China is the largest instant noodle market in the world. The country consumes several billion packages of instant noodles per year, accounting for almost 40% of total global consumption as of 2020. This blog post will provide an overview of China’s Instant Noodles Market, its trends as well best strategies to promote instant noodles in China.

China Instant Noodles Market Overview

In China, people have been using instant noodles since at least the 1970s and it is a common dish for many restaurants to serve. In Japan, there are reported averages of 48 packs per capita while South Korea sees 78 packages consumed annually on average. This data is showing us the instant noodle market in China still has a margin to grow.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

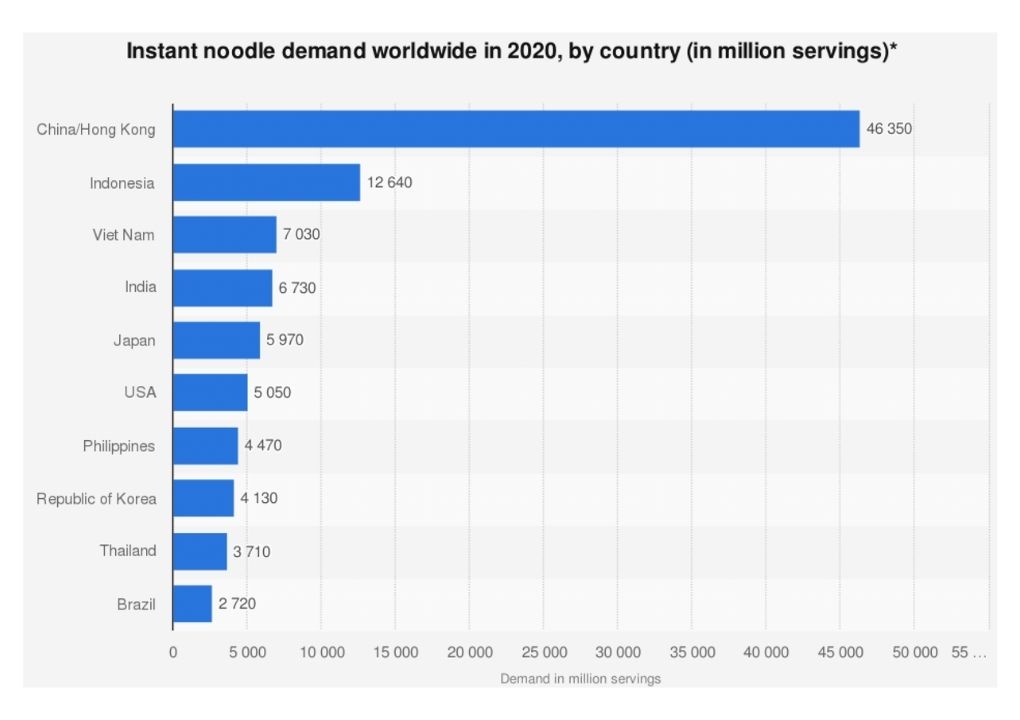

China has the greatest demand for instant noodles in the world in 2020 about 40% reaching 46 billion servings. In 2018, 40.25 billion packs of instant noodles were purchased in China. During the COVID pandemic, the dry food category was most demanded in China, accounting for 55% of purchases.

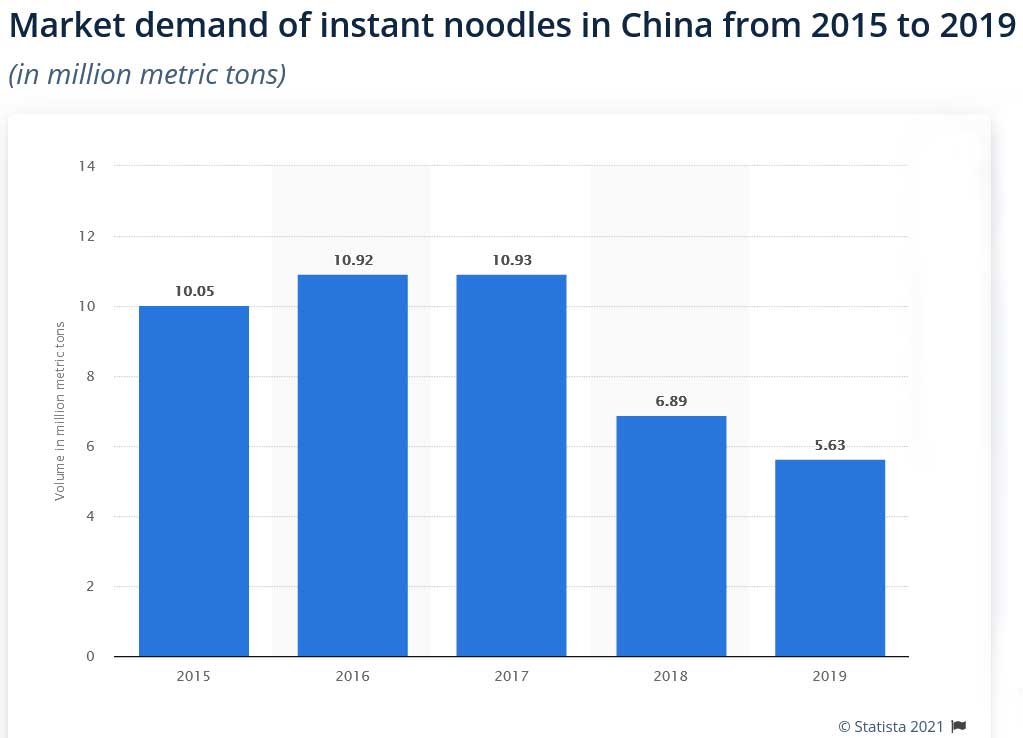

In 2019, the demand for instant noodles in China was approximately 5.6 million metric tons (as per the graph below). Although we note a stiff decrease in 2018 and 2019, the sales of instant noodles are growing again as of 2021.

What drives the sales of instant noodles in China?

In 2018, the Chinese consume 29 packs of instant noodles per person which is higher than the average of 13 packs in the world. When they purchase instant food, Chinese customers consider texture, flavor, and brand mostly.

Some of the reasons for instant noodles’ success in China are their convenience (in Chinese they are called 方便面 which translates by convenient noodles) and accessible price. On top of that noodles is a staple of many Chinese dishes.

People who pursue fast meals with cheaper prices. For instance, consuming instant noodles to replace meals sold in restaurants and canteens.

Instant noodles are also an extremely accessible staple and can be bought at any time in the numerous convenient store populating Chinese streets and residential complexes. They are varied and offer many flavor profiles that appeal to Chinese instant noodle lovers.

On a similar topic: Readymade meals in China are popular on Chinese E-commerce Apps

China Instant noodles market trends

- Cups and Bowls Instant Noodles

As the great reason for purchase motivation is the convenience of instant noodles, cups and bowls enable buyers to eat anywhere and easy to clean. This consideration makes cups and bowls instant noodles products more attractive than package categories.

- Healthy Preference

As health awareness rises, customers also pay attention to factors such as less oil, less seasoned, rich flavor, nutritional, healthy, etc.

For instance, in contrast to traditional instant noodles, the brand “Ramen Talk” focuses on high-end and healthy convenience foods. For its classic tonkatsu ramen uses semi-dried fresh noodles with barbecued pork mochi fungus green onion all in a refined soup base designed for home cooking without going out restaurant shopping!

- High-end and High-price Choices

With the rise of both heath conscientiousness and food delivery, instant noodles have started to lose some of their initial appeal with Chinese consumers. To counter this, noodles brands bet on innovative flavors and products. Now, customers can and are willing to purchase higher-priced instant noodles which reflects into instant noodle producers’ revenue.

For instance, Japanese Nissin invents “Chicken Ramen” instant noodles cups to successfully attract customers.

Brands are also taking advantage of the many favor profiles famous and trendy in the country such as Sichuan and Lanzhou as the below example will illustrate. Although it is not hard to find such dishes anywhere in China, having them available in the form of instant noodles is a novelty.

We just said it, there are lots of local and classic noodles restaurants in China, it is a staple. The 3 leading instant noodles brands all attempted to reach the same level of taste and texture as fresh-cooked noodles in a restaurant. For instance, Kangshifu’s “Express速达面馆”, Tongyi’s “汤达人” and Jinmailang’s “老范家速食面馆面”.

Last but not least, not only trying to invent new flavors but a local taste is a consideration as well. For instance, targeting certain Chinese customers with Spicy flavors as Nongshim’s spicy noodles.

- Diverse Categories

Tongyi’s innovates in a product category specializing in “Liangpi” (cold noodles) as most of the instant noodles are dried, fried, and soup noodles. They had a sales value of 7000 packs in a month on Tmall.

Chinese are highly willing to try out famous restaurants in daily life. Nissin collaborates with a famous ramen restaurant, Musashi, to launch instant ramen cups.

Challenges for an instant noodles brand wanting to enter the China market

- Domestic dominant brands

Chinese customers are loyal to certain brands with high brand recognition. Brands such as Kangshifu and Tongyi account for over half of the market shares, about 60% in total. In 2018, Kangshifu had once occupied 78% of the market.

For the new entry brands, you need to well select the distributions with marketing strategies. To compete in this food category, businesses that launch attractive products target customers’ needs win. It is a customer-oriented industry. Differentiating your products to stand out from competitors is important as well. For instance, Korean Samyang successfully sold out lots of super spicy noodles with spicy noodles challenge go viral online. As Chinese are also sensitive to foreign campaigns or product placements in K-dramas.

- Geographically wide-range and frequent O2O(Online to Offline) food delivery service

Main brands of Instant Noodles in China

Certain dominant brands in China have long brands history and loyal customers such as Kangshifu=Master Kong(46.6% of market shares in 2019), Tongyi=Uni.President(21.2%), and others(Jinmailang, Baixiang, etc). These two main brands all have their representative products to build their brand recognition.

- Kangshifu(康师傅) : Leading traditional Chinese instant noodles brand with a brick-and-mortar store selling noodles.

- Baixiang(白象): founded in 1997 in Henan, white elephant is a large chinese f&b group that mainly focuses on noodles but also produces beverages and seasoning.

- Tongyi(统一): Tongyi accounts for the second-largest instant noodles market share which is a Taiwanese brand. The group has many sector of activities such as finance, entertainement, electronics and so on.

- Jinmailang(今麦郎)

- Huafeng(华丰)

- Wugu Daochang(五谷道场)

- Doll(公仔面) 8 Tianfang(天方)

- Nanjiecun(南街村)

- Dahankou(大汉口)

Learn more about the Top 10 instant noodle Brands in China

How do Chinese customers purchase instant noodles?

Chinese customers mainly purchase instant noodles in convenience stores (Family Mart, 7-11, Alldays, Lawson), supermarkets, eCommerce(Tmall, JD.com, Taobao), wholesale markets, and vending machines. You can open your official accounts on eCommerce to be socially shared with your promotions campaign, product, and store home page, or take a good advantage on popular live streams promotion and group marketing.

Why should instant noodles brands invest in Chinese eCommerce?

To sell in a massive market where leading brands compete and a channel with huge sales revenue. Massive online shoppers and eCommerce users in China. In 2018, there are 520 brands sold on JD.com and 199 brands sold on Tmall. In general, more instant food categories are sold on JD which brings more competitiveness at the same time. Thus, consider your scale, budget, and store types choices to sell on different eCommerce platforms.

Find out more about Chinese eCommerce Platforms

Use Chinese Social Media to connect further with instant noodles lovers

Chinese social media are key to converting visitors into buyers. They help you with brand awareness and reputation. China’s most popular social media are Weibo and WeChat (as well as Douyin). Whatever you choose to use, make sure that your account is an official/business one. First of all, it will make you look more legit as an instant noodles brand, and secondly, it will give you access to a lot more marketing tools as well as visibility.

Marketing strategies on social media cover a large field of practices from content marketing, to paid ads or Kols for instance. Games, group marketing, and live streams are more and more popular strategies in China that can be your choice to catch the Chinese’s eyes and promote your marketing campaigns.

For instance, an Indonesian instant noodles brand, Seedap, launches a drawing contest campaign followed by a give-away that they communicated through their Wechat account.

The Malaysian brand of instant noodles also takes advantage of social sharing to encourage participants to create a team of three people in order to play simple and interesting games and win a prize.

Interesting purchasing experience and customer engagement will bring you more visibility in China, especially choosing placement on their frequent-used channels such as WeChat.

Want to launch your instant noodles brand in China?

Contact-us, whether you wish to distribute, direct sell, or investigate Chinese eCommerce platforms, we have solutions for you!