In 2024, the imported sausages market in China has been experiencing dynamic changes, driven by evolving consumer preferences, regulatory shifts, and global trends

- Growing Demand for Imported Foods: Chinese consumers have shown an increasing appetite for imported foods, including sausages, due to perceptions of higher quality, safety standards, and taste preferences. This trend is partly fueled by rising disposable incomes and a growing middle class eager to explore international cuisines.

- Preference for Premium Products: There is a significant market segment in China that prefers premium imported sausages over local alternatives. These consumers are willing to pay a higher price for products perceived to be of superior quality, authenticity, and flavor, driving demand for European and American sausage brands.

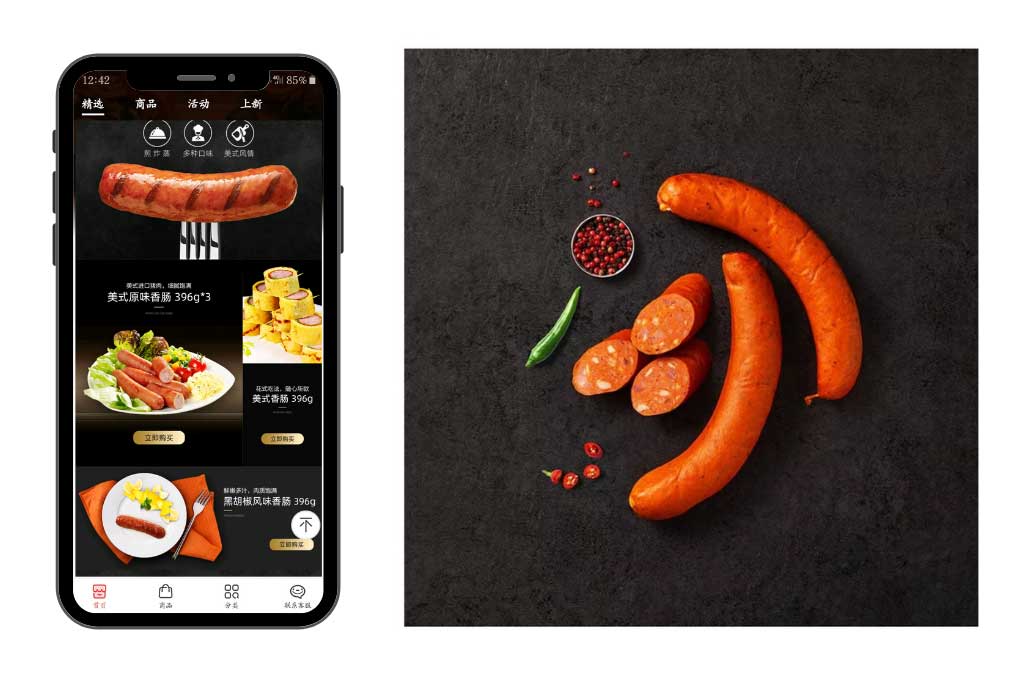

- Impact of E-commerce: The rise of e-commerce platforms like Tmall Global, JD.com, and cross-border e-commerce channels has made it easier for Chinese consumers to access a wide range of imported sausages. Online sales have significantly contributed to the market growth, offering convenience and access to consumer reviews and ratings.

- Health and Wellness Trends: Health-conscious consumers in China are increasingly seeking out imported sausages with health claims, such as organic, low-fat, or free from artificial preservatives. This shift towards healthier eating habits is influencing product offerings and marketing strategies in the imported sausages market.’read more here)

- Food Safety Concerns: Food safety scandals in the past have heightened Chinese consumers’ awareness and concern about food quality and safety. As a result, imported sausages, which are often subject to stricter quality control standards, are perceived as safer options, bolstering their appeal.

- Regulatory Environment: The Chinese government’s regulations and tariffs on imported goods, including sausages, can significantly impact market dynamics. Trade agreements and changes in import duties also play a crucial role in shaping the competitive landscape and pricing strategies for imported sausages.

- Cultural Adaptation and Local Preferences: While there is a strong market for traditional European-style sausages, success in the Chinese market often requires adapting products to local tastes and preferences. Some international brands have introduced flavors and product variations that cater specifically to the Chinese palate, enhancing their market acceptance.

The Chinese Pork Market

Pig meat is crucial to Chinese cuisine, culture, and its economy. Many menus in mainland China list pork simply as “meat.” In China, the global population eats around 28% of the world’s meat, half of it being pork. Pork is often offered during wedding banquets, lunar new year, and other celebrations. The country’s pork consumption is greater than all the meat Americans consume annually.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Now that the country is wealthier than before, pork accounts for 70% of all meat consumed in China. Chicken is a distant second at 15%, with pricier beef and mutton accounting for Nowadays, the Chinese eat more meat products than ever, and China is importing more meat products than ever before, the ost imported items :

- Edible offal of bovine animals

- Swine

- Sheep

- Goats

- Horses

- Asses

- Mules

- Hinnies

The meat market in China is the second largest sector in the country’s retail food market, after the fresh vegetables sector.

Nowadays, China occupies an important position in the global meat market. China is the world’s largest producer, consumer, and importer of meat. Pork occupied the most dominating position among all meat products in China market. Pork sales lead the meat sale, and pork sales accounted for the highest value in the Chinese meat market. Among all the types of meat, pork makes up 80% of the market, followed by poultry and beef.

These facts underscore the complexity and opportunity within China’s imported sausages market. International brands looking to enter or expand in this space must navigate a landscape shaped by consumer preferences, regulatory considerations, and the advantages offered by digital commerce.

Pork Consumption China in 2024

China butcheries slaughter almost 700 million pigs each year, by comparison with other meats, and pork meat is the most widely eaten meat among Chinese consumers.

- Chinese citizens consume on average 34.2 kg of pork meat per person,

- and the number is expected to grow in the future.

- Pork will remain Chinese people’s favorite meat in the years to come.

Pork demand in China

Geographically, China is not a beef consumption nation, but rather pork. Given the size of the market and its growing middle class, China’s pork market demand is now impacting the global pork industry. Chinese pork consumption grew annually for many decades, nowadays, China’s unprecedented economic growth has transformed the country into a global purchasing powerhouse. (same with Beef)

As the Chinese market contains almost 1.4 billion inhabitants, brand-savvy Chinese consumers still deeply value the stringent food safety standards, improved pork meat products quality that imported foreign brands promise, and they are willing to pay premium prices for them, the growing middle class is the major purchasing power.

The higher demand for quality pork in China is more than Chinese producers can supply, that means pork import to China is on the rise which the beneficiaries of China pork market amazing opportunity is global pork producers, it’s time to care about the demand of China pork market.

Pork meat importers in China

China’s pork imports are set to double, China demand for more pork (Meat and edible meat offal, fresh, chilled, or frozen), pork meat importers in China are not easy to connect directly, besides there are necessary rules and regulations regarding pork import into China, pork import to China goes through different procedures, however, the crucial steps are only a few.

The number one step to get into the China market is to connect with Chinese importers for pork meat in China, obviously, for many pork producers, this is the key to get into China’s pork market, bring their pork products to Chinese consumers. In order to help pork meat producers, import/exports businesses,

DISTRIBUTION IN THE CHINESE MEAT MARKET

Hypermarkets and supermarkets are becoming the leading distribution channel in the Chinese meat market

Processed meat products are mainly sold through new retail formats such as supermarkets and hypermarkets, dominated by Hema Fresh (盒马生鲜) and Yonghui (永辉), the former has developed an innovative online-to-offline (O2O) value proposition. This suits the increasingly sophisticated and demanding needs of urban fresh-food shoppers with rising incomes.

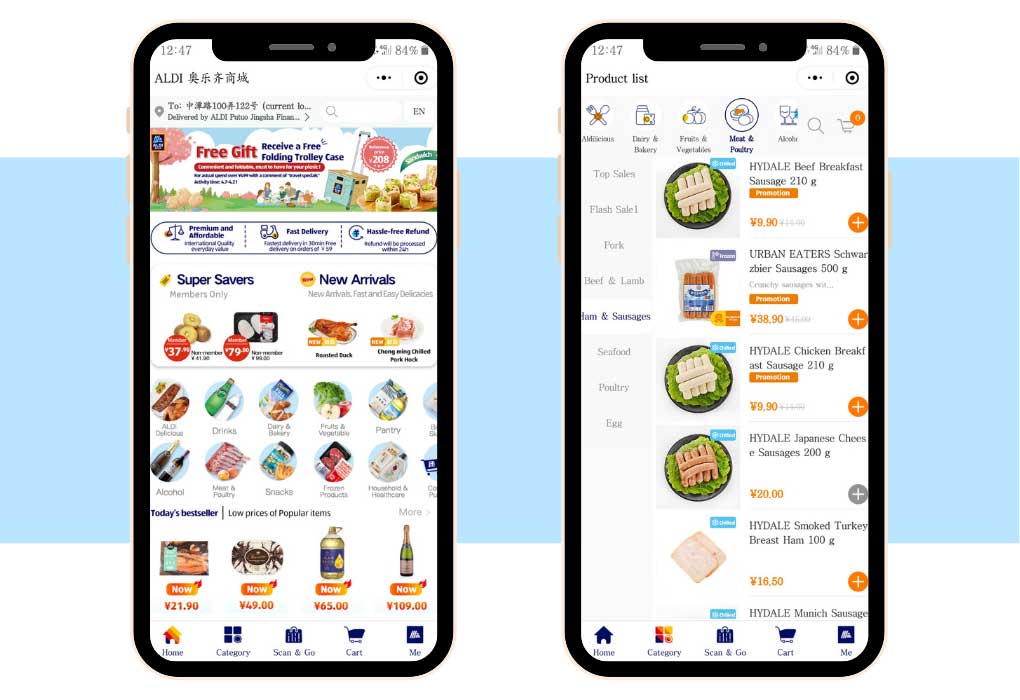

People are now able to buy more expensive cuts of meat than before, leading to greater demand for variety and quality of produce. Foreign hypermarkets like Walmart, Aldi, and Costco have also been reaping the benefits of China’s growing meat market.

E-Retailers are gaining popularity as a retail place for purchasing meat

The popularity of online shopping has surged in China, paralleled with China’s rapidly growing e-commerce market. Hypermarket and supermarket chains now are gravitating towards offering a seamless online-to-offline shopping experience. Hema Fresh, Alibaba’s grocery chain, is one of the leading fresh food retailers that offer mobile applications for online orders as well as in-store catering and offline shopping.

Around 60 % of the sales in Hema Fresh are made via the Hema Fresh mobile application, and shoppers can have the orders delivered free within 30 minutes within a 3-kilometer radius of each store. Hema Fresh’s successful pilot in China’s “new retail” landscape has given rise to food retailers to rethink their distribution networks, and perhaps through creating opportunities for partnership or licensing.

Sell Sausages and pork meat in China :

In China, it’s fundamental to understand the dynamics of digital marketing in China, indeed for good Baidu SEO you need a Chinese website hosted on a Chinese hosting site: Baidu, the main Chinese search engine, does not favor index websites with foreign hosting written in other languages. Your website must also suit Chinese standards and taste.

Selling imported sausages in China through e-commerce channels requires a nuanced approach to navigate consumer preferences, regulatory landscapes, and the competitive market. Here are five strategic tips to effectively sell imported sausages in China via e-commerce:

- Secure a Reliable Importer Specialized in E-commerce: Partnering with an importer experienced in the e-commerce sector is crucial. Look for partners with a strong track record, understanding of the regulatory environment, and established relationships with e-commerce platforms. Brands have to ensures products navigate customs smoothly and reach the online marketplaces without hitches.“Bridge Markets with the Right Partners”

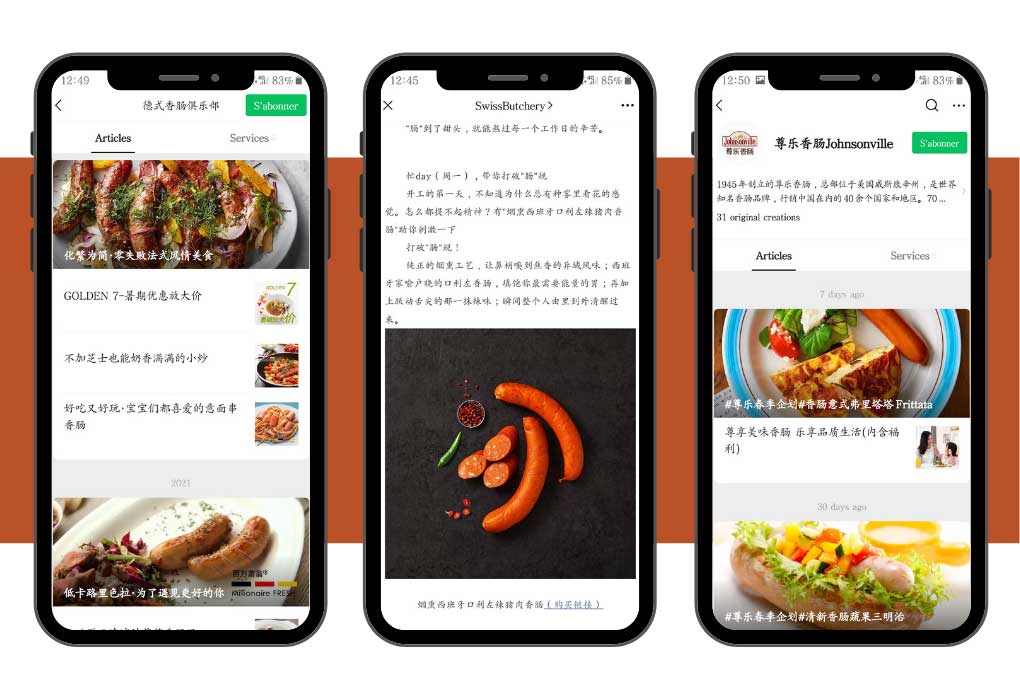

- Cultivate Trust Through Customer Testimonials: Chinese consumers highly value peer recommendations. Encourage satisfied customers to share their experiences with your products on their social media and within the e-commerce platform itself. Authentic testimonials can significantly influence purchasing decisions and build trust in your brand.“Real Flavors, Real Stories, Real Trust”

- Emphasize Corporate Communication on Safety and Quality: In a market sensitive to food safety, transparent communication about your sausages’ quality, safety standards, and certifications is essential. Use your e-commerce platform and social media channels to share detailed product information, including sourcing, processing standards, and safety certifications.“Transparency Tastes Best”

- Leverage Video Marketing to Tell Your Story: Utilize App like Douyin and Kuaishou to create engaging video content that showcases the quality, origins, and unique attributes of your sausages. Highlighting the authenticity and traditional aspects of your products can resonate with consumers seeking premium imported goods.“Savor the Story Behind Every Bite”

- Invest Heavily in Douyin Ads for Maximum Visibility: Douyin is not just a social platform; it’s a powerful sales tool. Allocate a significant portion of your marketing budget to Douyin ads. Tailor your campaigns to target demographics likely to be interested in imported sausages, utilizing Douyin’s robust targeting tools to maximize ROI.“Cut Through the Noise with Precision Targeting”

Read more

By implementing these tips, brands can navigate the complexities of the Chinese e-commerce landscape, effectively reaching and engaging consumers eager for high-quality imported Food in China.

Contact us to learn more about how to sell your products in China !

Contact-us today to learn about the solutions available for your company to start selling sausage Online in China