With the relaxation of the one-child policy and the premiumization across consumer goods, china’s baby care market is considered one of the most attractive in personal care. Chinese parents are spending more and more on their children, contributing to significant market growth in the sector and rising demand for domestic and foreign brands selling good quality mother and baby products.

Currently, China’s existing online community represents young demographics, having a bigger spending power than ever before. Families in this group are willing to pay heaps for products beneficial for their babies and mothers-to-be. Consequently, the market is categorized by a higher price-per-order than other industries. Moreover, they are also quality-conscious buyers who would choose to pay more for a better-quality product.

Need a cost effective TP (Tmall Partner) to sell in China?

We are an Official Tmall Partner e-commerce Agency. Our Services: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

Let’s take a look at the market dynamics of the baby products market in China and examine key trends and opportunities for foreign brands.

China’s baby care market in 2022

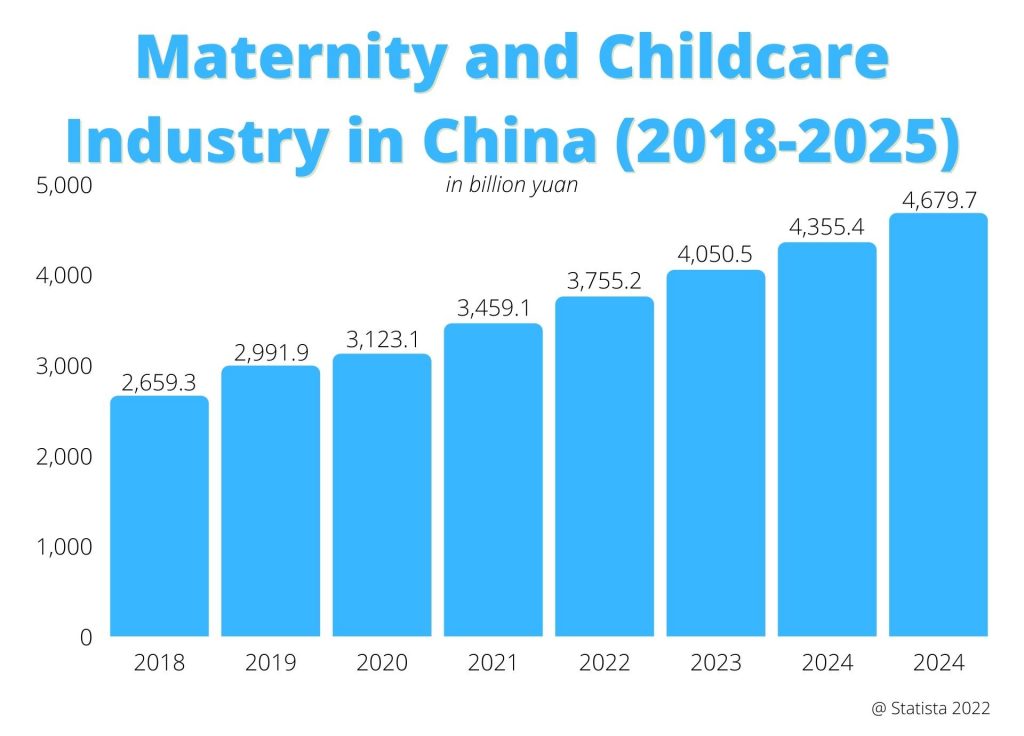

According to market research, the China baby care products market is expected to grow at a compound annual growth rate of 10.69% between 2020 and 2027 to reach a market size of US$23.469 billion in 2027, from US$11.531 billion in 2020. Chinese parents are willing to spend on their babies. They are concerned about baby health (due to many baby food scandals in the country), and thanks to the rising income of young parents in big cities, the market is experiencing steady growth.

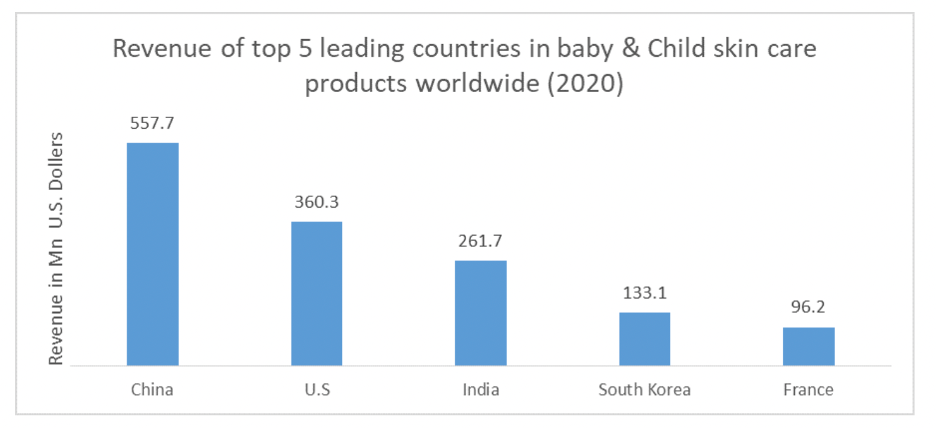

China is dominating the demand in the global baby retail market. Even though China is facing a declining birth rate problem (like most developed countries), the baby care products market is growing.

Especially after the COVID-19 pandemic, Chinese parents are more cautious and are spending more on products such as; high-quality baby food and baby formula, baby skincare products, baby bath products, and other categories related to health and hygiene.

What are the main market trends?

There are several trends stimulating the growing demand for maternity and baby care products in China. One of the most important observations is that safety and efficacy are extremely important for Chinese parents, but they are also starting to pay more attention to the brand’s social values, such as the packaging of products, ingredients of baby skin care products, the production process if the brand is ethical and so on.

Here are some of the key market trends to follow;

Chinese Millennials are choosing to have more than one child

Progressively, couples living in cities, earning significant income who were born as single children are choosing to have a sibling for their child. Although having a child in China is expensive, many people living in the urban metropolis can afford to have a second child now, which helps in the market growth in the baby products market.

Presently, infant care products are extremely popular in China’s e-commerce landscape. The growing trend among Chinese parents of providing their children with the best possible quality has fuelled the growth of cross-border e-commerce in the Chinese digital marketplace. Due to the presence of counterfeit products in the local market, Chinese parents trust foreign products more than local brands.

Chinese parents prefer to buy from foreign brands

Quality is more important than ever for Chinese parents, which presents a significant opportunity for international companies, which are often perceived by Chinese consumers to be of higher quality, safer, and more reliable than their Chinese counterparts plagued by food safety scandals.

Due to rising quality concerns, side effects of the products, etc., parents have become more conscious while purchasing baby care products, especially when it comes to baby formula and baby food.

The effects of this drive for quality can be seen in ever-more specific and detailed consumer demands for products to be healthy, pollutant-free, environmentally friendly, and contain minimal added additives, as well as to have a long service life. There is a growing number of brands increasingly launching herbal formulas and introducing organic baby products on the market.

Chinese Consumers are researching online

From community e-commerce to user reviews left online, to simply discussing new products on social media, Chinese mothers are using the Internet as an information source more than ever before. On the Chinese search engine, Baidu, more than 100 million searches related to Mother & Baby products are conducted each month.

The online market in China is the biggest in the world, so to be able to get to Chinese parents, you need to promote your baby care brand online, through many promotion and distribution channels. Most Chinese parents rely on online shopping and online channels, so don’t miss out on this opportunity if you want to become one of the market leaders in China’s baby products market.

Best ways to promote mother and baby products in China

Both online and offline distribution channels are dynamic and complex, with major companies across both channels seeking to take advantage of the growth in the mother & baby sector, and differentiate their approach to the market from those of their competitors.

If you want to cater to the rising demand in the baby products market and win customers over your competitors, there are some key actions you need to take to succeed.

Branding maternity brands in China

Chinese people don’t buy products from brands that they never heard of, as they need to gain trust before they purchase anything. It’s especially important for all kids-related items and baby food, as parents are double cautious to provide the best baby products possible.

Therefore, any company wanting to sell products in China needs to take care of branding on the Chinese market. There are some key elements to take into consideration;

Chinese website and Baidu search engine optimization

Just like in the West, any company offering products or services should have a good website, so that potential and existing customers can check any important information there. Most Chinese online retailers do have a website in China, so if you want to build your presence and sell mother and baby products, you need to have a website in Chinese.

It’s important that your website is hosted in China because Baidu favors those over foreign ones and will rank your site higher in the search results.

Apart from having a website, it’s also advisable to promote your brand in the Baidu ecosystem, on forums and Q&A platforms like Baidu Tieba and Baidu Zhidao, which help you boost your site. It will also help you gain a good reputation among Chinese mothers.

Reach Chinese parents on social media platforms

It’s very hard to get a name for your brand and arouse Chinese people’s attention without a presence on social media. People all over the world use social media platforms to check information, learn about brands, communicate with friends and check recommendations and reviews of products and services. China is no different.

Chinese social media platforms offer many opportunities to reach and attract a Chinese audience. Many Chinese online retailers have their own stores on Wechat, Douyin, or Little Red Book and let customers buy directly there, without the need of purchasing on the big online marketplaces.

You can focus on one platform, for example, Weibo or WeChat, to create content and arouse attention and use other ones (advisable Little Red Book and Douyin) for influencer marketing. There are many Chinese mother or Chinese parenting influencers that can help you reach a bigger audience, suitable for your baby products.

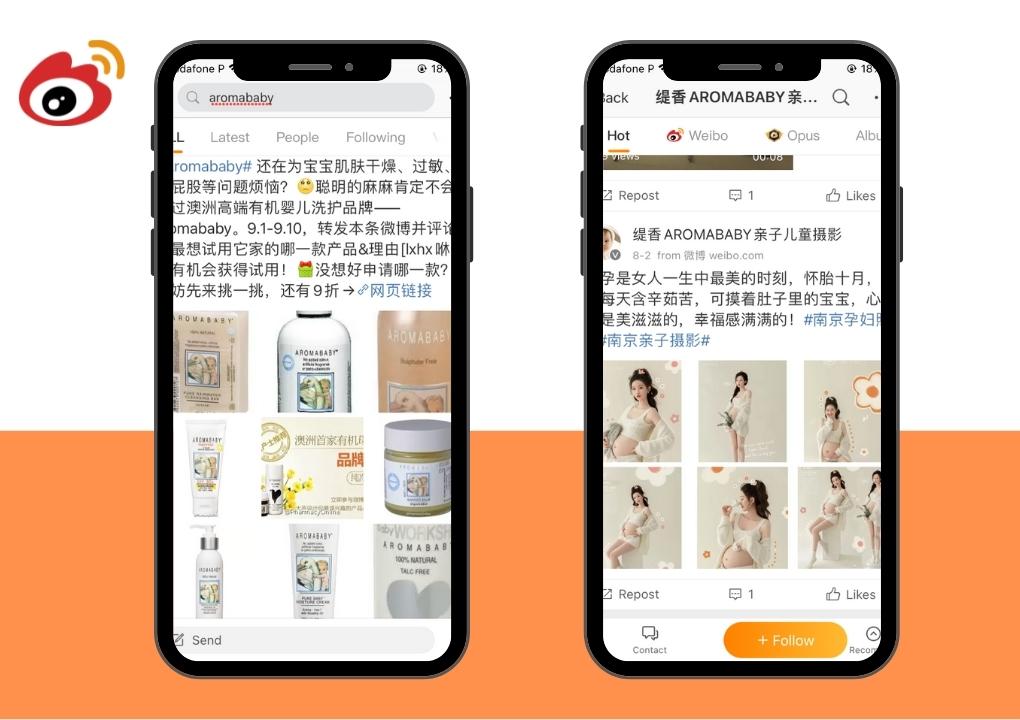

Check one of our case studies – Aromababy on Weibo:

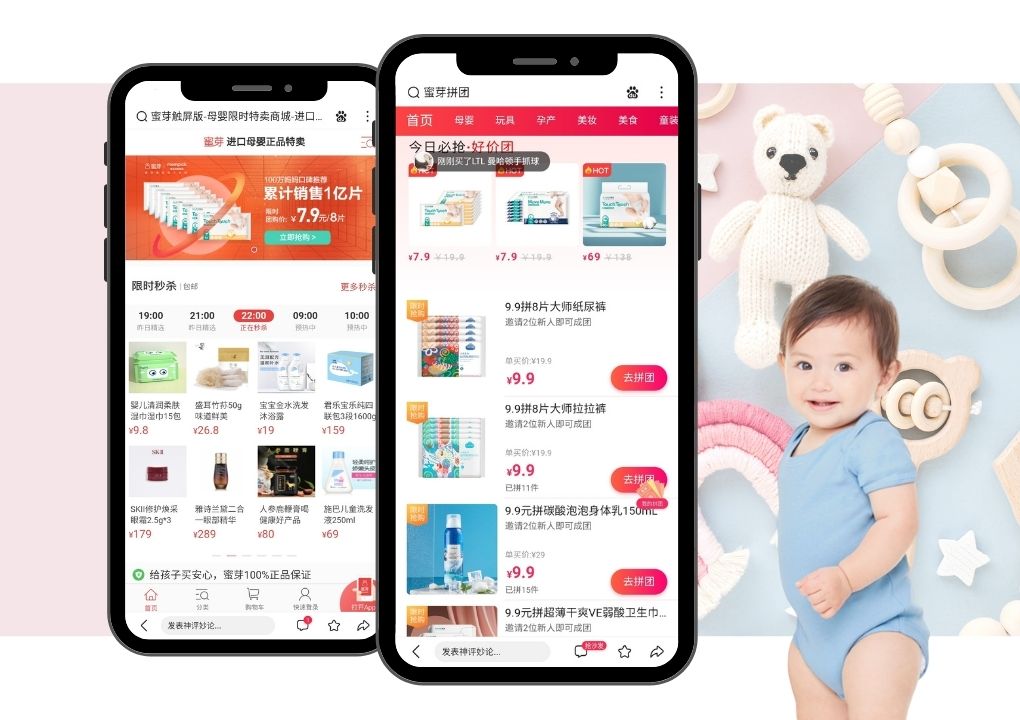

Target the audience of baby-dedicated websites

There are many websites and forums in China where pregnant women, soon-to-be-parents, and experienced parents share tips and opinions about maternity and baby products. Some of these websites are better for online sales, as they are specialist marketplaces, other websites will be helpful for brand promotion. Here are the most popular ones:

- MIA 蜜芽

- Beibei 贝贝网

- BaobeiGeZi 宝贝格子

- MuYingZhiJia 母婴之家

Presence of International Brands on Chinese E-commerce Platforms

Entering Chinese e-commerce platforms will give you the most visibility, as most Internet users prefer to purchase products there, due to the big choice of products and convenience. The best places to sell products on the Chinese market that we advise you to consider are; Tmall, Taobao, JD.com, and Wechat.

Use Tmall to Sell Maternity Products in China

Tmall holds the biggest market share in the e-commerce market of China at 57%. It mainly focuses on premium brands. This characteristic makes Tmall the most expensive e-commerce marketplace in China. For Chinese consumers, a high price indicates high quality therefore many customers prefer buying their products from Tmall.

The platform offers an opportunity for international brands to a cross-border service and directly sell products to Chinese consumers without being physically present in China via the Tmall Global sub-platform. Although it’s the most expensive e-commerce platform of all presented ones, it is also the most visited one, so you can be sure it will help you reach a bigger audience with your products.

Sell Maternity Products on JD

JD (Jingdong) is China’s largest online direct sales company. JD.com has 4,142 delivery stations across several districts of China. International companies can open individual online stores on JD.com and brands are permitted to import food, beverages, apparel, and shoes from overseas.

JD’s cross-border service, JD Worldwide, enables suppliers to sell directly to Chinese consumers without a local presence.

JD.com is less expensive than Tmall but still rather expensive. It provides active global promotion of JD Worldwide (mainly in the U.S. and Australia) and supports in-house logistics services. JD.com has a zero-tolerance policy for counterfeit products.

Ecommerce Opportunities in China via Taobao

Taobao is owned by Alibaba Group. It offers the largest C2C e-commerce marketplace in China. Taobao allows registered or non-registered businesses to sell directly to consumers. It has more than a million sellers, along with countless product categories.

Establishing a store on Taobao is virtually free but the online marketplace is ruled by small sole sellers who compete fiercely on price and honesty and authenticity is an unwritten rules of their trade ethics. Mostly, Chinese web celebrities are the most prolific sellers. They take advantage of their popularity and drive traffic to their Taobao online store from blogs, online videos, and social media. Chinese web celebrities are mostly known for selling cosmetics, baby, and clothing products on Taobao.

Sellers with a low budget and low-quality products opt for this platform. However, just like all other online platforms in China, Taobao also needs strong digital marketing skills to be visible to online customers. To sell on Taobao you will need to have a Chinese entity or partner with local distributors.

Ecommerce Opportunities in China via WeChat Official Account

WeChat is a Swiss knife of the digital ecosystem of China. It is all one app that integrates social e-commerce seamlessly. There are three types of service accounts available for promoting a business on WeChat; WeChat Subscription Account, WeChat Service Account, and WeChat Enterprise Account.

Businesses present on WeChat via the aforementioned accounts can broadcast information to their followers. The information post can be shared, reposted, or generated comments by the followers.

Wechat is a great place to test if your products match the target audience, as it allows you to open WeChat stores within so-called mini-programs, which are mini-apps within the WeChat ecosystem. You can build a shop there and bring traffic to it, inviting customers to purchase products directly on the platform.

Selling on WeChat is the most cost-effective option of all the mentioned ones and it’s a great choice for brands that don’t have a big budget and are not very known but would like to test the function and start reaching more customers.

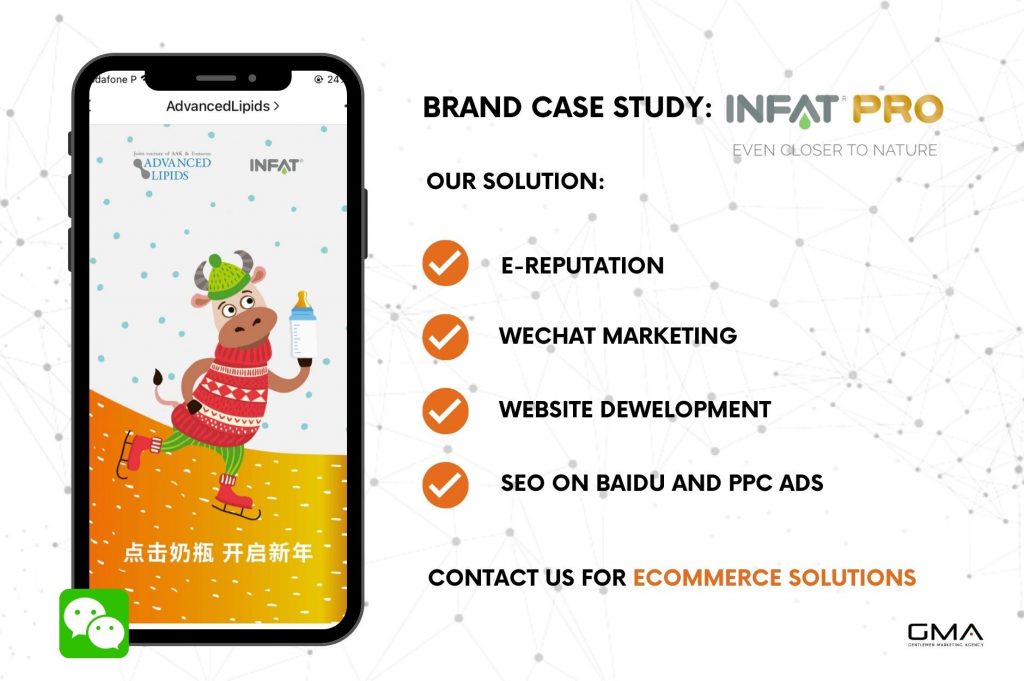

GMA Infat baby formula case study

INFAT 7.0 an advanced lipid infant formula milk headed to the Chinese market to roll out its products. INFAT 7.0 has done really well in other markets around the globe. Seeing its success, it wanted to enter the Chinese market digitally.

Initially, INFAT 7.0 came across resistance due to the language barrier, unique culture, and purchasing habits of the Chinese market. The first problem it came across was brand awareness, and search engine optimization techniques in order to be noticed on the web.

With the help of a local Digital Marketing agency, it produced quality content regarding its products, advertised its benefits on its Chinese website that provided an edge over its competitors and communicated with potential customers with the help of Q & A forums using the Chinese language and WeChat marketing. This strategy enabled them to avail of a comprehensive market share and generated 12 qualified leads in 2 months’ time.

Contact us to start selling your maternity and infant care brand in China

When considering a new entry challenge, our expert team will guide you in detail through the CBEC process including both your logistic operations and eCommerce optimization.

China is a marathon, not a sprint. Qualified brands are here for the long term and target high performances. Therefore, GMA will assign you a personal manager dedicated to analyzing your development capabilities but also monitor your investment while maximizing your ROI.

As a licensed TP operating in China for +10 years, contact us to determine which platform may be more suitable for your brand: JD or Tmall. Our experts will tell you all you need.

We advise you to sign up for our 15 min discovery call, where we will get to know if your products and qualification match customers’ expectations. You can present us with your brand story and our expert will guide you through your needs in China. If you match the qualification process, we offer you 1h of free strategy consulting and creative brainstorming sessions.

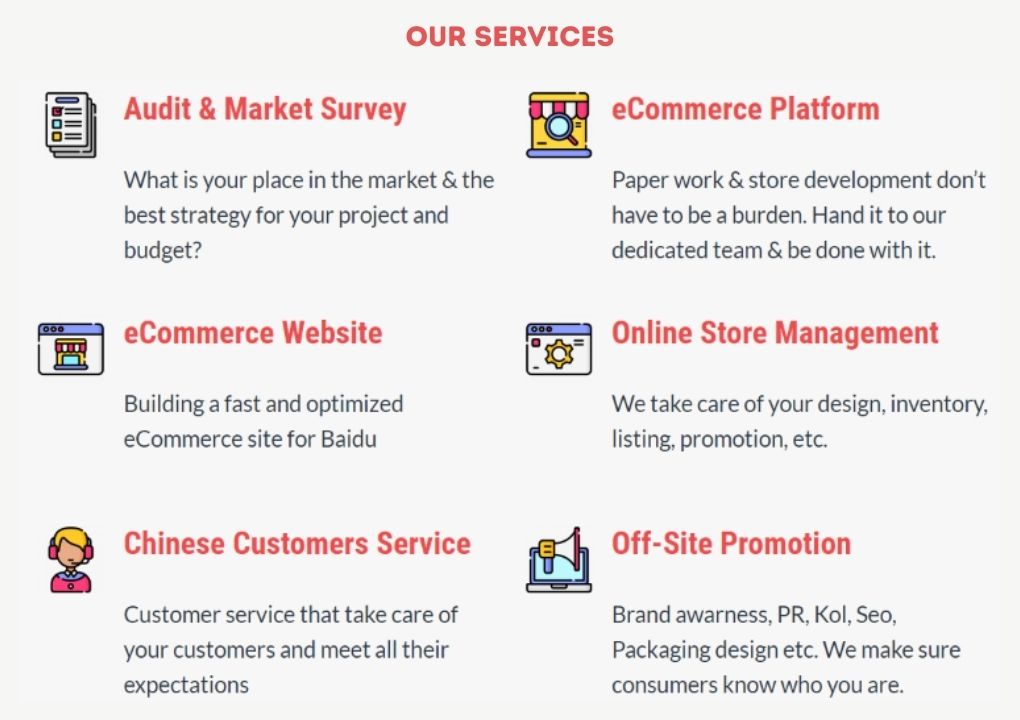

What do we offer?

We offer many different services, according to the needs of our clients. Here are some of the main ones;

Do not hesitate to contact us and apply for our 6 months brand incubator program. How it works:

- Brand interview: Tell us who you are and what’s your brand story. Let us get to know each other and see if you’re made for China.

- Strategy Demo: Get to know more details on the Chinese market, and how similar brands like yours are doing, and get a tailor-made strategy matching your needs, FOR FREE.

- Onboarding: if we determined that we can be a good fit and that we can actually help you to successfully grow your business in China, we’ll make you an offer to put your brand on a launchpad and get all you need for measurable success.

Tmall has invest a lot to promote Baby Milk Formula…

Upper middle class, Chinese consumers trust International products more than local products

The baby care market in China growing keep raising +15% as of 2018. International Brand dominate the Chinese maternity market, because Chinese mothers do not trust in Chinese product anymore.

China’s Super Mum Consumers: What 1 Billion Chinese Mothers Want?

Quality products for their babies…

Hello,

We have a taobao store, and we are reselling maternity products in China.

contact us to resell on our store.

oq.philip@gmail.com

Great article… super interesting and inspiring article.

It will lead a lot of brands to sell in China.

We hope so, and preferably they ask for our help to do so :p

In a more serious tone, thanks a lot for the feedback, and we are very happy to hear you are learning things with our content

In the West baby milk is like crazy. my wife is doing this business.

In the midst of a boom, the market is disrupting sales and worrying Australian parents who want to buy infant milk. Demand is so high that pharmacies and major supermarket chains have imposed a sales limit of two boxes per customer or keep their stock behind a secure counter.

This does not prevent some daigus from going back and forth to the store to buy more products. In a Woolworth suburb of Melbourne, a scuffle broke out among a group of shoppers, filmed last month as each attempted to collect goods. The employees had to remove the powdered milk from the aisle. The retail giant declined an interview request but said “work hard to make sure our customers have access to the stock they need.”

The Daigou Association is working in collaboration with a wholesaler to push shopping assistants out of stores, and thus “allow Australian mothers to buy the powdered milk they want.” A member of the association, Australian Post has scented a lucrative business there, weighing several hundred million dollars. It opened a concept store in Sydney in May 2018 with the sole destination of China. The store, still in the testing phase, sells beauty and health products. Employees speak Mandarin and make sure they are well stocked with infant formula, vitamins and cosmetics.

hello,

We would like to buy and resell popular foreign brand of baby and maternity in China, mainly via online channels.

Can you contact us with your products and prices please.