The video game industry in mainland China currently is one of the major markets for the global video game industry, where more than half a billion people play video games. Because of its market size, China has been described as the “Games Industry Capital of the World” and is home to some of the largest video game companies. In addition, China made up over 25% of the global video game industry and anticipated that half of China’s population is players in China alone. By 2024, in China online gaming industry is expected that there will be 772 million players in China.

The current health crisis has led 95 % of people to play more games. In fact, with hundreds of millions of people in China stuck inside their homes amid lockdown measures to combat the coronavirus, China online gaming market reached unprecedented levels of popularity in recent months.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

With many global companies entering China gaming industry, either by acquiring shares in Chinese gaming vendors or through sponsoring the teams of professional players, the market is expected to further grow in the coming years. In 2024, the video game market is expected to generate $46 billion in China.

Major players in the Chinese market

The China gaming industry is highly competitive owing to the presence of many small and large players in the market. The market appears to be moderately concentrated with the major players in the market adopting strategies like product innovation, service innovation, mergers, and acquisitions to stay ahead of the competition and increase their reach.

Major players in the Chinese videos game industry are :

- Tencent – Tencent is one of the world’s largest video game companies. Its popular games include Honor of Kings and PUBG Mobile. Tencent also owns stakes in many international gaming companies like Riot Games (developer of League of Legends) and Epic Games (developer of Fortnite).

- NetEase – NetEase is another significant player in China. It develops and operates some of the most popular online PC and mobile games in China. They are also known for partnering with Blizzard Entertainment to operate local versions of games like World of Warcraft and Hearthstone.

- Perfect World – Perfect World is a Chinese video game company specializing in MMORPGs. They have developed games like Perfect World and Swordsman Online. They also collaborate with Valve Corporation to operate Dota 2 and Counter-Strike: Global Offensive in China.

- MiHoYo – A rising star in the gaming industry, miHoYo developed the popular game Genshin Impact, which has achieved global success.

- YOOZOO Games – Known for its game development and distribution, with a focus on MMO and strategy games. They’re most recognized for the game Game of Thrones: Winter Is Coming.

- 37 Interactive Entertainment – A large gaming company that focuses on mobile games, including the globally popular game Puzzles & Survival.

- Lilith Games – Developers of popular games like Rise of Kingdoms, AFK Arena, and Warpath.

- iDreamSky – One of the largest independent mobile game publishing platforms in China, known for working with international developers to bring their games to the Chinese market.

Video Game Industry revenue in China

- Revenue in the Video Games market is projected to reach US$109.20bn in 2023.

- Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 8.04%, resulting in a projected market volume of US$148.80bn by 2027.

- In the Video Games market, the number of users is expected to amount to 844.60m users by 2027.

- User penetration will be 52.0% in 2023 and is expected to hit 57.5% by 2027.

- The largest market is Mobile Games with a market volume of US$81.90bn in 2023.

- In global comparison, most revenue will be generated in China (US$109,200.00m in 2023).

- The average revenue per user (ARPU) in the Video Games market is projected to amount to US$143.80 in 2023.

Users of video games in China

In the year 2022, in the China online gaming industry, around 28 percent of eSports users were below 25 years old, whereas about 8.1 percent were older than 44 years. If this is the target market, a company should focus on this community, adapting its video game to this market’s needs and interests.

This is what has done the Chinese platform Bilibili, creating a community for Chinese online gamers to share their gaming experience.

The market’s largest segment is mobile games

One of the major factors driving the China online gaming market is that the major publishers of games have established the mechanics that the PC games and video game consoles can be successfully modified to mobile screens, owing to which many popular games have been transferred to the mobile platform.

For instance, Tencent Holdings, Tencent Holdings, China’s biggest tech company, mostly present in the mobile gaming domain throughout the years with research and development has upgraded its WeChat app to become one of their most popular gaming platform in China.

Currently the company has a portfolio of around 147 mobile games. One of their most popular mobile games is Honour of Kings which has over more than 200 million players in China.

Mobile Gaming holds the maximum revenue due to rapid increases in China’s internet access through Wi-Fi networks along with the widespread adoption of 4G, 5G service, which is quickly bringing China to the top of global internet access rates.

Why video game market is a big opportunity for foreign companies?

Due to its big market share in China, the Chinese online games industries offer many opportunities for businesses. Recently, more and more international companies have started entering the Chinese online gaming market.

Often this is done either by acquiring shares in Chinese gaming companies or by sponsoring teams of professional players.

Chinese Video Game Market Trends

Female gaming industry

One of the major opportunities is in the female gaming industry. Chinese female players have spent around an average of 445 yuan each on video games in 2022, which represents an increase of more than 13.8% compared to the previous year.

Furthermore, the amount of female players is estimated to be almost 50% of Chinese gamers. Due to these reasons, companies need to take them into consideration.

Sponsor gaming teams or events to gain visibility

Another opportunity for foreign companies is to gain visibility by sponsoring professional gaming teams or events. Popular eSport gamers are seen as China Key Opinion Leaders (KOLs).

Sometimes, these KOLs are paid to organize gaming events in which they compete with other KOLs while being watched by thousands of people around the world. The revenue generated from advertisements during competitive events is predicted to increase to more than $1 billion.

The image below represents the International, an annual esports world championship tournament for the video game Dota 2 which also takes place in China.

Cooperation between FMCG/fast food restaurant chains and videogames

Cross-border promotion with FMCG (Fast-moving consumer goods) and fast-food restaurant chains have become another trend in the Chinese online game industry in recent years. For example, the cooperation between Pringles and CrossFire, Tencent’s video game.

Consumers that play online games can get the item code of CrossFire by purchasing Pringles potato chips. The packaging for the potato chips has turned into a promotion channel for the mobile game. Both CrossFire and Pringles can reach a larger group of users in the Chinese gaming market through such non-traditional cooperation.

Video and Live Streaming Platforms

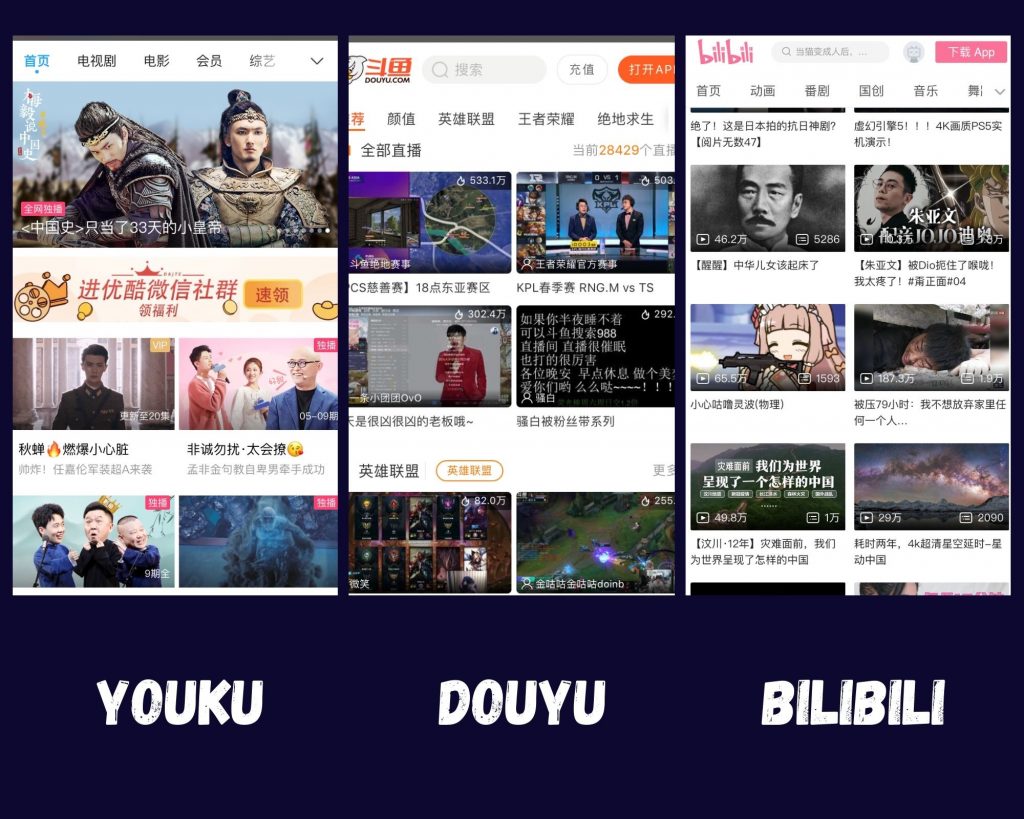

The young generation born after the 80s and 90s spend large chunks of their time with video game consoles in their hands or watching live-streaming platforms every day. Some popular names of such platforms include Douyu, Youku, and Bilibili. All three of these platforms can be very important for Chinese mobile games.

To conclude, the gaming industry in China is full of opportunities for foreign companies. However, worldwide gaming companies need to be mindful of the new regulations.

How to enter the Chinese rising online gaming market?

Licensing a Video Game in China

For an online game to become available in China online games industry, regulators must approve the game’s content and issue a license. Games that are deemed to have inappropriate content, such as too much violence or sexual innuendo, will be denied a license.

Licensing has gotten more selective since falling under the jurisdiction of the Central Propaganda Department.

Listed on Chinese app stores

Since July 2020, all online games require an International Standard Book Number (ISBN) in order to be listed on Chinese app stores.

The ISBN application in China involves several government bureaucracies, including the Ministry of Industry and Information Technology (MIIT), the Copyright Protection Center of China (CPCC), and the SARFT, among others.

New rules

Gaming addiction in China has become a growing concern in recent years. With the rise of online gaming platforms and the accessibility of mobile games, many individuals, particularly young people, have developed a dependency on gaming.

This addiction is often characterized by excessive gaming, neglecting other responsibilities, and experiencing withdrawal symptoms when unable to play. The Chinese government has implemented various measures to address this issue, including restrictions on game time for minors and the establishment of gaming addiction treatment centers.

For example :

- In 2018, the Ministry of Education released policy plans to introduce age restrictions and playing time limits for video games, suggesting that video game addiction caused myopia and poor health.

- In 2019, the General Administration of Press and Publication (GAPP) issued rules requiring real-name registration for online gaming. Further, the measures limit users from eight to 16 years old to adding RMB 200 per month into their accounts, and RMB 400 for users between 16 and 18 years old.

However, the battle against gaming addiction continues as experts and authorities work towards finding effective solutions to help individuals overcome this problem.

Cooperation with Chinese entities

Cooperation with Chinese entities is an unavoidable reality for foreign investors entering China’s online gaming market in a formal capacity.

In China, foreign servers are generally only accessible through the use of VPNs, which the majority of Chinese users do not use. Because most Chinese gamers use domestic platforms and app stores, like the Chinese Apple Store or Tencent’s app store, they will not be able to easily find or purchase a game hosted on a foreign server.

In addition, Chinese users may not be able to use foreign payment methods on foreign platforms, as digital payment systems like Alipay and WeChat Pay are commonly used in China instead of international credit cards.

Therefore foreign developers need to find a Chinese partner to register and publish their games, also because foreign-invested enterprises (FIEs) are prohibited from directly publishing games and acquiring ISBNs.

For example, the Japanese gaming company Nintendo distributes its games through a partnership with the Chinese tech and gaming giant Tencent.

Despite the hurdles to enter China’s gaming market, it remains a top destination for foreign game developers due to its enormous size.

China’s app stores

Even with the popularity of IOS, Android is still the most popular mobile operating system across China. However, due to China regulation laws, Google Play is inaccessible, therefore, there is a multitude of alternative app stores to download from.

Currently, there are over more than 200 app stores in China, with the top ones being Tencent Myapp, 360 mobile assistants, Baidu mobile assistant, MIUI app store, and Huawei app store.

How to market your video game in the Chinese market?

Mobile gaming has been very successful in recent years, making China an attractive market not only for game lovers but also for brands that want to enter the Chinese market and market their video games.

Here there are successful steps to follow to market your video game in China :

Localization: You should adapt your content to Chinese video games players

There is a huge range of elements and themes that can make a mobile gaming app successful. In China, Games with a more localized theme tend to do much better than games with a Western theme as they are more relatable to Chinese players. Visuals, characters, soundtrack, and story are all ways in which you can achieve this.

Quality Chinese content is the key, it’s important to understand the consumer and what gamers expect. They are very discerning in China and love technical news about the game’s development and the opportunity to collaborate in its development with open source gaming/trial versions etc.

How to gain visibility in China?

SEO on Baidu

The Chinese search online on Baidu for gaming information is important to gain visibility in the natural search results. This can also be combined with PPC advertising and banners to reinforce your visibility and reputation.

The basis of SEO in China starts on the Baidu search engine with a domain name en.cn. For optimal efficiency of your strategy, hosting your site in China will allow you to gain more visibility for your Video game website.

More and more people are using their mobile devices to access websites, this phenomenon means that mobile SEO also is important.

KOLs

Mobile games can also take advantage of the booming KOL (Key Opinion Leader) phenomenon in China to expand the fan base. China’s mobile game publishers can cooperate with gaming KOLs on Weibo and Wechat or do live streaming on video game platforms.

Especially in the video game market, these KOLs have a huge and precise fan base that can be transformed into high traffic for your brand.

Promote your game on WeChat

WeChat is China’s largest social media platform, offering a wide range of services from messaging and calling to shopping and payments. It had over more than a billion monthly active users. This makes it an ideal platform for promoting a game. Here are some strategies to consider:

1. Official Account: Creating an official WeChat account for your game is the first step. This can be used to share news, updates, promotional materials, and interact with your audience. There are different types of official accounts – Subscription Accounts, Service Accounts, and Enterprise Accounts, each with its own features and benefits. Typically, a Service Account would be the best fit for a game as it has more advanced features.

2. WeChat Moments: Similar to Facebook’s newsfeed, WeChat Moments allow users to share updates, photos, and articles with their friends. As a game developer, you can create ads that appear in WeChat Moments to promote your game. These can include videos, images, and links to your game.

3. Mini Programs: WeChat Mini Programs are sub-applications within the WeChat ecosystem. Game developers can create mini-games or interactive advertisements to engage users. This can be an effective way to give users a taste of the game before they download the full version.

4. Key Opinion Leaders (KOLs): Influencer marketing is also powerful on WeChat. Collaborating with KOLs who have a large following can help increase visibility and interest in your game.

5. WeChat Groups: WeChat groups are a great way to build a community around your game. You can create a group for players to share tips, discuss game strategies, and provide feedback. You can also share exclusive news and updates in the group to engage your most loyal fans.

6. QR Codes: QR codes are widely used in China and are supported by WeChat. You can create a QR code for your game or official account and share it on your website, on social media, in game chat, or at events to attract new followers.

7. Customer Service: WeChat allows you to interact directly with users through messaging. This can be used to provide customer service, answer questions about the game, and collect feedback.

Weibo is one of China’s largest social media platforms and is often compared to Twitter due to its format of short, public posts. Weibo had over more than 500 million active users, making it a prime platform for promoting a video game. Here are some strategies you can consider:

1. Establish an Official Account: The first step is to create an official Weibo account for your game. This will serve as the central hub for all news, updates, and promotional materials related to your game. Make sure to maintain regular activity on the account, as users prefer to follow accounts that provide fresh content frequently.

2. Collaborate with Key Opinion Leaders (KOLs): Influencer marketing is big in China, and many game publishers collaborate with KOLs to promote their games. Find influencers who have an audience that aligns with your target demographic, and set up sponsored posts or live streams where they play your game.

3. Engage with Users: Weibo allows users to comment on posts, giving you the opportunity to engage directly with your audience. Responding to comments and reposting user-generated content can create a sense of community around your game.

4. Hashtags and Trends: Similar to Twitter, Weibo utilizes hashtags to categorize posts. By using popular or trending hashtags, you can increase the visibility of your posts. You can also create your own branded hashtags to encourage discussion about your game.

5. Sponsored Posts and Ads: Weibo offers a variety of advertising options, including sponsored posts and display ads. Sponsored posts will appear in users’ feeds, while display ads will appear in the sidebar or other parts of the site.

6. Multimedia Content: Weibo supports multiple types of content, including images, GIFs, videos, and live streams. Sharing a variety of engaging content, such as gameplay clips or behind-the-scenes development insights, can help grab users’ attention.

7. Launch Events and Contests: Holding special events or contests can generate buzz and increase engagement. For instance, you could hold a giveaway where users who repost your announcement are entered into a drawing for in-game rewards.

Live streaming and Video game platforms

Due to the success of live streaming in China, these platforms could be a big opportunity for your brand. Some popular names include Douyu, Youku, and Bilibili.

Douyu

DouYu is a Chinese video live streaming service. The site is the largest of its kind in China with159.2 million million monthly active users in 2023.

Youku

Youku Tudou (优酷) is a video hosting service based in Beijing, China. It operates as a subsidiary of Alibaba Group Holding Limited.

On March 12, 2012, Youku reached an agreement to merge with Tudou in a stock-for-stock transaction, the new entity being named Youku Tudou. It has more than 500 million monthly active users, with 800 million daily video views.

Bilibili

Bilibili (哔哩哔哩) is a Chinese video-sharing website based in Shanghai, themed around animation, comic, and game, where users can submit, view and add commentary subtitles on videos.

Bilibili has developed several unique features that enable it to distinguish itself from other platforms. The site allows its viewers to send real-time comments that run across the screen while the video is playing, which significantly increases the sense of engagement. Bilibili creates a community for Chinese gamers to share their gaming experience.

To manage these three video game platforms could be a big opportunity for brands to gain attention from Chinese consumers and to improve their brand awareness.

Gaming Forums

Gaming communities turn to very active forums such as Baidu Tieba, Tianya, or Douban. These platforms can be used to talk about relevant and current topics and to promote your game.

Contact us to enter the Chinese online gaming market!

The China video game market is a rapidly growing and lucrative industry. With a large population of gamers and increasing disposable income, China has become one of the largest video game markets in the world. The market is driven by mobile gaming, with a significant portion of the population accessing games through smartphones.

Additionally, the rise of eSports and the increasing popularity of online multiplayer games are the major growth drivers of China’s online gaming market.

However, it is important to note that the Chinese government has implemented regulations and restrictions on video games, particularly on content and playtime for minors. These regulations can impact the market and require game developers to adapt their strategies.

Overall, the China video game market presents numerous opportunities for both domestic and international game developers and continues to evolve with the changing landscape of technology and regulations.

We are a China-based marketing agency offering cost-effective solutions to foreign brands interested in tapping into the Chinese market. Our team of Chinese and foreign experts has the experience and know-how needed to succeed in this lucrative, yet complicated market.

Gentlemen Marketing Agency offers many digital marketing and e-commerce solutions, such as web design, e-commerce and social media marketing strategies, localization, market research, KOL marketing, and more.

Don’t hesitate to leave us a comment or contact us, so that we can schedule a free consultation with one of our experts, that will learn about your brand and present you the best solutions for your China market strategy.

One Comment