E-commerce is booming in China, and luxury brands cannot afford to ignore this growing channel. Chinese luxury consumers are extremely savvy when it comes to shopping online, and they demand a unique and customized experience. In order to attract these consumers and drive sales, companies need to invest in e-commerce initiatives that deliver an engaging and personalized experience.

This article will explore the reasons why you need to focus on China’s luxury e-commerce trend and provide insights on how brands can best meet the needs of Chinese shoppers.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Overview of China Luxury Market

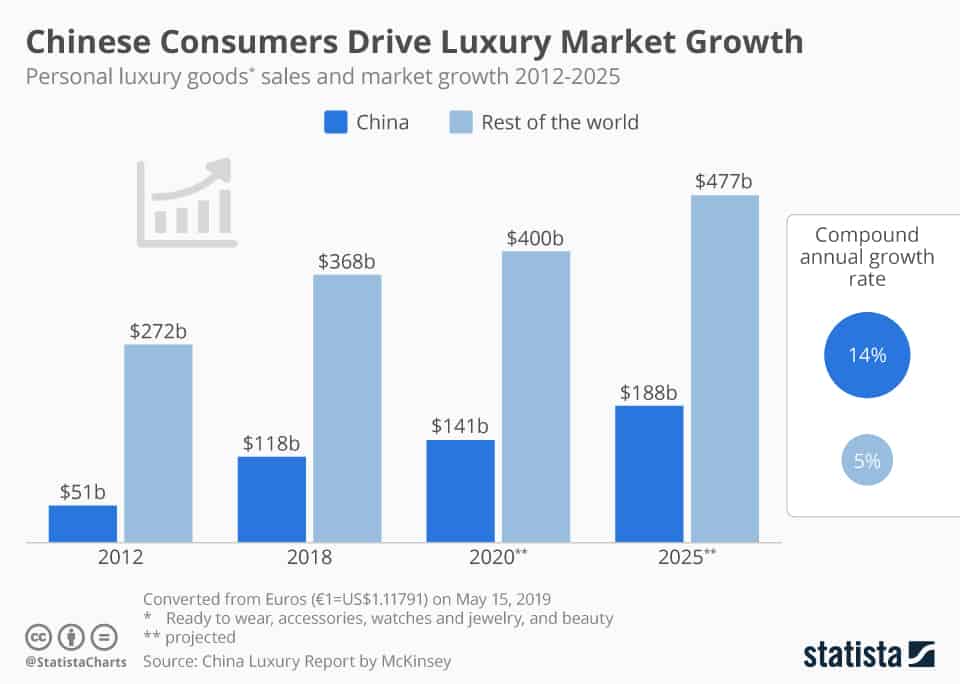

China’s luxury market is the fastest-growing in the world and one of the most important. It’s not just about high-end groups like Gucci and Chanel anymore; more and more people are starting to buy from mid-range brands such as Tory Burch. In a recent study by McKinsey, they found that China will be responsible for nearly half of all global luxury spending growth over the next five years.

This provides an opportunity for luxury groups looking to expand their business in this rapidly growing country. There is a huge demand for high-end personal luxury goods and services, but it’s also a very competitive market. It’s essential to be aware of what your competitors are doing in order to remain successful.

The shift in consumers group → Luxury e-commerce rise

The base of Chinese buyers of luxury goods is made up of fairly young individuals, with an average age between 20 and 35 years old: they tend to save less, spend more on leisure than their parents, do their shopping online more and more, and prioritize quality.

Some parts of the country have experienced increases in spending, particularly coastal areas such as Shanghai, while others have experienced declining growth or even negative growth. The middle class represents around 300 million people, which is 19% of the total population, according to the Chinese Academy of Social Sciences.

80% of Chinese buyers are under 45 years of age. They are highly fascinated by Western brands and have high internet consumption. Therefore, the most suitable way to reach this buyer group is through the Internet. Chinese people are more and more willing to purchase online because of the convenience of e-commerce platforms.

Tmall and JD, the two leaders of e-commerce in China, launched their dedicated luxury e-commerce platforms respectively called “The luxury pavilion” and “Toplife ” (which was sold and became Farfetch China). Tmall and JD aim to guide their super-wealthy customers to these platforms. JD.com and Alibaba are going toe to toe on the battlefield of high-end fashion, providing different advantages for their partners.

Chinese Luxury Consumer Behavior, how it impacts the Chinese luxury market

China is currently going through a consumer revolution; it is a constantly developing country that offers growing purchasing power to its people. As the standard of living improves, more and more people are focusing on high-quality products, and luxury goods manufacturers and service providers are experiencing significant growth in China. As a result, the price a consumer is willing to pay for a product has increased in recent years. Consumers today are looking for the highest quality products and services, and often turn to the big brands.

China is the largest market for luxury brands, accounting for approximately 47% of luxury consumption in 2023. Marketing is starting to play a key role in attracting Chinese consumers, as well as advertising and search techniques. As a general rule, the Chinese inquire a lot before the purchase, the main source of information being word of mouth. Buyers are curious about what is on offer, especially with regard to foreign products.

Luxury Forecast in China – Leader of the global luxury industry?

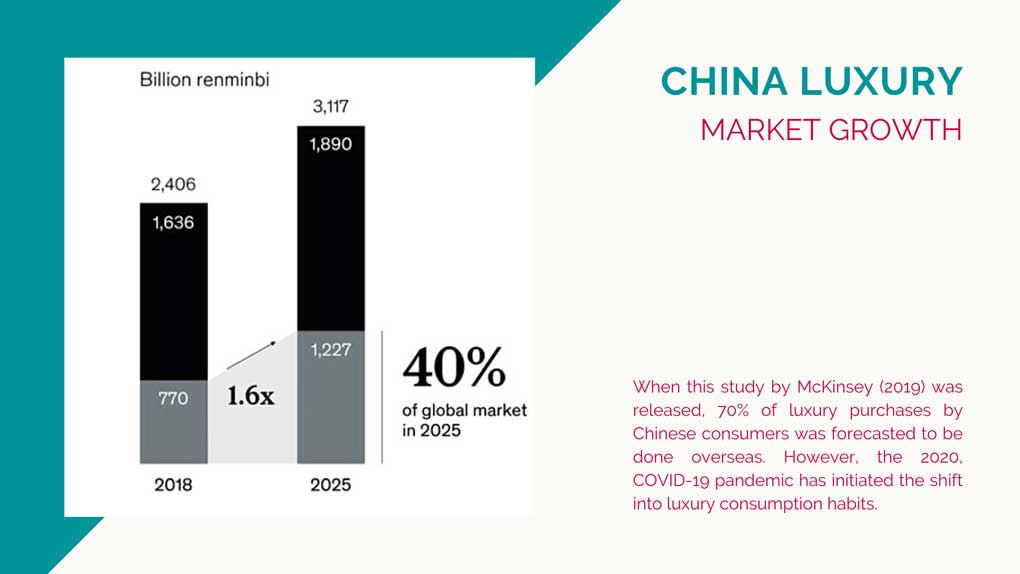

China is the world’s leading luxury consumer, contributing in particular to almost 40% of the global luxury market as of the first half of 2023 (predicted to reach 40% in 2025), and almost one in two (46%) luxury products in 2015 were purchased by a Chinese citizen. The luxury market is growing not only in first and second tier cities but also in lower-tier cities, as more and more netizens raise their incomes year-on-year, despite the Covid-19 lockdowns in 2021 and 2022.

According to Bain & Co, Chinese customers will make 50% of their purchases in China and not abroad. This trend will force luxury and premium brands to adapt, particularly to customers who do not travel, and to the specifics of the Chinese “local” market, which is very different from Europe and the US markets.

The luxury market in China: Major e-commerce platforms

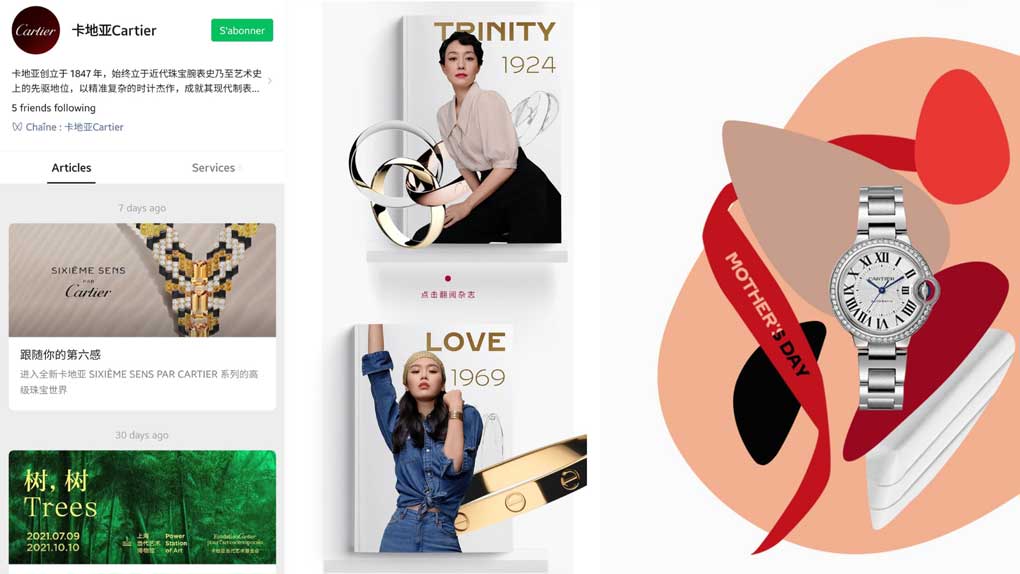

Major luxury brands such as Louis Vuitton, Cartier, Gucci, and so on have already jumped onto the luxury e-commerce wagon. You’ll find them on at least one of the Chinese e-commerce giants. Other brands are quickly following the movement.

Tmall and Tmall Global: #1 luxury e-commerce players?

When it comes to luxury e-commerce in mainland China, Tmall and its global cross-border version are the most popular option among foreign luxury companies.

It got the trust of its users, and many luxury and premium businesses already have one or several flagship stores on the biggest luxury platform in China.

Furthermore, Tmall users are already conditioned to make online luxury purchases on it without too many worries. Plus, on top of its traditional e-commerce marketplace, Tmall got a dedicated luxury channel for luxury shoppers in China!

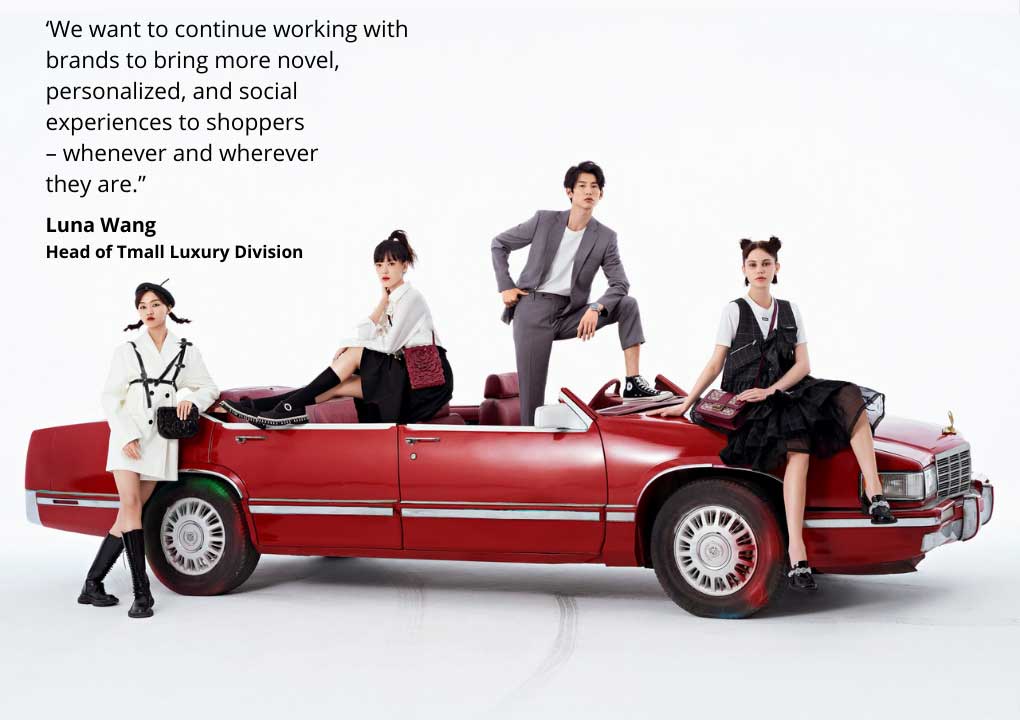

Industry’s Favorite in the Chinese Luxury e-Commerce market: Tmall Luxury Pavilion

The recent years have been difficult for luxury goods. Luxury companies have had to embrace technology and reinvent themselves. For example, through various platforms such as WeChat, Little Red Box, Weibo, Douyin and Tmall, etc. Today, the majority of big names are available on this channel.

To differentiate themselves from the competition, high-end brands have adopted creativity and novelty. Tmall’s Luxury Platform is one of the favorite websites of the top foreign and Chinese luxury brands in the game.

To drive revenue on the Tmall luxury channel, you can:

- Engage with Chinese buyers with qualitative experience: An invitation system is set up. Tmall selects Chinese buyers who have a real interest in the brand and who have a high income.

- Tmall combines Online and Offline: The Pavilion has worked on the convergence of the offline and online experience by offering a Brand Experience Center. Pop-up activations are exclusive to luxury brand sites.

- You can keep control of your brand: The main advantage of the platform is the experience. You will be free to pick the price, the merchandising strategy, and the communication strategy.

- A real boost to your exclusive product sales: Limited editions and exclusive products are always a success in China’s personal luxury market, you can have the same brand impact with Tmall Luxury Pavilion. The e-commerce platform provides several services, from virtual flagships to live streaming.

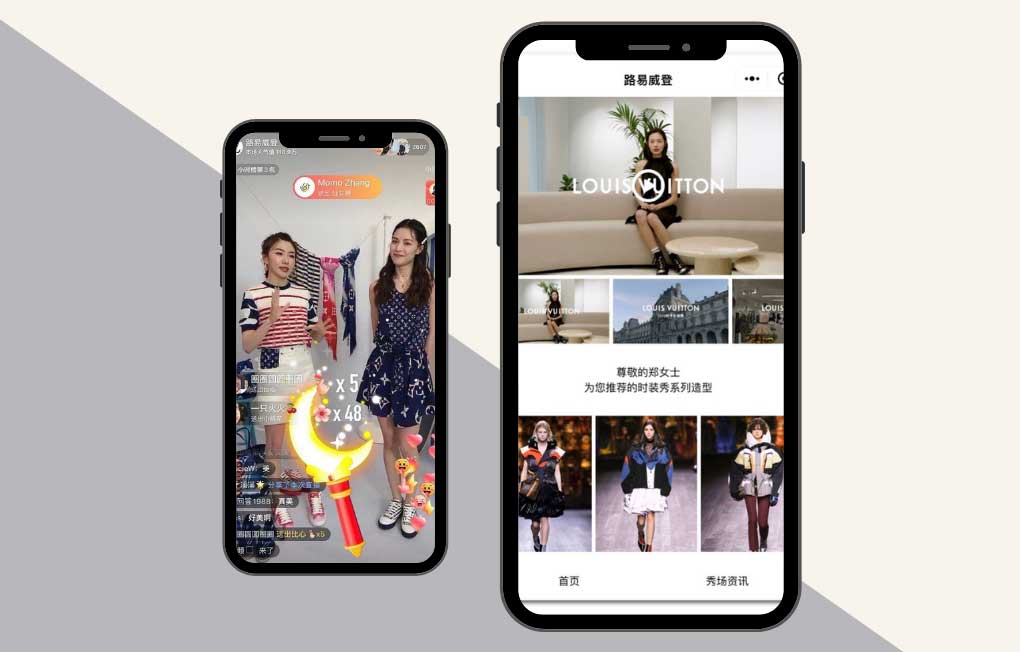

- Live-streaming: Tmall Luxury Pavilion is a key strategy to combine live-streaming trends and sales engagement. The ability to purchase is facilitated by the e-commerce platform.

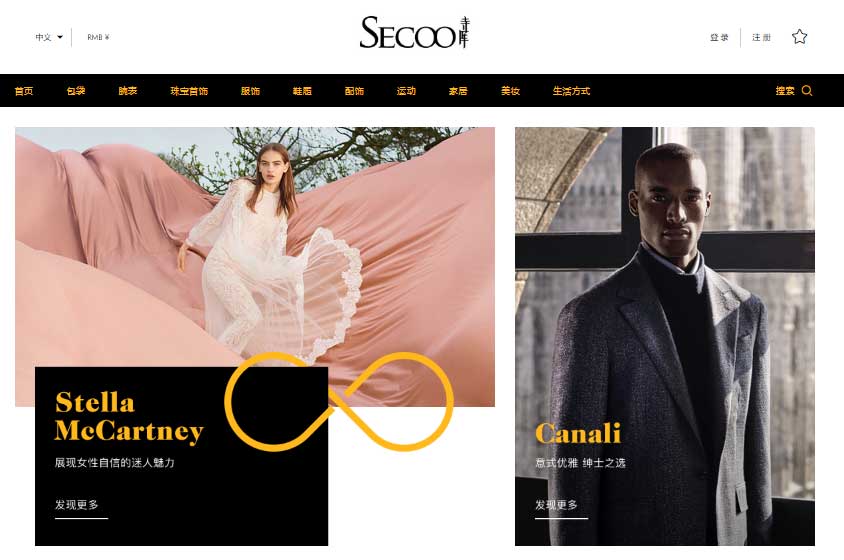

Secoo the luxury & lifestyle e-Commerce platform

Secoo is one of the largest Chinese multi-brand luxury B2C platforms. If your business is in the overall luxury sector, Secoo is the platform to turn to. In China, Secoo has managed to differentiate itself from Luxury Pavilion and Toplife, which have absorbed a large share of the online luxury goods retail market.

Today the platform operates for very big names like Miu Miu, Hermes, Rolex, Longines, and Bulgari. Additionally, to meet the growing desire of Chinese consumers for an upscale lifestyle, the platform featured cars from companies such as Bentleys and Porsches as well as personal yachts and jets.

Secoo enjoys an excellent image by offering authentic and credible luxury items. Secoo provides a high-quality service, such as same-day delivery, delivered by couriers in suits and white gloves.

WeChat & Luxury brands, together to innovate

In the beginning, WeChat was an app for communication, but it has developed a lot of features, waiting to be explored. We have to notice here that WeChat has now over 1.2 billion monthly active users. Thanks to its surprising capacities and its important user database, WeChat has gotten an incredible amount of attention from luxury groups.

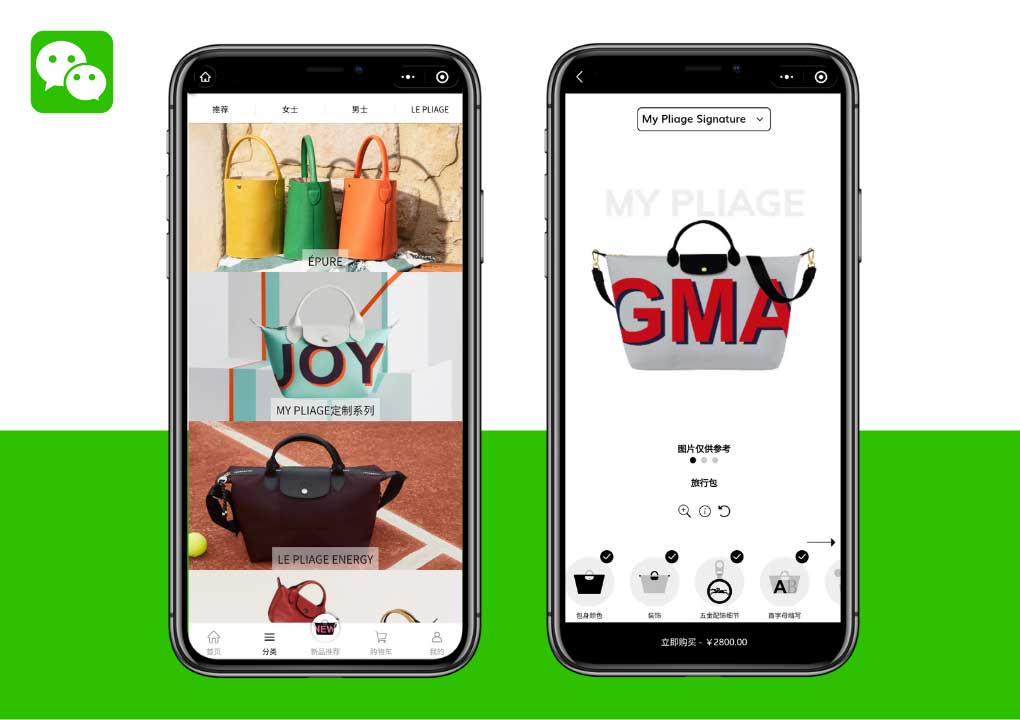

Wechat mini-programs widely used by luxury brands

The famous WeChat mini-programs are additional mini-apps to the classic WeChat social network. Yet in just a few years, these programs have won over Chinese users, with an impressive growth rate year on year. These programs do not require any special installation and combine both traditional social tools and shopping functionalities, that cater especially to the liking of Millennials and Gen Z.

For example, most of these programs are stores, games, services, or information. These mini-programs are highly appreciated, especially by luxury companies, because they help strengthen their customers’ loyalty and increase their notoriety even more.

Examples of high-end companies using Wechat Marketing:

- Through WeChat, the well-known French Longchamp offered the possibility to customize one of its flagship leather goods. Customers could choose the size, color, and style to make their personalized model.

- Users who have subscribed to Burberry’s WeChat official account can participate in the event launched by the brand and gain their own customized card. Burberry cooperated with WeChat and proposed to customers order ornaments at any time with their Chinese or English names on them.

- For the Chinese Valentine’s Day, Dior has posted on its official WeChat account, “Lady Dior small, the Chinese Valentine’s Day limited version, will be sale in the online shop”. It was only sold on WeChat, for a limited time and a limited number. This action became the best innovation in the luxury landscape.

- Yves-Saint-Laurent, promoted a number game on WeChat and Weibo to predict players’ lucky numbers. The exploration of luck in the last season of 2016 was predicted by the talented spirit of several, Evelyne Lehnhoff. People can get their own lucky number after they gave birth for months and days. There were many women engaged in this game. They participated actively, left messages, and shared with their friend on their social network.

Increase Luxury Sales with an O2O strategy: Combine Online platforms Promotion to Offline

Luxury brands need to communicate more often with their online customers. In big cities, Chinese people are almost all online. To reach your target consumer and your potential consumer, offline marketing activities must integrate online marketing strategies. You’ll have to publish informative content and interactive online activities that earn your customers rewards or point systems. It will help with developing inquisitiveness and loyalty.

This is the reason why you can use the O2O strategy. This strategy which can also be called OtoO is the initial of Online to Offline. It refers to changes in the behavior of consumers who are now preparing their visit to points of sale (Offline) with the help of an analysis phase of the website on the Internet (Online). The expression O2O thus reminds us that nearly 90% of the retail trade is done directly in physical points of sale but that this activity is also impacted by the “Online”.

For merchants, the benefits of the O2O strategy are:

- Drive sales traffic

- Dedicated eShop with exclusive branding

- Analysis of Consumers’ spending behavior

- Effective advertising and promotions

- Channel with targeted marketing

For customers, the benefits of the O2O strategy are:

- One time log in and enjoy wifi the whole day

- Prompted with nearby promotion

- Rebate system (gifts & redemptions)

- better consumers care

RED Little Red Book, the RDV of high-end and luxury lovers in China

The Little RED book is the new Popular App at this moment and a great way to work on your awareness and engagement. The Little Red Box is a Chinese e-Commerce application that is becoming more and more trendy with businesses in China, more particularly new luxury ones.

Indeed, the application is aimed at beauty and fashion brands and offers upscale products. The community that uses this platform is very active and consists mainly of women who share a lot with each other through this network.

The Chinese consumer is looking for reassurance when purchasing goods in China online. This is what the little red book offers. RED is an excellent word-of-mouth tool and gives credibility to the image thanks to the many KOLs that work on it and thanks to the “Shopping Notes” pages which are the opinions of customers on the products tested.

The use of KOLs to strengthen your image in the e-Commerce Chinese market

Users of the majority of Chinese social media platforms are increasingly turning to KOLs. Many brands see these people as a marketing opportunity since the communities that follow them tend to be very loyal to them.

Audiences seek authenticity in the content shared on social media and turn to KOLs they trust and can relate to. These Key Opinion Leaders generally have some expertise in a niche sector and succeed in meeting the needs and expectations of users who seek more quality than quantity in the sharing of content.

Currently, the trends that are most appreciated by KOLS concern the fields of beauty, cosmetics, and fashion. For companies that are already known internationally, it is easy to create a collaboration with a KOL: through live-streaming, product reviews, invitations to events, or content including the KOL becomes the direct face of the brand’s official advertisements.

For younger companies with less brand awareness, it’s best to work on your brand’s visibility and credibility first. If you have a small budget, you should use micro-KOLS or KOC which have fewer subscribers, and are cheaper but can be just as effective.

Key Opinion Customers speak to their community in a more personal way and make brand or product recommendations to help people they know personally. KOCs have more control over content creation, as brands are required to maintain co-creative marketing with them. They are often much more selective with the products they want to recommend. Having some brand awareness helps get the best deals with bigger KOLs and will help you increase sales later on.

The importance of offline experiences in Chinese marketing

The changing mindset and aspirations of Chinese consumers have opened up barriers in the world’s largest luxury market. Chinese customers have higher demand, increasing disposable income and therefore changing needs which brands will need to adapt to. Customers are looking for an experience, a moment of life.

In their integration strategy, we note the integration of a customer awareness strategy. Luxury brands are developing human-centered services to retain and attract consumers. For example, Cartier has developed personalized services.

With the development of e-Commerce, half of the Chinese luxury consumers now hope to live a digital experience directly at the point of sales in China. More than 50% of Millennials are ready to share their personal data to obtain ultra-personalized services from offline stores. They would like to live concrete experiences, for example:

- Connected and intelligent cabins

- Virtual or augmented reality

- Or even interactive and intelligent screens.

Burberry, for example, has used technology to improve its customer experience to the maximum. After showing its parade for next winter live on a giant screen in Piccadilly Circus, the English brand celebrated with pomp the opening of its store in Beijing on April 13. A big show was planned with light shows, 3D videos, and above all an impressive hologram parade.

Luxury & Art Exhibition: a winning combo in China

As explained previously, in the world of luxury in China it is essential to stand out from the competition, notably through the customer experience around the purchase of the final product. We have seen that although the vast majority of Chinese now consume through e-Commerce, the offline part should not be neglected and this is also possible thanks to art.

Indeed, art is constantly evolving and allows luxury companies to transform their products into true masterpieces. Today, China has become the must-see venue for innovations from famous names like Gucci.

The famous Gucci, which is the fourth luxury brand sold worldwide, pursues its wish to elevate fashion to the same rank as art. This ambition makes the iconic brand much more than a simple competitor, but an emblem of culture. For this, the brand has collaborated with many artists and seduces consumers in China with its “art walls” exhibited in large cities on buildings for example.

Gucci also offered immersive multimedia experiences, allowing consumers to be fully integrated into its world at numerous exhibitions ranging from Florence to Shanghai.

“I thought it was interesting to accompany people in these first six years of adventure, inviting them to cross the imaginary, the narrative, the unexpected, the glitter. So I created a playground of emotions that are the same as in the campaigns because they are the most explicit journey into my imagery”.

Alessandro Michele, Gucci’s Creative Director

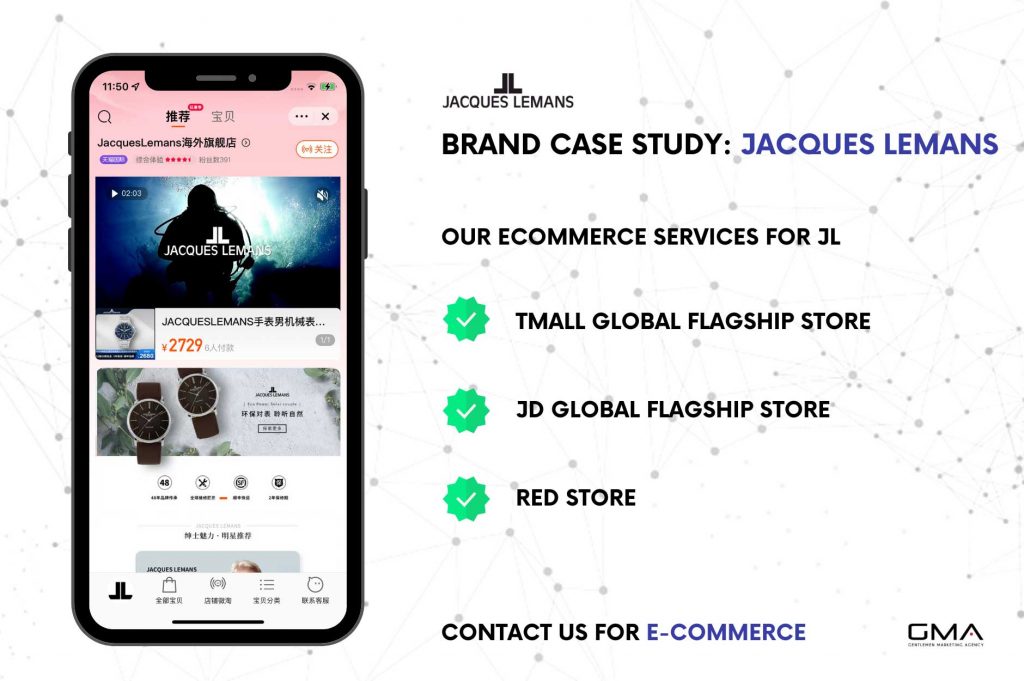

China Luxury eCommerce: need a partner to enter the Chinese market?

The digitalization of China has brought a lot of new tools, creating new opportunities. Do you want to explore the Chinese luxury e-commerce landscape?

GMA can help you with it. Our agency is specialized in digital marketing, and we have knowledge about Chinese consumers’ habits. We help you with:

- All your e-commerce operations in China

- Branding & social media marketing

- search engine optimization

- Market research and monitoring to stay on top of societal and fashion trends

- and so on

Do not hesitate to contact us for more information, see our case studies and speak to our Luxury Expert.

And feel free to keep scrolling on the blog for more free articles on the luxury market, Chinese e-commerce platforms and so on.

It is an amazing article, luxury is still a huge market, and Chinese are spending like hell in Luxury watch, bags etc…

Hi ,

How can I have the Chinese luxury brands list and the popular luxury brands in China…

For my research I need to have an idea of the China luxury goods consumption

Do you know if the luxury market is different from the luxury goods in China?

it is really a great article.

What do you consider Luxury and what is Premium Brands for you ?

In the meantime, you definitely need to look after the trend of Chinese nicknames. Especially for bags and cosmetics, the Chinese give nicknames based on pop culture, translation, or overall design to talk about a specific item. The majority of Chinese can encounter difficulties saying an international name. So, they come up with the original nicknames on Weibo or WeChat. For instance, the famous Longchamp bag called Le Pliage is named The Dumpling Bag in China. Yes, I like traditional Chinese food because the bag has the same aspect. Any luxury brand needs to stay aware of these Chinese cultural habits and could turn this trend into a key marketing strategy.

It is an amazing article. Tmall luxury pavillon is the best opportnity for luxury brands in China.