China has, for a long time, been the world’s manufacturing hub, with more than US$2.591 trillion worth of goods around the globe in 2020. But in recent years, it also became a digital powerhouse with more than 989 million internet users (in 2020) contributing to the rising use of social media and e-commerce at the forefront of their daily lives. One company that has taken advantage of this trend is Vipshop. Even though it operates only in China, its evolution is promising for fashion brands tapping into the Chinese market. By offering a wide range of brands to Chinese consumers, this online platform is a remarkable and useful tool to help brands make their way in the most populous country in the world.

What is VIP Shop?

Founded in 2008 and based in Guangzhou, VIP Shop (唯品会 Wei Pin Hui) is the third-largest e-commerce company specialized in online discount sales, with revenues of RMB 93 billion in 2019. Following its huge success, it was even listed on New York Stock Exchange (NYSE) in 2012.

VIP Shop is specialized in selling high-end fashion, cosmetic & beauty products, as well as home items at a discounted price. VIP Shop is divided into VIP.com, and VIP International, with warehouses all across China and overseas. VIP international uses direct overseas procurement and has its own delivery partners in Mainland China which allow the company to reduce some costs and provide qualitative and low-cost services to customers.

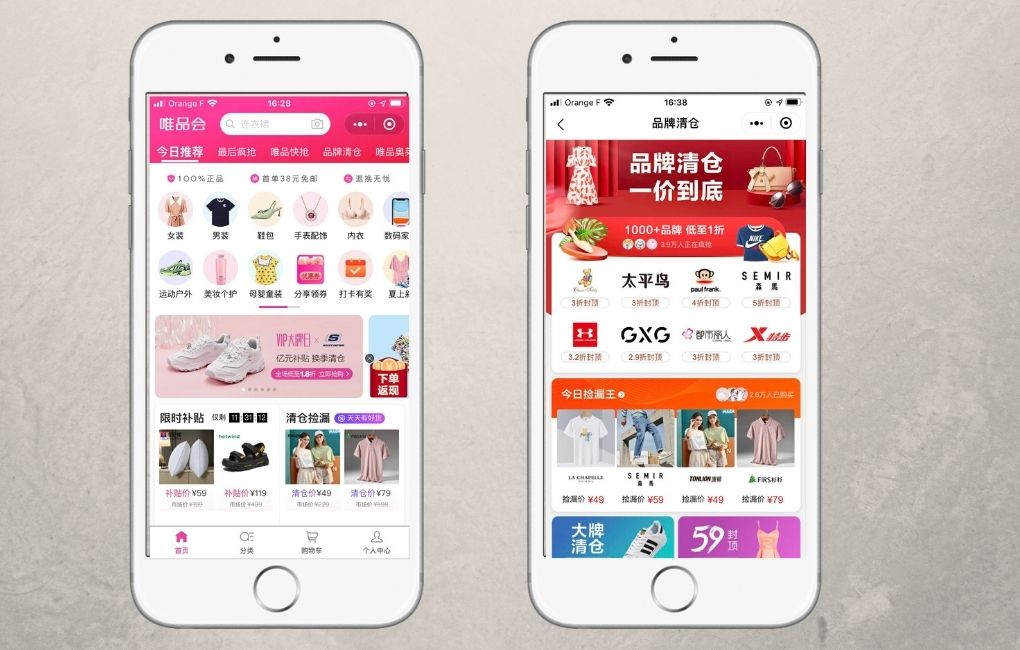

VIP.com

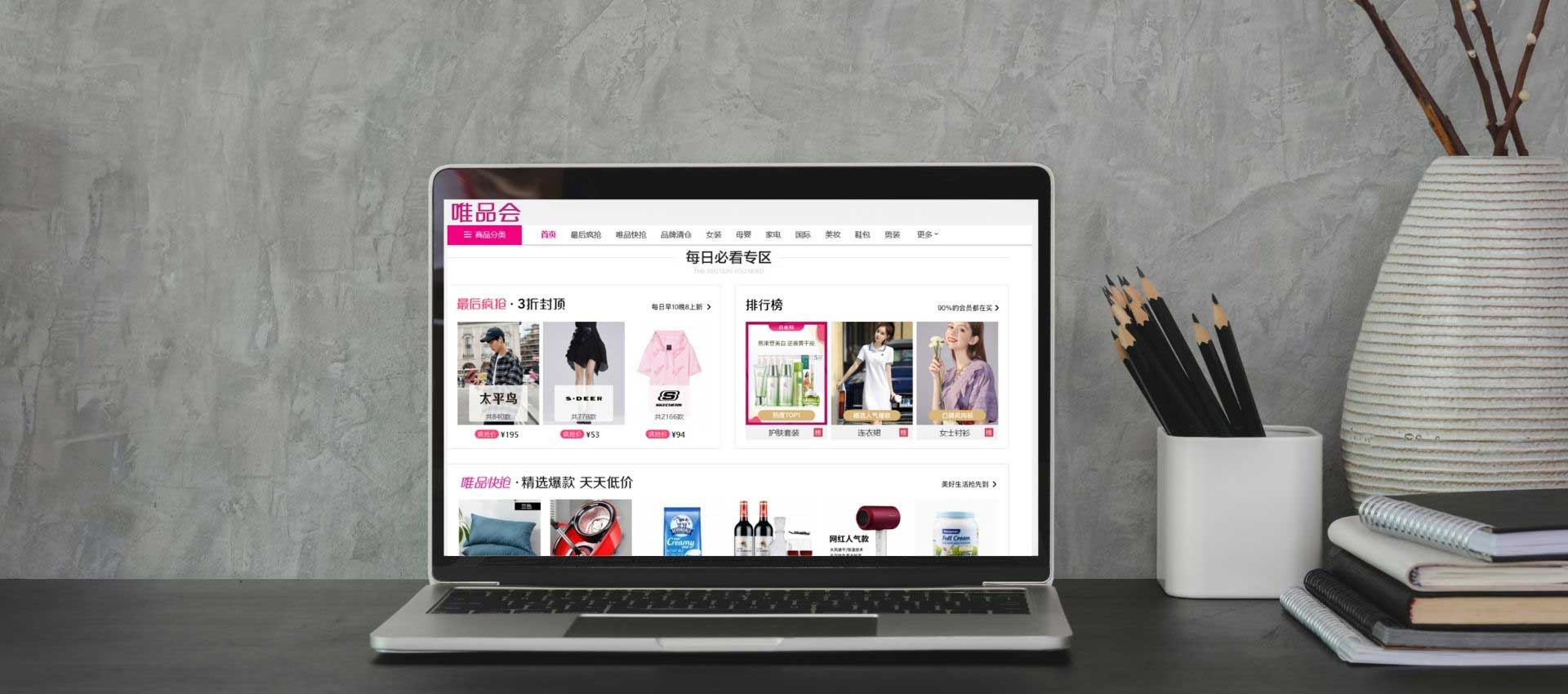

VIP.com Website

Vip.com is the leading online discount retailer for brands in China and its total active customers grew by 14% from 2018 to 2019, reaching 69 million active consumers. 85% of customers were regular customers and, accounting for approximately 96% of the sales. It is also important to underline that VIP.com is one of the world’s fastest-growing retailers.

VIP.com in numbers (according to VP.com’s report)

- More than 20,000 brands have joined VIP.com

- More than 2,200 brands have developed an exclusive partnership with VIP.com

- More than 300 million Chinese users have used VP.com

- It is the third-largest online retailer in China, after Tmall and JD.com

- 24.1 billion yuan of net revenue as of 2020

VIP International

VIP International’s Website

Introduced in 2014, VIP International is the cross-border section of VIP Shop, taking up 10% of the cross-border e-commerce market. On VIP International, all products are sourced and bought directly from overseas, while Chinese products are sold on VIP.com.

Some characteristics of VIP International

- It has set up professional buyer groups in 11 countries and regions to guarantee the products’ authenticity.

- It has also formed close relations with several consulates and long-term partnerships with well-known brands across the world.

- In-house 24/7 customer service

- Consumers can return goods within 7 days without any explanation. The process will be treated in China, so it means that they will quickly receive their refund.

- Based on its 12 warehouses overseas and 11 bonded warehouses in China, VIP International has built a sophisticated and flexible logistics network, which enables it to start delivery within 12 hours after orders are received.

Known for its variety of reputable international brands, VIP international is among the most popular e-commerce platforms in China, especially among the younger generation. Its main competitors are Tmall Global, JD Worldwide, and Kaola.

VIP Shop Users

Gaining popularity in recent years, VIP Shop has attracted more than 300 million users across China, and 69 million active shoppers as of 2019, a number that is going to increase significantly following the Covid-19 pandemic. As in any other part of the world, Chinese consumers were mainly purchasing directly online, increasing, even more, the gap between brick-and-mortar stores and e-commerce platforms.

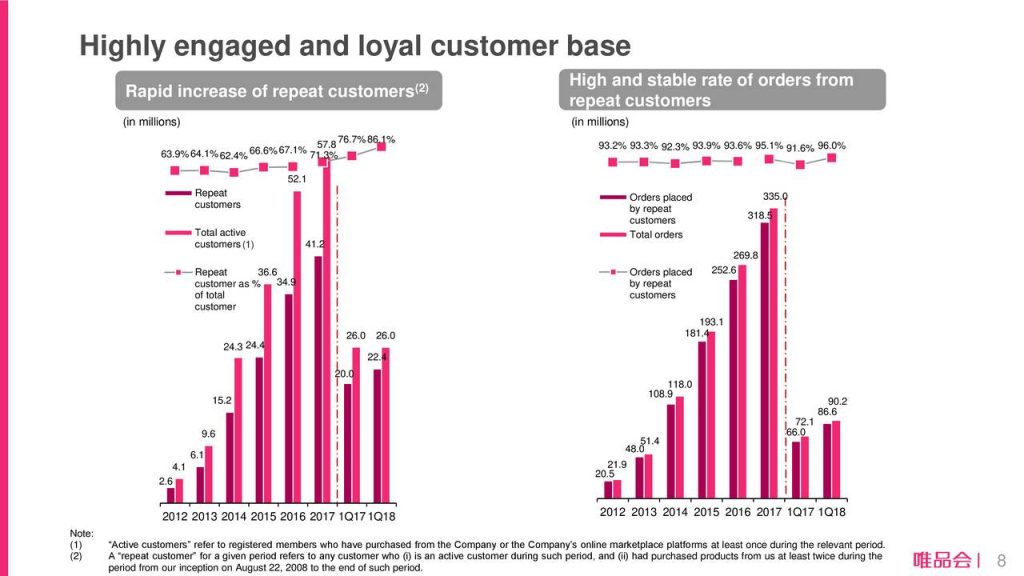

As we can from this data, thanks to its services and wide range of products, VIP users are loyal to the website, regularly purchasing on it. In fact, VIP Shop has one of the most highly engaged and loyal customer bases. Moreover, you have to take into account that almost 70% of VIP users are women born between 1980 – 1995, with a younger consumer base than before.

VIP Shop sales’ model

Compared to other e-commerce platforms such as Tmall and JD.com (B2C), VIP Shop has 38.1% of China’s online discount market share, becoming the world’s largest flash sales website. The products available on the platform are relatively low-cost compare to Tmall and JD.com, which is more resembling Taobao.

As a platform specialized in fashion, VIP shop was able to collaborate and sponsor many international fashion events such as the London Fashion Week in 2018, one of the world’s most popular fashion events. Through this sponsorship and partnership, it aims to introduce more trendy and authentic international brands to Chinese consumers via its powerful platform.

How fast is VIP shop growing?

Like JD, Vipshop mostly uses an in-house logistics network instead of relying on third-party delivery services like Alibaba. That’s why VIP shop and JD consistently report lower operating margins than Alibaba.

VIP shop runs a B2C (business-to-consumer) online marketplace that sells apparel, accessories, and other products through ongoing flash sales. Having about 2% of China’s e-commerce market in 2017, VIP Shop is now just after Tmall and JD.com and was able to surpass Pinduoduo and Suning.

JD.com and Tencent co-invested $863 million in Vipshop 2017 to counter Alibaba’s supremacy. That investment gave Tencent a 7% stake and boosted JD’s existing stake from 2.5% to 5.5%. VIP Shop has launched more than 400 million “mini-programs” on WeChat (the top messaging and most popular app in China). It also bundled VIP membership packages with Tencent Video subscriptions.

Users are able to pay with VIP’s Payment system and other third-party online payment services such as WeChat pay or Alipay.

What kind of products are sold on VIP.com and VIP International?

Categories of products Featured on VIP Shop’s Website

VIP.com is still relatively small compared to Tmall and JD that are dominating the domestic and general E-Commerce market. VIP International, on the other hand, was able to overtake Tmall and Kaola in terms of sales.

As shown on VIP.com’s website, you will see that almost all the brands displayed on the website are internationally renowned brands in the sectors of beauty, cosmetics, apparel, and clothes.

VIP.com and VIP International are not very suitable for small-sized companies, as it mainly works with brands that Chinese consumers are already aware of. Some notable brands that are working with VIP Shop include Calvin Klein, Armani, Tommy Hilfiger, Adidas, Maybelline, Bioderma, etc.

VIP Shop: A Taobao Competitor?

It is important to take into account that VIP Shop also targets consumers in China’s lower-tier cities. While Alibaba, which has a market cap of $256 billion, dominates China’s e-commerce landscape with its marketplace that connects buyers and sellers, Vipshop has carved itself a small, but profitable niche.

Compared to Taobao, VIP Shop allows its users to benefit from incredible flash sales in terms of fashion, cosmetics, beauty products, apparel, etc. These events are VIP Shop’s main success among Chinese consumers. As a matter of fact, the more people can have access to flash sales, the more lucrative the event will be, attracting millions of consumers. The platform often organizes its sales around “featured brand+heavy discount+ flash sales” on many special occasions such as 11.11, Valentine’s Day, Labor Day, Children’s Day, etc.

How to Sell on VIP.com?

If you want to sell your goods on VIP.com, you will have to develop your online reputation first, as the platforms only accept brands that are already known by Chinese consumers. Then, either you can apply directly through VIP Shop’s website, or via Tmall’s partners.

Don’t forget that you’ll also need a Chinese website with a “.cn” domain to ensure that your website will run correctly in China. Moreover, it will drive traffic to your website’s Chinese website at the same time as you’ll sell products on different marketplaces like VIP shop, Tmall, or JD.

After that, you can increase your visibility through social media such as WeChat, Weibo, and Xiaohongshu for example. Then, you’ll have to provide a Chinese entity with several official documents. Don’t forget that you’ll also have to provide any information about your company (Company name, Email, Description of your company and your activities, your website, categories of products you want to sell, etc) and send all of this through the website and via email to this address: global@vishop.com. If they don’t reply to you within a week, you can try to contact them again via this email: feeback@vishop.com.

Compared to other platforms such as Tmall and JD.com, VIP.com is way less expensive and not as strict in terms of regulations and funds. You won’t have to pay membership fees, deposits, listing fees, etc.

The waiting process will take about 5 weeks, then you’ll be able to sign the official contract and upload your products online. Be careful, all the process is in Chinese, so you’ll need to have a Chinese native employee, or contact an agency that will take care of the process. You can contact us to have more information, and we’ll take care of everything.

VIP.com and WeChat

VIP.com has linked to WeChat in the way that its platform is directly accessible through WeChat. Thus, it is easier for users to click on it. They don’t even have to download it, as it works like a mini-program on WeChat.

Another very popular feature of VP.com is that it allows brands to directly have their mini-program through WeChat, attracting more consumers as well as increasing their sales.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Why should you choose VIP Shop to sell your products in China?

The e-commerce industry in China is booming, and it’s much more common to sell luxury goods via online channels in China than in the West. Because of this, many international luxury brands have partnered with Chinese e-commerce companies over the years to sell their wares, and Vipshop offers international luxury brands an interesting alternative to the country’s leading players.

Vipshop provides services that help brands manage their sales like WeChat mini-program stores and official Chinese websites.

A good example of a VIP Shop using a mini-program on WeChat is Fendi. Vipshop created a pop-up store via mini-program for the Italian luxury brand to promote its “FF Reloaded” collection in May.

Another brand, Salvatore Ferragamo, had its Chinese website run by a VIP shop. Over the past ten years, Vipshop appears to have amassed a young, highly engaged, and loyal customer base deeply concerned with fashion and luxury.

Contact us to sell on VIP.com

VIP can be an effective trial tool for foreign brands to test out their newest products in the Chinese market before venturing into more substantial e-commerce activities. At the same time, flash sales websites can be considered an effective marketing technique to give more exposure to one’s brand.

China’s e-commerce market is full of potential but there are also a lot of challenges that foreign brands should be ready to face. Entering the Chinese market is not as easy as it might seem. Thus, collaborating with an agency specialized in the Chinese market is extremely rewarding and cost-effective.

With almost 10 years of experience in this field, GMA knows exactly what solution should be applied to your business according to your needs, budget, and expectations. Proud of the success of the companies we have accompanied through the process of expanding their activities in China, we want to help every motivated and determined company. If you have any questions about VIP.com, VIP international, or simply about the Chinese market, do not hesitate to contact us and we will reply to you within 24 hours.

Let know about what going on here.on may way,I know on VIP side,there’s no play.

How much will it cost to sell on vip.com I have a unique organic skincare line which includes soaps and skin creams . My company is a small start up with great potential in the organic market, but we will need a partner to invest with to help us grow .

Hey Saleemn

Your project sounds great and Organic cosmetic has great potential in China.

To know more about the cost of VIP and how to sell on VIP feel free to contact-us via our contact form or at ecommerce@marketingtochina.com , we are always happy to assist!