In recent years, there have been growing concerns about the safety and quality of baby milk formula products in China. To address these concerns and ensure the well-being of infants, the Chinese government has implemented new regulations for the production, sale, and distribution of baby milk formula.

These regulations aim to improve the safety and quality standards of baby milk formula by imposing stricter requirements on manufacturers. This includes mandatory registration with relevant authorities, adherence to specific quality control measures, and regular inspections to ensure compliance.

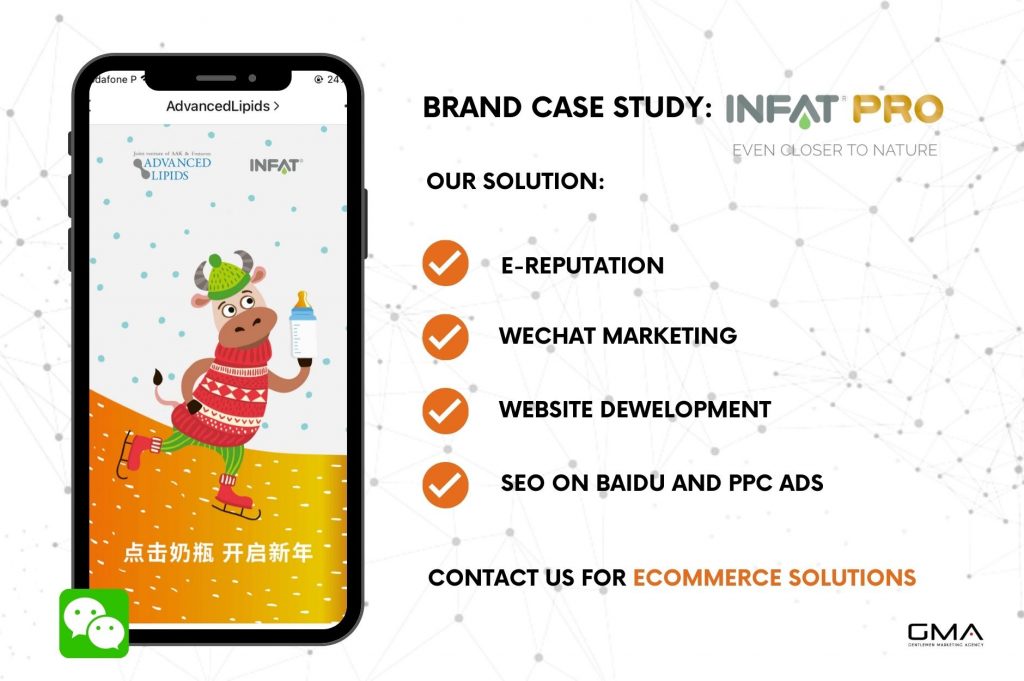

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

The new regulations also focus on enhancing the transparency of information provided to consumers. Manufacturers are now required to provide clear and accurate labeling, including information on the nutritional composition, production date, and expiration date of the product. This allows parents to make informed choices when purchasing baby milk formula for their little ones.

This article demystifies these new standards, explaining them simply for you to leverage your marketing strategy effectively. Ready to conquer the Chinese infant formula market?

Let’s dive right in!

Overview of the Baby Formula Market

The China infant formula market has experienced significant growth in recent years. With a large population and increasing disposable income, Chinese parents are increasingly turning to formula milk for their infants. This growing demand has attracted both domestic and international players in the market, leading to fierce competition.

One of the key factors driving the growth of the Baby Milk Formula market in China is the rising awareness about the importance of nutrition and health among parents. They are willing to spend more on high-quality formula milk that provides essential nutrients for their babies’ growth and development.

However, the market in China has also faced challenges. In 2008, a major scandal involving contaminated formula milk led to a loss of trust among consumers. This incident prompted the Chinese government to introduce stricter regulations and safety standards for formula milk manufacturers.

International brands have been actively entering the Chinese market, capitalizing on their reputation for quality and safety. They often collaborate with local distributors or set up their own production facilities in China to cater to the growing demand.

The Baby Milk Formula market in China is witnessing rapid growth due to increasing awareness about nutrition and health, as well as the availability of online shopping platforms. However, it is essential for manufacturers to maintain high-quality standards and comply with government regulations to gain and retain consumer trust in this competitive market.

New Regulations for Baby Milk Formula in China

China has recently implemented new regulations for baby milk formula, which require manufacturers to meet stricter standards and undergo extensive testing and certification processes.

Competent authority

The role of the competent authority is essential in understanding and complying with China’s new regulations for baby milk formula. These authorities, coming from exporting countries, are responsible for recommending infant formula manufacturers for registration.

The CFDA (China Food and Drug Administration) oversees these entities and ensures that infant formulas meet strict quality and safety standards outlined in Chinese regulations, which were updated in 2021. It is crucial to adhere to these standards to ensure the safety and compliance of infant formulas in China.

It’s a painstaking but essential certification process designed to ensure only top-quality products reach the growing Chinese market. And amidst challenges like US trade policies leading to a shortage of baby formula, it’s even more critical that we adjust our strategies to meet these strict regulatory requirements effectively.

Market access approval

Navigating the regulatory landscape for baby formula in China demands a meticulous and rigorous process. As part of these new stringent standards, infant formula manufacturers are required to obtain market access approval for milk production before their products can penetrate Chinese borders.

In order to enter and maintain visibility in the Chinese infant formula market, companies must undergo exhaustive evaluations and inspections by key authorities such as the China Food and Drug Administration (CFDA) and State Administration for Market Regulation (SAMR).

These organizations scrutinize every aspect of the product, from formulation to packaging compliance, to ensure that it aligns with the new regulations outlined in GB 10765-2021, which is a relevant standard for infant formula in China.

Even foreign brands interested in entering this lucrative market are subject to food sanitation inspections to ensure quality control. It is not enough to simply gain initial entry; companies must also continuously adhere to the updated rules for infant formula in order to maintain visibility in one of Asia’s largest consumer markets.

Product compliance

In the world of infant nutrition, product compliance is now more critical than ever in China. The Food Safety Law of China insists that all baby milk powder formulas must go through a rigorous registration process under the watchful eye of China’s Food and Drug Administration (CFDA).

This year, new regulations were introduced in China for infant formula, causing a lot of attention among both local and foreign formula makers. These regulations require companies to make significant changes to their products to meet the strict guidelines.

These changes include adjusting nutrient requirements, registering factories, and facing potential consequences for non-compliant products.

These regulations are considered to be some of the strictest in Chinese history. It is important for formula makers to stay informed about any upcoming revisions or amendments announced by the regulatory board.

The scandal regarding baby milk formula

The scandal in 2008 regarding baby milk formula was a major food safety incident that occurred in China. It involved the contamination of infant formula with melamine, a toxic chemical compound. Melamine is normally used in the production of plastics and fertilizers, but it was added to the milk powder to increase its apparent protein content.

Tragically, this contamination led to the illness of hundreds of thousands of infants and the death of at least six babies. The melamine-contaminated formula caused kidney stones and other complications in the affected infants.

The scandal exposed serious flaws in China’s food safety regulations and led to a widespread loss of trust in Chinese-made baby milk formula products. The Chinese government responded by cracking down on the dairy industry and implementing stricter regulations on dairy companies.

It’s important to note that this scandal was specific to China and its domestic market. However, it had a significant impact on the global perception of Chinese-made baby milk formula and raised concerns about food safety standards in other countries as well.

Changes in Nutrient Requirements

The new regulations for baby milk formula in China include revised minimum and maximum values for nutrients, as well as mandated lactose content.

Revised minimum and maximum values of nutrients

China has implemented new regulations for baby milk formula, which include revised minimum and maximum values for nutrients. These regulations aim to establish a standardized nutritional composition for these products, ensuring that infants receive the necessary nutrients in a safe and effective manner. The changes in nutrient values are intended to promote the overall health and well-being of babies consuming these formulas.

| Nutrient | Minimum Value | Maximum Value |

|---|---|---|

| Protein | 1.8 grams per serving | 4.5 grams per serving |

| Fat | 0.3 grams per serving | 6.0 grams per serving |

| Linoleic Acid (LA) | N/A | 1400 mg LA/100 kcal |

| Selenium, Manganese, and Choline | Revised | Revised |

These changes require careful formulation and thorough testing to ensure compliance. It is important to stay informed about these changes as they directly affect the composition, labeling, and marketing claims of products. It is crucial to remember that regulatory compliance goes beyond meeting the minimum requirements; it is about providing safe and nutritionally adequate products to consumers.

Mandated lactose content

The recent regulations for baby milk formula in China include a notable change regarding the lactose content. Lactose, a natural sugar found in milk, is important for infant nutrition and digestion. The revised standards now require all baby milk formulas to meet specific lactose content requirements.

This change aims to ensure that infants receive sufficient amounts of this essential nutrient, which provides energy and supports their growth and development.

By implementing these requirements, the new regulations further improve the safety and quality of infant formula products in China.

E-Commerce

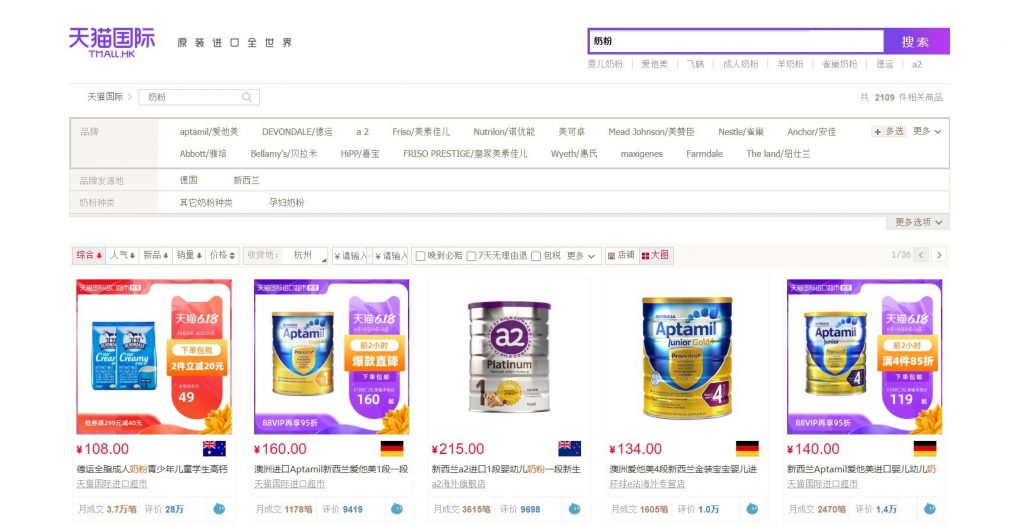

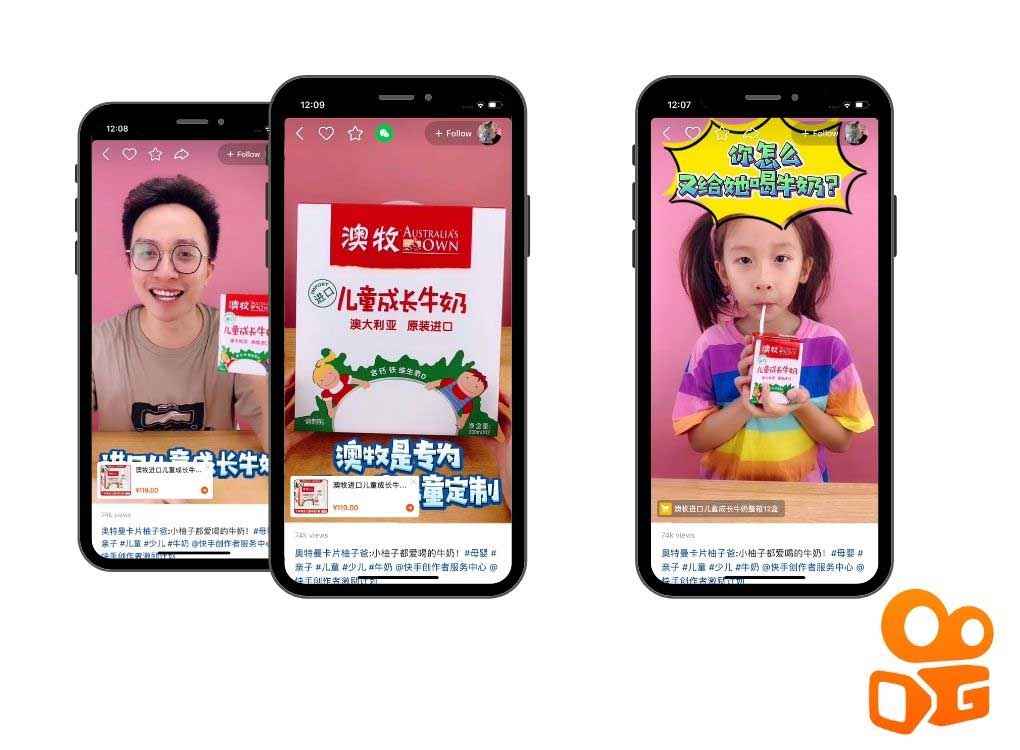

The impact of e-commerce on baby milk formula in China has been significant. With the rise of online shopping platforms such as Tmall, Baidu, JD.com etc. parents now have easier access to a wide range of baby milk formula brands and options. This has led to increased competition among manufacturers, resulting in improved product quality and affordability.

Additionally, e-commerce has provided a convenient and reliable channel for parents to purchase baby milk formula, especially for those living in remote areas where access to physical stores may be limited. The online platform also allows for better transparency and information sharing, as parents can read reviews and compare products before making a purchase.

However, it is important to note that the Chinese government has implemented stricter regulations on the sale and import of baby milk formula to ensure its safety and authenticity, which has further boosted consumer confidence in e-commerce platforms.

Overall, the impact of e-commerce on baby milk formula in China has been positive, offering parents more choices, convenience, and peace of mind when it comes to providing nutrition for their infants.

Impact on Baby Formula Market

The new regulations for baby milk formula in China are expected to have a significant impact on the market, potentially affecting small and foreign brands while creating thriving opportunities for major local brands.

Potential impact on small and foreign brands

The new regulations on baby milk formula in China are expected to have a potential impact on small and foreign brands. These regulations are considered the strictest in the world and are likely to reshape the industry landscape, especially for milk produced in China.

Many imported formula brands may leave the market due to compliance challenges, creating opportunities for major local brands to thrive.

This increased competition may put pressure on smaller and foreign brands operating in China. However, Chinese consumers still have a high demand for safe and trustworthy foreign brands, despite previous safety concerns with domestic products.

Thriving opportunities for major local brands

The new regulations for baby milk formula in China have created thriving opportunities for major local brands. With the implementation of these regulations, domestic players and multinational corporations (MNCs) are expected to excel in China’s infant formula market.

This opens up lucrative prospects for leading Chinese manufacturers who can capitalize on the changing landscape and consumer preferences.

The challenges faced by international baby formula brands, such as declining birth rates and competition from local brands, have cleared the path for major Chinese players to establish dominance in this industry.

Infant formula accounts for a significant portion of the baby care market in China, making it the largest segment in terms of sales. This presents an ideal opportunity for major local brands to tap into this growing market and solidify their position.

Furthermore, Chinese parents are increasingly trusting and purchasing locally produced infant formula over foreign alternatives, indicating a shift in preference towards domestic brands. These changing consumer preferences align perfectly with the evolving regulations, allowing major local brands to gain an edge over their competitors.

By leveraging these opportunities through strategic marketing initiatives targeting Chinese consumers’ trust in homegrown products, brand’s can maximize potential growth within this thriving industry.

We are your local partner in China! Contact us!

The new regulations for baby milk formula in China have brought about significant changes in the industry. With stricter standards and requirements, only major local brands and multinational corporations are expected to thrive under these rules.

As the market adjusts to these new regulations, it will be interesting to see how they shape the future of infant formula consumption in China.

We are a China-based marketing agency offering cost-effective solutions to foreign brands interested in tapping into the Chinese market. Our team of Chinese and foreign experts has the experience and know-how needed to succeed in this lucrative, yet complicated market.

Gentlemen Marketing Agency offers many digital marketing and e-commerce solutions, such as web design, e-commerce and social media marketing strategies, localization, market research, KOL marketing, and more.

Don’t hesitate to leave us a comment or contact us, so that we can schedule a free consultation with one of our experts, that will learn about your brand and present you the best solutions for your China market strategy.