Alibaba has introduced the “Taobao Exchange Market” (宝购汇市), a new app dedicated to selling competitive prices, lower than those found on its own platforms like Taobao and Tmall, and even undercutting prices on Pinduoduo, a rival app.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Alibaba’s gaming subsidiary, Lingxi Interactive Entertainment, launched an e-commerce app called “taobao Exchange Market,” focused on beauty shopping.

However, Lingxi Interactive Entertainment has responded to Interface News, clarifying that they have no connection with “Taobao Exchange Market” or its developer, “Shanghai Jiaoyi Mao Technology.”

The Apple App Store lists the developer of the Taobao Exchange Market app as “Shanghai Jiaoyi Mao Technology.” Interface News, upon checking the Tianyancha platform, did not find the aforementioned “Shanghai Jiaoyi Mao Information Technology Co., Ltd.” mentioned in the reports.

Among the subsidiaries of Lingxi Interactive Entertainment, there is a similarly named “Guangzhou Jiaoyi Mao Information Technology Co., Ltd.”

Lingxi Interactive Entertainment further stated to Interface News that the information about the app developer can be easily changed. The APP is actually operated by a company based in Hunan, which has no affiliation with Lingxi Interactive Entertainment. source

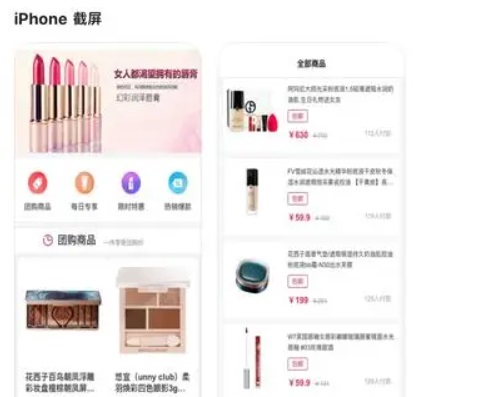

Group-buying, daily exclusives, limited-time discounts, and best-sellers

The Taobao Exchange Market app offers four main channels: Group-buying, daily exclusives, limited-time discounts, and best-sellers. It features a wide array of both domestic and international brands, including Florasis, Dior, and YSL, many of which are popular on Taobao.

With product prices ranging from 10 RMB ($1.41) to over 1,000 RMB ($140), the app targets a broad spectrum of consumers, from those who are price-sensitive to those willing to spend more.

The question arises whether this standalone beauty app will enable Alibaba to broaden its reach in the online beauty market or if it will eat into the sales of its other platforms. This move comes at a time when Alibaba is facing increased competition.

An analysis by GMA highlights that Alibaba is adapting strategies to meet new market challenges, possibly influenced by competitors like Pinduoduo, known for its heavy discounts and rapid growth. Additionally, Taobao’s dominance in the beauty market is being contested by Douyin’s rising e-commerce sector, particularly in the realm of livestreaming sales.

In the first three quarters of 2023, Douyin reported beauty sales of $13.6 billion, showcasing the potential in this category. Alibaba, recognizing the lucrative opportunity in the beauty sector, has invested in the Vietnamese beauty retailer Haski, valued at $2.2 billion, to strengthen its position.

However, the competition is fierce. Other e-commerce players are expanding their beauty offerings. For example, during the Singles’ Day festival, brands like Hourglass, Chantecaille, and Hairmax achieved impressive sales through live broadcast sessions on Xiaohongshu. Kuaishou also reported significant growth in its international brand GMV during the 618 shopping festival.

It remains to be seen how Alibaba’s Taobao Exchange Market will perform in the highly competitive Chinese beauty market.

China’s ecommerce landscape 2024

China’s ecommerce landscape is a dynamic market like usual full of transformations. It continues to change, and all brands must adapt to consumer behaviors, nw trend, embrace digital innovations, and leverage all good opportunities.

Read more