Delving into the Chinese alcohol market, specifically in the realm of online sales, can feel a bit like wandering through an intricate maze. Trust me when I say this because I’ve navigated those twisty passages myself! You might be surprised to hear that beer is steadily growing more popular across China – quite the incentive for potential sellers like yourself.

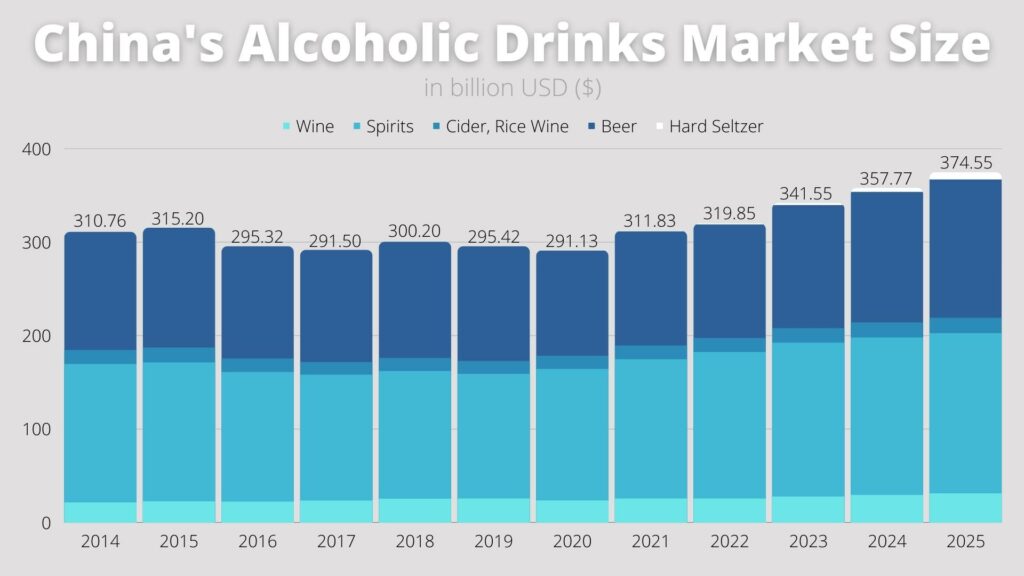

In 2022, the earnings hit 319.9 billion USD. By 2027, China’s alcoholic drinks market is predicted to grow to 385.6 billion USD. If global companies want a piece of this big market, they need to understand how China works and adjust their approach to the market dynamics and key industry trends.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

But fear not! This blog post intends to guide you with practical insights about making your mark within this highly profitable sector. Are you ready to take on the rich tapestry of China’s thriving digital landscape? Let’s dive headfirst into it!

Key Takeaways

- The Chinese alcohol market amounted to 319.9 billion USD. By 2027, China’s alcoholic drinks market is predicted to grow to 385.6 billion USD.

- Selling alcohol online in China is a good idea. The digital market is growing fast, making it a great place to sell drinks.

- There are strict rules for selling alcohol in China. Understand these rules before you start selling there.

- Use social media to sell your brand in China. Get help from big names on the internet or Key Opinion Leaders (KOLs) too!

Overview of the Chinese Alcohol Market

The Chinese alcohol market is diverse, offering a variety of alcoholic beverages that cater to wide-ranging consumer preferences. From locally produced baijiu to imported wines and spirits, there is an expansive selection that appeals to different tastes.

China’s alcoholic beverage market is changing rapidly due to shifts in taste, more disposable income, and a booming middle class. While Baijiu was once king, drinks like Wine, Spirits, and now Hard Seltzer are gaining ground.

The wine sector expects a 45.15% revenue jump from 2014 to 2027, highlighting its rising popularity. Spirits too have seen a 23.44% growth, with a demand for premium and imported brands. Hard Seltzer’s introduction has shaken things up, pulling in 2.09 billion USD in three years, and showing vast potential for both local and international companies.

Notably, foreign brands are gaining traction due to their perceived quality and prestige. Furthermore, the demand for beer in China has been on the rise, opening up lucrative opportunities for both local and international brewers.

With income levels increasing rapidly across the country, more consumers are showing a preference for premium liquors over traditional drinks – powering growth in what is already one of the world’s largest alcohol markets.

Popularity of foreign brands

People in China love foreign drinks. This includes mixed cocktails and Western spirits. These goods from other countries have a big fan base in the Chinese market.

Big businesses from all over the world make their beer and spirits in China. Even though these companies are not from China, they still do well. It is clear that people crave drinks from other places, especially those ready to serve or pre-mixed cocktails made by Western spirit producers.

Types of alcoholic drinks preferred by Chinese consumers

Beer

Beer remains a dominant force in China’s alcohol market. Year-on-year, beer sales have seen a remarkable increase of 34%. China is not just a massive consumer but also a leading producer, contributing to 25% of the global beer output and producing a staggering 35.7 billion liters in 2022 alone.

The beer landscape is dominated by brands such as Tsingtao, Snow, and Harbin. What makes beer so popular among Chinese consumers is its flavorful yet mild taste, with an average alcohol content of around 5%.

Notably, millennials have developed a penchant for beer, with 91% frequently indulging in white, yellow, and dark beers. While Germany stands as the top beer importer in China with a 52% market share, the market is also observing a growing demand for imported craft beers.

Spirits

The Spirits segment is massive in China, with the market volume reaching an impressive US$156.70 billion in 2022. This category is broad and includes liquors like Vodka, Whisky, Rum, Brandy, Gin, and, of course, the traditional Chinese liquor, Baijiu.

Baijiu holds a significant place in the hearts of the Chinese, often being the drink of choice during traditional ceremonies. Among the imported spirits, whisky is the most preferred, purchased regularly by 18% of consumers. Brandy and vodka also have a significant following.

Hard Seltzer

Hard Seltzer is a category on the rise, witnessing a substantial revenue increase of 1.07 billion USD between 2019 and 2022. Hard Seltzer caters to consumers’ desires for beverages that are both refreshing and low in alcohol, emerging as a contemporary alternative to more traditional alcoholic drinks, lowering heavy alcohol consumption.

Wine

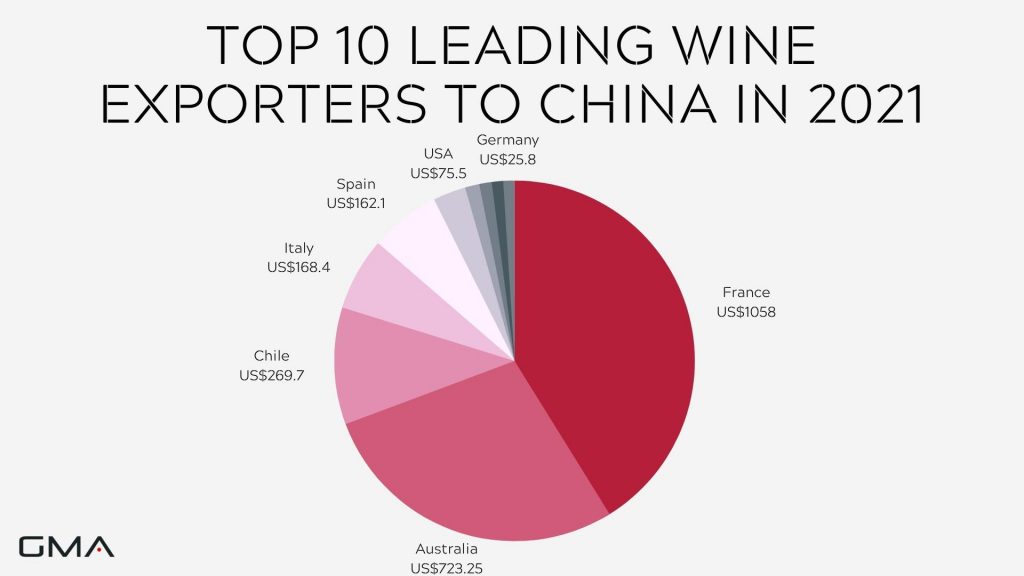

The Wine market has been flourishing. Between 2014 and 2022, the segment enjoyed a robust growth rate of 40.68%. Red wine stands out as the most popular among Chinese wine enthusiasts, making up a whopping 80% of all wine per capita consumption.

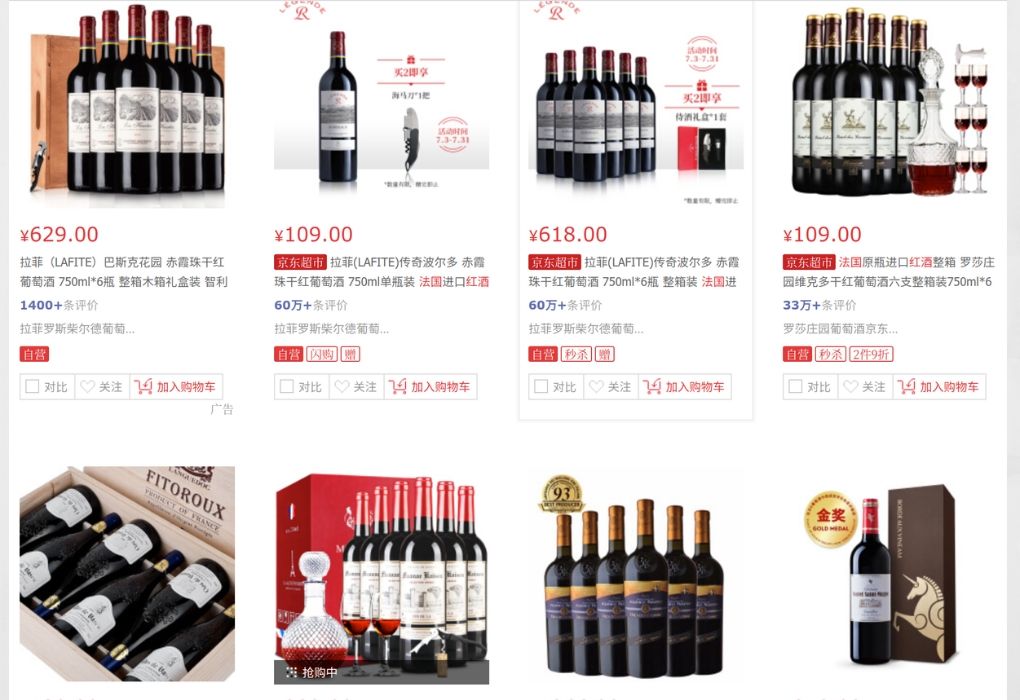

Approximately 20% of the wine imports come as bulk wines. It’s also interesting to note the shift in consumer behavior as many now prefer to research and purchase wine online through platforms like JD.com, Taobao, and Tmall. Wine fairs are becoming increasingly popular, allowing brands a direct interaction with potential consumers.

Cider, Perry, & Rice Wine

The cider, perry, and rice wine segment comprise beverages produced from fermentation processes, excluding grapes, such as fruit wines, and rice wines like Sake and Soju. This segment experienced a revenue growth of 15.58% from 2014 to 2022, which clearly indicates the growing interest in these beverages.

Such drinks, especially fruit wines, have found a particular audience among millennials, who are always on the lookout for novel experiences and flavors.

Pre-mixed alcoholic beverages

Lastly, Pre-mixed Alcoholic Beverages have been carving out their niche, especially among young Chinese women aged between 20 and 30. The allure of pre-mixed cocktails lies in their convenience and trendiness, eliminating the need for elaborate preparations, unlike other mixed alcoholic drinks. These beverages offer a hassle-free, fashionable choice for those looking to enjoy a night out with friends.

The Best Tactics to Promote Alcohol Online in China

China’s digital market is exploding with potential. Social media and Key Opinion Leaders (KOLs) are excellent tools for driving brand awareness and attracting customers. Building a robust online presence can skyrocket your alcohol sales in China.

Create a Chinese website and focus on Baidu SEO

If you’re looking to sell alcohol online in China, it’s crucial to have your own Chinese website. This isn’t just about language but about making sure your site feels familiar and easy to use for local customers.

Once you have your site set up, you can’t ignore Baidu, which is like the Google of China. You’ll want to make sure your website shows up when people search on Baidu, and that’s where Baidu SEO comes in. Remember, Baidu works differently from other search engines, so you’ll need to learn its rules.

In short, if you want to attract Chinese distributors and buyers, start with a local-friendly website and get savvy with Baidu SEO. It’s a practical and effective way to make your mark in the Chinese alcohol market.

Utilize social media and KOLs

In the dynamic China’s liquor industry, understanding and effectively using social media is not just an advantage—it’s a necessity.

One of the foremost platforms to start with is WeChat. This multifunctional app is deeply ingrained in the daily lives of Chinese consumers. By setting up a WeChat official account, brands can gain credibility and establish a direct communication channel with their audience. You can design interactive H5 brochures that provide detailed product information, launch WeChat stores for easy access to your products, and regularly post updates to keep your followers engaged.

For brands aiming to captivate the younger demographic, Douyin is a prime platform. Its short video format is a hit among the youth, and it’s an excellent space for brands to showcase their personality, values, and of course, products, in an entertaining manner. The vibrant and energetic nature of Douyin content can make your alcohol brand resonate with the younger generation, making them more likely to become loyal customers.

Weibo, another influential platform, should not be overlooked. Known for its power to make content go viral, Weibo is where trends often start. Sharing engaging stories, hosting contests, or simply putting forward captivating visuals can give your brand the boost it needs to capture the Chinese audience’s attention.

On the other hand, Xiaohongshu offers a different kind of appeal. It’s a hybrid social media and e-commerce platform where users share product reviews, lifestyle tips, and more. Collaborating with Key Opinion Leaders (KOLs) on Xiaohongshu can be a game-changer. These influencers can create authentic content around your brand, providing reviews or tutorials, which can significantly influence purchase decisions.

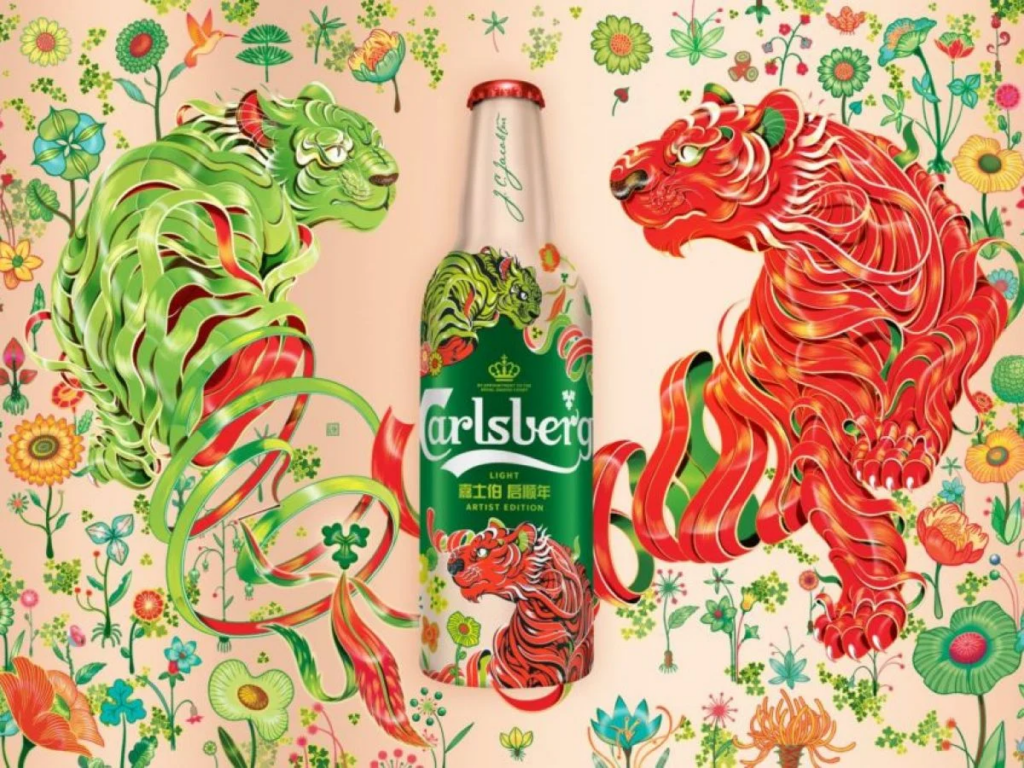

Good branding and localization are keys to success

Establishing a brand in the Chinese market demands more than just translating a global strategy; it requires a deep understanding of local tastes and preferences. Central to this is the adaptation of product tastes and packaging designs to align with local sensibilities.

For instance, flavors and ingredients favored in the West might not be as popular in China, and vice versa. Similarly, packaging that works well in one region might not resonate with the aesthetics and cultural symbols familiar to Chinese consumers.

Brands must invest in thorough market research to truly understand their Chinese audience’s desires and expectations. By tailoring products and their presentation to the local palate and preferences, as well as to the market insights, companies not only show respect for Chinese culture but also significantly increase their chances of success in this diverse and competitive marketplace.

Maintain good e-reputation

In China, what people think of your brand is super important. If they hear something bad about it, they might stop buying from you. So, if you’re selling things like wine or beer, you should make sure people are saying good things about your brand online.

Chinese shoppers often check online comments before they buy. They trust what their friends, family, and others say on the internet. If they see good comments, they’re more likely to buy your product. But one bad comment can make many of them change their mind.

So, it’s a good idea to keep an eye on what people are saying about your brand online. If this sounds hard, you can get a digital marketing agency to help. They can make sure that most of what people see and hear about your brand is good.

Challenges and Solutions for Selling Alcohol Online in China

Navigating the online alcohol sales scene in China brings a mix of challenges and opportunities for brands. Here’s a breakdown:

Enter E-commerce Platforms

The digital market is vast, and pinpointing where to place your brand can seem overwhelming. Major platforms like Tmall, Taobao, JD, and Pinduoduo each cater to different audiences and have their own dynamics. To navigate this, brands should research and understand the core audience of each platform.

For instance, Tmall is perfect for high-end brands due to its upscale consumers, while Taobao attracts a more general crowd. JD is famed for its strong distribution network and logistics, making it a top choice for brands aiming for extensive reach. Pinduoduo, with its group-buying approach, is for those targeting consumers seeking discounts.

Regulate Product Listings

E-commerce platforms in China have strict rules around product listings. Keeping every detail in line with these regulations can be a task. To handle this, brands should invest effort into familiarizing themselves with the specific requirements of each platform. For example, Tmall might ask for more detailed product descriptions than Taobao. Regularly revising listings to ensure they’re in line with the platform’s latest standards is key.

Distribution Challenges

Given China’s vast landscape, ensuring timely deliveries and upholding product quality during transit can pose challenges. A solution is to form partnerships with well-established platforms. JD, for example, offers a broad logistics network, easing some distribution concerns. Brands might also think about using local distribution centers to ensure quicker deliveries.

Competition and Pricing

The online alcohol sector in China is crowded. Standing out while also offering competitive prices is a challenge. To combat this, brands should underscore what sets them apart. Whether that’s the history of the brand, the quality of ingredients, or a distinct flavor profile, it should shine through in online listings.

Also, keeping an eye on competitors’ pricing, especially on bargain-centric platforms like Pinduoduo, is crucial.

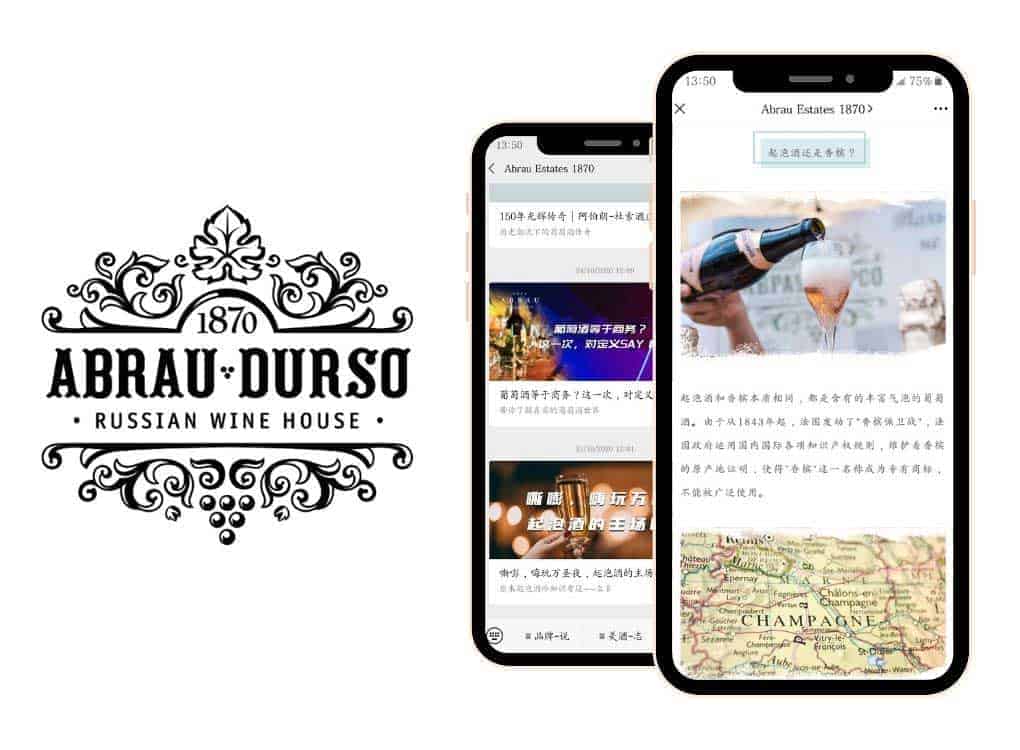

Case Study: Abrau Durso in China

Abrau Durso is a renowned Russian wine brand, particularly known for its sparkling wines. With a history that dates back to 1870, Abrau Durso wanted to tap into the burgeoning Chinese wine market and address Chinese drinking alcohol from abroad. Entering China was a formidable task due to its complex marketplace dynamics, competitive landscape, capita alcohol consumption favoring Baijiu, and established wine preferences.

Strategy

- Localization: Abrau Durso understood the need to resonate with the Chinese consumer. They held wine tasting events and exhibitions to introduce Chinese wine enthusiasts to their products, emphasizing the uniqueness of Russian sparkling wine compared to its more familiar Western counterparts.

- Brand Positioning: The brand emphasized its historic legacy and the high quality of its wines. They promoted the fact that their wines come from one of the oldest wine-producing regions in Russia, appealing to Chinese respect for tradition and authenticity.

- Collaborations: Partnering with local influencers and wine experts, Abrau Durso organized events to promote its wine varieties. This collaboration allowed the brand to reach out to a broader audience, utilizing local figures’ credibility to vouch for its products.

- Distribution: Abrau Durso made its products available on major e-commerce platforms such as Tmall and JD.com. They also targeted upscale restaurants, bars, and hotels in major cities to cater to the elite, who often drive trends in the Chinese alcohol market.

By adapting its strategies to fit the Chinese market, Abrau Durso successfully introduced Russian sparkling wine to a vast new audience. Its presence in both online and offline channels ensured maximum visibility, and its collaborations gave it an authentic touch in a foreign land.

How We Can Help Expand Your Alcohol Brand in China

Our expertise lies in providing comprehensive support that enhances your brand’s reach, from navigating legal prerequisites to crafting winning strategies for the competitive online market.

Want to tap into China’s bustling alcohol industry? Keep reading to discover how we can bolster your success!

Comprehensive services for market entry

I’m here to help you grow your alcohol brand in China. You don’t have to do it alone! Here’s how I can support you:

- We’ll look at the big picture of your brand.

- We will find out what works for your kind of drink in China.

- We will create a plan just for your brand to succeed in China.

- I can help you understand all the rules about selling alcohol in China.

- We can use the best online places and tools to make your brand known.

- My team and I will keep an eye on new things happening in the Chinese market that may affect your brand.

- Don’t worry about legal stuff! My team has got that covered too.

Latest developments in the Chinese market

Big changes are happening in the Chinese alcohol market. More people want to read about drinks online before they buy. This trend is making online sales of alcohol go up fast! The rules for selling drinks are also changing.

These changes can open new doors for brands and sellers looking to grow in China. Lastly, things might get better in 2023 after a tough year in 2022.

Compliance and legal support

We know the law can be hard. But we are here to help. We will give you all the legal support you need for your alcohol sales in China. We know a lot about this field, so we can guide you with export regulations and compliance rules.

Selling wine, spirits, or beer in China needs a good plan.

Also, our team is always up to date on changes to these laws. For example, only drinks that meet certain standards can come into China from other countries. Our job is to make your brand fit well within these guidelines.

If you’re ready to enter the market, contact Gentlemen Marketing Agency today!