The Chinese Cherry’s market is very interesting for producers in the world. You should read this article to have a better understanding of the Fresh Fruit market in China.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Case study : How to sell Cherries on Chinese e-Commerce?

China: Pinduoduo and the Chilean Fresh Fruit Exporters Association team up to welcome peak cherry sales season

The Chilean Cherries Committee and Pinduoduo held a joint press conference on December 22 to welcome peak season sales.

Cherry in China is a status symbol, as they are expensive.

Juan Jose Vidal Wood from Chile, the Chilean Commercial Consul to Shanghai stated that Chile’s unique geographic environment makes it an ideal place for growing cherries. To ensure safety and perfection in both the production and export supply chains, the Chilean Cherries Committee and the local government have invested significant manpower and material resources into the packaging and orchard.

“We are happy to sell Chilean cherries to friends on Pinduoduo.”

read more about Pinduoduo

The Chilean Cherries Committee and Pinduoduo have been working closely since last year’s strategic cooperation. They have created the shortest supply chain model that “direct supply and shipment from Chilean origin” and they have continued to work together ever since. This has resulted in a 200% average annual increase in Pinduoduo’s Chilean cherry production over the last three years.

“We are committed to bringing high-quality fruits direct from their source to thousands of homes. Frank, Pinduoduo’s corporate affairs director, stated that Pinduoduo hopes to be one of the top online sales platforms for Chilean cherry fruits in the 2021-2022 season.

The Chinese market has been the main destination for Chilean cherries

The Chinese market has been the main destination for Chilean cherries since 2008 when Chilean cherries could be imported to China. The Chilean Cherries Commission had earlier issued an official forecast that Chilean fresh cherries exports would increase by 2.6% in 2021-2022, to reach 361,800 tonnes.

Cristian Tagle, Chairman of the Chilean Cherries Committee believes that the quality cherries arriving on the Chinese market this year will be very high due to the dry weather in Chile.

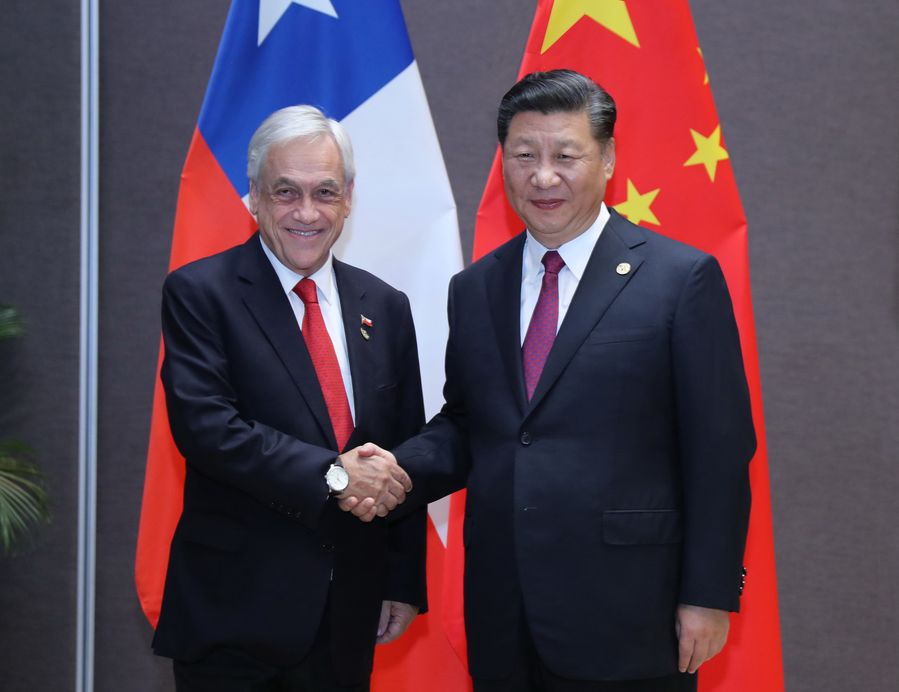

The Chilean Commercial Consul in Shanghai (left), and Pinduoduo Corporate Affairs director Frank (right), attended the event and gave speeches. Photo by Zhong Tianyi

Chile & China

Chile is China’s closest relative country. However, Chile has the most cherries, which means that they must be cared for during long transportation times. How can cherries from faraway countries still taste fresh? This was a problem for Chilean farmers.

The second container of Chilean cherries arrived by air at Shanghai Huizhan Fruit and Vegetable Wholesale Market on October 31st. This is the largest fruit trading hub in Jiangsu and Zhejiang. Photo by Zhong Tianyi

Brooks, the first batch from the air-freighted variety was actually launched in Guangzhou’s Jiangnan wholesale marketplace in October. The high cost of cherries is due to limited air-freight flights, high freight costs and high prices.

The arrival of the first Cherry Express to Hong Kong in December saw the prices of Chilean cherries steadily drop. Most varieties are currently shipped by sea, including Santina and Royal Dawn. Santina is the most resistant and has a high water level. It can maintain a great condition even after long distance travel. This variety has been loved by Chinese consumers for many years.

This year’s Chilean cherries are larger than in previous years. The “Recommended Quality Guide for Export Cherries” published by the Chilean Cherries Committee states that starting December 1, 2021, the minimum size for cherries to be sent to China will increase to XL. The smaller L sizes will not be shipped. In accordance with the Pinduoduo platform’s requirements, Chilean cherries must also have the “green code” in order to pass customs quarantine, PCR tests, and verification materials.

This exclusive fruit has been promoted by Pinduoduo since December, just before the peak in Chilean cherries sales. The average daily order volume for cherries on the platform is more than 50,000. The platform was able to sell more than 250,000 kilograms Chilean Cherries thanks to the Pinduoduo’s “10 billion subsidy” event. This took place on December 22nd, including pre-sales.

After the collapse in cherry demand over the weekend and late last week, there was hope that China’s import cherry market is recovering with Wednesday’s reactivation of cherry sales at key wholesale markets. Produce Report’s investigations have shown that over the past few days, most wholesale markets and other players in the import cherry supply chain responded to the adverse market conditions with flexibility and took a proactive, positive approach to increasing sales.

read more

Social media & Livestreaming

Social media monitoring and surveys of retailers suggest that although last week’s news had a significant impact on consumer demand, some consumers still feel positive about imported cherries and that there are signs that this may be a sign that the market is beginning to rebound.

Several retail channels have seen very little change in sales volume since Jan. 21. Some retailers, particularly brick and mortar ones, experienced significant drops in sales during the weekend and the first few days. Most people are optimistic that sales will rebound as social media conversations continue and consumers absorb positive and reassuring news from official media outlets.

Wholesale markets that are key to product flow are taking positive steps. Jiangnonghui Market management announced Tuesday that it would offer a 50% discount on its transaction fees for imported cherries.read more

China Cherry Market

Although cherries account for 46% of the world’s stone fruit trade, their share in terms of exports volume is only 19%.

In monetary terms, the world’s cherries exports are increasing by $363.27 million every year. This is significantly more than other stone fruits like peach, plum and apricot. This is despite cherries being on average 3-4x more expensive than other stone fruits.

Cherry trade is gaining more profit than other stone fruits. Why is this happening? What makes their international trade so successful? Why is there a rise in worldwide demand for cherries? Despite the fact that cherries have been growing in production around the world, the global price of cherries is rising faster than other stone fruits.

Andriy Yarmak , the economist at the Investment Centre of the Food and Agriculture Organization of the United Nations was available to answer these and other questions as part of a virtual training about the organization of promotion and packaging of vegetable and fruit products for export. The USAID Competitiveness, Trade and Jobs Activity, (CTJ Project) organized the event.

First, cherry trade is becoming more important than other stone fruits. Their cultivation in Southern Hemisphere nations, where they can export during the New Year holidays, is the second reason for growing popularity of cherry. The Northern Hemisphere has a large population that is willing to pay high prices for expensive fruits, due to its cold winters. Third, cherries are a delicious fruit that most consumers love, unlike plums, peaches, or even apricots. Andriy Yaarmak said that he has never met anyone who doesn’t like cherries.

He also pointed out other factors that contributed to the worldwide success of cherries, such as the acceleration of breeding programs and improved growing technology. This allows for increased fruit size. In many parts of the world, cherry calibers 30+ or 32+ are the norm.

These same factors have a positive impact on the organoleptic qualities of cherries as well as on their quality. This allows for an increase in shelf-life.

According to an expert, Modified Atmosphere Packaging technology (MAP) was another important discovery that helped to increase the popularity of cherries on the global market. This technology allows cherries to be kept fresh up to 60 days without any significant loss in quality. The maritime logistics of cherries was possible thanks to this packaging technology. This significantly decreased shipping costs than air logistics. This resulted both in a lower price for the consumer and a higher demand. The MAP technology allows cherries to be shipped in sea containers to nearly any place in the world.

Read more

“China’s cherry liberty is another feature of the cherry market that has made it a huge success.”

The Fruit Exporters Association has made cherries a symbol for the Chinese New Year. Chile is able to reap the benefits of this as cherries are ripe there at just the right time. Chilean cherries were sold in China before the Chinese New Year. They are packaged beautifully and sold in large quantities. They are also a symbol for economic prosperity in China. It is considered to be a high-status commodity to purchase cherries in China in winter.

Cherry in China is a status symbol, as they are expensive.

Cherry of high caliber and darker color are preferable on the Chinese market. Andriy Yarak explained that China and Hong Kong import $3B worth of cherries each year, with the majority falling on New Year’s holidays.

He also pointed out that cherries have a faster growth rate than any other stone fruit. This is a sign of a high demand. However, fresh apricot prices are decreasing each year, while world trade is increasing. However, it is not as fast as cherries.

Expert says that Uzbekistan (Kyrgyzstan), Tajikistan, and Kyrgyzstan have a great opportunity to profit from cherries exports. They have direct access to cherry markets unlike Turkey and other countries. Additionally, labor costs in Uzbekistan are lower than in Chile and Turkey. The smaller the fruit is, the more costly it will be to harvest. The climate is ideal for cherry growing in Central Asian countries. Fourth, other than China, there is a growing demand for cherries in many other Asian nations. Andriy Yarak believes that Central Asian countries will be able to export cherries to Europe and the Middle East, thanks to their low transportation costs relative to the high price.