Are you exploring ways to tap into the booming health market in China? If so, we’ve been there and understand how challenging it can be. With China’s healthcare market growing at lightning speed coupled with an aging population, it paints a picture of vast potential for new entrants.

Let’s dive deep into this thriving industry, exploring various sectors ranging from pharmaceuticals to telemedicine through this guide. Fasten your seatbelts – we’re about to embark on an exciting journey!

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Key Takeaways

- The health market in China is growing rapidly, driven by an aging population and increasing healthcare spending.

- To enter the Chinese healthcare market successfully, companies should conduct comprehensive market research, build partnerships with local entities, understand consumer preferences, harness technological advancements, grasp the regulatory environment, develop a robust online presence, cater to increasing demand, and mitigate potential risks.

- The different sectors in China’s health market include pharmaceuticals (which make up about 55% of the sector), health supplements (estimated at 299 billion RMB in 2022), and medical devices (with high demand for foreign-made devices).

- Leveraging advancements in technology such as digital health solutions and telemedicine can provide a competitive edge in the Chinese healthcare industry.

Strategies to Enter China’s Healthcare Market

To successfully enter China’s healthcare market, it is important to develop effective strategies tailored to the unique characteristics and preferences of Chinese consumers. By understanding their needs and leveraging advancements in technology, such as telemedicine and digital health solutions, foreign companies can gain a competitive edge.

Market research and focus on consumers

Breaking into China’s healthcare market requires a deep understanding of consumer preferences and needs. Chinese consumers’ demand for health and wellness products is robust, indicating a thriving potential marketplace ripe for your company’s offerings.

More than ever before, these discerning customers are willing to pay premium prices for superior-quality items. Surprisingly, this trend is not only confined to urban elites but extends beyond them due to rising disposable incomes across the board.

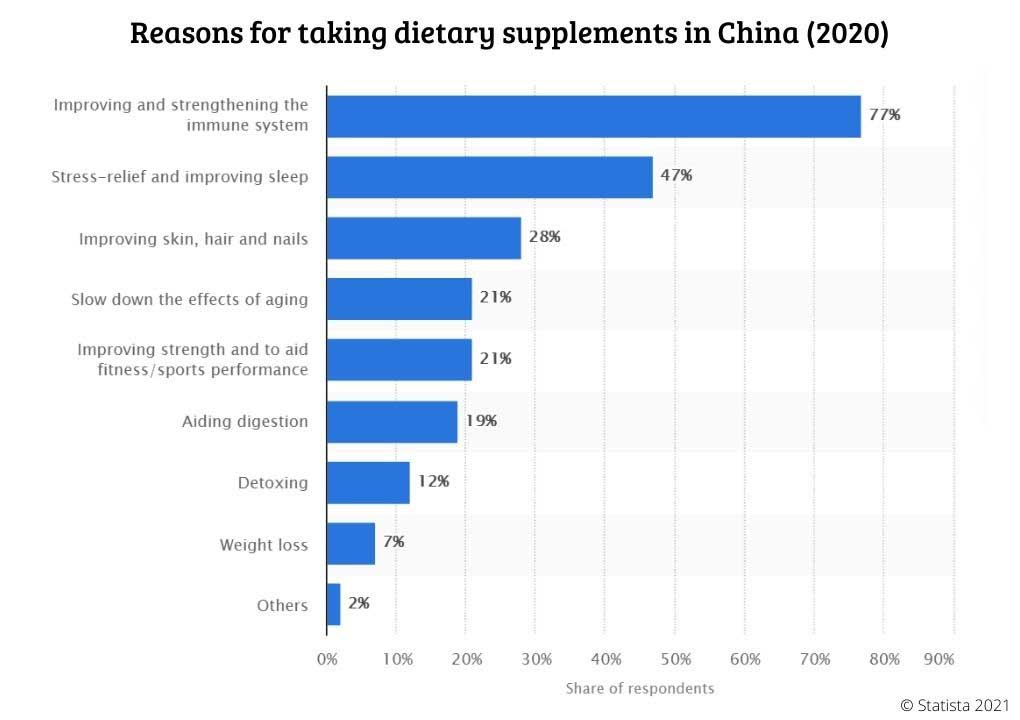

For example, when selling health supplements to Chinese consumers, it’s good to start by understanding their motivations:

To successfully connect with this diverse group, it’s vital we adapt our strategies to their unique buying characteristics while fostering strong relationships with local retailers within the sector.

Medical tourism also reflects an under-served need among consumers who seek out international landscapes for improved health outcomes—a factor worth considering in fine-tuning your product or service offering.

Start by building your digital presence

In China, being present online is something that you can’t omit. If a company, especially from the global market, doesn’t work on its online presence in China, it won’t be trusted or even noticed. Therefore, there are some key elements to take care of, in order to build brand awareness, visibility, and trust among your audience.

Chinese Website

Having a dedicated Chinese-language website is a critical first step for any organization hoping to penetrate the Chinese health care industry. Your website is often the first point of contact for potential customers, so it needs to be accessible, informative, and attractive.

It is essential to ensure that your website is hosted in China or neighboring regions to guarantee fast load times. It should also be mobile-friendly, as the majority of Chinese internet users primarily use mobile devices for browsing. Additionally, the site should be designed and written with local cultural nuances and user preferences in mind.

Baidu SEO

Baidu is the leading search engine in China, hence optimizing your website for Baidu is vital for reaching your potential customers. To be successful at Baidu SEO, you should understand the algorithms and ranking factors that Baidu uses, which are different from those of Western search engines like Google.

Some of the key factors to consider include having a .cn domain, ensuring your site is in Simplified Chinese, improving your site’s loading speed within China, and getting backlinks from other Chinese websites.

Social Media Presence

With over 1.2 billion active users on WeChat and over 580 million on Weibo, establishing a strong social media presence is another key component of entering the Chinese healthcare market online. These platforms offer businesses the opportunity to build brand awareness, engage with consumers, and drive traffic to their websites. Providing valuable and engaging content that caters to the needs and tastes of Chinese users can help cultivate a loyal following.

Of course, each social media platform in China caters to a unique demographic, and it’s crucial to understand these nuances when developing your healthcare marketing strategy.

WeChat, known as Weixin in China, is the most widely used social media platform in the country. Its user base is broad, cutting across different age groups, locations, and interests, making it a must-have platform for any digital marketing strategy in China.

WeChat offers businesses various features like official accounts for publishing content, WeChat groups for community building, and WeChat Mini Programs for providing a range of services within the app itself.

For a healthcare company, you can publish informative articles about health and wellness, launch mini-programs for health assessments or doctor appointments, and build communities around specific health topics.

Weibo, often referred to as “China’s Twitter”, is another popular platform, with its users skewing slightly younger than WeChat. Its real-time, public nature makes it an excellent platform for viral marketing and big announcements. For healthcare businesses, sharing health tips, research findings, product launch information, and industry news can help you reach and engage your audience on Weibo.

Little Red Book (Xiaohongshu)

Xiaohongshu, or “Little Red Book”, is a unique blend of social media and e-commerce platform that predominantly caters to urban, educated, and upper-middle-class women aged between 18 and 35.

Users share their product reviews, lifestyle tips, and personal stories on the platform, making it a great place for influencer collaborations. Healthcare businesses can use this platform to build trust and authenticity through user-generated content, like sharing before-and-after stories or product reviews.

Douyin (TikTok in China)

Douyin is extremely popular among Gen Z users (those born between 1996 and 2010) and has a reputation for fun, creative, and short video content. Given the platform’s visual nature, it can be ideal for demonstrating how your healthcare products work or sharing impactful patient stories. Leveraging trends and popular music can help your content reach more people on Douyin.

Remember, each platform serves different purposes and audiences, so your content and approach should be tailored to each one. Combining the strengths of each platform in a coordinated strategy can help you maximize your reach and impact in China’s healthcare market.

Influencers and Key Opinion Leaders

Influencer marketing is huge in China and can be particularly effective in the healthcare space. The use of Key Opinion Leaders (KOLs) to endorse products or services can significantly boost brand visibility and credibility. Choosing the right influencer is crucial – they should not only have a sizeable following but also align with your brand values and be able to convincingly advocate for your healthcare products or services.

Live Streaming

Live streaming is another rapidly growing trend in China, offering another opportunity for healthcare businesses to reach and interact with their target audience. Hosting live streaming sessions can help educate potential customers about your products or services, answer their questions in real-time, and drive sales. Platforms like Douyin (TikTok’s Chinese version) and Kuaishou are popular choices for live streaming.

E-Reputation Management

Maintaining a positive online reputation is paramount in China’s healthcare market. Given the high level of digital engagement, customers are likely to share their experiences and opinions online, and these can greatly influence others.

Monitoring and managing online reviews, addressing negative feedback, and actively promoting positive customer experiences can help establish trust and credibility in your brand. Tools like the social listening feature on WeChat can be invaluable in managing your e-reputation effectively.

Make use of advanced technology

Emerging technologies are reshaping health services and products, from streamlining patient data management to bridging access gaps for underfunded rural areas. In essence, we’re seeing a revolution sparked by mobile tech integration and Internet-based care delivery systems—a clear indication that digital health is on a rapid growth trajectory in China.

The competitive landscape of this industry has expanded with advancements like these, rocketing the value of both pharmaceuticals and medical devices markets to commendable heights.

This surge could be due to initiatives like “Made in China 2025,” which hint at positive implications for foreign entities looking to import medical equipment from here. Thus, leveraging these technological advancements effectively could open up opportunities not just within direct caregiving areas but also across associated industries tied down to health tech innovations.

Build partnerships with local entities

Entering the Chinese healthcare market can be challenging, but building partnerships with local entities is an effective strategy for success.

Start with local government health commissions – they’re your gateways to crucial market insights and potential collaborations. Next, partnering with local hospitals and clinics will unlock the intricacies of patient demographics and healthcare delivery in China.

Don’t overlook the world of academia. Collaborations with Chinese research institutions can propel your innovation game and lend you credibility. Joining industry associations and professional networks will connect you with key players and keep you updated on the latest trends.

Lastly, harness the power of business development platforms. They’re your handy tools, offering services like matchmaking and networking events to ease your market entry.

China’s Healthcare Market Deep Dive

China’s healthcare market is experiencing the fastest growth rate in the world, with a projected compound annual growth rate (CAGR) of around 12%. This means that the industry is expanding rapidly and presents significant opportunities for investment and growth.

According to McKinsey, China’s healthcare market is leading global double-digit growth and has a substantial impact on the overall global healthcare market. The pharmaceutical sector alone is expected to reach $332 billion by 2022, highlighting its strategic importance and potential for further expansion.

| Healthcare Market Parameter | Data |

|---|---|

| Projected growth rate (2023-2027) | 8.83% |

| Estimated Healthcare Market Volume in 2027 | $26.75 billion |

| Estimated worth of Healthcare Sector by 2030 | $2.4 trillion |

| Value of Over-the-counter (OTC) healthcare market in 2021 | $24.6 billion |

| Projected CAGR of OTC healthcare market | More than 3% |

As you can see, the potential for growth in the Chinese healthcare market is immense. Factors such as an aging population, economic growth, and an expanding healthcare industry are contributing to this. It’s time for foreign companies to consider capitalizing on these lucrative opportunities.

Key players and sales channels

Several domestic and international companies have established themselves as key players in China’s healthcare market. These include major pharmaceutical companies such as Sinopharm Group Co., Ltd. and Shanghai Pharmaceuticals Holding Co., Ltd., as well as medical device manufacturers like Mindray Medical International Limited and MicroPort Scientific Corporation.

When it comes to distribution channels, the leading ones include drug stores and pharmacies, which provide easy access to over-the-counter (OTC) medications and health supplements. Other important sales channels include food and drinks specialists, where health-related products can be marketed alongside nutritious food options, and hypermarkets, which offer a wide range of healthcare products under one roof.

But today online channels also play an important role in the health market, with more and more people choosing to buy drugs, supplements, medical devices, and other products online. Platforms like Tmall or Taobao play an important role in local healthcare infrastructure, this is why we focused on your online marketing strategies in the previous paragraphs.

China’s healthcare provider market

With an aging population, rapid economic growth, and expanding basic health insurance, China’s healthcare industry is booming. Rising incomes and increased health awareness among Chinese consumers are driving demand for quality healthcare services.

In fact, profits for China’s hospitals have seen a remarkable 70% increase over the past three years. While only 7% of hospitals in China are privately owned, there is potential for further privatization in the future.

Startups aiming to enter this market need to navigate China’s healthcare sector and be aware of intellectual property regulations. Private hospitals also play a crucial role in meeting the growing demands of Chinese patients with about 15% of total patient visits accounted for by private institutions in 2020.

Deepening basic health insurance

China’s healthcare system aims to provide coverage for its population through a social medical insurance system. Currently, more than 95% of the total population in China has basic health insurance coverage.

However, as the country moves towards full enrollment of the population into basic medical insurance schemes, limitations become apparent. These include challenges related to financing, product coverage, patient responsibility sharing, and data security concerns.

These aspects highlight areas where innovative solutions and partnerships can play a significant role in deepening basic health insurance access and improving overall healthcare outcomes.

Impact of China’s aging population on healthcare demand

China is currently facing a serious demographic shift, with around 250 million people aged over 60, accounting for 18% of the population. This aging population will significantly boost the demand for healthcare services in China’s healthcare market.

The pharmaceutical industry is predicted to reach $332 billion by 2022, reflecting its strategic importance and growth potential. Additionally, there is an increasing pursuit and demand for healthcare due to economic development and improved living conditions amongst the elderly population.

However, this also poses challenges and raises questions about the sustainability of healthcare costs.

Impact of COVID-19 on the Healthcare market

The COVID-19 pandemic has had a profound impact on China’s healthcare market, particularly in relation to the country’s private health system. The “zero-COVID” strategy implemented by China has led to a diversion of resources, resulting in the suspension of hospital operations and significantly affecting the overall healthcare market.

This redirection of resources has also contributed to challenges faced by China’s healthcare system due to a shortage of medical professionals, with only 6.41 public health workers per 10,000 population at the end of 2019.

Furthermore, this global health crisis has driven up consumer interest in health insurance, as over 60% of non-policyholders in China plan to purchase health insurance policies. Chinese consumers also started to look for medical resources and products online, growing the online sales of products like health supplements and medicaments.

Different sectors in the Chinese Health market

China’s health market encompasses various sectors, including pharmaceuticals, medical devices, healthcare services, health insurance, biotechnology, digital health/health tech, and more.

Discover the immense opportunities and growth potential in each of these sectors to thrive in China’s dynamic healthcare industry. Read on to explore the exciting prospects that await you!

Pharmaceuticals

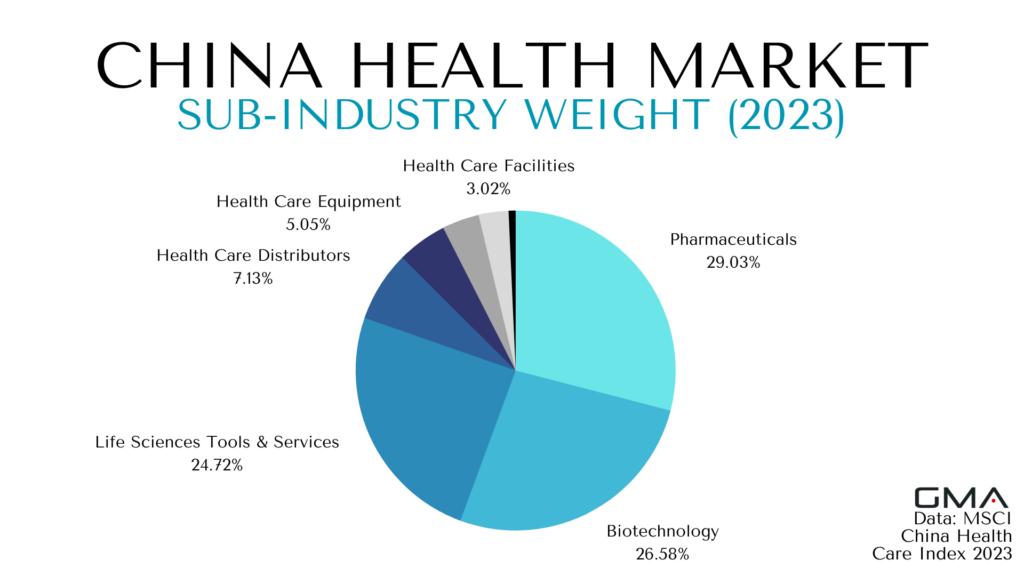

Pharmaceuticals play a crucial role in China’s healthcare market, making up about 29% of the sector. With the pharmaceutical market size expected to reach $161.8 billion by 2023, it presents immense opportunities for foreign companies looking to enter China’s thriving healthcare industry.

As one of the leading industries in China, the pharmaceutical sector covers both synthetic chemicals and drugs, as well as traditional Chinese medicine.

China has been encouraging pharmaceutical enterprises to focus on the research and development of innovative drugs in recent years. This emphasis on innovation, coupled with China’s position as the world’s largest producer of pharmaceutical ingredients, highlights the potential for growth and collaboration within this sector.

Health Supplements

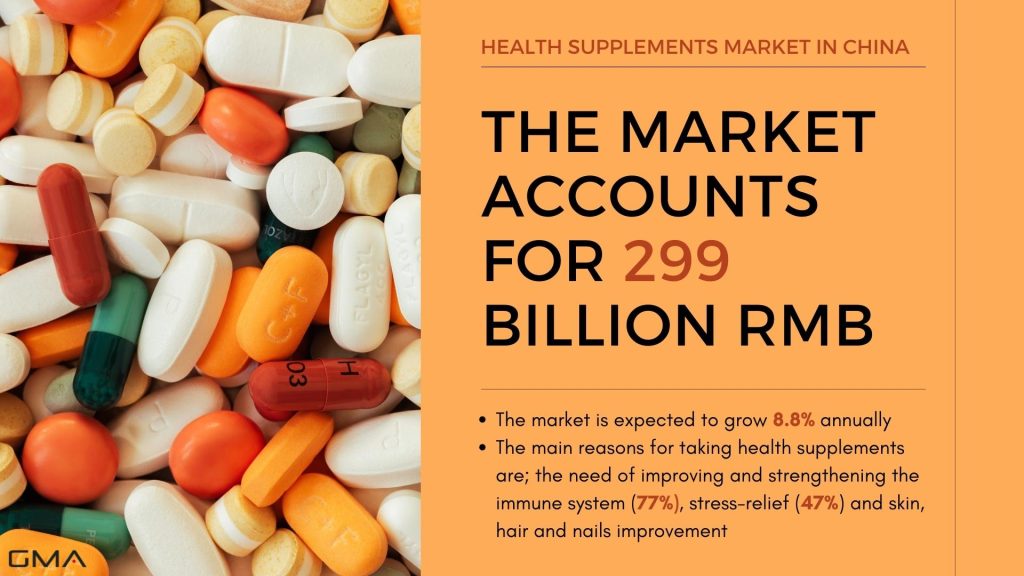

With an estimated size of 299 billion RMB in 2022, this sector has seen significant growth in recent years.

The rise can be attributed to improving living standards and a growing health awareness among the Chinese population. This focus on health and an active lifestyle offers great opportunities for food, beverage, and supplement companies looking to enter the market.

Notably, the Vitamins & Minerals segment is projected to grow by 8.85% between 2023 and 2027 alone – reaching a substantial market volume of US$7.22bn by 2027.

Medical Devices

In China’s booming healthcare market, the medical devices sector holds enormous potential for growth and opportunity. With imports accounting for three-quarters of the country’s healthcare market, there is a high demand for foreign-made medical devices.

China has seen an increase in the number of medical procedures due to factors such as an aging population and greater access to healthcare services. The country’s highly regulated medical device industry operates under a “pre-market” recordation or approval system.

This means that before bringing your medical device into China, it must be recorded or approved by the relevant authorities.

The Chinese medical device market is projected to grow by 7.15% from 2023 to 2028, making it an attractive prospect for businesses looking to expand their reach. In 2019 alone, the industry reported revenues of RMB 629 billion, highlighting its significant size and potential.

China’s “Made in China 2025” initiative also places emphasis on developing the domestic medical device industry further, presenting opportunities for both local and international companies involved in manufacturing and distributing medical equipment.

Healthcare Services

With the rapid growth of the industry, there is an increasing demand for high-quality healthcare services that cater to the diverse needs of the population. This includes a wide range of services such as hospitals, clinics, specialized treatment centers, and home healthcare options.

The government has made significant investments in expanding access to healthcare services and improving overall quality standards. Through publicly funded basic medical insurance, near-universal coverage has been achieved, ensuring that the majority of the population can avail themselves of these essential services.

Moreover, advancements in technology have played a crucial role in enhancing healthcare delivery in China. Telemedicine and digital health solutions have gained popularity, providing convenient access to consultation and diagnosis from anywhere at any time.

Health Insurance

China’s health insurance industry is constantly evolving and presents significant opportunities for both domestic and foreign companies. In 2011, nearly 95% of the population was covered by one of the three medical insurances available in China. Now the numbers are even higher, especially after the COVID-19 pandemic.

However, it is essential to note that Chinese health insurance plans often have narrow coverage limitations, high co-payments, and low coverage maximums.

For private insurers entering the Chinese market, understanding customer needs is crucial. Many private insurers struggle due to a poor understanding of these needs. However, there is increasing consumer interest in health insurance as more than 60% of non-policyholders plan to purchase coverage.

Biotechnology

With significant investment in biomedical research and development (R&D), China is becoming a hub for innovation in healthcare.

Despite being relatively nascent, the biotech sector offers lucrative opportunities within the second-largest healthcare market globally. The integration of big data and technologies like genomics and data analytics is propelling advancements in personalized medicine and precision healthcare.

Notably, Chinese biotech companies are playing a pivotal role with their international reach and establishment of biotech hubs across the country, fostering collaboration and innovation.

Digital Health/Health Tech

With an estimated market volume of US$84.67 billion by 2027, the digital health market in China is projected to grow by 11.36% between 2023 and 2027.

Chinese consumers are increasingly turning to the internet for medical information, with patients spending roughly 29.3 hours online each week, dedicating around 26% of that time to searching for healthcare-related information.

This creates a vast audience that can be reached through various digital platforms.

Technology is revolutionizing healthcare delivery in China’s Internet health market. Digital solutions such as telemedicine and mobile health apps are transforming how people access medical services and manage their well-being.

Wellness and Fitness

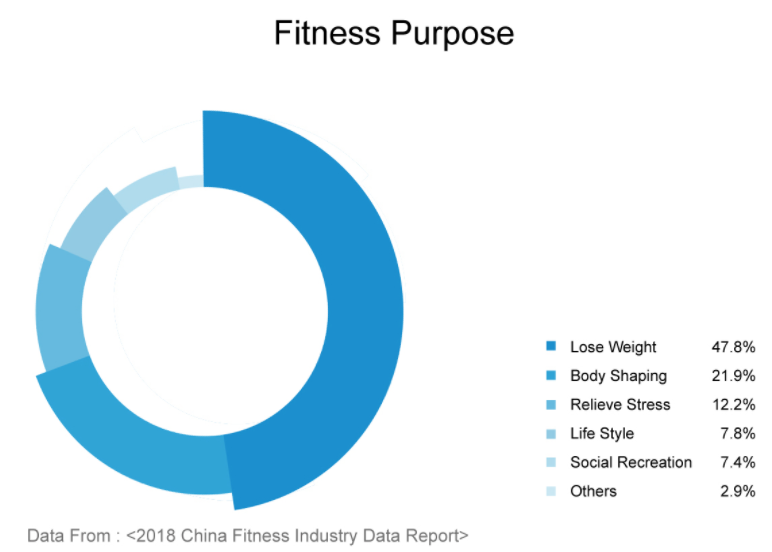

In China, the wellness and fitness sector is experiencing a surge in demand as more and more Chinese consumers embrace an active and healthy lifestyle. With the focus on health increasing, there are numerous opportunities for food, beverage, and supplement companies to tap into this growing market.

The Chinese wellness market is currently valued at an impressive $683 billion, making it the second-largest in the world. In addition, China’s fitness industry is rapidly expanding as people prioritize physical well-being.

Leading companies in this sector include Wellness Group, Will’s Fitness Company, and CSI-Bally. So if you’re looking to make your mark in China’s health market, exploring opportunities within wellness and fitness could be a smart move.

Home Healthcare

With the Chinese government advocating for home-based healthcare services and rehabilitation as the primary healthcare model, this sector is booming.

Major cities like Beijing, Shanghai, Shenzhen, and Jinan offer various home-based healthcare services to cater to the needs of urban residents.

Notably, there has been significant government support for home-based healthcare initiatives in China. This has contributed to the rapid expansion of this market segment. As incomes rise and health awareness increases among individuals, more people are seeking convenient and personalized healthcare options that can be delivered at their doorstep.

In addition to meeting consumer demands for convenience, China’s aging population also plays a crucial role in driving the demand for home-based healthcare services. The country’s universal coverage through publicly funded basic medical insurance ensures that a large portion of the population can access these services.

Mental Health Services

In China, there are significant challenges when it comes to providing adequate care for individuals with mental illnesses.

The social stigma surrounding mental health issues and the government’s lack of proactive initiatives are major obstacles.

China has been heavily affected by mental health-related diseases, making it crucial to address this pressing issue. Unfortunately, there is a shortage of resources and service capacity in the country, particularly due to insufficient financial investment from the government.

However, there have been recent efforts towards reforming the mental health system and building an integrated community-based approach.

It is worth noting that there are disparities in accessing mental health services between rural and urban areas in China.

Case Studies

We’ve come across some incredible success stories of foreign companies that have entered and thrived in China’s health sector. These stories illustrate the immense opportunities and potential for growth in this industry. Let us share a few of these success stories with you:

- Abbott Laboratories: Abbott, a U.S.-based healthcare company, has successfully tapped into China’s growing medical devices sector. By introducing high-quality products and leveraging their global expertise, Abbott quickly gained traction in the Chinese market. Their innovative devices, such as blood glucose monitors and diagnostic equipment, have been well-received by Chinese consumers.

- Pfizer: As one of the world’s largest pharmaceutical companies, Pfizer has made significant progress in China’s healthcare market. Through strategic partnerships with local entities and continuous investment in research and development, Pfizer has become a trusted brand among Chinese patients and healthcare professionals. They’ve successfully introduced several life-saving medications to the Chinese market.

- Johnson & Johnson (J&J): J&J is another prime example of a foreign company excelling in China’s healthcare market. With a focus on consumer health products, medical devices, and pharmaceuticals, J&J has established a strong presence in China. They have effectively localized their marketing strategies to cater to Chinese preferences while ensuring strict adherence to quality standards.

- AstraZeneca: This British-Swedish multinational pharmaceutical company has achieved remarkable success in China through its commitment to innovation and collaboration with local partners. AstraZeneca has introduced breakthrough medications targeting prevalent diseases like cancer and respiratory disorders, contributing significantly to improved healthcare outcomes for Chinese patients.

Why Choose Us for Your Health Market Entry in China?

In conclusion, the health market in China presents immense opportunities for foreign companies looking to expand their presence. With its fast-paced growth, increasing healthcare spending, and large aging population, the Chinese healthcare industry is ripe with potential.

By understanding consumer preferences, leveraging technology advancements, and building strategic partnerships with local entities, businesses can successfully navigate this dynamic market and tap into its vast potential.

At Gentlemen Marketing Agency, we understand the importance of effective communication and strategic content development when it comes to market entry in China’s healthcare industry.

Our expertise lies in crafting engaging and informative content that resonates with your target audience – marketing managers like yourself who are looking for valuable insights into the Chinese health market.

With our deep understanding of China’s healthcare landscape, including key players, regulatory environment, and consumer preferences, we can help navigate the complexities of entering this rapidly expanding market.

What sets us apart is not only our extensive knowledge of the Chinese healthcare market but also our ability to provide unique solutions tailored specifically to your needs. Whether you’re interested in exploring partnerships with local entities or capitalizing on government support for healthcare initiatives, we have the expertise to guide you through this journey.

Don’t miss out on the opportunity and contact us today, so we can discuss your project!

This is a comprehensive guide to health market in China. I found it very helpful.

Very good article, so useful.

I am a Distributor in China of Sport and searching for wellness brand like Lululemon to distribute in China

You can send me your price, brand information on WeChat