Due to rising health awareness and increasing disposable income among Chinese netizens, the vitamins and food supplements market is recording record growth, becoming the biggest market in the world, accounting for 5.14 billion dollars in 2023. China is facing many problems, like an aging society, social stress, and environmental problems like air and water pollution as well as the end of the zero-covid policy. To prevent and shield themselves from the consequences of these problems, Chinese people of all generations turn to health supplements.

With the increasing health awareness and the upgrade of healthy consumption in China, food supplements, especially imported ones are highly in demand in recent years. According to NutraIngredient- Asia, food supplements also have a record high in sales in terms of GMV (Gross Merchandise Volume) among all imported goods on Tmall. In this article, we will examine the vitamin and health supplements market and see how foreign brands can attract Chinese enthusiasts of health products.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Overview of China’s health supplement market

China is the biggest vitamin and health supplements market in the world and the most important fact is that the market is just getting started, so it’s one of the sectors with the biggest potential for domestic and foreign brands. Chinese consumers are more and more interested in Western health supplements and start educating themselves on the subject.

The market accounts for 5.14 billion dollars in 2023, with a CAGR of 8.85% between 2023 and 2027. The health supplements market size is expected to grow significantly in the next years, reaching 7.22 billion dollars in 2027.

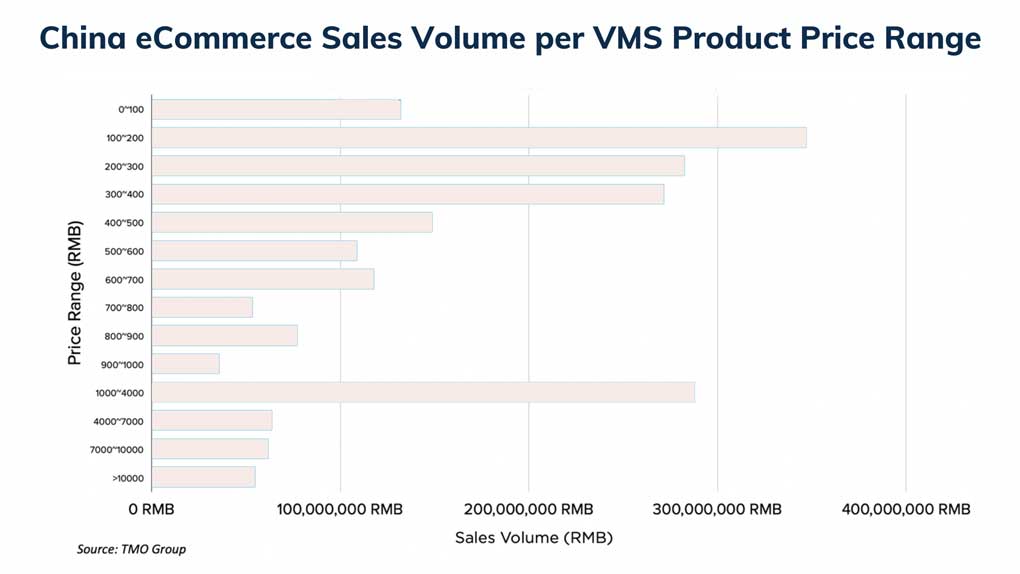

One of the reasons for the growth in health supplements sales is the emergence of vitamins and health supplements on online platforms. In 2019, online sales for dietary supplements accounted only for 28.1%, while in 2023 the numbers went up to 61.8%, and will stay on this level.

Dietary supplements were one of the top sellers during the 2022 Singles Day shopping festival

Although this year’s 11/11 shopping festival wasn’t as exciting as the ones from previous years and experts say that Tmall’s Singles Day has reached its peak in terms of sales, health supplements were performing very well. In November 2022, the total health supplements products sales grew to 4.78 billion RMB from 4.52 billion RMB in 2021, while the average transaction price rose to 340 RMB from 308 RMB.

The most popular category doesn’t come as surprise – almost 18% of sales come from beauty and nutrition supplements. As young Chinese customers want to look good and improve their skin, they turn to beauty supplements and not traditional Chinese medicine like older people. In order to maintain a healthy lifestyle, they train, eat healthily, and invest in good cosmetics and vitamin and health supplements that they find on social media and e-commerce platforms.

Why do Chinese consumers buy health supplements?

As the incomes of the Chinese middle class are rising, people can afford to take care of themselves better than they did before, investing in sports, looks, and health products. Due to prolonged lockdowns in many Chinese cities, people started taking care of themselves more, engaging in sports, and eating better. The Chinese government is also promoting a healthier lifestyle due to problems with the aging society in China.

According to a survey done by Statista in 2020, most of the people (77%) that consume dietary supplements do it to strengthen and improve their immune systems. This is especially important now, in 2023, when the zero-covid policy ends and many people get sick with covid and flu. This situation contributes to a big growth in overall vitamins.

Another big reason for taking health supplements is the need of coping with stress and improving sleep. Many young workers in China stay at work late for 6 days a week and they are notoriously stressed, which causes many problems and insomnia. This is true for young generations all around the world, and Chinese Millennials and Gen Z are no different.

Improving skin, hair, and nails is also one of the reasons for taking food supplements for 28% of respondents. In 2023 we expect that this number is even bigger, as people in China started investing in beauty more than ever before. This also includes supplements and cosmetics that are meant to slow down the effects of aging and improve strength.

What is also worth mentioning is the senior group in China that start purchasing Western supplements. Although many of them still prefer traditional Chinese medicine, more and more take additional supplements or experiments with “Western” medicine in order to stay healthy and strengthen their immune system.

How to sell food supplements in China?

Although the market is still not mature and there are many opportunities for foreign brands in the health supplement market segment, there are many aspects to consider and learn about before entering the market.

Distribution channels of health supplements in China

At present, the sales channels of China’s food supplements products are mainly sold in three ways:

- Direct sales;

- E-commerce;

- Pharmacies.

Due to the relatively short history of the healthcare product industry, consumers have limited brand awareness, and the choice of channels for healthcare companies has become the core of corporate competition.

The best way for foreign brands to promote and sell health supplements to Chinese consumers is online. It’s definitely easier and best for the entry-level.

E-commerce can help brands to reach more targets and increase brand awareness

E-commerce is extremely well-developed in China, with Alibaba’s Taobao and Tmall dominating the market and changing Chinese people’s shopping behaviors. 35.3% of China’s retail sales occur online and China represents more than 50% of the world’s e-commerce.

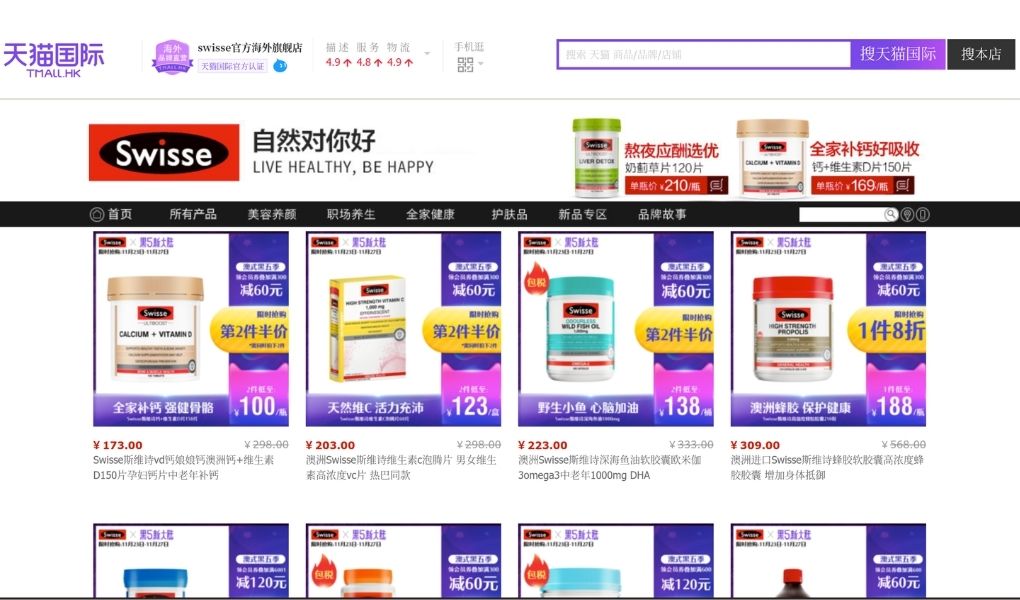

Selling online via Chinese e-commerce platforms or cross-border channels like Tmall Global can help brands to reach more targets. In addition, for overseas brands who don’t have a presence in China, selling through cross-border e-commerce can not only save time and money but also have a test on the market as a first entry into the unknown market.

Apart from Tmall, there are other options, like its biggest competitor JD.com etc. But it’s important to understand that those platforms work with big brands with an established presence in China and are quite expensive.

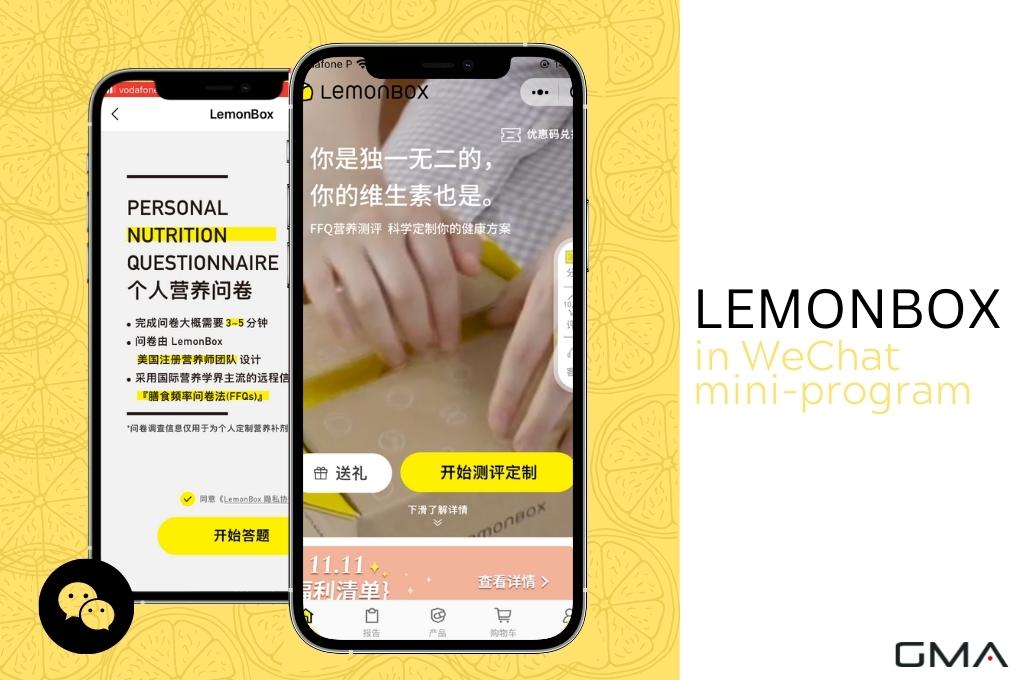

There are also other ways to sell which don’t require a big investment in the beginning. Social e-commerce is becoming very popular in China, and platforms like WeChat, RED, Douyin, and Weibo all offer online marketplaces that are way cheaper than the giants of the market.

In order to be able to sell to Chinese consumers, it’s crucial to establish a presence in China, so that people recognize your brand and trust the quality of your products.

Branding and e-reputation are your way to build brand awareness

Chinese customers are very tech-oriented and while Westerners check one or two places for company information, Chinese people can go way beyond, searching the internet for information. This is why it’s important to focus on branding and e-reputation in order to gain consumers’ trust.

The first thing to do is to have a Chinese website hosted in China. There you can put all your brand and product information as well as all your contact point and social media accounts. Having a website also requires good Baidu SEO to increase your visibility in this most popular search engine.

Baidu works like Google which means there are many platforms linked together, that work in your favor. E-reputation is very important in China and Baidu can help you get it. You can participate in online forums like Zhihu or Baidu Tieba to put your name out there and start conversations around your brand. This will also increase your SEO score.

Social media will help you gain the trust of your audience in China

There is a new trend that more and more young people starting to pay attention to nutraceuticals in Mainland China, and not long ago, it was the middle-aged or even elderly people’s preference. However, no matter whether it concerns younger people or older people, social media plays a key role in nutraceutical brands’ success.

Social media and e-commerce are no new things to new middle-aged and elderly people in China since Chinese people are highly linked to their smartphones and strongly rely on the Internet to choose good products. Chinese people are very wary of unknown brands and products with a good reputation that is perceived as premium and reliable. This makes e-commerce and community word-of-mouth recommendations essential for food supplement sales.

You can use different social media platforms for different purposes. WeChat is an all-in-one platform, where you can send newsletters, sell through private traffic or own your store within the platform. Weibo will help you get to people of all age groups, while RED and Douyin will help you address young Chinese women and men looking for vitamin supplements through their favorite KOLs and live-streaming videos. There are many options to choose from and it’s best to be present on all of those platforms for the biggest exposure.

Case Study: By-Health’s social media activities

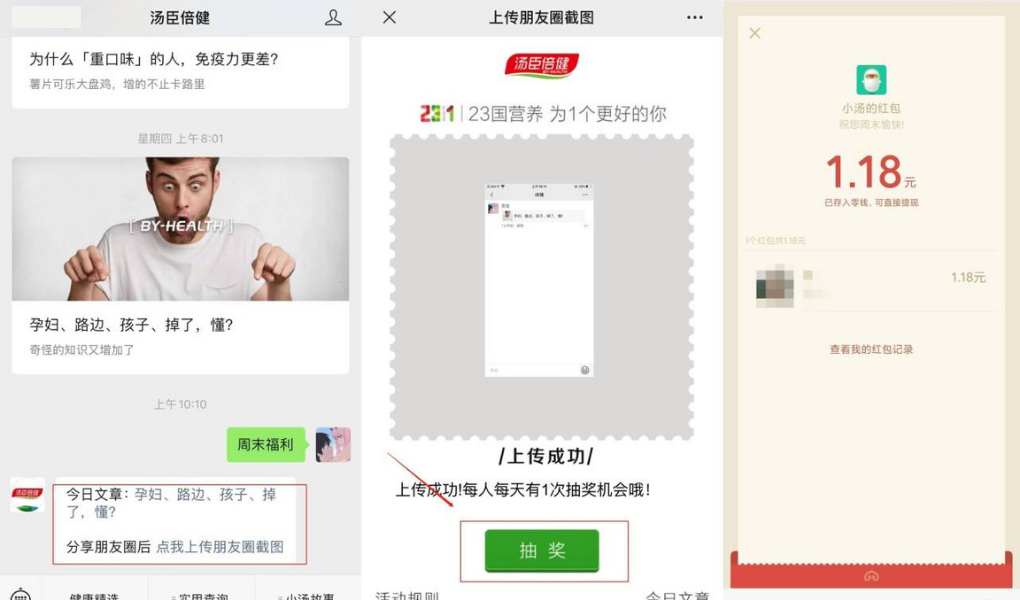

For instance, By-Health has created the “By-Health Nutrition Academy” official account on WeChat-the Chinese largest social media and invited more than 200 national nutritionists and more than 100 authoritative experts in medicine and nutrition to share knowledge and reply to followers’ questions about nutrition and health. This has increased brand awareness and promoted its reliability among Chinese targets.

Moreover, By-Health has been highly active in engaging its audience through community management. For instance, the company offers directly money to its followers in the form of a weekend bonus, as a result, a lot of users on WeChat were attracted and followed the brand and then get to know the brand and its products.

By-Health is present everywhere on Chinese social media, trying to get as much attention in the Chinese nutraceutical market with giant potential.

As the above picture shows, By-Health has also an official account on Weibo-China’s largest social network. This platform is very suitable for event marketing and boosting brand awareness since it’s open to everyone. Every content on the platform can be seen by anyone who surfs on the platform.

Nutraceutical brands should stay relevant in China’s digital transformation

On the one hand, the demand for nutraceutical products is growing rapidly in China, and on the other hand, the industry is also changing rapidly: consumers are becoming more mature and changing their consumption habits. Traditional distribution channels are changing as well.

The Internet and digitalization have changed the way companies interact with consumers and create value. And there are constantly new competitors entering the industry with business model innovation. In the evaluative Chinese market, only by keeping relevant can businesses have a lead over peers.

GMA has been working with foreign brands for their entry into the Chinese market since 2012. As an expert in the Chinese market and Chinese digital marketing, we are your perfect partner who is capable to work out a successful strategy for businesses in different industries.

We offer different digital and e-commerce solutions depending on your brand’s goals, needs, and budget. Don’t hesitate to leave us a comment or contact us so that we can schedule a free consultation with one of our experts that will learn about your brand and present you with the best solutions for your market entry in China.

One Comment