At $5.8 Trillion in 2018, China has the second’largest market in the world according to Alizila group (Alibaba)

Trending in China eCommerce

The e-commerce market in China is currently shifting. Chinese consumers are influenced by foreign and South Korean fashion trends, music, and TV-shows (such as dramas) that portray different lifestyles. As the market becomes more and more competitive the Chinese market tends to be more internet savvier by the day in their demands. Foreign products are reported to witness a gradual increase through 2020. A substantial growth reveals that of 2018 E-Commerce, the total value for import E-commerce sales were over 20%.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

China has many cross border e-commerce platforms, the list led by Tmall and Kaola. The 24-34 years old represent 48% of cross-border consumer and are the largest user segment. This segment of online shoppers is highly educated with a high income.

Industries Rapid growth

The new-rich millennials in China are practically chasing exclusive luxury goods. High-quality usually refers to imported goods, which add the luxury touch to an item. The most chased foreign products are:

- Cosmetics & beauty products

- Baby products

- Food & Beverage

- Fashion & Luxury

Fashion & Jewelry

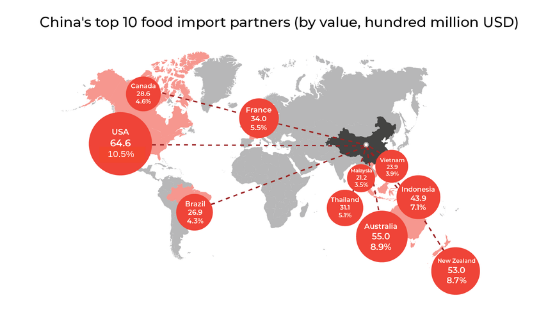

Food and Beverage

- Due to safety concerns in local F&B products, consumers in China tend to choose foreign products. repeated scandals damage the trust in domestic food and this gives opportunities to foreign products.

- The increase of disposable income has led Chinese consumers to travel abroad, this leads to a desire to consume have a more diversified taste when choosing.

- According to Deloitte China’s cross-border e-commerce retail import penetration rate* increased rapidly from 1.6% in 2014 to 10.2% in 2017

Cosmetic & Beauty

As competition in the global cosmetics market continues to heat up, China presents a range of promising new opportunities. During the past five years, China has been one of the world’s fastest-growing cosmetics markets. According to Euromonitor data, China’s market for cosmetics grew from RMB 24.3 billion in 2014 to over RMB 42.8 billion in 2018. It’s annual growth has steadily built momentum, rising from 9.7% in 2015 to 21.7% in 2018.Baby products

The Baby Product Manufacturing industry in China produces a range of products, such as baby food, clothing, toys, and skincare products. The industry has grown strongly over the past five years. Industry revenue is expected to increase at an annualized 7.8% over the five years through 2019, to $174.4 billion.China Social eCommerce

Combining both social media and online shopping, so-called social commerce, is the secret of success of the most popular border eCommerce platforms in the Chinese market. However, there are some obstacles to overcome and opportunities when importing goods to China – from direct shipping to customs clearance in China and from the 2019 CBEC regulation to tax reductions. Therefore, marketplaces have emerged as fulfillers and marketing boosters.Trends to follow in 2020

- Livestreaming will become an even more important sales medium.

- We will see a shift from KOL marketing to KOC marketing.

- Short-video apps will continue to embrace e-commerce.

- Recommerce will become the new hit.

- Group buying will continue to grow as major e-commerce platforms launch their own group-buying functions.

- Mini programs will supplement shopping platforms for brands.

- Parcel delivery will continue to get faster.

- China’s data-based consumer-to-manufacturer (C2M) model will drive e-commerce forward.

- Vertical e-commerce sites will gain traction.

- We will see a changing landscape of cross-border e-commerce.

more content for E-commerce

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

more content for E-commerce

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

In 2016, more than 15% of the population will …..

any more fresh data?

hello,

any more information I can read about E-commerce in China?

Hi Sofia,

we can help you , send us an email and we will send your our white book