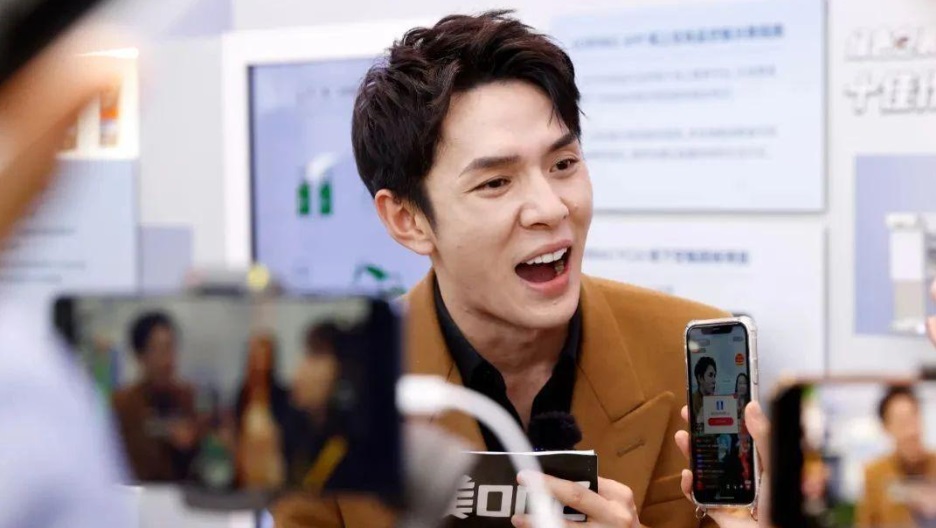

Situation is complictaed now in China, he Denied rumours.

The topic #LiJiaqiDoubleElevenIncomeExceeds25Billion# surged on the hot search on Weibo and other social Media platform.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

25 billion yuan of revenues? 3Billion $ in one week ?

Media reports claimed that according to statistics from Li Jiaqi’s team and calculations based on the sales volume and pricing in his live streaming room, it was conservatively estimated that Li Jiaqi’s total income during this year’s Double 11 surpassed 25 billion yuan. However, Li Jiaqi’s team responded: “This is purely fabricated.”

The topic had garnered over 340 million views on social media. CRAZY

The media reported that, according to Li Jiaqi’s team’s data, based on the sales volume and pricing in his live streaming room during Double 11, Li Jiaqi’s total income was conservatively estimated to exceed 25 billion yuan.

Why Li Jia QI play low profil ?

In response to these claims, Li Jiaqi’s company Mei One told Jiemian News, “The data is purely fabricated and seriously inaccurate. The Double 11 sales and data collection are far from over, and Li Jiaqi’s live streaming room has never published GMV data.

The so-called 25 billion income is purely speculative.”

Previously, speaking about the changes in Double 11, Li Jiaqi in an interview with China News Service’s Economic channel, indicated that consumers are now more focused on pragmatism, paying more attention to the functionality, value, and practicality of products. Their buying behavior has become more rational, not blindly following trends or engaging in impulsive spending. This shift in consumer mindset and philosophy is commendable.

This year, a notable trend is that major e-commerce platforms have not disclosed their GMV (Gross Merchandise Volume) figures for Double 11, moving away from emphasizing growth and instead focusing on the results of refined operations.

According to some media , on the first day of this year’s “Double 11”, Li Jiaqi’s sales reached 9.5 billion yuan, a decline of over 50% compared to last year.

Last year, Li Jiaqi’s live stream sales accounted for nearly one-third of the total Double 11 sales, but this year, the proportion has dropped to about one-fourth.

What s the reality ?

Li Jiaqi has frequently topped the hot search lists due to his declining sales. Not long ago, he was embroiled in controversies involving floor price agreements, exclusivity deals, and counterfeit goods, and was frequently questioned and suspected of monopolistic practices.

9.5 billion yuan

During this year’s “Double 11”, Li Jiaqi’s first-day sales amounted to 9.5 billion yuan, a more than 50% drop compared to last year. Last year, Li Jiaqi’s live broadcast sales accounted for nearly one-third of the total Double 11 sales, but this year, it has decreased to about a quarter. Industry insiders believe that the “de-topification” of live streamers seems to have become a unified goal for brands and platforms. Data from iResearch shows that in 2023, the turnover from corporate self-broadcasts will account for 49.8%, equal to that of influencer live streams. source

Nandu Big Data Research Institute reviewed Li Jiaqi’s live room sales on the first day of Double 11 pre-sales over the past two years. In 2022, the GMV on the first day of Double 11 was about 21.5 billion yuan; in 2021, it was 10.6 billion yuan. This year’s GMV is the lowest in three years.

The decline could be attributed to controversies involving Li Jiaqi during this year’s Double 11.

Anti Monopoly Policy

On October 24, an employee of Haishi Electric exposed that JD.com, before launching the Double 11 event, unilaterally changed the promotional price of a Haishi oven from 669 yuan to 639 yuan, breaching a prior price agreement with Haishi. JD.com procurement staff immediately denied and pointed the finger at Li Jiaqi’s live stream room, questioning its “exclusive choice” behavior and the so-called “lowest price on the whole network,” suggesting monopolistic tendencies, with all three parties having differing claims.

The Beijing policy of De-Topification” of Live Streamers

Experts: The Rise of Store and Brand Self-Broadcasts Is an Inevitable Trend

According to the Securities Daily, industry insiders believe that the “de-topification” of live streamers seems to have become a unified goal for brands and platforms. Data from iResearch shows that in 2023, the turnover from corporate self-broadcasts will account for 49.8%, equal to that of influencer live streams.

According to Yangcheng Evening News, “Store broadcasting has welcomed

Li Jiaqi Marks This Year’s Double 11 Shopping Festival”

As the Double 11 shopping festival kicked off this year, a series of controversies centered around Li Jiaqi, a prominent Chinese live streamer, continued to unfold. The commotion began with a WeChat post from a JD.com procurement employee, accusing Li of manipulating prices to the detriment of consumers. This was quickly followed by complaints from another top streamer, “Crazy Xiao Yang Ge”, who was discontented about the exclusive control of goods by Li’s team. These incidents, coupled with accusations of counterfeit practices and recent revelations of corruption within the Mei One product selection team, have kept Li at the center of a whirlwind of scrutiny. source

At the heart of these controversies lies the “lowest price on the whole network” model adopted by top streamers like Li. Originally, Double 11 was conceptualized around the idea of offering low prices. This year, discussions about who should offer the lowest prices became a focal point, reflecting not just a debate on the industry’s developmental model but also the vested interests of different platforms.

Double 11 and prices

Despite being an annual event, this year’s Double 11 saw an intensified focus on low pricing strategies across all platforms. Li Jiaqi’s team adopted the slogan “Low, low, low, low, low, see Li Jiaqi first on Double 11”, emphasizing low prices in a manner reminiscent of elevator advertising.

In a similar vein, Taobao Tmall Group also set “the lowest price on the whole network” as its core target this year, shifting its focus away from GMV as the primary performance metric. JD.com, traditionally emphasizing “faster, better, and more economical”, narrowed its theme this year to just “real cheapness”.

JD play the card or Real Cheap

The dispute initially erupted when a JD.com procurement staff member’s WeChat post went viral. It concerned a complaint from a brand about JD.com’s pricing of a product being lower than Li’s live stream price, allegedly breaching a so-called “floor price agreement” and incurring substantial penalties.

The post claimed that JD.com subsidized the price difference at its own expense to offer consumers the lowest possible prices, gaining widespread support and recognition online. However, a statement from the brand later clarified that JD.com did not subsidize the price change, leaving the brand to bear the loss.

This was followed by a verbal onslaught from “Crazy Xiao Yang Ge”, who had to remove a beauty device from his live stream for pricing it lower than Li’s, expressing his dissatisfaction with Li’s “floor price agreement”. Although his criticism didn’t garner as much attention as JD.com’s, it highlighted the intense competition in the live streaming industry.

These controversies raise questions about the sustainability of the low-price model in live streaming and e-commerce, especially in the context of changing consumer spending power. They also bring to light the challenges faced by top streamers like Li Jiaqi in navigating the complex and competitive landscape of China’s online retail market.

Despite these issues, Li’s sales figures remain impressive, though they have experienced a significant drop compared to previous years. The overall slowdown in the live streaming e-commerce sector and the diminishing allure of major promotional events for consumers also play a crucial role in shaping the future trajectory of the industry.

More readings