Moncler focus on China in 2024, with expansion and strategic focus on the biggest luxury market in the world.

Moncler, the Italian luxury fashion brand known for its high-end down jackets and sportswear, has made significant strides in the Chinese market.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Moncler’s strategic approach to conquering the Chinese luxury market,

- Robust Growth: Moncler has experienced remarkable growth in China, with sales significantly increasing. The brand’s performance in Asia, particularly in China, has been a major contributor to its global revenue, demonstrating the country’s importance as a key market for luxury fashion.

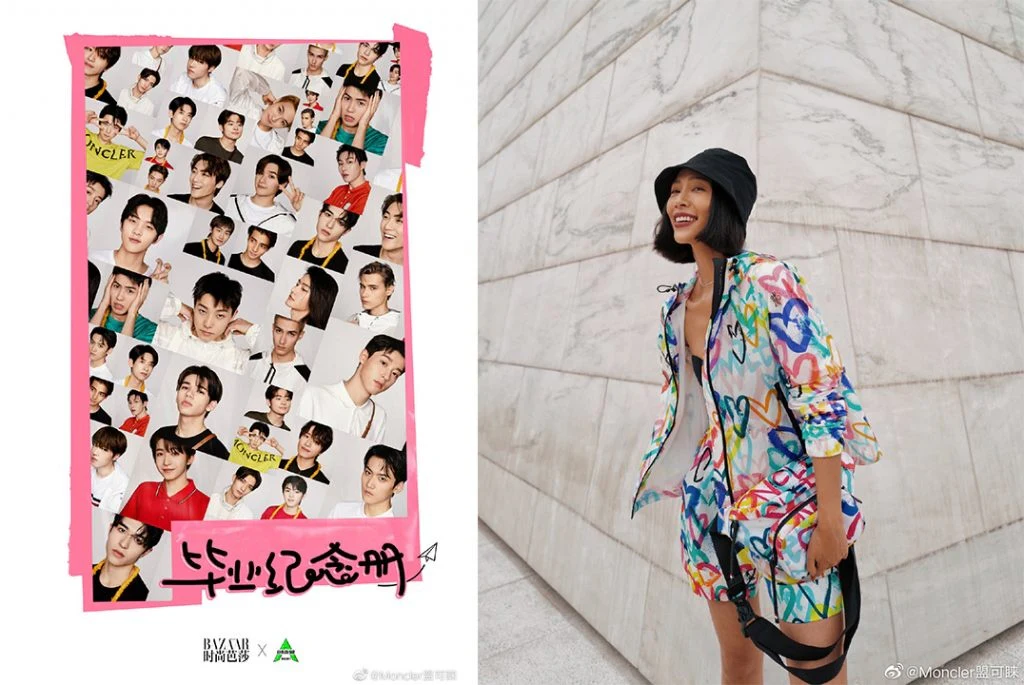

- Strategic Collaborations: Moncler has engaged in strategic collaborations with local Chinese brands and celebrities, such as the partnership with Beijing-based outerwear brand Christopher Raxxy for Singles’ Day 2023. These collaborations have helped Moncler increase its brand visibility and appeal to the Chinese audience.

- Cultural Engagements: The brand has made efforts to connect with the Chinese market through cultural engagements, including taking over a local ski resort to present its Grenoble 2023 Fall series at the Changbai Mountain International Resort in Jilin province, showcasing a deep understanding and respect for local preferences.

- Retail Expansion: Moncler has expanded its retail footprint in China, opening flagship stores in major cities and luxury shopping centers. This includes a significant presence in locations like Chengdu’s Taikoo Li, a leading luxury shopping center, where premium sportswear brand Stone Island, part of the Moncler Group, opened a new flagship store.

- Digital Marketing Focus: Recognizing the importance of digital platforms in China, Moncler has actively engaged with Chinese consumers through social media platforms like Weibo and Douyin. The brand’s digital marketing efforts have included viral video campaigns and influencer collaborations, aiming to capture the attention of the digitally savvy Chinese consumer.

- Localizing Offerings: Moncler has tailored its offerings to suit the tastes and preferences of the Chinese market, from product design to marketing strategies. This approach has helped the brand resonate more deeply with local consumers, contributing to its success in the region.

- Commitment to the Chinese Market: Moncler’s continued investment and strategic focus on China underscore its commitment to the market. The brand’s efforts to understand and cater to Chinese consumers, from product innovation to customer experience, highlight its dedication to expanding its presence and influence in China.

Moncler’s strategic approach to conquering the Chinese luxury market, leveraging local collaborations, cultural engagements, and digital innovation to strengthen its brand and connect with consumers in one of the world’s largest luxury markets.

Moncler Group emerged as a standout in the fiscal year 2023, surpassing analyst forecasts with its robust performance in Asia. The group saw a 17% increase in sales, reaching $3.2 billion, and a notable rise in operating profit to $969 million. A significant milestone was achieved in the first half of 2023, with sales breaking the 1 billion euro mark for the first time, driven by a remarkable 39% growth in Asia.

The Moncler brand, contributing the majority of the group’s sales, witnessed a 17% growth in the final quarter year-over-year. The brand’s largest market, Asia, saw a 28% increase, buoyed by strong recovery in China post-COVID restrictions.

Interview CEO Moncler

Stone Island, another group brand, experienced a 7% sales increase in the same quarter, with the Asian market contributing a 22% rise year-over-year.

Moncler’s strategy of collaboration continued to shine, with partnerships with Adidas Originals, Palm Angels, and Rick Owens under the Moncler Genius project, alongside a third season collaboration with Daniel Arsham. These collaborations positioned Moncler as the fifth hottest fashion brand in Q4 2023, according to the Lyst Index.

Localized marketing in China

In China, Moncler leveraged local collaborations, including a special Singles’ Day 2023 campaign with Beijing-based Christopher Raxxy. The campaign featured Chinese celebrities Zhou Yutong and Wang Anyu, achieving over 9 million views on Weibo.

In December, Moncler expose its Grenoble 2023 Fall series at the Changbai Mountain International Resort in Jilin province. source Jingdaily

To boost its presence in China, Moncler took over a ski resort for the first time, presenting its Grenoble 2023 Fall series at Changbai Mountain International Resort. This move, alongside Stone Island’s expansion with a new flagship store in Chengdu, underscores the brands’ commitment to the Chinese market.

As Moncler looks towards 2024, the focus remains on brand strengthening and luxury community engagement, navigating the global market’s uncertainties with a distinctive strategy that continues to pay dividends, especially in the burgeoning Chinese market.

Moncler is leveraging various platforms to engage with its Chinese audience

Moncler employs a multifaceted strategy to sell its luxury fashion products in China, leveraging various platforms to reach and engage with its target audience. Here’s how Moncler utilizes platforms like Xiaohongshu (Little Red Book), Tmall, and Douyin to enhance its market presence in China:

Little Red Book

- Content Marketing: Moncler master Xiaohongshu’s unique blend of social media and e-commerce functionalities to engage with Chinese VIP consumers through high-quality content. The brand shares engaging posts and stories that showcase its products, lifestyle, and heritage, leveraging the platform’s user-generated content model to encourage authentic customer reviews and photos.

- KOL Collab : Collaborating with Key Opinion Leaders (KOLs) and influencers on Xiaohongshu allows Moncler to tap into established audiences, gaining visibility and credibility. These influencers create content that resonates with their followers, from unboxing videos to styling tips featuring Moncler products.

Tmall Flagship Store

- Flagship Store: Moncler operates a flagship store on Tmall, Alibaba’s leading e-commerce platform, offering a wide range of products to Chinese consumers. This official online store ensures product authenticity and allows Moncler to participate in major shopping festivals like Singles’ Day (11.11), which significantly boosts sales.

- Customized Shopping Experiences: Utilizing Tmall’s sophisticated e-commerce tools, Moncler provides personalized shopping experiences, including product recommendations and exclusive offers for Tmall users. The platform’s analytics also help Moncler understand consumer preferences and adjust its strategies accordingly.

Douyin, for massive exposure

- Engaging Video Content: On Douyin, Moncler leverages the platform’s vast user base and preference for short-form video content by creating engaging and visually appealing videos that highlight the brand’s products and fashion shows. These Tiktok videos help increase brand awareness and appeal to younger consumers, it is cool and it works 😉

- Interactive Campaigns: Moncler participates in interactive campaigns on Douyin, encouraging users to create their own content featuring Moncler products. This strategy not only enhances engagement but also promotes user-generated content, amplifying the brand’s reach.

- Livestreaming: with for ex, Douyin’s livestreaming feature, Moncler can showcase its collections in real-time, offer exclusive deals, and interact directly with consumers. This direct engagement builds a stronger connection between the brand and its audience, driving sales and loyalty.

By integrating these platforms into its sales and marketing strategy, Moncler successfully navigates the digital landscape in China, connecting with consumers across different touchpoints. This comprehensive approach allows Moncler to enhance its brand visibility, engage with a wide audience, and drive sales in one of the world’s largest luxury markets.

Read more