promise. Defining the desired consumer experience should be one of the top priorities for brands

3-Innovative Products and Services

Consumers in China, particularly women, are more aware of ingredients used in cosmetics and other self-care products. Brands should consider including organic and natural ingredients as part of their offerings to appeal to an increasingly health-conscious customer base.

Are you looking to increase your brand’s reach in China’s women’s self-care market?

Let us assist you with that! We have the knowledge and resources to help take your business even further. During 10 years we helped more than 600 brands succeed in the Chinese market and reach their Chinese consumers.

Our agency in China can help you create a strategy tailored to the women’s self-care market, leveraging our expertise and insights into the local industry.

Contact us today to learn more about how we can help your business succeed!