The final target is to sell in China, but please take 3min to read this article. China’s cosmetics market continues to rise at a fast tempo in tandem with the quick advancement in the Chinese financial state in recent years.

Fast development in China’s cosmetics retail market

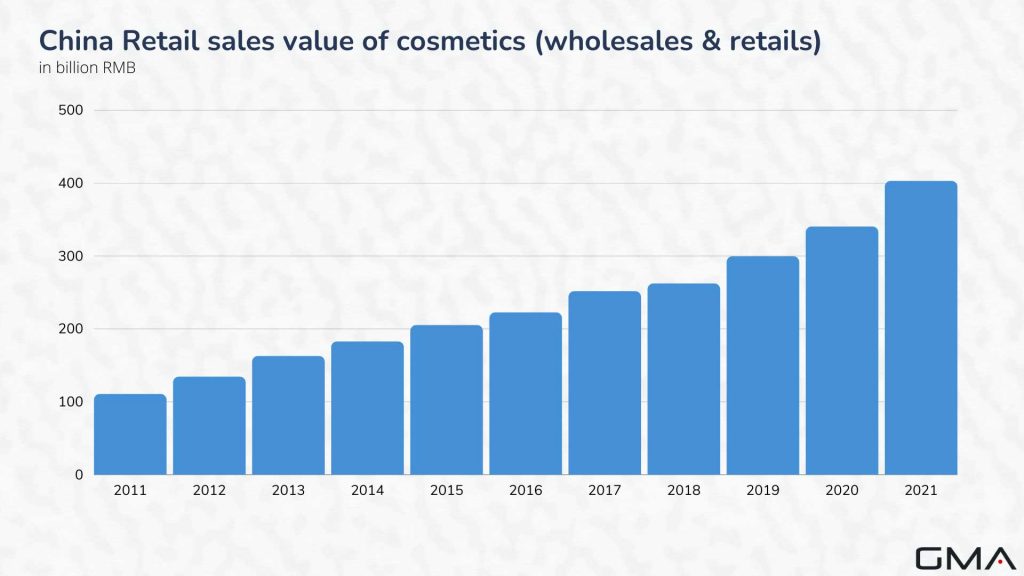

In recent years, China’s cosmetic market has been developing rapidly. Data from Statista reveals: that in 2019, the retail sales (wholesales + retail companies) value of cosmetic products reached a record high of 299.2 billion yuan. In 2021, the market was worth 402.6 billion yuan.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

As the demand for cosmetic products expands further in second-and third-tier cities of China, cosmetics retail is expected to maintain its growth momentum in the short run.

Moreover, Chinese men’s changing attitude towards skincare fosters the men’s cosmetics market in China. From 2013 to 2018, the sales of men’s cosmetic products increased by around 37 percent.

Top Selling Beauty Products in China

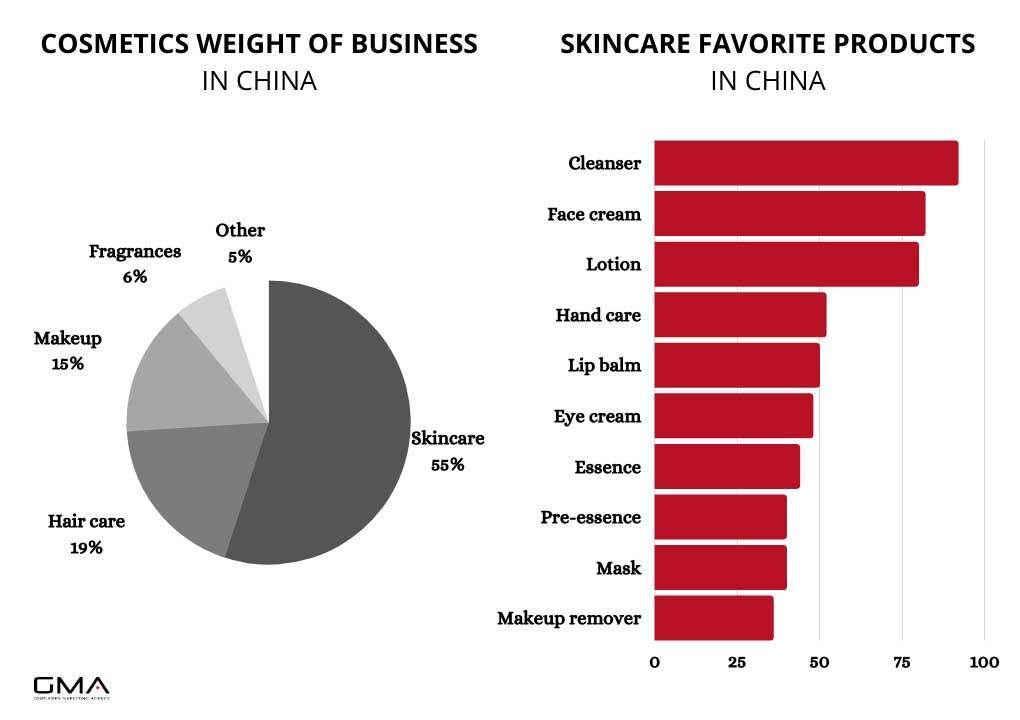

Latest composition of China’s shopper marketplace of beauty solutions:

- Skincare solutions: the fastest escalating sector inside the cosmetics marketplace.

- Shampoos and hair care items: a marketplace specialized niche getting saturated, observing growth decelerating.

- Make-up products and solutions: the market is significantly saturated, significantly for enhancement products, this sort of as color correcting (CC) and blemish balm (BB) products. Gross sales of eye make-up merchandise recorded major advancement in recent years.

Goods for kids: product sales of products suitable for use by small children continue on to soar. - Sunscreen goods: sunscreen products help assure income is not going gradual down during common quiet seasons.

- Anti-aging solutions: cosmetic merchandise that aids consumers to keep youthful and struggle with aging is progressively well-liked.

- ports activities cosmetics: lots of people who really like sports and health pursuits are keen to take care of a sexy visual appearance likewise. They need athletics cosmetics that will enable reduce the lack of moisture and they are anti-odor, anti-sweat, and anti-bacteria, packaged in compact, moveable measurements.

- Cosmeceuticals: individuals have growing recognition of solutions that mix cosmetic and pharmaceutical options, such as location lightening products, zits remedy lotion, and acne breakouts ointment.

- Green/natural cosmetics: containing all-natural or nutritional elements, these kinds of as aloe and vitamins.

China’s cosmetics trends

Currently, China’s skincare goods sector is trending in the direction of the high-end. Euromonitor figures exhibit that the 2016 market shares of high-end skincare merchandise far outstripped that of mass marketplace fast-moving alternate options. It was estimated that the skincare market in China would be worth around 211 billion yuan in 2020.

Buyers favor key global brand skincare products and solutions, and expanding practices are switching from price-focused to high-quality and brand-driven.

In accordance to China’s Skincare and Cosmetics Industry, a 2016 HKTDC Study study report, Chinese women’s most vital considerations for buying cosmetics include things like: “product benefits/efficacy” (66%), “brand” (64%), and “word-of-mouth” (60%). Young respondents were a lot more motivated by factors these kinds of as “word-of-mouth” and “price”, though experienced respondents had been extra captivated by “natural/organic/herbal ingredients” and “high-tech/biotech products”.

Performance of China’s domestic cosmetics brands

Chinese cosmetics brands have grown quite significantly in terms of popularity with Chinese consumers of all age groups.

We most notably think of the brand Floraris and the perfect diary that bet on the online channel to launch their brands. The two brands are not the top selling cosmetics brands on Tmall dethroning long-time leader estée lauder!

Post-80s and post-90s foster the booming of China’s cosmetics market

The main shopping groups for make-up goods tend to be the post-80s and post-90s generations, who are worth the looks and trendiness on the solutions, and therefore are hugely delicate of product or service updates. Therefore, numerous brands are collaborating with film/TV stars and beauty bloggers or positioning embedded advertisements in films/TVs and enjoyment gatherings to be a solution to increase sales.

Based on the HKTDC survey, women of all ages in China have gradually formed the pattern of placing on makeup. This is certainly significantly genuine for young women, aged 20-30. The 88% of the age group putting on make-up is higher than that of 31-45 12 months aged gals, at 83%. Guys also are commencing to take care of their skin, with 63% of male respondents using cleansing milk, lotion, or confront cream.

China is entering in “Male Beauty Era”

The men’s cosmetics sector displays powerful advancements, specifically skincare products for guys. According to estimates by Euromonitor, the male skincare products and solutions marketplace expanded by 5% year-on-year in 2016. In 2016, males accounted for 52.2% of the mainland’s overall populace. In 2018, the male skincare market is estimated to reach RMB15.4 billion and In 2020 it reached $US2.6

In 2019, the growth rate of male beauty products is higher than that of women (31% year-on-year growth versus 29%), and this market continues to grow at a very fast pace. It is estimated growth by 15.2% over the next 5 years, compared to a global average of 11%. According to Tmall, we are entering the Chinese ‘Male Beauty Era’.

Nonetheless, the share of cosmetic solutions for guys within the general cosmetics sector is relatively compact. Oil control and cleansing are the two major worries. Though facial cleansers go ahead and take lion’s share with the male marketplace, the need for specialty products and solutions like masks, sun-blocks, and people with whitening and moisturizing capabilities is likewise rising. This demonstrates that male customers are having to pay much more notice to skin problems these kinds as aging and coarseness.

Cosmeceuticals: organic cosmetics

Cosmeceuticals, primarily Chinese organic cosmetics, are opening up a different territory in the cosmetics current market. It can be understood that more than 170 enterprises have tapped into China’s cosmeceuticals current market to this point, and quite a few of these renowned pharmaceutical firms in China, this kind of as Tongrentang and Yunnan Baiyao.

According to a report by the forwarding Industry Research Institute, the cosmeceuticals industry maintained a double-digit growth rate, while China’s consumer goods market remains at a single-digit growth rate. The market size soars to 62.5 billion yuan (USD 9.2 billion) in 2017 from 11 billion yuan (USD 1.6 billion) in 2010 at a compound annual growth rate of 28.16 percent. China’s dermo-cosmetics market is expected to hit 81.1 billion yuan (USD 12.0 billion) by 2023.

Whilst cosmeceuticals have professional medical qualities, they can be labeled as cosmetics because you can find nevertheless no official definition for the term “cosmeceuticals” on the mainland. According to the Restrictions around the Hygienic Supervision in excess of Cosmetics, no health care jargon or claims of professional medical efficacy should be utilized in beauty items’ packaging or instructions.

China’s cosmetics market – opportunity & challenge for foreign companies

China’s cosmetic market is gaining momentum. This is a market full of opportunities while competition and challenges exist.

Chinese customers are not like Western buyers, just as this article explains, and the market is also different from foreign ones. Therefore, localization from products to marketing strategies is very essential for the brand’s success.

Before entering the market, you need to understand Chinese customers’ lifestyles, and shopping attitudes, last but not least, the Chinese e-commerce platform, e.g. Tmall, JD, XiaoHongShu, Jumei…

Branding is the key to winning on the Chinese cosmetics market

To stand out from the huge competition in China, building an evocative and high qualitative image is crucial. Chinese consumers do not rely a lot on what companies are saying due to many scandals that happened in the past. They build their own appreciation by making research and a Brand’s word-of-mouth is very important.

Of course, you have to ensure your brand’s value and provide Chinese with quality products or services, but a good branding strategy will help you overtake local brands and gain a competitive edge over foreign competitors. Digital is the future of branding and Gentlemen Marketing Agency is specialized in this area. We help you to create and grow your brand in China by using the latest digital tools.

Chinese Social Media boosts your cosmetics brand recognization

There are 904 million (2019) netizens in China and most of them (80%) are using their smartphone to connect to the internet. Social media platforms have become their main interest online. They are connected to follow the news or their KOLs (Key Opinion Leaders in China), to be entertained, or for work. In fact, the limit between professional use and personal use of social media platforms is disappearing.

Also, when consumers need information, they research online to find it. Your brand needs to be referenced online in order to connect with your Chinese consumers. The main social media platforms such as WeChat or Weibo, the first for daily communication and the second for micro-blogging, are now used as research tools by the Chinese to find details about your product or service or to contact you.

We help you to choose a suitable strategy and take care of creating your page or account on the chosen network. Our effective Chinese staff will be in charge to answer all questions and requests from users.

E-Commerce helps Cosmetics Brands reach more Chinese customers

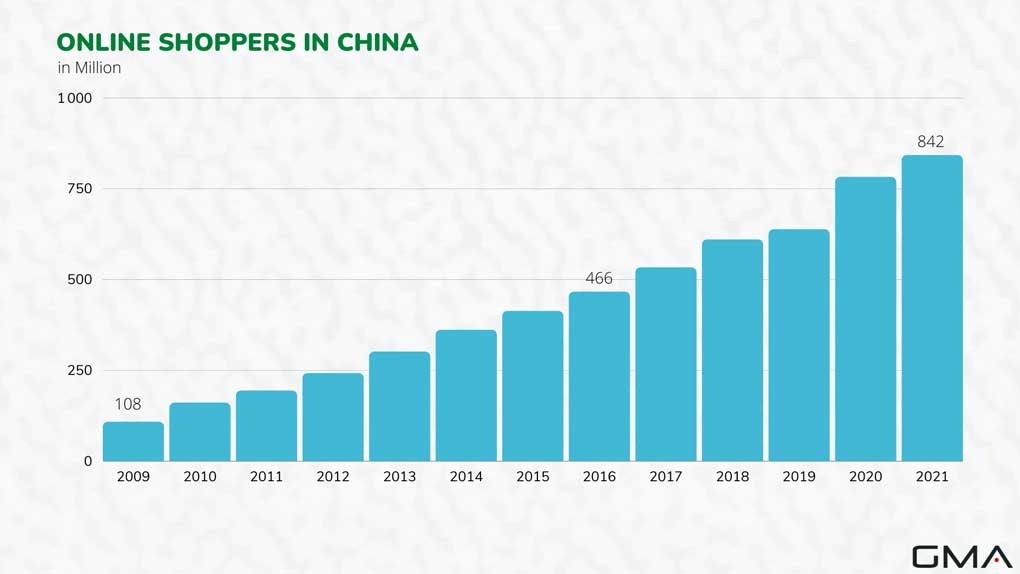

Today, Chinese consumers do their purchases most of the time online, through some specific e-commerce platforms. Actually, a lot of physical stores in the big cities fall into the dealing of being a showing-room.

The trend of online shopping occurred in early 2010 with Taobao, launched by Alibaba Group. Because of the fast pace of life in China, people are seeking more efficient solutions and services to get straight to the point. Another reason is the convenience of e-commerce.

We can find a larger range of products on the Marketplaces such as TMALL or JD.com, even imported products and foreign brands not available in China.

However, all these platforms are not equal. VIPshop and Little Red Book, for example, might be better to sell cosmetics than the others. We will find the best distributors to sell your products in China. Customers must find your product in a strategic location, whether it is online or in physical stores.

Example of Case study: RENE FURTERER

René Furterer is a French cosmetics company, located in Paris. They are specialized in hair care and beauty. The brand provides a wide range of products for different types of hair in China. The Cosmetics industry is expanding rapidly in China and is now among the most important sectors in the country with Chinese consumers’ new focus on beauty habits.

- We audited their TMALL and Taobao stores to facilitate sales. An in-depth report on performance/sales stats in their e-commerce field.

- Market competition analysis; also we manage social media marketing with KOLs. TMALL optimization resulted in a sales increase. A total of 100 KOLs engaged with the brand, over 60k new followers, and a significant improvement in the brand’s visibility (2.1M views).

TMALL’s B2D Strategy is changing the distribution in China

Recently, the platform has implemented a B2D strategy (Business to developers) to resolve the problem of China’s distribution. Through a dedicated application, TMALL manages to connect distributors with the brand directly to avoid any intermediate connections.

Concretely, while a brand sells its product to a distributor priced at RMB 20 when the final consumer wants to buy the product, the price could have already easily reached RMB 200 on the market.

Gathering all distributors, and providing them with the means to connect to the brand, allows for significant gains for all participants (the final customer, as the intermediary distributors) and therefore the success of the product and its brand in China.

When e-commerce combines with social = China’s Social commerce Craze

Little Red Book or Xiaohongshuis an e-commerce platform. But it is above all a platform that provides users with shopping tips, product reviews, advice, and promotional offers. Xiaohongshu gets a rapid development these years.

The app has more than 300 million registered users as well as 100 million active users. By providing useful content, Xiaohongshu is keeping its users on its platform every day. Little Red book analyzes the data of its subscribers so it can deliver customized content according to their tastes and expectations. The application keeps developing this group cohesion by strengthening the community’s feelings toward individuals.

Need help launching your beauty brand in China?

We are a Shanghai-based digital marketing agency, working in a multicultural environment. having more than 10 years of experience with multiple clients from all around the world, we have developed many successful projects and acquired the know-how to deliver results. We aim to help and partner with foreign companies to develop their business in the Chinese market.

Feel free to contact us to discuss your need

![Immunity Boosting Market in China [Full Report]](https://ecommercechinaagency.com/wp-content/uploads/2023/05/boosting-china-768x545.png)

Hello

Thank you for giving a very informative information.Please keep writing amazing blogs.

very good blogs. thank you for your help.

Hello , a growing middle class has put China on track to become the largest global market for cosmetics. it is a Vital Market for all Skin Care Brands in the World.

Hello

I am a importer in China and want to resell cosmetics products from oversea. I have connexion to some shopping mall , and can manage Tmall Store , douyin for you .

i am searching for famous brand of beauty

Let s connect, send me your Brochure and information on wechat please