WeChat Video (copycat of douyin ) is getting really popular and open new function for Advertising linked to Miniprgrogram , or wechat Shop. WeChat Channel has rapidly evolved into a ROI player in the digital and e-commerce ecosystem in China

WeChat video look like this …

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

WeChat Channel’s E-Commerce GMV Exceeds 100 Billion Yuan, WeChat Pay Team to Join Development Efforts

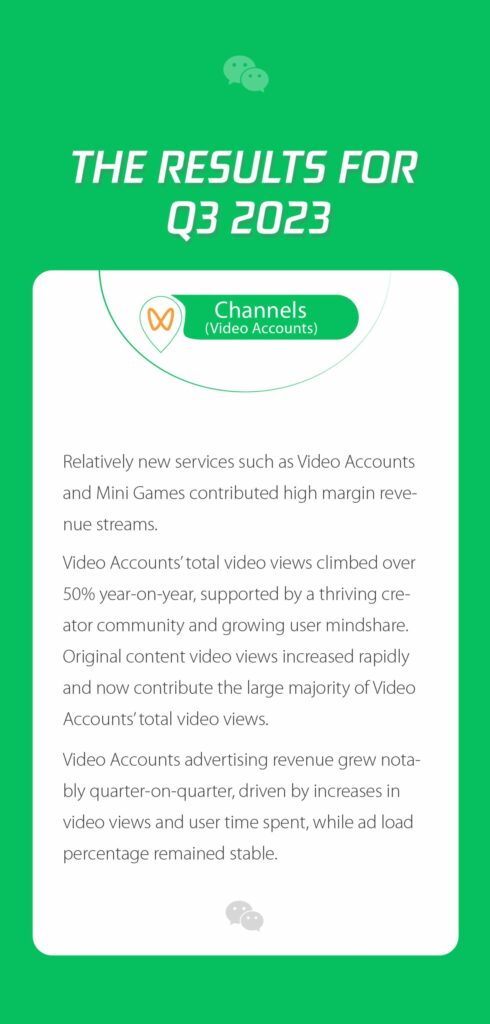

WeChat Channel is currently Tencent’s fastest-growing sector with the potential to generate significant revenue in the near future. If WeChat users start shopping on WeChat Channel, it’s likely to boost Tencent’s advertising revenues. In the second quarter of 2023, the internal circulation advertising revenue for WeChat (which includes ads for WeChat Mini Programs, WeChat Channel, Official Accounts, and WeCom as landing pages) increased by more than 30% year-on-year, accounting for over half of WeChat’s advertising revenue. Additionally, a source from Tencent revealed that WeChat Channel mini-stores have started generating revenue through commissions.

With a stable and scalable advertising revenue, Tencent’s other ventures can benefit from a better growth environment. The growth in sectors like WeChat Channel, WeChat mini-games, and e-commerce allows Tencent to maintain a robust growth rate even without major game launches over a three-month period.

However, when compared to industry counterparts(like Douyin) , both the advertising revenue and e-commerce of WeChat Channel are relatively small.

According to financial reports, WeChat Channel’s advertising revenue in the second quarter of this year was 3 billion yuan, while Kuaishou’s was 14.35 billion yuan in the same period.

In 2014, Alibaba, holding nearly 80% of China’s online retail market share, made the largest IPO in human history in the United States. That same year, Tencent sold its struggling e-commerce business to JD.com.

A decade later, the e-commerce industry has seen significant changes. Live streaming e-commerce has emerged, creating a new market worth trillions of yuan.

Philip, the founder of GMA, comments on the evolving e-commerce landscape in China: “The e-commerce market in China is undergoing rapid and dynamic changes, driven by technology and consumer preferences. Platforms like WeChat Channel are at the forefront of this transformation, offering new and innovative ways for brands to connect with consumers.”

WeChat handles a GMV of over 1 trillion yuan per quarter.

Tencent entered the e-commerce market in 2005 with its site Paipai.com, which reached 50 million registered users. However, by 2024, after not seeing significant improvement in its e-commerce ventures, Tencent sold the business to JD, shifting its focus to strategic investments in platforms like JD.com, Vipshop, and Pinduoduo.

In recent years, Tencent made sporadic attempts in e-commerce, such as the development of the Mini Program for smart retail and the innovative Mini program

Currently, Huiju has been adjusted to a brand discovery Mini Program

With the rise of live streaming e-commerce led by Douyin and Kuaishou, Tencent once again saw an opportunity. Now, the daily active users of WeChat Channel rank second nationwide, just after Douyin.

At Tencent’s third-quarter 2023 earnings conference, President Liu Chiping stated that short videos have paved the way for live streaming e-commerce. After establishing a good live streaming e-commerce supply chain and building relationships with relevant merchants, live streaming e-commerce can be developed.

A WeChat insider stated that Tencent’s current core idea for e-commerce is not to develop WeChat Channel in isolation but to consider how to integrate it with Mini Programs, WeChat Pay, and WeCom.

Before the emergence of WeChat Channel, many merchants already operated their Mini Program shops within WeChat. For example, luxury brand Louis Vuitton opened a Mini Program mall on WeChat but never opened a store on Tmall. An important reason is that luxury giants insist on controlling sales channels; they believe the traffic of Mini Programs is their own and worth carefully managing, but the traffic of Tmall stores is uncontrollable.

USD 210 BIllion GMV for WeChat

The Manager at Tencent explained that a quarter’s GMV of WeChat Mini Programs exceeds 1.5 trillion yuan, but a large amount comes from offline transactions and transactions generated by platforms like Meituan, JD.com, and Didi. The emergence of WeChat Channel not only provides more traffic and exposure for these merchants but also potentially retains new customers attracted by live streaming.

According to Tencent’s Chief Strategy Officer (CSO) James Mitchell, the current ad load of WeChat Channel is less than 3%, much lower than the over 10% ad load of domestic counterparts.

In a recent meeting, the WeChat team and Tencent’s top management discussed future plans. “The boss didn’t set any growth targets,” said the source. He just proposed some new innovative directions, encouraging the team to experiment and explore slowly

10 Facts about WeChat Channel in 2023:

- Rapid User Growth: WeChat Channel has seen a significant increase in daily active users, making it one of the most popular platforms in China after Douyin.

- Diverse Content Creation: The platform supports a variety of content formats, including short videos, live streams, and interactive posts, catering to a diverse audience.

- Integration with WeChat Ecosystem: WeChat Channel is seamlessly integrated with other WeChat services like Mini Programs, WeChat Pay, and Official Accounts.

- E-Commerce Capabilities: It has strong e-commerce capabilities, allowing brands to directly link their products and services in the content.

- Targeted Advertising: WeChat Channel offers targeted advertising options using Tencent’s vast data resources, ensuring relevant ads reach the appropriate audience.

- Live Streaming Features: The platform has enhanced its live streaming features, making it a hub for live commerce and interactive consumer engagement.

- Growing GMV: The Gross Merchandise Value (GMV) transacted over WeChat Channel has shown substantial growth, indicating its rising importance in e-commerce.

- Interactive Engagement: WeChat Channel focuses on high user engagement with features like comments, likes, and shares, fostering community interaction.

- Brand Exposure: It offers significant exposure for brands, both through organic content and paid advertising.

- Mobile-First Approach: WeChat Channel’s mobile-first approach aligns perfectly with China’s predominantly mobile internet user base.

Conclusion about WeChat Channel and E-commerce for International Brands:

WeChat Channel has rapidly evolved into a formidable player in the digital marketing and e-commerce space in China. Its integration within the broader WeChat ecosystem provides brands with a unique opportunity to engage with consumers through rich, interactive content while seamlessly connecting to e-commerce functionalities. The platform’s robust user base, combined with advanced targeting and analytics capabilities, makes it an ideal choice for brands looking to expand their reach and drive sales in the Chinese market.

Need a partner in China for your e-Commerce?

For businesses seeking to leverage the full potential of WeChat Channel, partnering with a specialized Ecom agency like GMA (Gentlemen Marketing Agency) can be a strategic move. GMA, an agency with expertise in WeChat, specializes in e-commerce and offers services ranging from video production, content creation, to developing Mini Programs and WeChat stores.

Our deep understanding of the WeChat ecosystem and the Chinese digital landscape makes us well-equipped to help brands navigate and succeed in this complex but rewarding market.